5 Things You Can Learn From 4Q Bank Performance

Our first indication of industry performance for 4Q comes to us in the form of earnings disclosures from the top 24 banks. In this article, we break down five lessons learned from analyzing large bank performance for the fourth quarter (4Q) of 2020 compared to 2019 and see how we can turn this data into actionable insights to improve community bank performance.

One: Small Is Beautiful

As usual, one thing we always check is the relationship between size and performance. Once again, we find that asset size and performance are inversely correlated. This goes for individual metrics such as the ones highlighted below, but also the overall value of the bank. A bank’s price/earnings multiple had a -32% correlation in 4Q. It was not only easier for smaller banks to increase performance, but the market rewarded smaller banks more.

The easiest area for banks to drive value through growth is through efficiency. However, as can be seen below, next to NIM, that is one of the clearest areas where value was hard to drive in 4Q. In fact, it was the smaller banks that had, the lower efficiency ratio below the magic 60% area led by NYCB at an impressive 41.4%.

The major takeaway here is that if you’re growing for growth’s sake, you could be doing it wrong. Only efficiency was positively correlated. The larger your size the more it worked against you when it comes to loan growth, deposit growth, net interest margin (NIM) and, the ever-important return on equity.

The major takeaway here for community banks is that there is nothing wrong with growth, just make sure you are gaining operating leverage in the process. If growth doesn’t make you more efficient, then you are just becoming a larger, more inefficient bank – a trend that drives you out of business faster.

The average return on average equity increased to 11.9%, or a little less than 1% higher than last year for this period. The cost of capital fell to around 9.5% for these large banks (still about 11% for community banks) as trading multiples increase. Banks increased performance mostly by reducing relative credit provisions (JP Morgan Chase), having a superior business model (Capital One, Silicon Valley Bank), reducing expenses (Ally), or a combination of all three.

Banks that continue to produce below their cost of capital, such as Wells Fargo, Bank of America, and others will find that attracting new capital will be increasingly expensive. These large banks have enough liquidity and capital flexibility to handle this. However, for community banks, the combination of growth and producing a return on equity below 11% is a bad vortex to overcome.

Three: Deposit Glut and Trimming for Efficiency

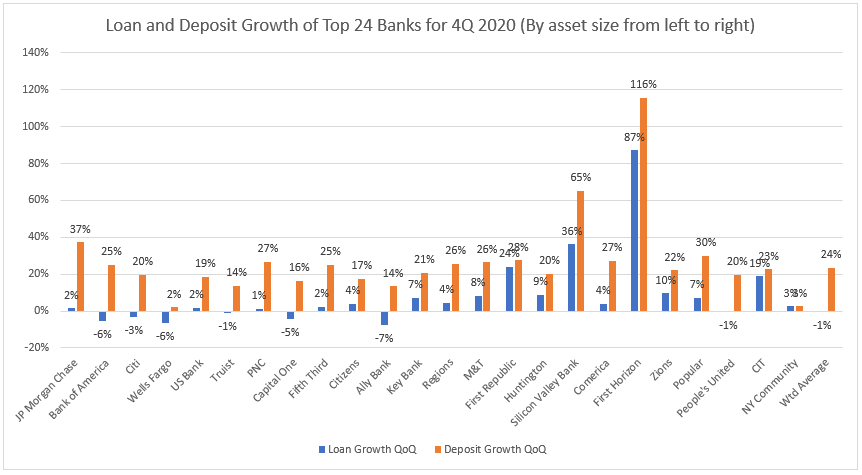

Few banks, with the exception of Wells and NYCB, had problems with deposits. Deposit growth was torrid at 24% year-over-year (below). Unfortunately, it is at a time when deposit value is among the lowest in history.

The key takeaway here for community banks is to make sure you are not growing loans or deposits without paying attention to quality. To our earlier point on efficiency and operation leverage, now is the time to shed deposits with higher rates (Money markets & CDs) and restructure deposits with higher maintenance cost such as small-dollar retail checking. Now is the time to market for more of these higher-cost accounts to move online and on mobile to allow for greater self-service and electronic delivery. High rates, high-interest rate sensitivity, paper statements, and higher branch usage are all markers of lower quality deposits.

In this market, banks need to distinguish between high quality and low-quality growth. If you don’t know which you are getting, that could be a mistake.

Four: Loan Struggles and Margin

On average, loan growth decreased at the top 24 banks by 1% with Ally, Wells Fargo, Bank of America, and Citi struggling (above). Banks like SVB, First Republic and Citi did impressively well with organic growth. First Horizon acquired Iberiabank so their numbers were skewed for both loans and deposits.

Net interest margin decreased an average of 53 basis points largely driven off lower loan pricing. Loan pricing hit a near-cycle low for most sectors, along with credit during late 2019. Credit spread slowly increased starting early March only to gap out in May to some of the widest since the Great Recession.

Banks however reduced loan volume so little of this margin found the balance sheet. By June of 2020, spreads quickly tighten almost as fast as they increased. By 4Q, spreads were near their record tights, just in a lower interest rate environment. The net result is that these 24 banks took about 40% of the rate drop into their cost of funds in the form of lower deposit rates, but the rest came out of margin.

In addition, the lingering effects of the Paycheck Protection Program (PPP) forgiveness effort also distracted many banks for core loan growth in 4Q 2020. Going forward, banks are being more efficient with the next round of PPP (PPP2) in 2021 and have devoted not only more resources to core loan growth but core resources on how they can leverage the goodwill garnered by PPP.

Smart banks will roll their PPP2 effort into both SBA 7(a) production and conventional long-term financing to help their small business customers take advantage of the reopening economy. Loan demand and supply of credit is expected to increase. Given the market, the critical decision will be what is the view on credit.

In talking to many of these top 24 banks, the general sentiment is a guarded optimism with a bias towards the “risk-on” mentality. That is in mid-2020, the sentiment was defensive in nature. Now, given the vaccine, loosening business operation restrictions, and the potential for more stimulus, many of these banks are thinking to add a conservative amount of risk to the portfolio. Almost every one of these banks will continue to fight for higher-debt-service coverage loans at near-record tight credit spreads, but now the thought is to take some risk on selected industries hit by the pandemic but have a clear path out. Conservatively underwritten hospitality, for example, fall into this category as some banks are helping their larger borrowers acquire property at advantageous prices while the bank charges advantageous credit spreads.

Banks will have to carefully pick and choose where they want to expand risk in their portfolio. It will be these decisions that will have a material impact on loan performance the likes of which we have not seen since 2010, the last time banks were in this position.

Five: Retail needs help

Commercial and wholesale did relatively well at each of these top banks with the exception of Wells Fargo. Return on assets for these sectors was up to 1.8%, up about 30 basis points from 2019. Return on assets decreased about 20 basis points to 2.3% and a majority of banks that reported detailed breakout data for retail reported lower revenue. JP Morgan Chase continues to lead banks in retail return performance due to their success in moving customers online and ability to generate fee income.

Compressed margins and reduced retail activity make retail less profitable requiring a shift in resources eventually. However, right now the big gains are continuing to grab the small business customer. It is interesting to note that JP Morgan Chase, Bank of America, US Bank, Wells Fargo, and Popular, all have strategic initiatives to focus more on providing small businesses with greater payment capabilities and enhanced cash management offerings (data, invoicing, and international services).

Putting This into Action

While we will get the data for the rest of the industry in the next several weeks, the largest 24 banks give us an early indication of what is ahead. The above is a prioritized order of concepts community banks should be thinking about strategically as it moves into the jaws of 2021. Managing growth and return is perhaps the largest strategic imperative in this market followed by creating a framework to judge quality growth from destructive growth.

While 2021 will not be easy, for community banks that position themselves, they will find that they can easily surpass the competition and set themselves up for future success.