5 Things You Are Going To Have To Do With Your Branches In 2021 and Beyond

The combination of the COVID-19 pandemic and the interest rate environment drives every bank to rethink their branch delivery. In a world with six percent net interest margins, banks can have all the branches they want. However, in an environment with sub-three percent margins, banks can no longer afford an extensive bank network. Banks that say – “We will let the customer choose how they want to bank,” abdicates both agency and fiduciary duty. In this article, we look at the economic imperative of how bankers must change branch delivery and five things to put in motion immediately.

Increase safety precautions: Job one of banks is to keep everyone safe. While we may get a vaccine in the next year, the delivery and uptake will undoubtedly take years. As such, in addition to current safety precautions, banks will need to handle both the reporting of COVID-19 positive employees and customers in the branch and have the ability to contract trace.

Rebalance Branch and Digital Delivery: Any banks that thinks that keeping a large branch network open is helping their customer base may be misguided. A majority of branches in this country are now net drains on capital. Every day that goes by erodes bank’s capital and the probability that the bank will be around for the long-run. That branch likely has about $1mm of amortized cost and $600,000 to $1mm of annualized operating cost. If that branch serves 2,000 customers and 75% of choose to use the branch over digital and call center channels, that is an annualized cost of over $500. Add indirect cost such as operations, marketing, community outreach, and management time to manage, and you get an annualized cost of close to $600 per active branch user. The problem is your bank will likely make less than half of that on them in 2021 and 2022.

This means banks likely need to reallocate capital away from their branches and into digital delivery. Customers use the branch because we MAKE them use the branch. Move lending, account opening, financial management, and problem resolution online and watch what happens to branch traffic – it will plummet. If a customer can have a Facetime-like connection, chat, e-sign, and full product access via digital delivery, few customers will want to spend their time coming into the branch no matter how much they like the bankers.

Consider your most efficient branch in your state probably has a per-customer cost of close to $200 per customer per annum and your least efficient digital platform, for a $400mm total asset sized bank with all the bells and whistles probably has a digital cost of delivery of $75 per customer per year at worst. Our point – if you think you can’t afford technology because of your size, you REALLY can’t afford brick and mortar. Better to overspend on digital technology than overspend on inefficient physical delivery.

If you are one of those bankers that have convinced themselves that your customers prefer the branch experience, it is likely because you have a customer base that either might not know any better or are using you because you are underpricing your services – either way, that spells trouble for shareholders.

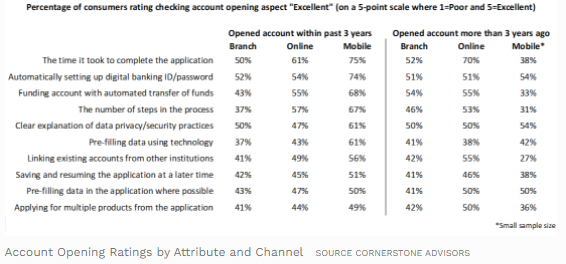

The reality is that even an average digital platform, particularly mobile, outperforms the branch at almost every turn. Take the recent data below on account opening by Cornerstone Advisors. Online and Mobile topped the branch experience in ALL ten of the criteria.

If you need to be face-to-face with a banker to help pick a checking account, get a mortgage, or solve a problem, we will submit to you that your processes are too complicated. The average activity that goes on at a branch currently isn’t brain surgery, and you are likely over-indexing on the importance of a branch visit. Our findings are that more than 85% of all branch activity is better served by both parties by moving online. If you have the right process and the right technology, data has shown that satisfaction increases, engagement increases, and profitability increases. Are your branches going to keep up?

Not to put to fine a point on it, but also be careful about what new investment you make in the branch. Adding more drive-up lanes, walk-up teller lines, interactive teller machines, or cool designs may help in the short-term, but it is but a Band-aid that will only serve to slow the capital bleeding. It is far better, in our opinion, to invest that capital you would have spent on the latest interactive teller and invest it in your digital channel.

Change Product Mix to Increase Profitability: Having more than $40mm in deposits used to make any branch profitable. No more. In this day and age, with margins so compressed, that number is well over $500mm and often into the billions for banks with high-efficiency ratios. You can no longer expect deposits or consumer loans to carry you and need to figure out how to drive more treasury management, mortgage, and additional fees through your branch network. That likely means more of a focus on engaging with the small business and becoming more of a trusted advisor for areas such as payments, capital, M&A, technology, marketing, wealth, estate planning, and others. While bankers will not need to be experts in each of these areas, they will be able to leverage technology-based tools and partnerships to help while earning fees in the process.

Change service delivery: As checks and cash become less, there will quickly reach a point in the next three to five years where many banks will cry “uncle” and move away from the physical processing of items. It will become too expensive on the margin. The pandemic has moved more small businesses than ever to become cashless. More transactions over digital mean fewer transactions at a branch. Human capital at the branch will have to change to be more universal banker-like in nature with more of a focus on training customers to use the bank’s digital channels.

Beyond that, account representatives will also need to upgrade their skills to offer more financial advice and planning services as well as digital education. The branch will change from being primarily transactional to a focus of education.

A Different Strategic Paradigm: Most banks have a completely backward paradigm when it comes to branch strategy. Bankers think if they build branches, customers will come. If they come, then the bankers can get them using other products and onto digital. It is precisely the opposite.

Banks can no longer afford a six-year breakeven period for de novo branches. Instead of building branches to aggregate customers and taking that risk, banks will aggregate customers first through digital channels and then build branches to support those customers that need physical, face-to-face interaction. This means fewer branches and branches largely located in metro markets. Instead of serving 2,500 customers, a branch will evolve into serving 25,000 customers. The bank can then use those main branches to connect with the few remaining customers that are not on digital.

With that type of scale, banks can then afford to turn their branches into an experiential destination complete with memorable technology, smells, sights, and unique experiences.

What Your Future Holds

If you have ever said – “but our branches will be our competitive advantage,” you might as well sell the bank now. It is a flawed strategy that is about to get worse. Undoubtedly, you have some customers that will ALWAYS prefer the branch. Unfortunately, these customers will become fewer and fewer as technology improves, and channels like wearables, internet of things, voice, and augmented reality become more plentiful.

As branch traffic drops, your costs will increase to the point where instead of being at a competitive 40% efficiency ratio, you will be closer to 100%. You will no longer be competitive on deposit or loan rates and no longer have the excess cash flow to reinvest in technology. Unfortunately, by the time that occurs, it will be too late to sell at anywhere close to book value. You will be more of a liability than an asset and will start to trade substantially below book value.