15 Items That Will Trip Your Borrowers Up in The New PPP Forgiveness Application

Last Friday night, the SBA released the long-awaited Paycheck Protection Program (PPP) application, and while it clarified some aspects of the program, its complexity also surprised many bankers. In the SBA’s defense, it is hard to strike the right balance of speed to market, simplicity, and breadth of idea inclusion, so overall, we must give the SBA high marks for this effort. Despite those marks, we have identified 15 areas where banks will need to focus on providing further education, process, or technology to make the process as efficient as possible. Spending 15 minutes reading this article now could potentially save you hundreds of processing hours later.

The High-Level Areas of Risk

The below 15 “quagmires” are all areas where the process can get off-track and how a little forethought in design, messaging, or technology can save tons of pain later. For example, just putting a process in place to validate the business name of the borrower will take seconds upfront, but will save hours of time later correcting errors because someone changed an approval number on “Smart Kid Academy Westmont, LLC” when it should have been changed for another franchisee of “Smart Kid Academy WestPoint, Inc.”

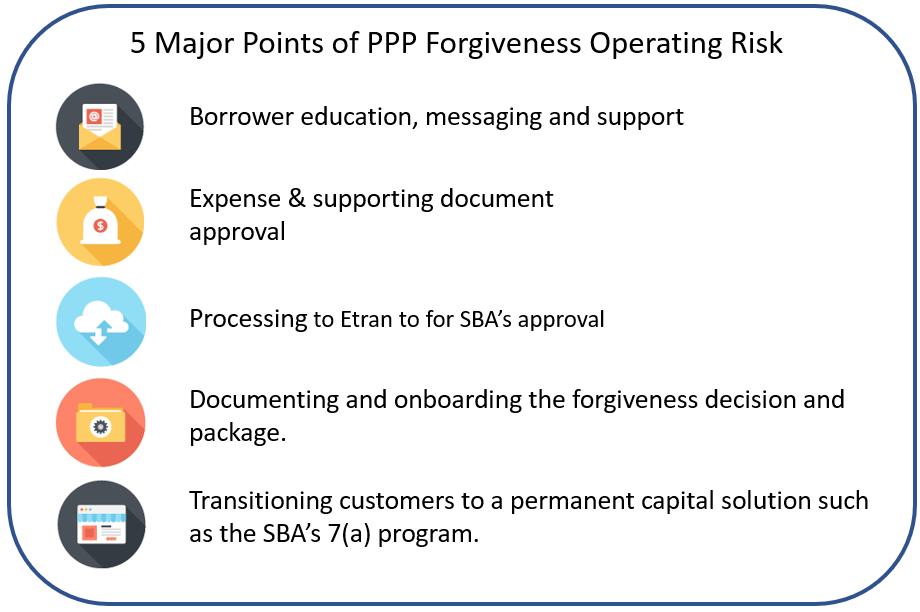

Each of these risk areas covers five main categories and can be summarized by issues around: 1) Training and communication; 2) Preparing to make difficult approval/review decisions; 3) Processing the loan with the SBA; 4) Documenting and onboarding not only the forgiveness application but the non-forgiven loan; and, 5) Transitioning the borrower to a longer-term capital solution such as the SBA’s 7(a) program.

Banks can use these areas and the following 15 points to either refine their current planned process or help inform them when choosing a technology partner.

The 15 Potential Quagmires of Forgiveness Process Inefficiencies

Getting more granular, here are our 15 areas that could trip banks up unless they solve these issues upfront:

Business Name: Borrowers need to match their name on the forgiveness application to their original PPP 2483 application form. While this seems obvious, an estimated 2% of borrowers did not use their exact legal name on the PPP application causing problems. Things like “LLC,” “Inc,” and “&” instead of “and” tripped many up. Banks either need to instruct borrowers or have technology that pulls the exact name off their PPP application and populate that into the forgiveness application.

There is also the issue of how a bank’s process or technology treated a borrower with multiple companies. If a bank treated multiple companies or affiliates under one application, then the bank may need the ability to decision each separately for forgiveness. Conversely, if the bank broke apart each company, then it needs to figure out a way for the borrower to access each application. For some bank technology, you needed a separate email for each application. Borrowers with six or more companies ran out of legitimate email addresses and had to start making them up. Now, borrowers need to be notified and then access each of those applications which could be difficult with a fake email address.

Additionally, in the heat of the processing battle, names were often confused, causing additional errors in the system. For forgiveness processing, banks must not only set up ways to continue to validate the name in their quality control checks, but train staff to validate the name AND an additional datapoint such as SBA Loan Number.

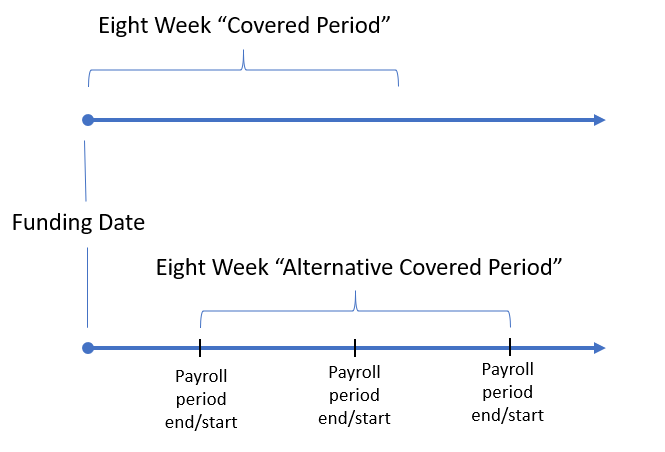

Disbursement Date: The difference between the note date, the funding date, and when the borrower checked their bank account to see if the funds were in, there continues to cause problems. A majority of banks did not provide the funding date to the borrower, thereby leaving the borrower in the dark when completing their forgiveness application. Any technology needs to capture the exact funding date as that not only drives interest accrual but the “Covered Period” as well.

Covered Period vs. Alternative Payroll Covered Period: For the sake of calculating PAYROLL, Borrowers get a choice on if the eight-week period to test expenses starts on the Disbursement Date (termed the “Covered Period”) or on the next biweekly (or more frequent) payroll period (termed the “Alternative Payroll Covered Period.” Note that the Alternative Payroll Covered Period does not impact the calculation of mortgage interest, rent, or utilities. Further, companies that pay some of their employees on a monthly basis AND some on a biweekly basis will be confused as to which box you check.

$2mm Audit Flag: Borrowers need to check, or the bank needs its technology to aggregate not only the original loan amount for the borrower but the original loan amount for ALL the affiliates. Banks that processed affiliate transactions separately may struggle to aggregate the information in their online application.

Payroll Costs: In addition to figuring out what Covered period to use, borrowers also need to calculate vacation pay, parental/family leave, sick leave, and other health benefits (excluding ANY employee contributions) for the same period. Payroll costs are considered paid on the day the paychecks are distributed, not cashed, or when the ACH is originated. However, payroll costs are INCURRED but not paid, on the day that the employee’s pay is earned. Thus, payroll costs that are incurred but not paid during the borrower’s LAST pay period of the Covered Period (or the Alternative Payroll Covered Period) ARE eligible for forgiveness IF paid on or before the next regular payroll date. This is a slight change to the conservative understanding of some banks that wanted to play it safe and advised clients that payroll would only be treated on a cash basis.

Of course, the $100,000 prorated cap continues to apply, and borrowers will need to be reminded of this limit and how to factor this maximum salary/wage limit into their calculations.

Up to this application, most banks were using the common human resources definition which calculates a full-time equivalency (FTE) of an employee based on a 30-hour week. With this new application, the SBA has clarified this definition to be a 40-hour week, which is likely to trip many borrowers up that are used to calculating an FTE on a 30-hour week normally used for tax or healthcare calculations. Banks will have to teach borrowers to calculate their FTE count or use the simplified method that the SBA allows by using any employee working 40-hours or more to count as a single FTE and any employee working less than 40-hours to count as a 0.5 FTE. Borrowers can either calculate the FTE or use the simplified method. The significant issue here is that this is one more item that a bank’s process, review, and technology must now change.

FTE Safe Harbor: The recently clarified safe harbor provision allows a payroll exemption for borrowers that have furloughed workers and cannot get them back for the Covered Period. This provision allows borrowers to exclude the FTE count in their eligibility calculation if they have made a good faith offer, in writing, to employees to return to work. This safe harbor provision also includes employees that were fired for cause, voluntarily resigned, or voluntarily requested a reduction in hours.

All this is good news to borrowers, but now the bank is left with trying to explain this not-so-simple calculation to the borrower. What makes matters worse is that it is unclear what evidence the bank needs to rely on or even if the bank should ask for supporting documentation to evidence the safe harbor exemption. While it is clear the bank does not need to accept documentary support, borrowers need to retain this information, and the question comes up is what role the bank should play in helping borrowers, particularly those over $2mm.

Mortgage Interest, Rent, Utilities, Transportation, and The Missing “Other” Category: All these expenses that were in effect prior to Feb. 15th, 2020, are to be calculated during the Covered Period. Borrowers will need help figuring out if to do this on a cash or accrual basis. Borrowers will also have to understand the difference between providing the obligation to pay and the actual proof of payment. Banks will need to decide if they want just proof of payment or both. Further, some technology available to banks will take in credit card charges while most will take in bank statement information. Banks (or the technology provider) will have to find a way to not only categorize the proof of payment but need to ascertain the period the payment is for, which may or may not be within the Covered Period.

While most of the utility’s expenses are clear to include water, gas, electricity, telephone, and internet, what is unclear is how to separate bundled expenses such as the businesses that have TV, data, and telecom in one package. The SBA has been unclear if cell phone bills are included in telecommunications and waste management appears to be left out.

When it comes to transportation, it remains unclear if this includes items like Uber to get employees to and from work due to the risk of public transportation, the cost of shipping of goods or the cost, to include deprecation, of running a fleet to handle the transportation of goods and services.

It is important to note that the recent clarity here from the SBA’s application means that all eligible non-payroll expenses must be paid during the Covered Period and not the Alternative Payroll Covered Period. Expenses will also qualify if they are incurred and paid on or before the next regular billing date, even if the billing date is after the Covered Period.

Noticeably missing from the application is the “Other” category that has been mentioned in the CARES Act and in previous SBA Interim Rules but has NOT been included in forgiveness. Borrowers can use the loan’s proceeds for “Other” obligations such as inventory (being the most asked about), accounting services, and other expenses, but it just will not be included in forgiveness. Banks will have to train their staff on this point as this missing category is sure to raise many questions.

PLP and Lender Number: The application asks for the SBA’s loan approval number (often referred to as the “PLP number)” and Lender Number. The issue is that customers may not know where to find the former and have no idea of the later. Thus, banks need to build one or both of these into the message to the customer to include, create a file upload to the system to store this information, or have to manually input the data with each application.

EIDL Advance Amounts: The borrower will have to include Emergency Injury Disaster Loan (EIDL) Advance Amounts on the form, and banks will need to verify not only those amounts but those amounts that do exist should the borrower mistakenly leave this field blank. This presents a little bit of a workflow issue as most banks have moved their SBA Etran process from the middle of the process where they had it during origination to the backend of the process for forgiveness. Thus, should the bank find an outstanding amount, the bank will need to adjust the forgiveness amount and then communicate that to the borrower.

The other issue here is that the borrower, or the bank technology, will need to include the EIDL application number. It is unlikely that the bank has this data, and so will need to not only ask the question but then create a process to validate the number.

Action Status: Banks will have to take some action on each application. Some banks are taking the stance that they will review each document and verify each payroll submission, expense, and reduction. Other banks just plan on relying on the borrower’s attestation that the documents are legitimate and correct. The banks that plan to underwrite, may “Approve” the transaction, while other banks that have a lower standard of risk care may be “reviewing for completeness” or “verifying” the application. While this might be considered semantics, your bank’s position, the action that you take, and how that action is communicated to the customer may make a difference in a court of law.

Application Signature: Handling the signature is an additional challenge in processing and workflow. It would be operationally easy for the customer to submit a signed application and for the bank to accept it. However, this is likely in only about an estimated 75% of the cases (if marketed correctly). In those instances where a bank may need to make some modifications to the application, the bank’s process or technology needs to return the correction, a modified application, allow for a signature and then allow for approval. Banks that handle this manually through email may find a logistical challenge of losing track of applications and getting the borrower confused. Any technology leveraged by the bank should have this process well thought out.

Reamortization and Updated Loan Terms: For borrowers that do not get full forgiveness, banks need an efficient way to communicate the remaining amount left on the loan. Many banks, for example, amortized the original PPP loan over the 18 months following the deferral period. Now, these banks need to include the forgiveness amount in their calculations and achieve the borrower’s acceptance. Conversely, those banks that treated the loan with a bullet maturity in month 24, just need to notify the customer but now need to be hyper-focused on the tail risk.

Optional Demographic Information: The SBA has on its application a shortlist of demographic questions such as race, gender, ethnicity, and if the borrower is a veteran. On the PPP application, banks were blind to this information, so the threat of any disparate lending was largely moot. Now, however, banks need to be careful. Not that banks would decision off this information, but it is unclear how this information will be reported and used, so every bank now runs into the issue of – what if by statistical chance in declines more female or minority-owned businesses? Does it try to compensate? It is a potential ethical dilemma waiting to happen to a large number of banks for no other reason than by random occurrence.

In addition to the dilemma, banks now need to scramble to change their electronic application and Etran transmission XML to accommodate. While that seems easy, it just another set of error codes that we have to figure out potentially.

File retention: The bank is obligated to not only retain PPP files for six years after the date the loan is forgiven and terminated but also make these files available to the Office of the Inspector General when asked. Some systems we reviewed require banks to manually download each document from the customer, a process that could take months for thousands of applications. Others store the documents, application, supporting calculations, and activity log in a single pdf file in a secure file structure such as Sharepoint or Box. Banks need to have a vision of how they want to process, manage, audit, and retrieve files in mass.

The 7(a) Loan Transition: The intent of PPP was not to bring relief to small business but to bring enough relief so they can keep their workers employed. The Program doesn’t solve the real issue, which is how to provide enough support to get the small business customer back on their feet. This is the real risk to the economy, to the borrower, and to the bank’s balance sheet. This means the government and the banking industry will likely need to transition as fast as possible to another, more permanent source of capital, and the 7(a) program seems to be the odds-on favorite.

The challenge for banks is how to leverage the PPP data and be in a position to quickly provide relief towards the end of the eight-week program. This means making sure banks pre-qualify borrowers, provide additional education/support plus provide a process to move the 7(a) application along.

Too many banks are getting distracted with PPP Forgiveness at the expense of sacrificing speed to getting long-term capital in our small businesses hands so they can survive into 2021 where their business is likely to return to normal.