5 Trends Bankers Need To Know From The Fed’s New Payment Study

Last month, the Federal Reserve released its 7th, tri-annual U.S. payments study, and, as usual, it had some eye-opening trends that all banks need to consider for their long-term strategic planning. For example, while consumers have always said they preferred debit cards over cash, last year was the first year in US history where consumers used their debit cards (28% of all transactions) more than they used cash (26% of all transactions). In this article, we highlight some major trends and discuss how banks can best position themselves to take advantage of the shifts in payments.

One – More Transactions & Payments

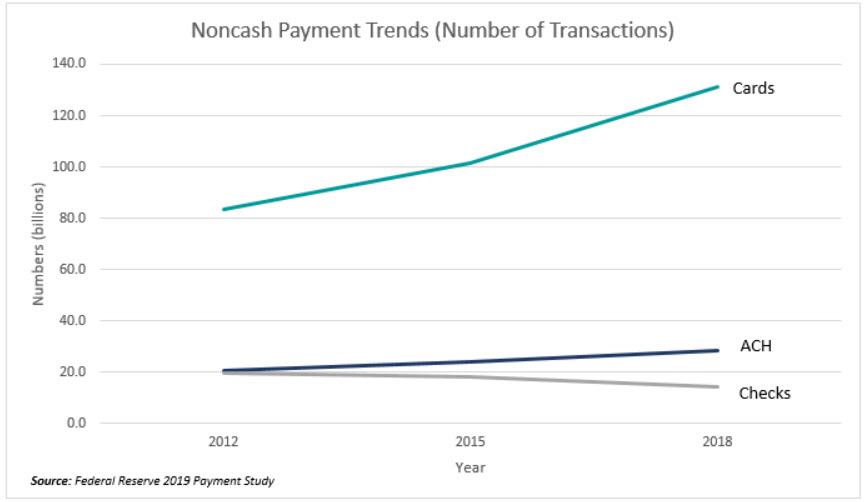

For starters, transactions in the form of non-cash hit a record $97T. Both the number of noncash transactions and volume increased at an increasing pace coming in at an annualized rate of approximately 7% and 5%, respectively.

For bankers, that means that our customers are using their accounts more than ever before for trackable transactions, particularly for electronic payments. With each of these transactions, a stream of data comes with it that will become increasingly valuable.

Two – Its About the Convenience of Cards

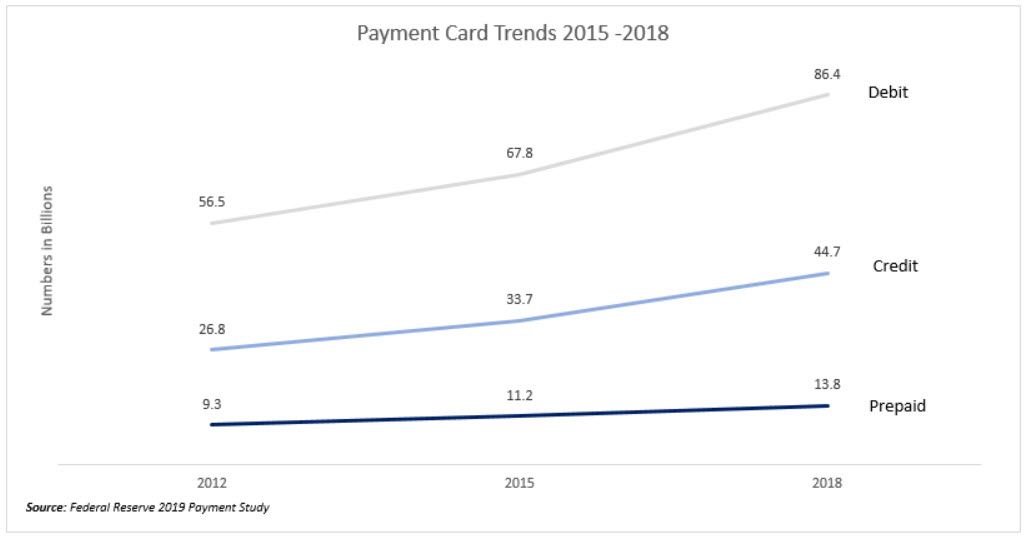

Card payments (both credit and debit), which represented 7% of core noncash payments by value but 75% by number, grew at an annualized rate of almost 9%. This is one of the fastest increases we have ever seen. Debit cards, including prepaid, are being used nearly twice as often as credit cards.

Of interest is that remote general-purpose card payments reached $3.3T, almost equal to the value of in-person general card payments.

The takeaway here is that because of the control and convenience, both businesses and consumers are using their cards for more and more transactions, particularly e-commerce and recurring bill payments. For banks to remain competitive, not only are we going to have to be adept at reflecting that card data back to the customer in the form of dashboards and alerts, but we are going to have to continue to build out card control features to allow customers to stop recurring payments, dispute transactions, handle travel and be able to restrict the card by time, location and type of transaction.

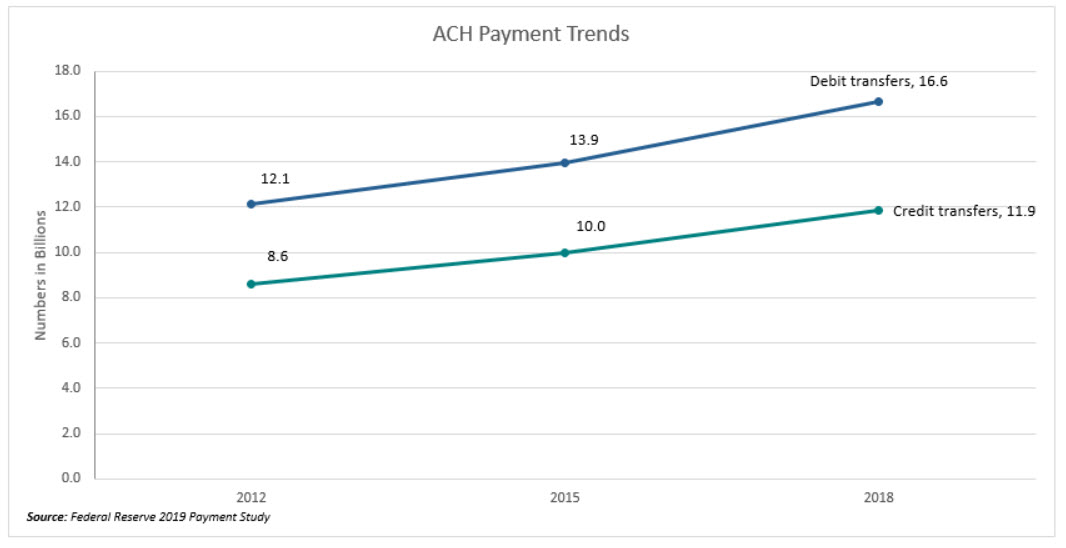

Three -The Rise of ACH & RTP and the Fall of Checks

Total ACH payments, grew 6% per year by number and 7.2% per year by value from 2015 to 2018, faster by both measures than from 2012 to 2015. 2018 marked the first time that the number of ACH debit transfers exceeded payments from checks.

Speaking of checks, the number of check payments fell 7% per annum and the value of check volume also declined at 4%.

Of all the lessons here, this one is the least evident. While it is no surprise that both cash and checks are decreasing, the stark lesson here is that at some point, both cash and checks will be too expensive to service in our present capacity. This has far-reaching implications as to pricing for check and cash handling services and even calls into question if banks still refer to the primary customer demand deposit account as a “checking account.”

Further, and even less evident, is the growing importance of ACH, and its brother, real-time payments (RTP). Because of the cost structure, banks will play a growing role in the payments game. In the next three years, we look for ACH and RTP growth to eclipse that of cards. Look for banks to start building out transaction data and payment controls similar to that of cards.

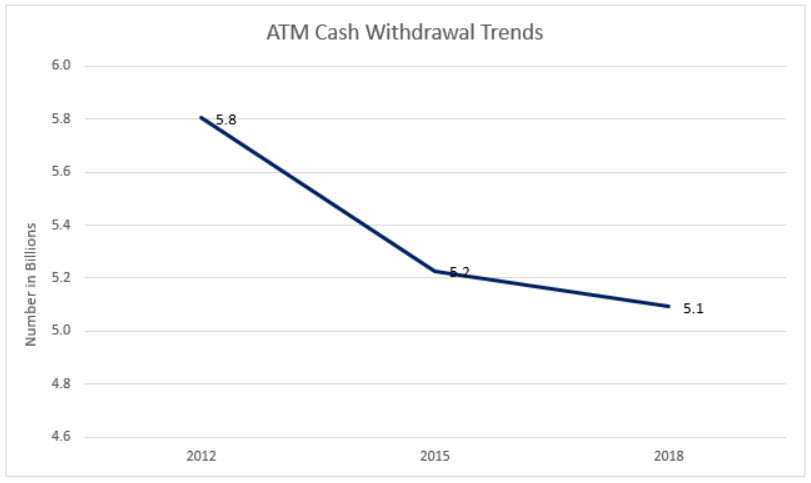

Four – Reallocate Your ATM Investment

There were just over five billion ATM withdrawals in 2018, a decline of 0.1B. While this is a slower decline than registered in 2015 and the average amount of ATM withdrawal increased $10 to $146, the trend of less ATM usage will continue as electronic payments replace cash. Look for this trend to reaccelerate as Venmo, Zelle, and cards continue to increase in usage.

This means rethinking your ATM investments and reallocating that capital to electronic payments.

Five – No Matter Who You Are You Need A Payment Strategy

The data shows that electronic payments will continue to increase in importance. Ease of use will be critical to include the ability to limit, dispute and automate payments. In addition, the ability to reflect back transaction data, trends and alerts will propel electronic payment adoption at an even faster pace.

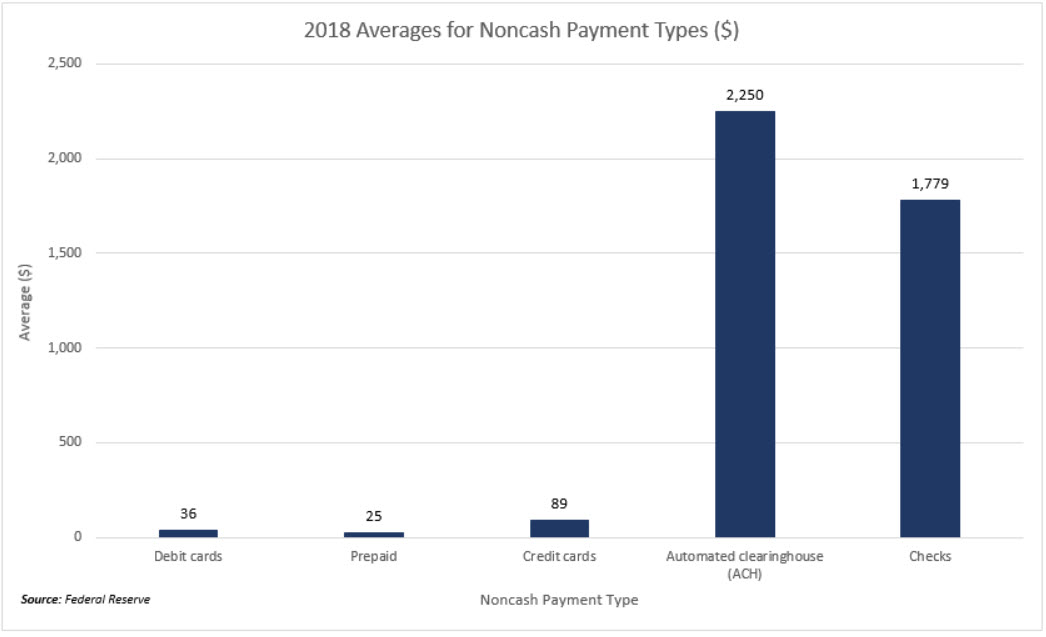

One thing that stands out loud and clear is that ACH/RTP because of the single item dollar size (below) and the frequency, will be critical to handle. Banks will want to allow their customers to send AND request payments between financial institutions and individuals online and on their mobile.

For some banks, this may just mean getting a one or more payment partners that can facilitate ACH/RTP and other channels for their retail or commercial customers. For other banks that see payments as a strategic advantage in the future, they may want to develop their own API/gateway in order to allow payment-as-a-service to their commercial customers. This would allow banks to provide their customers with the same capabilities as the bank has so that the bank’s commercial customers can send and receive electronic funds from their customers more efficiently.

The Opportunities Are Huge

Just take housing. Almost 37% of the US population rents their homes and pays rent to an estimated 20 million landlords in the US. More than 85% of those payments are via checks with a cost structure that is five times that of ACH. No matter if you bank the household or the homeowners association, your bank can play a valuable role in facilitating recurring payments.

Housing is just one section of the market, utility payments, municipal payments and thousands of other sectors are ripe for disintermediation that will change over the next five years.

Along another dimension, debit card rewards are another significant opportunity that most community banks overlook. This is still uncommon but a proven tactic that allows banks to build targeted offers and motivation to use debit cards over checks or credit.

The growing importance of payments, the rapid shift to electronic means, and the rise of new payment platforms such as Zelle/Venmo/RTP have created a unique opportunity for banks. 2020 will be the year that many banks lay the groundwork to not only enable their customers to utilize various payment channels but provide the customer with more data and control. It doesn’t matter if you are a retail, commercial, or specialty bank, chances are getting a cohesive payment strategy is critical for your future.