ARC Hedge Program Update On LIBOR Transition

On October 23, 2020, the International Swaps and Derivatives Association (ISDA) published the Fallback Protocol (Protocol) that allows firms that use LIBOR to transition to SOFR if LIBOR becomes unavailable in the future. CenterState Bank’s ARC program allows community banks to offer up to 20-year fixed-rate loans to customers, but retain an adjustable asset priced at 1-month LIBOR plus a credit spread, and CenterState (not the community bank) carries the derivative and converts the fixed rate that the borrower pays to the adjustable-rate that the bank accrues. Because the community bank is not a derivative counterparty, it does not need to deal with ISDA documents and the Protocol’s impact on swaps; however, the bank does have a loan indexed to 1-month LIBOR. In this blog, we will explain how community banks using the ARC program will retain their economics if LIBOR is discontinued and how the note will accrue on the SOFR index.

The Transition from LIBOR to a Risk-Free Rate

If LIBOR is discontinued at some point after 2021, ISDA has created a process for all industry participants to migrate to SOFR as the benchmark rate. The transition to SOFR will require two adjustments: first, an adjustment must be made because SOFR is an overnight rate, and LIBOR is a term rate, and second, another adjustment must be made because SOFR is a risk-free rate and LIBOR has a credit risk component. Therefore, the final rate used under the Protocol (called Fallback Rate) is adjusted for both of these requirements. The Fallback Rate ensures that the contracts (the loans) align as closely as possible to the original agreement, resulting in a rate that is fair and predictable and does not advantage the borrower or the lender.

The Fallback Rate can be presented as follows:

Fallback Rate = Adjusted Reference Rate + Spread Adjustment

Where:

Adjusted Reference Rate takes into account the day convention and SOFR compounding.

Spread Adjustment takes into account the credit component of LIBOR.

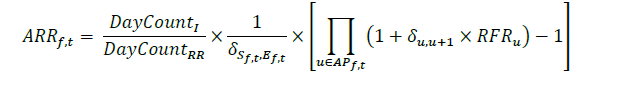

Unfortunately for banks, the Adjusted Reference Rate (represented as ARR in the formula shown below) is a compounding interest rate that most core systems currently cannot handle.

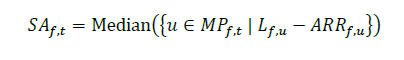

Furthermore, the Spread Adjustment (represented as SA in the formula shown below) further complicates calculations for community banks.

Between the daily compounding, the adjustments, business conventions, and lookback periods, the Fallback Rate becomes overwhelming for most banks’ core systems.

Adjustment Services Vendors

Rather than have participants calculate the Fallback Rate from scratch for each contract, ISDA has provided participants with the option of using adjustment services vendors for LIBOR fallback calculations. These vendors (Bloomberg is one of them) will calculate Fallback Rates for all LIBOR currencies, for each LIBOR tenor, and for each calendar date. These vendors will make these rates available for all market participants.

Currently, Bloomberg calculates the Fallback Rate for 1-month LIBOR that resets on 9/30/20 as 0.20215%. That means that if 1-month LIBOR was discontinued, and a bank had a loan priced at 1-month LIBOR + 2.50%, and the LIBOR was reset on 9/30/20, the all-in rate yield for the bank would be 0.20215% + 2.50%, and payment on the loan would be due on 10/30/20 based on a rate of 2.70215%. These vendor calculations are currently provided on an indicative basis until such time as a trigger event occurs, making LIBOR unavailable, and at that time, the Spread Adjustment becomes fixed (currently, that Spread Adjustment for 1-month LIBOR is 0.11448%).

The adjustment service vendors simplify for banks the operational transition from LIBOR to SOFR and overcome some of the operational risks faced by the industry with a new index. The vendors perform the calculations based on the methodology developed by ISDA, and their work is verified by ISDA. Vendors are required to provide this information broadly and without charge (although such free information may be time delayed or subject to restrictions).

The only remaining operations risk for banks is that the Fallback Rate is available at the end of the payment period. Therefore, depending on the number of lookback days (convention is two days), the borrower’s payment is not known until 2-business days before payment is due.

Key Takeaways

The transition from LIBOR to SOFR mandated by central banks creates a number of operational and legal challenges for commercial banks. However, adjustment service vendors will facilitate the adoption of SOFR by applying calculations according to publicly available and transparent rules. Without this service, many banks would be challenged to develop in-house accrual and billing capabilities.