Why Community Banks Should be Selling Participations

Most community banks will find it challenging to meet their loan growth targets in 2021. Part of the challenge is lack of loan demand, elevated and rising loan payoffs, and stiff competition. Therefore, most community banks conclude that they do not want to sell participation in a good commercial loan to another lender. However, selling loan participations can be a highly profitable strategy for many banks. We recently worked on a loan that highlights the importance and enhanced profitability of such a strategy.

Scenario

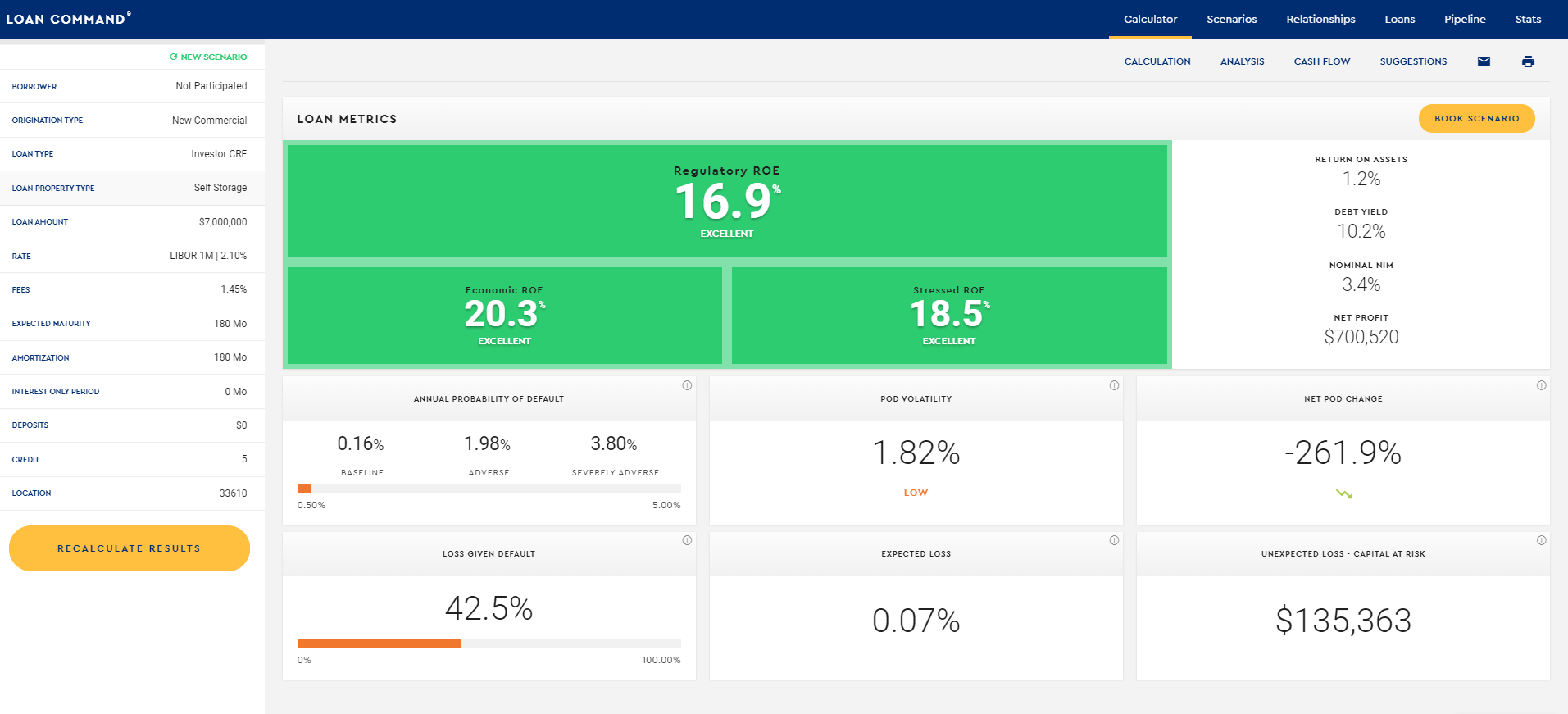

Our bank underwrote a $7mm loan to finance two self-storage facilities for a customer. The loan was structured as a 15-year fully amortizing term facility, priced at 2.10% over the index and fixed to the borrower through the ARC program at 3.73%. The bank also generated 1.45% in hedge fees ($101k). The bank’s loan pricing output is shown below.

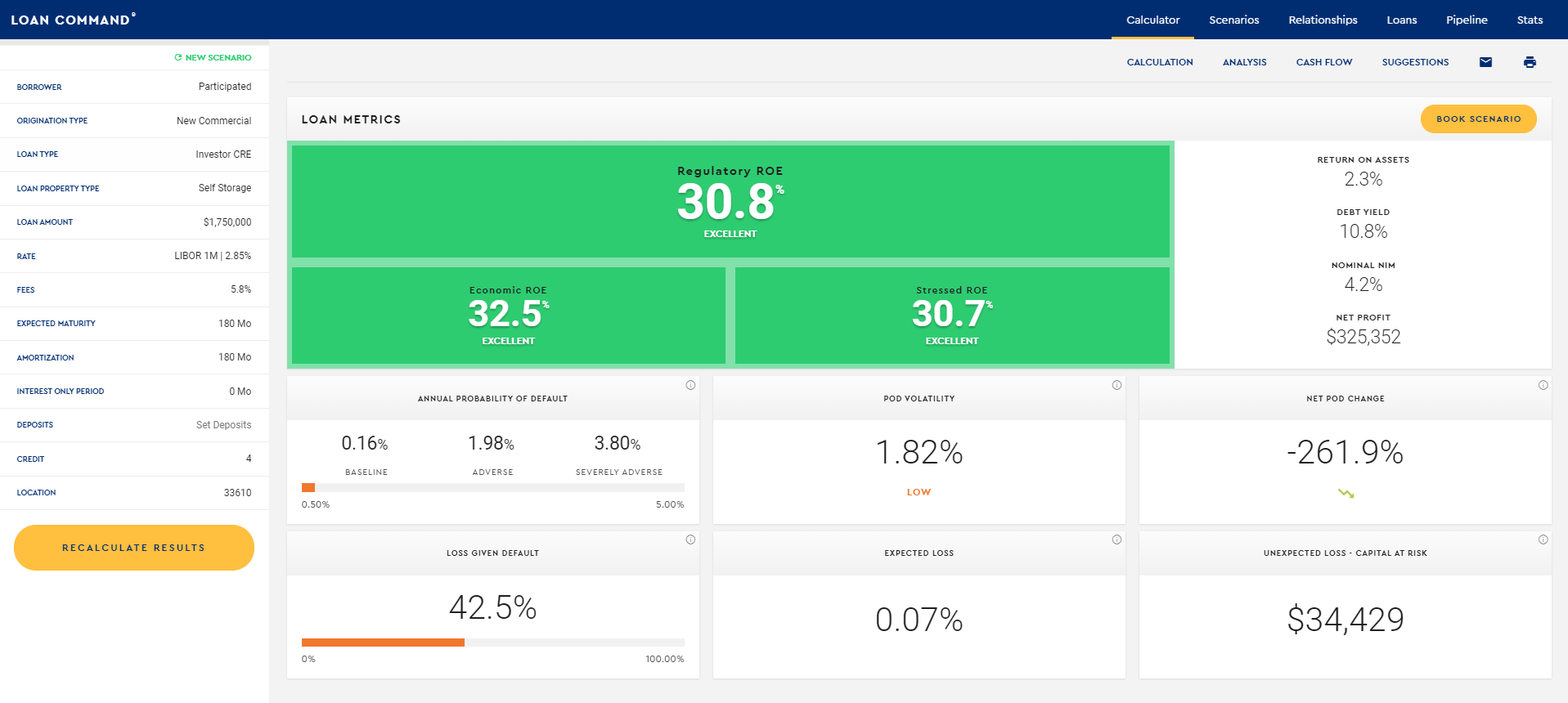

The loan is relatively profitable on its own at 16.9% regulatory ROE. However, the originating bank intended to find a participant to take 75% of the credit, not because of any capital or concentration issues, but because the bank’s strategy is to find suitable participants to increase profitability on the retained credit. The bank was able to sell 75% of the credit to a bank that desperately needs commercial loans, and the participation was structured with a 25bps servicing scrape, and the originating bank kept the entire hedge fee. The originating bank also retained certain key loan administration rights despite only holding 25% of the loan. The bank’s loan pricing output for the participated loan is shown below.

While the bank only retains 25% of the earning asset, the effective credit spread is increased to 2.85%, and the upfront fee increases to 5.8%. The regulatory ROE for the loan jumps from 16.9% to 30.8%.

Why This Participation Makes Sense

In this particular instance, the originating bank had an aggressive participation strategy that looked to maximize profitability. Despite the originating bank’s desire to grow its loan portfolio, the bank strategically decided to sell a loan participation in this credit for the following reasons:

- Create a participation market: Selling a participation in a quality loan begets interest from the participant for additional future loans. The originating bank is developing a ready-made participation market for additional credits and has sold to many other banks within and outside its market. While the originating bank sold $5.25mm of an earning asset, it will create a pool of banks that are willing participation buyers for future credits.

- Improve pricing: The originating bank is finding it challenging to meet loan origination goals, but there are many banks that are finding it even more difficult to source commercial loans. By identifying those banks with less access to loans, the originating bank can scrape a 25bps servicing fee and recognize a whopping 5.8% upfront hedge fee. This strategy turbocharges the bank’s ROE. This multiplier effect is a tremendous boost to the bank’s performance.

- Why sell earning assets: Detractors will claim that the $5.25mm participation sold will need to be replaced with Fed Funds or lower-yielding securities; however, there are a few rebuttals. First, the loan is structured as a 15-year fixed to the borrower with a prepayment provision. The prepayment speed on this type of loan is meager, and the probability of the loan remaining for the term is high. Eliminating loan prepayments is a significant advantage for the bank and the participant. Second, the bank is cultivating a participation market that allows it to offer competitively priced loans. The higher ROE that the bank earns enables the bank to price more aggressively to win business as long as the economics for the participant is still acceptable. The originating bank is leveraging the participant lenders’ lack of loan demand by creating a more competitive offering in its local market. Third, the originating bank is gaining a reputation among borrowers in its market for competitive pricing, leading to more loan opportunities. Fourth, the originating bank is also gaining a reputation with lenders who want to work at the bank because of the increased loan activity.

Properly structured and executed participation strategies can lead to positive ancillary effects, which often offset the need to find more earning assets. The participation strategy can lead to substantial future loan demand for the originating bank.

Conclusion

Some community banks are dismissing the benefits of selling loan participation. However, originating banks that can identify participant banks facing even more challenges to book and retain loans can create an arbitrage opportunity to increase profitability. In the long term, they can also increase loan outstandings.