Actively Managing Loan Duration

Uncertainty creates significant challenges for business managers, and while variability in outcomes is a business constant, the degree of uncertainty during a pandemic is extraordinary. Therefore, how do community banks distill today’s interest rate forecasts and position their loan portfolio for optimal performance? Choosing the duration of your loan portfolio isn’t a passive decision. Banks can play an active roll in structuring their loans to achieve both the optimal duration for the borrower as well as for the bank. In this article, we explore how banks can have intent in structuring loans.

The Federal Reserve

The Federal Reserve has taken unprecedented steps to increase monetary stimulus. Banks’ cost of funding is driven by the front-end of the yield curve, and at this part of the curve, the forecast of future rates is highly unsettled. Last week the FOMC made it very clear that the path of the economy will depend on the course of the pandemic, and in the course of achieving its dual mandate of maximum employment and price stability, the FOMC will target two percent inflation over the long run. Therefore, if inflation has been running below the two percent goal, as it recently has, the FOMC will aim to achieve inflation moderately the target so that the longer-term expectations remain anchored at two percent.

The FOMC statement last week and the general strategy creates substantial uncertainty. How far above two percent will the Committee allow inflation to rise? The FOMC states that it will allow inflation to moderately exceed two percent for some time, but “moderately” and “some time” is not defined. How does the Committee weigh previous periods of sub-two percent inflation with future periods above two percent inflation? Will, that be period averaged, and if so, what period will the Committee use?

The answers to these questions are straightforward – the FOMC doesn’t know because the FOMC cannot predict the future. Instead, members of the Committee want to reserve as much future flexibility in their stance on monetary policy and, at the same time, use their statement to affect their desired current monetary policy. They achieve this goal by stating that they want maximum employment and are willing to allow inflation to exceed two percent, thereby signaling a longer pause. They will decide in the future when they believe that “inflation moderately exceeds 2 percent.”

That means that bankers may be better served by consulting with epidemiologists than with economists.

Bankers’ Dilemma

Community bankers do not have the luxury of structuring their loan portfolios based on their prediction of future interest rates and credit environment. In a still competitive lending environment, with many lenders still competing for better credit quality loans, bank managers have limited ability to dictate loan structure. Other than to walk away from loans that do not fit the bank’s credit box or rate view, most community bankers are subject to the demands of the market. The market today is clearly leading borrowers to fixed-rate financing for commitments as long as the market will permit.

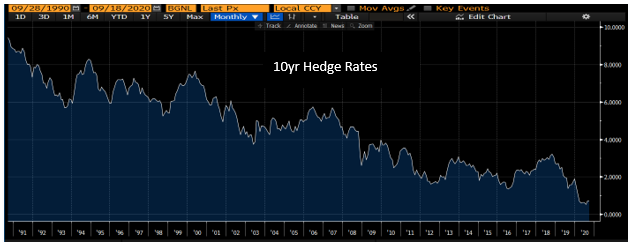

The graph below demonstrates the ten-year cost of money for the last 30 years. Ten-year cost of funding is the lowest it has been in history at just under 0.70%. The average credit spread in the market (roughly 2.50%) results in ten-year loan rates at under 3.50%. It is clear that most borrowers if given the option, would prefer to lock in their loan rate at the historically low cost of carry.

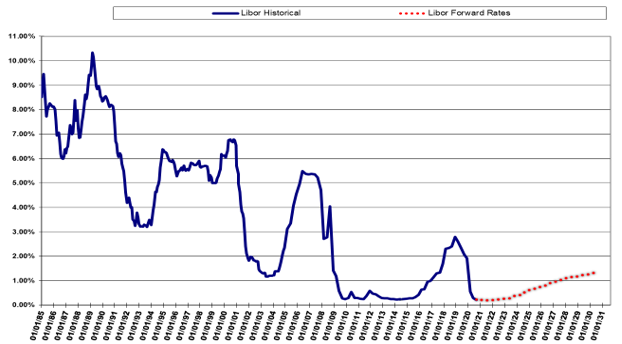

The graph below shows the market’s expectation of forward interest rates. Borrowers that are deciding on commitment terms for their financing are not obtaining material cost advantage by borrowing short versus long. For example, the difference between the three and five-year cost of funding is only six basis points, and the difference between five years and ten-year cost of funding is only 29 basis points. For relationship borrowers (those that have long-term funding needs and are willing to deal with their financial institution for three years or more), the natural tendency is to ask for ten years or longer loan commitments.

How Should Community Banks Respond

Community banks must be able to address the following market conditions:

Low Rates: Long-term interest rates are at historic lows and many borrowers will want to take advantage of this funding opportunity.

Flat Curve: The yield curve is flat and many borrowers will pay slightly more to obtain longer loan commitments.

Competition for Quality: Top tier bankable customers are more precious during challenging credit conditions, and these customers have more options than lesser quality credits.

Community banks must create an efficient platform to offer longer-term fixed-rate financing to their top quality customers without taking an unnecessary risk, and the most significant risk facing community banks is being negatively selected by obligors whereby top tier credits with broad financing options take advantage of the current market and those banks that cannot address customer demand are left with less desirable, lesser credit quality, borrowers.