What Your Bank ROE Says About Staying Independent

We recently published an article (here) that demonstrated how return on equity (ROE) (and return on assets (ROA)) were the main predictors of community banks’ survivability. Conversely, community banks’ NIM and credit quality were not, in themselves over the last four years, predictors of which community banks survive or become acquisition targets. Community banks’ average ROE for 2024 was 10.4%. The question we want to address in this article is what bank ROE community banks target and the minimum ROE level required for community banks to remain long-term independent and healthy.

Community Bank ROE Performance

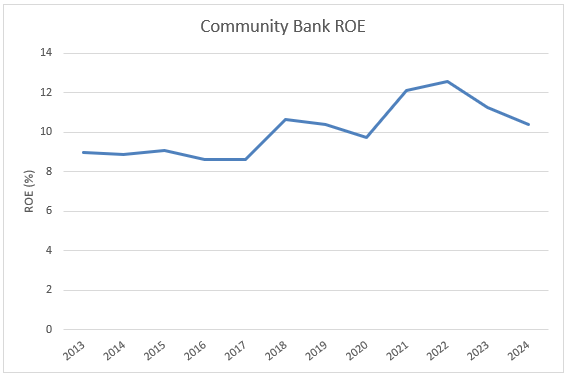

Community banks (defined as banks under $10Bn in assets) annual average ROE since 2013 is shown in the graph below.

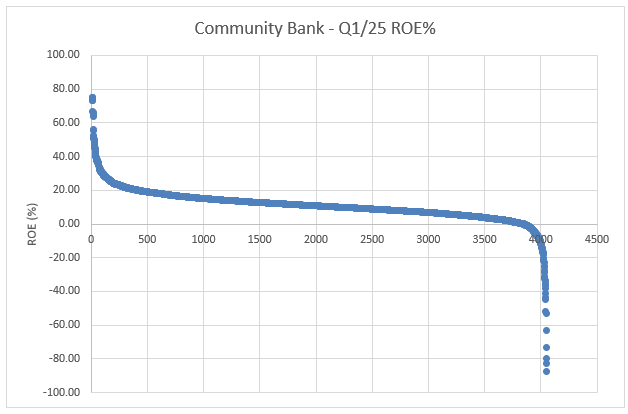

While the average community bank ROE in Q1/25 was 11.09%, the distribution of performance varied greatly. The bottom quartile of all community banks’ ROE was negative (-1.47%), 5.2% of all community banks generated negative ROE, and 45.5% of all community banks’ ROE was under 10%. The ROE distribution for all community banks (4,056 total banks) is shown in the graph below.

The target Bank ROE for a community will vary for every institution, but we can approximate the long-term equity investors target to retain ownership of a bank. A bank investor will measure the return on investment and the distribution of that return (volatility). There are various models investors may use to assess return and risk, but the most widely used is a risk premium model called CAPM (capital asset pricing model). The model calculates the expected return for an asset given the risk of investing in that asset. The model formula appears below:

Expected return = risk-free rate + (asset beta X (market return – risk-free rate)

CAPM allows us to measure the expected bank ROE that investors demand to retain bank ownership. Historically, for the banking industry, CAPM has shown cost of equity at approximately 8% to 12%. Using today’s numbers, we demonstrate that the average community bank’s cost of equity is 11.97% using the following inputs:

- The 10yr Treasury (currently 4.31%) is the general measure of the risk-free rate.

- The market return minus the risk-free rate is also called the market risk premium and can be approximated by the S&P500 long-term return (10.2%) minus the 4.31% risk-free rate.

- The final number is the asset beta, or the community bank’s stock risk (volatility of returns) relative to the overall market. The KBW Nasdaq Bank Index’s long-term beta is referenced at between 1.10 to 1.32 (depending on period and method of calculation). However, we believe that the community bank beta is generally slightly higher than the KBW index. We will use 1.30 as community banks’ equity beta in the current environment.

Current Bank Performance

As of Q1/25, 58.21% of community banks generated below the target 11.97% ROE as calculated above using CAPM. CAPM is a measure of an investor’s required return, given the risk of that investment. However, community bank investors may have other measures of required return aside from CAPM. For example, some investors have intergenerational investment time horizons, which may lower a community bank’s cost of capital. The inputs we used for CAPM are mostly backward-looking, and community investors may have a different forward-looking assumption that lowers their required ROE. Some investors may be measuring returns not based on ROE but on pride in ownership, involvement in the community, or managerial/board involvement with the bank. This can also lower the bank’s cost of capital.

Unfortunately, the banking industry may be facing some key headwinds. On May 30, 2025, Moody’s Rating Services issued a negative outlook on the US banking system. Moody’s cited slower GDP growth through 2026, macroeconomic and policy uncertainty, weaker real estate valuations, and tariffs leading to increased prices as the main culprits for the industry’s negative outlook.

Conclusion

For the industry, on average, banks under $10Bn in assets do not meet their target ROE. However, the top quartile of community banks consistently exceed the ROE target.

If your management team would like to reach its target ROE, we are offering a community bank summer performance series. For a limited number of banks, we will offer an analysis of your bank’s balance sheet, business model, efficiency, technology and product pricing. After a questionnaire and interview, we will hold a 45-minute strategy session explaining how management can elevate ROE to meet your bank’s minimum required target. For further information please follow this link.