5 Things Your Bank Should Be Doing Now to Not Get Acquired Later

It was only two years ago when we were in the golden age of banking. The ten-year treasury was above 3%, loan growth was strong, funding cost was low, and credit quality was near its high – if not at record highs for some banks. Fast forward today, and you have a 0.67% ten-year, a large chunk of your balance sheet in forbearance, deteriorating credit quality, and margins near record lows. There are some obvious things that you should be doing to ensure you can survive in the long run. In this article, we step through the five top initiatives that will have the largest impact on your equity.

Capital is Dear

While there is plenty of money looking for a home these days, banks are not all that interesting compared to other alternatives. If you exclude credit card banks, the average return on equity (ROE) for the industry is a paltry 3.5% this year. Worse, projections show banks deteriorating further into next year before only a slight improvement. That is below a bank’s cost of capital, which makes it hard to attract new equity. As such, banks need to hold onto their capital and be laser-focused on how to deploy it.

Of course, not all banks are producing returns this low. There are a few more than 1200 banks that are producing over a 10% return on equity. These banks are averaging a 12% return, and we will look at how these banks are doing it.

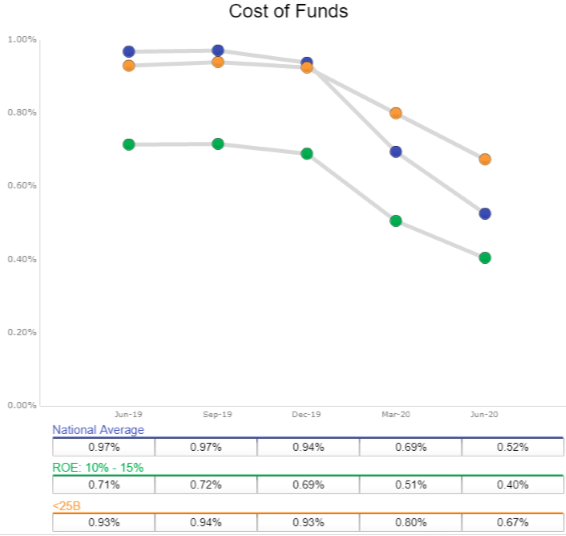

Priority 1: Cost of funds

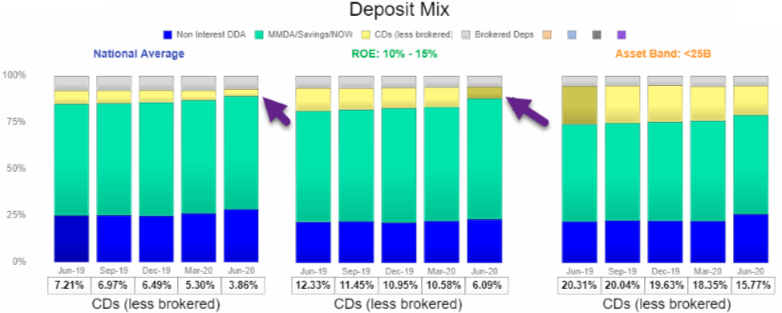

With interest rates low, deposits plentiful, slower loan growth, and the yield curve flat, banks cannot afford to pay up for deposits. Most deposits on a bank’s balance sheet cost the bank more than they make. Top-performing banks and national banks have been doing this better than smaller community banks, and it is starting to make a difference.

Higher performing and national banks have aggressively let their certificates of deposit run-off. Where CDs made up 11% of the average top-performing bank’s deposits at the start of the year, which is down to 6%. Meanwhile, the average community bank is still hovering at around 16%.

To make matters worse, many community banks are still paying up for money market accounts. While we will talk about cutting costs in a second, every bank needs to be aggressive at reducing rates.

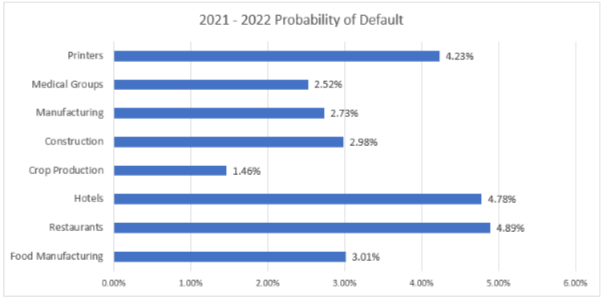

Priority 2: Be Selective on Credit

That medical practice or printer may not be the credit you think it is as historical rates are radically different going forward. If you are still pricing all credits the same, that is a mistake. In good times, credit quality tends to converge, and there isn’t much difference between “good’ credit and “bad” credit. Now, with the pandemic credit shock, not only does the dispersion of credit increase but so does the volatility of the probability of default. All this adds up is that banks need better analytics and need to be more granular in both their credit analysis and pricing.

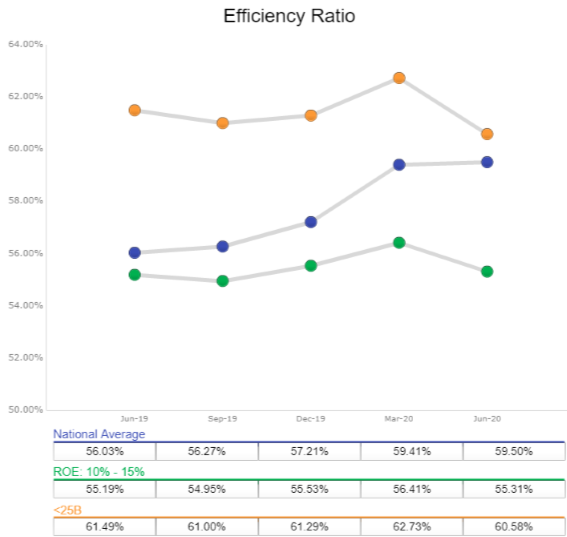

Priority 3: Efficiency Rules

Your branches are likely closed, yet you are still increasing deposits. You have less face-to-face interactions, but new customers are still coming aboard for treasury services, deposits, wealth, and loans. Your branch network, likely your highest functional cost, must be in question. It is the reason why your deposits are so expensive relative to their value. Every bank needs to be questioning its branch network, and can they reduce their footprint to save $1mm per year for every branch discontinued.

If you don’t have a digital account opening and the ability to send wires, ACH, and person-to-person payments via your bank’s mobile app, you need to as that will go a long way to reducing your physical branch burden.

Next to your branch network, your loan production is likely your second-largest functional cost. This needs to be automated, as well. Digitizing your commercial and consumer loans is no longer a nice to have, but a must-have to survive over the next several years. It is the difference between making those deposits cost you money or make you money.

Outside of loans and deposits, there are a variety of internal functions that need to be automated and digitized. Human resources, finance, your call center, fraud, compliance, and more all need to be reworked and be more efficient. A hallmark of performing banks is an efficiency ratio below 50%.

Going forward, that ratio needs to be below 40%, which means more of an investment in technology and process automation.

The pandemic has effectively sped up bank’s technology investment by about five years and has made it more offensive. Banks are spending more on infrastructure than in year’s past both because key parts of the architecture are now required with more employees working from home (end-to-end security, collaboration tools, cloud-based tools, etc.).

Further, bank customers are more and more prioritizing a bank’s technology capabilities over price. This is a major shift from year’s past and a trend that has been exacerbated over the last six months. Consumers and businesses are now choosing their bank based on technology capabilities first, then customer service, and then price.

Priority 4: Reserves

Do you know how bad credit is going to get? Neither do we. For that matter, it is still unclear when credit losses will peak, but the consensus is from the hundreds of banks we talk to is somewhere late 2Q or early 3Q of 2021.

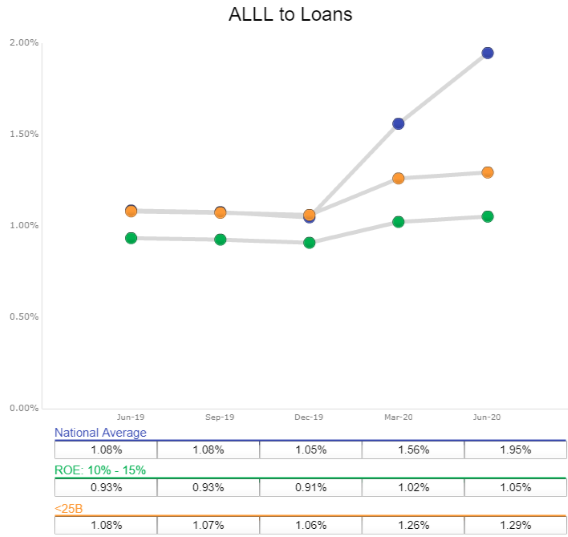

National banks have jumped their reserves from 1% at the end of the year to almost double that at 1.95%. Most community banks are still in the 1.3% range and have only increased reserves by about 23 basis points. We are not sure if this is a mistake, but in terms of equity valuation, it is better to take reserves now when the market is expecting you to do so than have to take credit losses that impact capital later.

It is also worth noting that top-performing banks have the lowest reserves. Why? Because most of these banks have been trending up in credit quality. These banks have tightened credit spreads, booked loans that have over 2x debt service coverage, focused on generating fee income, and have the ability to sleep better at night.

This is the opposite strategy of many community banks that have instituted floors and priced credits effectively wider. They price wider and often get adversely selected. In times of improving credit quality, this strategy can pay off. However, in times of credit stress, this strategy can be devastating.

Priority 5: More Marketing / Branding

Finally, banks need to set themselves apart by products, marketing, branding, or preferably all three. The level of service is high at most community banks, so that is not a differentiator. What can be is marketing. As we have written about (HERE), banks have reduced marketing, the cost of marketing is down, potential customers are more sensitive to good marketing, and conversion rates are higher. All this adds up to a higher return on your marketing investment.

In times of uncertainty, customers and potential customers pay attention to bank marketing. Now is the time to gain customers and market fee lines of businesses.

Putting This into Action

M&A activity has been slow and will remain slow during the pandemic and credit crisis. Few banks will be forced to sell until they realize that credit losses surpass their reserves and start to approach about 50% of the last downturn. Until the end of the credit cycle can be more accurately predicted, buyers will not be anxious to take the chance on credit uncertainty. This likely means that M&A will likely start to pick up during the back-half of next year.

Low rates, a flat yield curve, Covid-19 pandemic, and credit stress has changed the game for banks. It is now imperative to take cost out of the system and to develop a platform with higher operating leverage and a lower cost structure that the banks that you are looking to acquire. The more you can maintain risk-adjusted margins, generate fees, keep credit quality relatively high and operate with more efficiency, the more banks you can buy and the more you can pay because your cost saves will be greater. Fail to make these changes, and the opposite will occur.