S&P Global’s CBC Annual Banking Conference – Here are the Key Insights

S&P Global’s annual Community Banking Conference (CBC) should be on every executive banker’s agenda. This banking conference is designed to highlight top performing banks, their strategies and tactics. The 2024 conference covered a wide range of topics that matter and has the highest ratio of top-performing banks to attendees of any conference in the industry. That means that when you attend panels and roundtables, you will likely get tested advice from veteran bankers who have proven their skills and won awards. In this article, we highlight our lessons learned and boil two jammed-pack days into a ten-minute read.

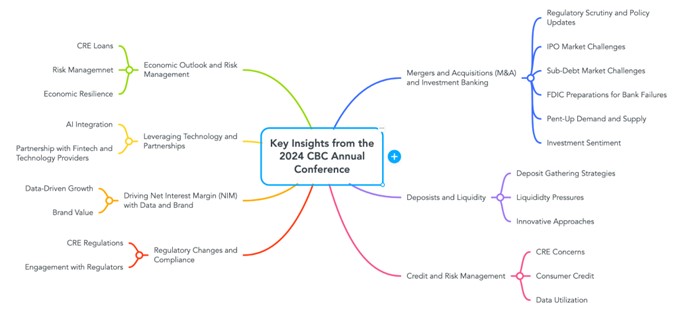

Let’s start with a mind map of the banking conference so you can see the topics covered:

The Economic Outlook

Executive Summary: There are no rate cuts ahead, inflation risk is a concern, and we likely need a substantially higher neutral rate than what we have seen in the past.

Dr. Lindsey Piegza, the Chief Economist for Stifel Financial, member of the Chicago Federal Reserve Advisory Committee, SIFMA’s Economic Advisory Chair, and well-respected author, kicked off Day 2 of the banking conference by discussing how $6T of stimulus has resulted in $2.5T of excess savings. This stimulus, along with a record intergenerational wealth transfer, is helping the consumer, which helps the economy. This stimulus will likely result in a neutral level of rates higher than where it has been in the past. Thus, we may need to be closer to a 6.5% Fed Funds level to get the price stability that the Fed has desired in the past.

Offsetting this is consumer weakness. While spending has come down from double digits to the current 6% growth level, there is a growing level of fragility. We are seeing more use of 401ks and credit cards to supplement spending, which is not a good sign.

While the labor market remains strong, Dr. Piegza pointed out the noise in the labor numbers. We are undercounting workers from both legal and illegal immigration, and a large percentage of the workforce is now working multiple gigs that are overcounted. The latter is one reason we have recently seen higher-than-expected non-farm payroll numbers.

More consumer spending and tight labor markets have resulted in “super core inflation” (sans housing, energy, food, and other volatile components) that is still increasing. As such, the Doc expects the Fed to remain on the sidelines through this year and well into next before we see three to four consecutive months of downward momentum in inflation. Dr. Piegza breaks it down, saying there is a 70% probability that the Fed will stay on hold this year, 20% they will cut rates, and 10% they will raise rates. As a side note, the Fed will do what it must do without regard to this being an election year.

The critical takeaway here is that banks should not expect margin relief from the Fed any time soon, and higher interest rates, combined with social media impact ala Silicon Valley Bank, continue to create a real risk to banks in the form of potential credit issues and short sellers.

Deposits and Liquidity: Getting Creative to Attract Deposits

Executive Summary: Greater liquidity requirements and continued upward COF pressure from mix and rate changes will continue to erode margins hurting earnings. To counter margin erosion, bankers must restructure the culture of deposit gathering.

Nathan Stovall, Director of Financial Institutions Research at S&P Global, kicked off Day 1 of the banking conference as he provided valuable insights into the current state of community banking. He noted that banks and regulators are putting a premium on deposits and liquidity (and contingent liquidity), leading to slower loan growth and modest margin pressure. He argued that banks should track not just a loan-to-deposit ratio but an asset-to-deposit ratio due to slowing loan growth and growing investment portfolio assets that will act as a loan surrogate.

In addition to that pressure, as the economy has tightened, more depositors have demanded higher rates and as a result the industry has seen a 30% decrease in non-interest-bearing deposit levels since 2021.

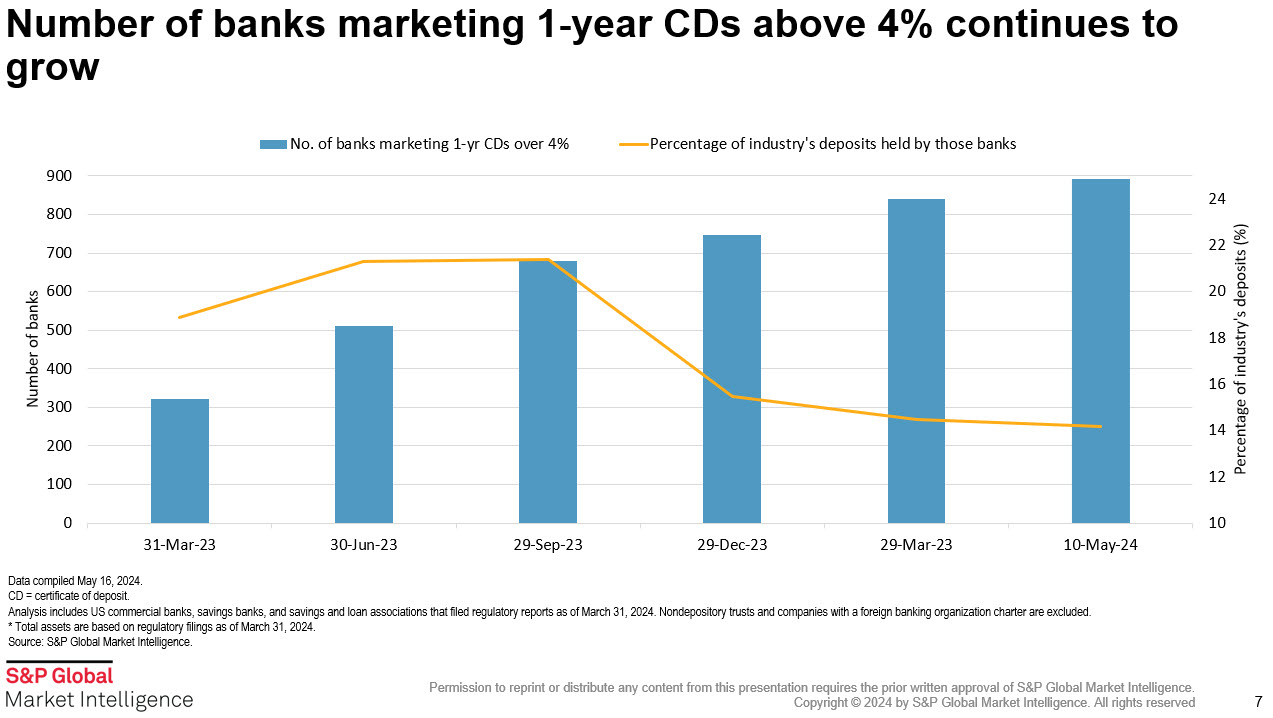

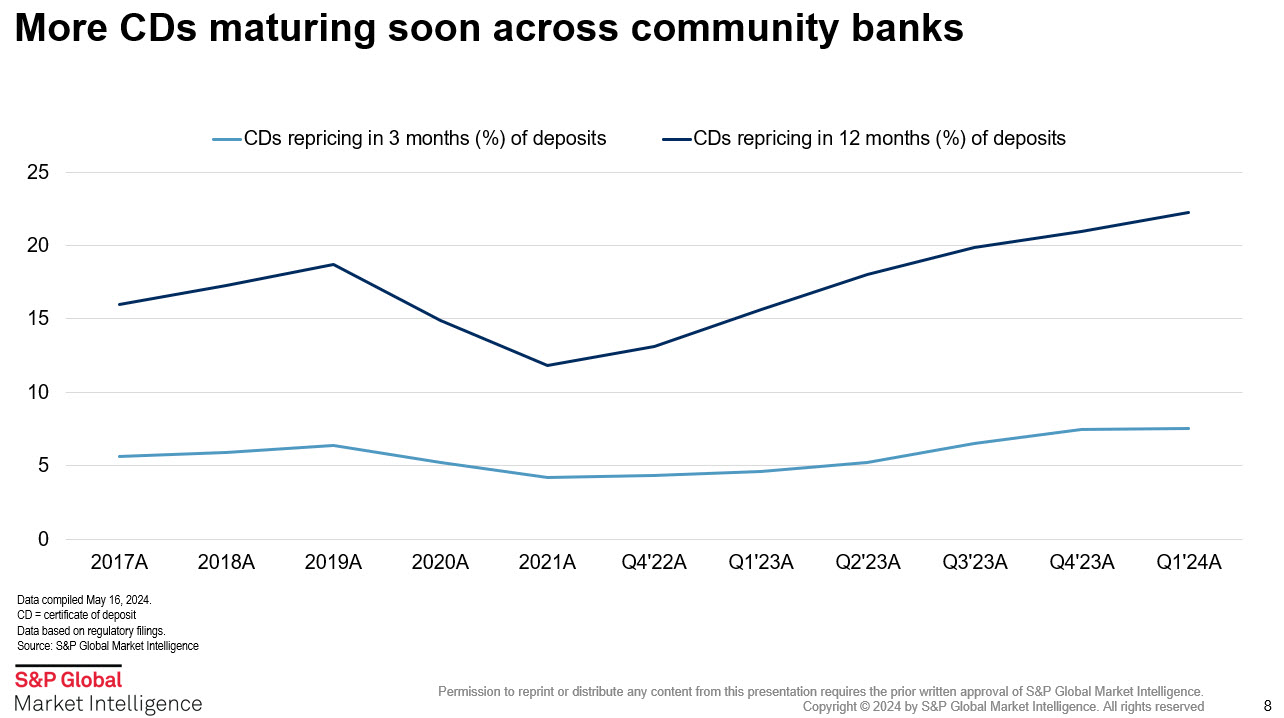

Watching the behavioral evolution of those under 35 years old who have never seen higher rates is interesting. They went from not caring about rates to shifting liquidity into certificates of deposits to demanding 5% deposit levels. This pressure will continue to occur even if the Fed cuts rates. More and more banks are posting CD rates above 4%, and more and more CDs are coming due (see below). These trends will continue to cause banks’ cost of funds (COF) to rise to maintain their existing deposit base.

Nathan made an interesting point about banks like Goldman, which tried to cut rates by 10 basis points but had to raise them again as deposits left the bank.

Kelly Brown from Ampersand emphasized finding niche markets and making sure every employee pays attention to the depositor. Her point was that your bank likely has some expertise and passion that can be turned into a marketing effort. Her example was a Ft. Worth bank that leaned in on rodeos. The goal was to create an entire banking program around all the people and businesses that touch rodeos and the equestrian industry. Having a niche market strategy can help drive low-cost deposits, but it also takes a top-down management approach. Creating a culture of low-cost deposits starts with educating employees about deposit value, hustling, and then exciting a culture.

Unfortunately, more and more banks are relying on brokered deposits and CDs to meet their liquidity needs. Some banks are paying over 5% and as much as 6.10%. In a similar fashion, Walden Mutual Bank (its sales pitch is worth reading) is offering a 100-year CD at 4.75%, which has no shortage of media and potential customer attention.

Increasing deposit betas highlight the importance of creative strategies to attract and retain deposits. In addition to niche markets, a strategy that we love, we also implore banks to hold someone accountable for deposits, spend money on marketing, and provide compensation to gather low-cost deposits. As several panelists pointed out, compensation works wonders—give five basis points for gathering and maintaining low-cost deposits.

Greg Muenzen from Curinos also discussed niche segmentation and creative approaches to attracting deposits. For instance, banks can target specific demographics, professions, or local interests to create tailored deposit campaigns. The key is understanding your community’s uniqueness and leveraging those insights to build stronger relationships and stickier deposits.

During the High Performing Bank Roundtable, Curtis Griffith of South Plains Financial shared how his bank managed deposit outflows without overly relying on brokered funds or high-rate CDs. They successfully retained long-term customer relationships by enhancing treasury management and adjusting lender incentives to prioritize noninterest-bearing deposits. This is a playbook that any bank can follow if it is devoted to beefing up its treasury management platform.

Regarding contingent liquidity, regulators want banks to see adherence to the guidelines, which is diversification by customer, by customer type, by geography and by duration, said Josh Siegel, Managing Partner, Chairman and CEO of Stonecastle Partners. They want to see different sources – that could be FHLB, deposit programs or networks or the brokered sweep market, so that the risk of a large amount of liquidity walking out overnight goes away. Make sure that you have as many contingent funding sources in your arsenal as possible. You don’t have to use them all the time, but you must prove that you can use them, Siegel said.

Driving Net Interest Margin with Data and Brand

Executive Summary: Banks should leverage data to focus on the limited products and customers that make a difference to their bottom line. By having a continuous sales and marketing effort, banks can turn a string of small wins into significant gains.

This banking conference was excellent at highlighting deposit tactics. Driving net interest margin (NIM) with data and brand requires a strategic focus on leveraging customer insights and strong branding to enhance profitability. It’s wild that banks complain about the cost of funds yet don’t invest in deposit marketing, data, or new products.

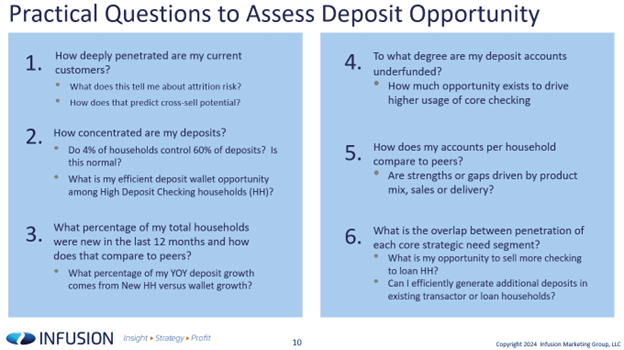

Data mining can be simple and starts by asking the right questions (example below) and then analyzing customer segments. The effort revolves around trying to understand the capacity, propensity, and awareness of the target customer and understanding how your bank’s first-party data compares to others. For example, customers are likely to use their bank to store wealth, transact wealth, or borrow to build wealth. The key is to get more customers to do all three.

Banks can identify high-value opportunities and tailor their offerings to meet specific demands, improving customer retention and attracting new deposits. This data-driven approach also helps spot early warning signs of credit risks and take proactive measures to mitigate potential losses, thus protecting NIM.

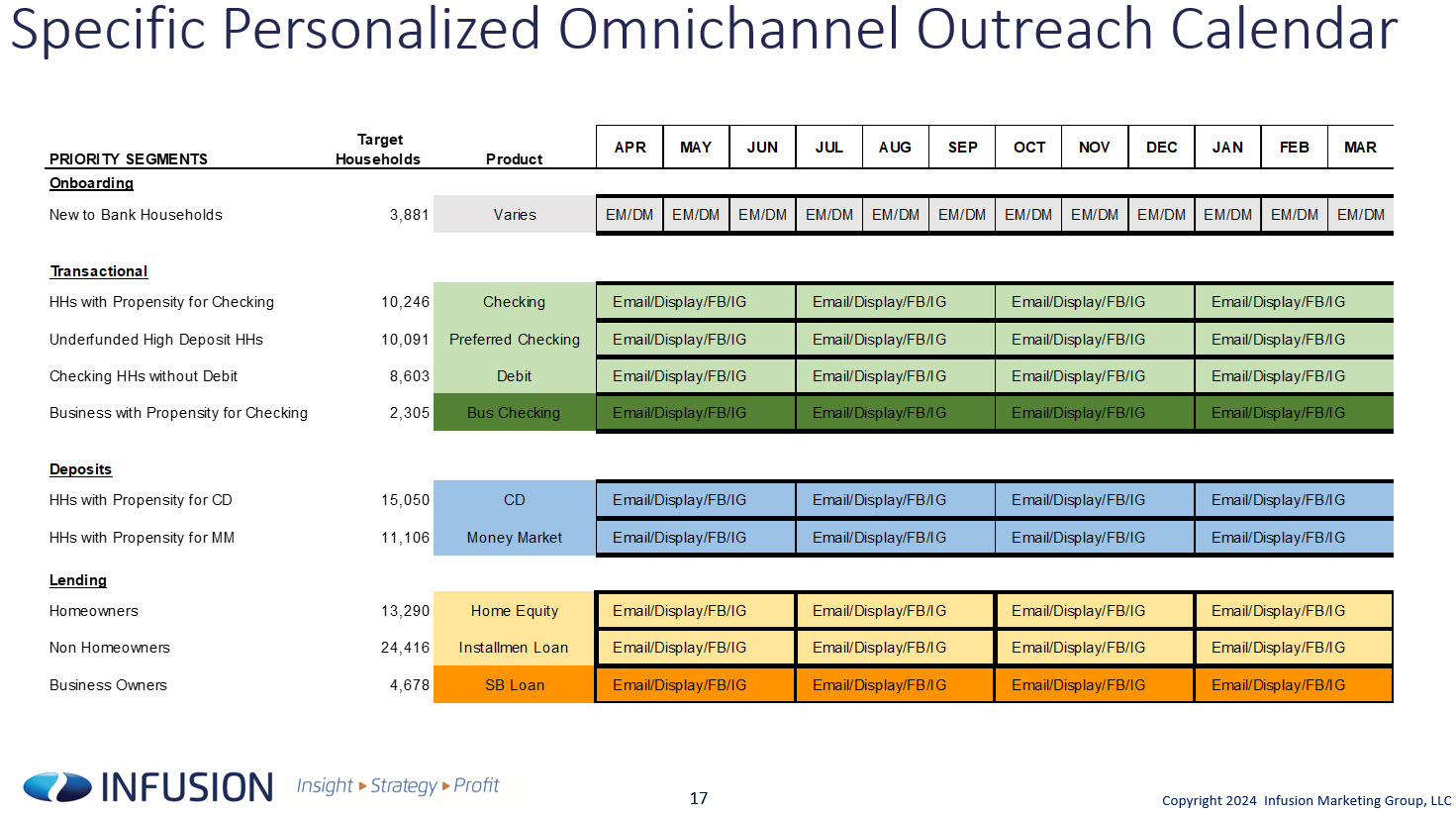

Dan Marks, President of Infusion Marketing Group, discussed the success of Chick-fil-A in building a brand. The key to their success has been getting two things right – the emotional appeal of their brand promise and execution in delivering that brand promise. Dan talked about having intentional and continuous discipline to get the fundamentals right around cross-selling, gathering deposits, and building a balance sheet. He laid out a sample marketing plan (below) based on data that drives a prioritized action plan. This systemic, relevant outreach across multiple channels results in targeting a small number of customers that can have outsized performance.

The important banking conference lesson here is to do more than talk about the “product of the month.” Customer needs change, so a bank should continually search for ways to help those needs without relying on rate. Customers who don’t have a money market account, have not contributed to retirement savings, or don’t have an emergency fund account are all examples of marketing programs that have worked for hundreds of banks.

The Banking Conferene DNA – The Real Estate Outlook

Executive Summary: Cautiously optimistic, but watch out for office exposure.

Another strength of this banking conference is its DNA in credit. This year, because commercial real estate is such a larger concern in banking and with the regulators, the banking conference tackled this from several angles.

The economic forecast for community banks is guardedly optimistic, but pressures are mounting from maturing commercial real estate (CRE) loans, especially office exposure. Brendan Browne from S&P Global Ratings warns that a material amount (almost 25% by our math) of CRE office loans are coming due in the next 12-24 months, and they’ll need extra capital due to higher loan-to-values (LTVs). While we have reason to believe banks might get lucky (our take HERE), banks need to stay proactive with risk assessments and keep sufficient levels of capital reserves on hand. The changing landscape of office real estate has even led a portion of banks to support the strategic repurposing of office space for residential, hotel, or mixed-use conversions.

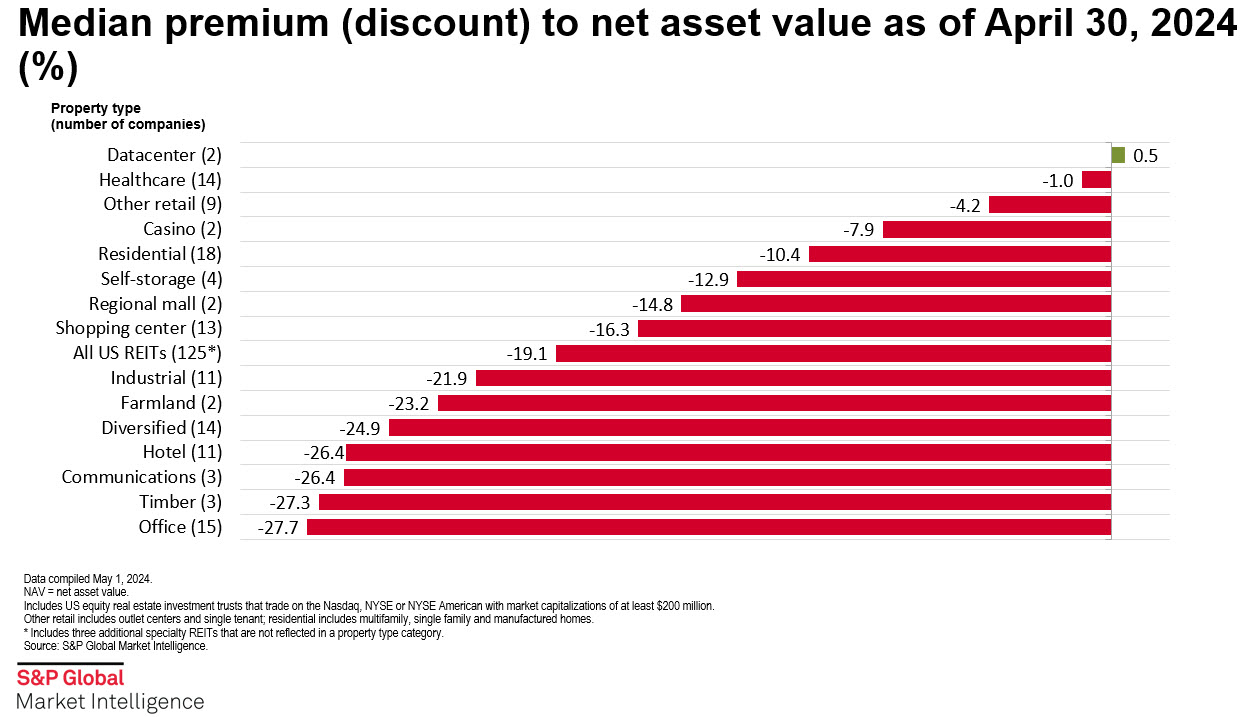

To that point, Stovall pointed out that the REIT markets give us a fairly accurate indication of real estate values, and most public values are below where banks have underwritten the property’s value. Many banks have underappreciated the impact of higher rates and slowing net operating income; as such, their loss-given default levels are likely higher than they think. The exception is data centers, which are still increasing in value due to the artificial intelligence shift.

Despite the potential risks, the overall economic outlook is stable thanks to robust consumer spending and a strong labor market, according to Darin Mellott from CBRE. He highlighted the economic slowdown and the Federal Reserve’s aggressive interest rate policies to combat inflation. However, Mellott cautioned that inflationary pressures and credit market stress mean banks can’t let their guard down.

One interesting point that both Mellott and Stovall expressed is that despite the reality and even though a bank might be well-reserved (most are now), regulators still may require higher capital above the minimum if you have over 300% commercial real estate (CRE) exposure or have concentrations in subsectors such as office or multifamily. This also applies to banks with over 100% of their risk-based capital in construction or have grown CRE portfolios by 50% over the last three years. There are 532 banks in this category, but many more banks are on the verge.

Banks above the 300%/100% threshold are trading at significantly lower tangible book multiples than the rest of the market, and many of these banks will be forced to raise dilutive capital to survive or sell (as eight of the top 20 banks have already done).

Leveraging Agility and Data Analytics

Executive Summary: Banks are making data a strategic imperative, which is starting to show. Every bank, to survive, needs to figure out how to see a holistic view of their customer.

Barry Ripes from Equifax noted that community banks have an edge in agility and close customer relationships, which can be harnessed for more effective risk management. However, robust credit risk management practices are necessary with consumer credit delinquencies ticking up, especially among lower credit score segments. Barry emphasized the need for banks to enhance their risk assessment frameworks and utilize predictive analytics to stay ahead of potential defaults.

Higher credit quality and maintenance of stringent underwriting standards are needed across the board. Banks should double down on proactive treasury management and strategic hiring to ensure they have the right talent in place to navigate the challenges ahead. Darin Mellott highlighted how data analytics can give banks a leg up in understanding and managing credit risks. Banks can stay ahead in a challenging environment by spotting early warning signs and taking proactive steps. Mellott underscored the importance of leveraging data to make intelligent moves, reducing the risk of unforeseen financial setbacks. Additionally, institutions should adopt integrated risk management systems to streamline risk mitigation processes.

To be effective, banks need to address five challenges in their data strategy – 1) Know where your data is; 2) How will you ingest that data; 3) How can you get the data into a format you can use; 4) Figure out what you want to do with the data; and 5) How will you empower staff to act on the data? The last point is vastly underappreciated in banking.

Taking raising deposits as an example – can your bank produce a list of all your small business customers that send more than $10,000 to Chase, Capital One, American Express, or a similar firm? How many of your customers are paying off their corporate card at an operating account that your bank controls? This is easy data and doesn’t require a complex data strategy. Banks will not be able to develop a relationship if they don’t invest in the data that describes the relationship.

For lending, most banks would be surprised at the percentage of customers that have loans from other banks and fintechs. Knowing who these customers are is a multimillion-dollar opportunity for any bank and is the first step in winning these customers back. Mining a loan document uncovers a plethora of data that can be used to gather other loans and deposits. It is there for the taking; banks must prioritize it.

Regulatory Changes and Compliance: Staying Ahead of the Game

Executive Summary: Regulatory pressure continues around earnings, banking-as-a-service, and commercial real estate exposure.

Regulatory scrutiny is as intense as ever, especially around CRE and overall risk management. Regulators closely monitor CRE exposure and risk-weighted capital thresholds, with the imposition of individual minimum capital requirements becoming common. Banks need to maintain detailed, transparent records to stay compliant.

CRE is one clear area where banks need to prove to regulators that they understand the credit and the market. Banks must sell their underwriting story with facts, data, stress tests, and clear presentations to make the regulators worry less.

Josh Siegel, CEO of StoneCastle Partners, stressed the importance of proactive communication with regulators and demonstrating a nuanced understanding of risk. Regular updates on risk management practices and proactive measures to address potential issues are key. And with the FDIC preparing for potential bank failures, it’s more critical than ever to manage regulatory compliance and be ready for FDIC-assisted deals if the opportunity arises.

Exams are getting tougher. Management teams that are building their identity to the board around being a “1” rated bank are in for trouble. The industry is seeing more pressure to improve earnings and more pressure around third-party risk. The 100 to 150 banking-as-a-service (BaaS) banks will remain under the Bank Secrecy Act (BSA) and anti-money laundering (AML) regulatory pressure. Some BaaS banks are finding they have reduced friction too much with technology. When it comes to BSA and AML, sometimes a little friction is good.

Furthermore, banks looking to grow through mergers and acquisitions (M&A) or organically are required to hold more capital. Recent deals like Provident/ Lakeland demonstrate the regulatory demand for substantial capital reserves. This requirement ensures that banks can absorb potential losses and continue to operate smoothly despite economic downturns or market stress.

Tech and Partnerships: Driving Efficiency and Innovation

Executive Summary: Banks need a technology strategy that provides for continuous efficiency improvements for core competencies while leveraging partnerships to help with key initiatives such as AI, data, and product development.

Advanced tech and strategic partnerships are essential for driving growth and operational efficiency. Industry leaders highlighted how AI is increasingly being used to enhance customer service, improve risk management, and boost efficiency. From fraud detection to personalized customer interactions and automating routine tasks, AI is becoming a game-changer.

One battlefield is in treasury management, given the rise of fintechs. These are some of the most valuable customers in a bank, and many banks are on the verge of losing this battle. Banks that are competing are doing so by introducing better onboarding, rich APIs, integrated banking, enhanced products, and actionable data. Siya Vansia, Chief Brand and Innovation Officer at Connect One highlighted several partnerships that have proven successful, including online account opening with Mantl, the introduction of sub-accounting to clients from Z-Suite and utilizing Nymbus as a flexible modern core to act as a sandbox and innovation platform.

Collaborating with fintech and other tech providers can equip community banks with the tools to compete effectively, enabling them to offer innovative products and services without massive in-house development.

M&A: Navigating Challenges and Seizing Opportunities

Executive Summary: Valuations and regulatory pressure have kept M&A depressed, but that is changing.

Perhaps one of the best strengths of this banking conference is that you get to predominately hear from bankers, followed by the analyst and investor take on banking. This provides a fantastic holistic view of the banking industry.

These days, there is a critical lens on whether an M&A deal makes strategic sense – does it help scale, diversify offerings, and enhance market presence? After that, today’s deals need to be clean with little explanation from due diligence findings. After that, cultural alignment, clear communication, and streamlined operations are key to realizing the full benefits of M&A. As Caspar Bentinck of Piper Sandler stressed – banks must be sold right now. There is pent-up supply but not pent-up demand. Sellers can no longer think they will have four to eight suitors waiting for them. It is getting harder to engage buyers for the smaller deals right now.

Regulatory scrutiny and capital requirements have dampened M&A activity, and depressed bank stock valuations are affecting pricing. However, as banks strive for efficiency and strategic growth, the potential for increased M&A is significant. One key factor will be bringing more capital to a deal to ease regulatory approval (ala Pac West, UMB & Fulton). Yes, your accretion is hurt, but the chance of the deal going through increases.

Pricing for whole bank deals hovers around 1.5x tangible book, yet few buyers can afford that level. Due to various pressures, more deals should be done below that price. Banks with strong capital positions are well-placed to acquire weaker institutions or merge with peers to achieve greater operational efficiency.

The CBC investment banking panel offered too many great insights at this banking conference to put in narritive form. Here are some other significant insights:

- Paul Egge from Steller Bancorp highlighted the strategic value of staying under regulatory thresholds for CRE exposure, stressing conservative lending practices and relationship optimization to manage risk while positioning for opportunities.

- Matt Veneri, head of investment banking at Janney Montgomery Scott, discussed how credit unions compose about 22% of the M&A demand and are willing to consider larger, more sophisticated deals (First Financial, for example).

- Each investment banker stressed having honest discussions with the board as to M&A strategy and timing. Sometimes, the buyer is there now at a 1.2x tangible book price but will not be in the future. Other times, you can’t count on a buyer, so a solid plan is required for true shareholder value creation. Any plan needs to be balanced against the bank’s capabilities, access to capital, and the age of its management team. An older management team, a bank that can’t consistently earn above the cost of at least sub-debt at 11%, might want to lower the expectation of their exit price.

- The low-premium merger of equals (MOE) trend still has legs. The market should see more of these all-stock deals where you can get quick earnings accretion, making for a good capital raise story if you can create a narrative about why the MOE will throw off a 25%+ premium if they perform. These deals attract capital and create liquidity for all. This should be the fate of many $300mm to $500mm banks that need to get together. The same goes for banks in the $1B to $3B range. While the headline, or “country club price,” as one banker called it, will not be there, the right partner at the right time is often the best way to create value for a two-year horizon. Like chess, you must think ahead several moves. Getting too much of a premium stands a better chance of hurting you in the long run if the strategic fit is not there. The acquirer will become the acquired. It is better not to love the deal upfront but to love the pro forma earnings growth on the backend. This sets shareholders up for their next acquisition and keeps the party going. Forget book-based pricing and think of earnings-based pricing.

- With regard to de novo banks, raising $30+ million and taking five years to break even doesn’t make much sense in this market when you can acquire a bank at near book value.

- Nathan Stovall from S&P Global discussed how broader economic factors, such as higher credit costs and slower loan growth, are pushing banks toward consolidation. He emphasized the need for a robust, long-term strategic approach to M&A.

- While we are unlikely to see a wave of failures unless we have a deep recession, there will be more “Friday night failures.” As such, many banks are gearing up for that eventuality.

- Unless you have the pedigree, it is difficult to raise capital right now in anticipation of a deal. While plenty of money is on the sidelines, it will not sit idle if the bank is underperforming. Most banks will have to wait for a deal to raise capital. Retained earnings is the best form of capital, so every bank should focus on its operations first and then groom their shareholder base second. You never want to ask for money the first time you meet someone, so cultivate future shareholder relationships now.

- The initial public offering market is still viable but difficult. Many investors will not buy a roll-up strategy (as they got burned in the past) but are looking to buy discounted assets from good operators. This is another reason why it helps to have a higher quality credit portfolio instead of reaching for spread. Leveraging capital with quality assets is a better story than a wider net interest margin but with credit volatility.

- Buyers for sub-debt remain hard to find. Pricing is now north of 9%, which makes it hard for many banks to be accretive. In previous cycles, banks used to be buyers of other banks’ sub-debt. Now, few have the stomach or the liquidity for it. This higher cost of accessing the sub-debt market adds financial pressure on smaller banks, pushing them towards consolidation to strengthen their capital base and achieve economies of scale. Sub debt is still an option, but it is not attractive unless there is a good story to it.

The Banking Conference Bottom Line

The S&P Global 2024 CBC banking conference underscored the dynamic, challenging environment community banks are navigating. By zeroing in on deposit performance, liquidity management, credit quality, human capital, and strategic growth, banks can position themselves for success in an increasingly complex market.

Harnessing technology, strategic partnerships and innovative approaches to deposits and risk management will be essential. Engaging proactively with regulators, making data-driven decisions, and cultivating a strong brand will be critical to sustaining growth and profitability in the coming years. The landscape will keep evolving, but community banks that adapt and innovate will be primed to thrive.

This banking conference is one of the better gatherings of the year in our industry due to the access to so many high-performing banks. Be sure to save the date – May 19th and 20th, 2025—and plan on attending.