9 Vital Tips For Banks To Improve PPP Performance

We have often characterized banks as being “manufacturers of credit.” Like any manufacturing process, banks need to produce a product, in our case loans, to meet the customer’s demand. Loan production takes inputs such as capital, analysis, and documents and combines them in a standardized process to produce an end product. The Paycheck Protection Program (PPP) has presented a tremendous challenge for banks. After three days of manufacturing credit, we have honed ten essential concepts that may help your bank do more than its fair share of getting America going again.

Step One: Set Objectives

Banks cannot optimize PPP loan production unless they are clear on their objectives. Does your bank want to process the most loans, process the most dollars of relief, help the most workers, help support its extended credit, help bank profitability, or something else?

Each objective drives how you structure the loan production process and how you prioritize those loans through that process. For example, many banks are choosing to process loans below $30,000 last. While this does not help the most customers or the most businesses, it does help get the most dollars out the door and theoretically keeps the most workers in their jobs. Being clear about your objectives gives you a better probability of meeting them.

Step Two: Prioritize Customers

In order to do the greatest good, banks will need to either structure their process to ensure some level of prioritization or prioritize customers before the process. Once objectives are established, then filters and ordering functions need to be completed to rank businesses that want loans. The most common way to accomplish this is to analyze the data around each submission, such as the number of workers on the payroll, requested loan size, or if the customer has an existing loan, and then queue customers accordingly.

One idea here is to establish a “Registration List” that puts customers into the start of the processing funnel and asks some questions upfront, such as estimated loan size, if they are a current loan customer, their business structure, or how many workers they have. Once the data is collected, customers can be ranked and then channeled.

Alternatively, banks could design a process that prioritizes within itself. The easiest way to do this is by channel. Since sole proprietorships and independent contractors, for example, correlate to smaller loan sizes. A separate channel could be established so that those customers self-select. These customers could be sent to a specific department, handled manually be their relationship manager, or given a coded link that tags the customer for future sorting.

Banks can also build prioritization into their systems. Question three, for example, on the PPP application asks about affiliations, and if yes, what is the nature of those affiliations. Decisioning of this answer should impact the process. Since businesses that own other companies create a more complex application, these loans should be channeled into a different workflow for a different set of BSA checks as well as a modified closing process. In this manner, overall processing can be sped up as a greater number of resources can be allocated to the primary workflow, and complex applications don’t hold up the production of credit.

As you prioritize customers, we encourage banks to not only think around the concept of need but also the need of the community. Doctors and doctor groups, for example, are struggling under the cost of supporting the health of their community in a time of this medical crisis. Banks may want to move healthcare professionals and supporting services to the front of the line regardless of if they have a loan with your bank or their requested loan size.

Finally, there is a difference in need. Some firms need money now. Other firms need the money later but have the need to confirm the money now. Here, while there is little difference in confirming the loan number through the SBA system, E-Tran, there is a difference in how you process. The former should be expedited all the way through funding, while the latter can be lagged for documentation, closing, funding, and boarding. While this processing difference doesn’t seem like much, because the window for grabbing loan numbers is so short, minutes matter. By our estimation, 15%+ of customers can be lagged which equates to a material difference in throughput processing.

Step Three: Forecast Production To Inform The Process

If there were ever a person to turn to for insight during this crisis, it would be Edward Deming, the father of modern production. Deming used to tell his classes, that “Learning is not compulsory…neither is survival,” “It is not enough to do your best, you must know what to do, and then do your best,” and “without data, you are just another person with an opinion.” When setting up any system, Deming would have you model and then chart what process you need to get accomplished as he would often tell you that if you can’t describe what you are doing, then you don’t know what you are doing.

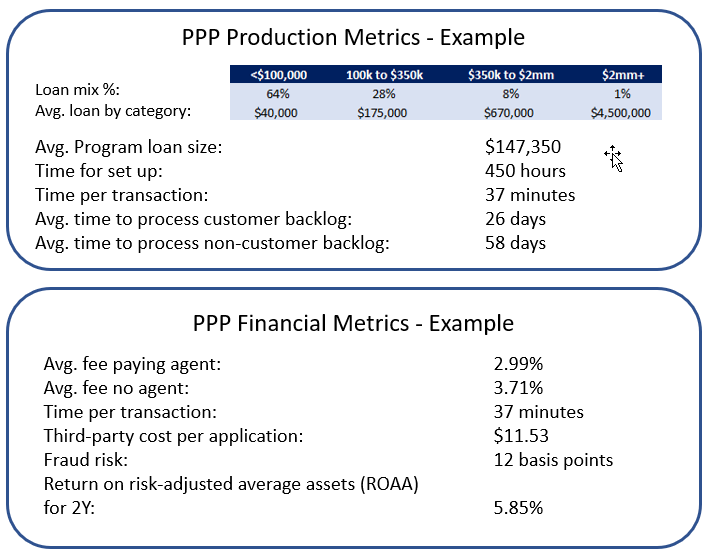

Deming’s teachings all add up to once you have your loan production processes mapped and defined; you should next model the process to see your sensitivity to specific inputs. We have done some modeling of the Program and have the following approximate metrics:

Step Four: Making Critical Decisions

This is no time to be timid. Bankers need to get comfortable operating on 70% of the information and trusting that they can figure out the rest on the fly. This isn’t an ideal place to be, but it is the reality of the situation. Since so many of our customers are financially hurting, it is a social imperative to get money out the door as fast as possible within the bounds of safety and soundness.

That means you are going to have to make dozens of “best guesses.” For example, the largest one is what to do about not having the form of the promissory note approved. While the industry has been hearing that a standardized note will be furnished by the SBA, as of the date of this publication, there is no such note. Items like the methodology of amortization is a large hole that banks need to decide. Most banks are standardizing around 18 months of full amortization after the deferral period. However, this decision drives up costs, changes the credit profile, and likely hurts liquidity as a balloon note is likely more tradable should a secondary market develop.

How to handle agent fees, how to prioritize customers, if your bank is going to validate past government defaults through the CAIVRS system, if you are going to go to two shifts for extended processing, if you are going to take on non-customers at the start, making sure you get payroll certification right, working around problems with the E-Tran system, if you are going to have calculators on your website and hundreds of other decisions need to be made and made quickly. The more issues you can think through now, and the more effort you can seek to improve your decision-making process, the faster you can go later.

Step Five: Getting Ready For Funding

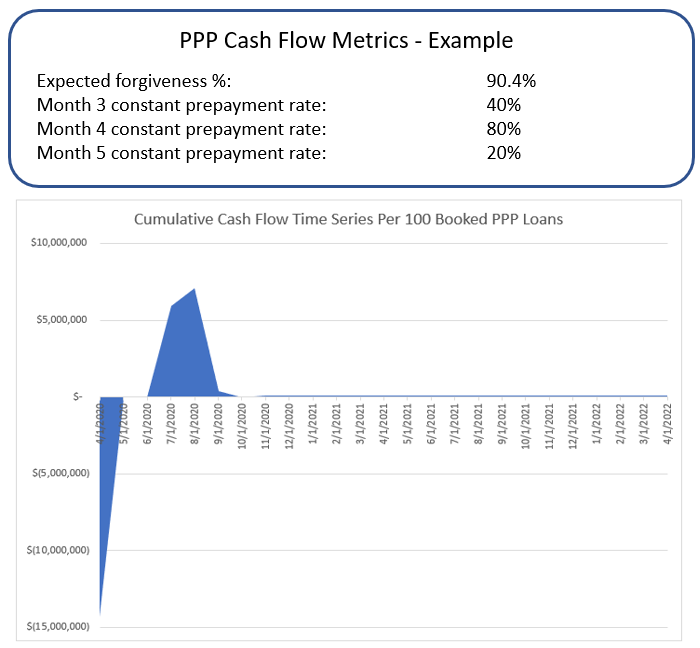

It is rare that banks have to move so much money out the door so quickly. Depending on your throughput, liquidity management can be a major effort. As can be seen, above in our “Cumulative Cash Flow Time Series,” we presented the consensus estimates, using a set of assumptions of what the funding need and cash flow estimates per 100 booked PPP loans.

Since this Program can change on the fly, CFOs need to monitor, manage and analyze not just production but also program changes for its impact on financial performance and cash flow demands.

Step Six: Market Your Outcome

When it comes to marketing around this program, this isn’t a passive process. We have heard too many bankers say they are not “marketing the Program” with the logic that they do not want to compound their processing problems. While this might be true, this doesn’t mean that you cannot “message” the Program as a little marketing can go an awful long way to achieving your objectives.

Since every customer is anxious, every customer will not only open your emails and click through your content but will respond. We see marketing metrics that the industry has never seen before, and banks should be taking full advantage of this fact.

Customers that are waiting in line to submit an application or for funding should get a communication every day, and banks need to be as transparent as possible. While this may be uncomfortable for banks, it is even more painful for the small businesses of America that not only have the uncertainty but need to make their own life and death decisions. The better information they have from your bank, the better they can make those decisions. Being able to manage your reputation is critical, and bank marketers need to stand by to render advice to the business lines.

Further, messaging about what documents they need, how to calculate their expected loan amount, the security of your process, how forgiveness will work, helping the small business manage their cash flow, the estimated time to application acceptance, the estimated time to funding and hundreds of other points should be front and center.

The creation of explainer videos, graphics, blog posts, and more needs to be produced immediately – content abounds. Bankers not only need to work closely with marketing, but bank marketers need to step of their game and learn this new product. No marketing professional should be waiting around to be told what to do. Now is the time for organized action and creativity.

Marketing doesn’t stop after the loan is funded either, banks should ready weekly messaging to help keep PPP borrowers informed and to make sure they can take full advantage of forgiveness. This not only helps the small business but helps the bank as well, and our guess is that with a little marketing, banks can improve performance for everyone.

Step Seven: Automate and Streamline Your Process

Now that you have the process underway, it is time to trim for speed. Banks should consider holding daily process improvement meetings to brainstorm how to increase throughput. Channeling Deming again – “you can’t manage what you don’t measure.” Hence, the first step here is to establish a set of daily metrics such as the number of applications processed, number funded, backlog, average loan size, length of time to process, and satisfaction rating.

Further, it pays to have all team members get in the habit of taking notes during this process. Not only will those notes be useful for the daily meetings, but it is highly likely we will be facing similar programs and efforts in the future. The more accurate we can record history, the better chance we must improve the future.

As Deming taught – “A bad system will beat a good person every time.” Keeping this in mind, bankers need to look for ways to streamline the process and employ technology to jump the number of loans processed per day.

Getting customers ready on the front-end is the single most significant thing banks can do. Utilizing electronic signature and integrating that system with your document system such as LaserPro is a natural improvement most banks have not made. Having a web application is also a huge improvement if you have those capabilities. Finally, make sure you expand your cadre of employees that have access to E-tran is critical as that is likely to be a bottleneck for many banks. Since this process takes days for access approval, you want to start now instead of waiting.

Banks can also utilize robotic process automation (RPA) to speed things up. Populating E-Tran, generating the document pdf, uploading the pdf to Docusign (or other e-sign system), sending out update emails, and similar are all easy wins.

Bankers need to also take a critical look at their process and look for parallel processing paths. For banks that check the CAIVRS system for past defaulted Federal debt, it is a question of if this even needs to be done. If your bank determines that it needs it, then consider moving it to after note generation so your bank can check it after the customer has the note to review and sign. Should it come back with a negative response, banks can always stop funding, and the advantage is that it doesn’t slow the process because it is happening in parallel.

The other major parallel process that banks are having success on is for all non-customers or non-customers that have loans but not transaction deposit accounts, as soon as they file the application, you can hit them up for online account opening in order to speed the funding process.

By the same token, banks should ask themselves where they can create separate workflows similar to what we already discussed about businesses that own businesses. Independent contractors and non-profits are two easy examples of where banks may want to create different workstreams to aid processing.

Step Eight: Train and Be Ready To Expand the Process

Once you get rolling and you have streamlined the process, now you want to quickly expand the number of employees that can be dedicated resources. Chance are you are not making too many new loans, so you likely have conventional underwriters that can help with PPP production. In similar fashion, since most of your branches are drive-thru only, banks should consider reassigning tellers to help with loan document processing and closing.

Step Nine: Committing To Future Technology

The PPP effort has created a tremendous challenge for bankers. We have been asked to fund hundreds of billions of dollars, for a brand-new process, given only vague guidance, in a ridiculously short amount of time, while managing the most extensive health crises we have faced in modern times – all while working from home. As usual, bankers have arisen to this Herculean task. However, it could have been easier, and those lessons should not be lost.

The largest lesson that the industry has learned from the PPP effort is this – the more technology you have available to you, the more optionality you have in production. Banks that have invested in an automated loan processing system, a robust website, online account opening, data warehouse, a CRM system, an orchestration/workflow layer, integration tools, marketing automation, automated scheduling, chat/chatbots, RPA, and so forth, have found themselves being able to move much faster than banks that have not.

In your after-action report, when this is all said and done, be sure to interview other banks that produced superior metrics in order to learn the tools and methods they used to succeed in a time of crisis. Chances are, they had a superior process because they employed superior technology. Take this opportunity to learn your bank’s deficiencies and strive for improvement. It is only by elevating the performance of the entire process, can you increase the performance of your employees.

As Deming would say, “Your bank was perfectly designed to produce the results that it achieved.’ The question is, was your performance good enough for the future?

Regardless of how you process, given all that the industry is up against, banks are doing a fantastic job arising to the occasion. Our industry has never processed so many loans in such a short amount of time. This episode not only presents one of the most exceptional learning experiences in banking history but has given banks yet another way to prove our value to American society.