Using EOS in Banking – A New Operating System

Likely, you do not have a common management framework at your bank. Maybe you practice some of the teachings in the seminal book Good to Great, you might work in Porter’s Five Forces, maybe you use an Objective and Key Results (OKRs) approach, or you might loosely use the McKinsey 7S Model. However, it is doubtful you utilize a complete operating system. Some banks do. This article discusses using EOS in banking – the Entrepreneurial Operating System.

What is the EOS?

No doubt your bank does fine. In fact, small banks with less than 50 employees usually do great. Communication, vision, and strategy are relatively easy. The CEO can talk to everyone and communicate effectively daily. However, as a bank grows, communication gaps, unclear roles, and inefficient processes begin to creep in. “Fine” is not good enough. Resources are stretched, objectives become complex and a once-strong vision begins to blur. You need to limit credit but grow customers. You need to manage multiple product lines across different customer bases and geography. You need to grow while managing profitability and risk.

This is where using EOS in banking becomes a competitive advantage and serves to increase efficiency and align teams/divisions towards a common goal.

EOS is a comprehensive business management system focusing on alignment, growth, and control. Its six key components—Vision, People, Data, Issues, Process, and Traction—can inject life into a tiered organizational structure and restore a bank’s effectiveness.

EOS in banking consists of the above six principles that we will summarize today and then a set of tools that we will cover in a forthcoming article. EOS has transformed banks such as BankProv have entirely adopted the methodology. Other banks, such as ours, have adapted pieces of the method to incorporate into their culture. EOS in banking is a journey that can assist any organization in navigating the pursuit of excellence.

Getting a Vision within the EOS in Banking Framework

If you want to know the quality of the bank, ask about their vision. If it doesn’t go any farther than – “We seek to deliver exceptional results to our customer, employee, community, and shareholders,” – that bank is in trouble. Having a proper vision means having clear core values, a distinctive purpose that drives alpha or performance above peers, and a plan to get to a clear destination. A quality set of core values might look like the example below:

The vision comes from the top and bottom of the organization. It becomes shared and communicated across all levels. Each team breaks down part of that vision to do its part to reach the destination.

A clear EOS mission allows all employees and board members to answer the following eight questions:

- What are our core values?

- What is our core Focus?

- What is our ten-year target?

- What is our (high-level) marketing strategy?

- What is our three-year picture?

- What is our one-year plan?

- What are your “Big Rocks” (quarterly priorities of our primary initiatives)?

- What ” issues ” are getting in the way of achieving all of this?

All of these questions are challenging. However, it is vital and a foundation of EOS in banking that all bank staff and board know the answer to these questions. It would be best to have everyone’s energy pulling and pushing in a single direction to achieve great things. If the direction needs to be clarified, effort gets diffused.

Data

Everyone may be rowing in the same direction at your bank, or they may not. To test this, ask any department or product manager for their key performance indicators (KPIs) and see what happens. Chances are you will not get any. If you do, they are unlikely to align with a shared vision. If part of the vision is about “service,” then how is EVERY division, department, and product manager measuring it? KPIs are a way to measure progress and provide an unbiased view of bank health. It is hard for a bank to shift from vague goals, instincts, and hunches, but this one step can be transformative in itself.

People

Since most bankers are disciples of Jim Collin’s classic, Good to Great, most banks do well about making sure every seat is filled with the right person who shares the core values and has the necessary skills. Get the right people in the right seats and foster a culture of transparency and accountability, and a bank cannot help to outperform.

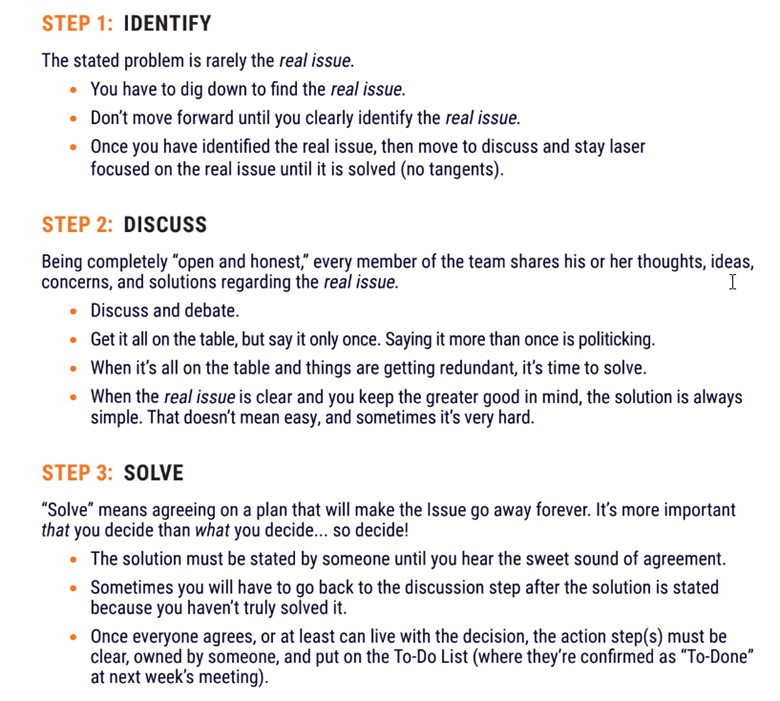

Issues

The Issues component is about acknowledging problems, discussing them openly, and finding solutions. This is a process called “IDS” – Identify, Discuss, and Solve – and is detailed below. EOS in banking is about creating a safe space where any employee can raise concerns without fear. This approach makes problem-solving more proactive and efficient while not hamstringing a bank with always having to reach a unanimous decision before they can go forward.

Processes

Processes are standardized to ensure consistency in operations. This is another area where most banks already excel. Identifying and documenting core processes that serve the customer and employee and managing risk helps banks have a foundation for process improvement. Processes aid in training and provide uniformity in services while reducing risk.

Traction

Lastly, EOS in banking has a “Traction” component, which breaks down long-term goals into 90-day “sprints.” Regular meetings ensure bank teams are on track, make necessary adjustments, and achieve goals at the desired speed. This constant cycle of setting goals, executing, reviewing, and resetting helps banks maintain steady progress.

Coming Up Next in EOS in Banking – Tools

While the above six principles are value-affirming, what makes EOS in banking so valuable is its set of ready-to-use tools that can help any bank manager turn in superior performance. In an upcoming article, we will break down these tools that have the potential to dramatically increase the rate at which your bank increases franchise value.

EOS isn’t for every bank, but it can play a critical role for most banks. This article was designed to make you curious about the methodology and consider adopting all or part of the framework now as your strategic planning season begins. Hopefully, there will be a couple of ideas and tools for your bank to work on to improve performance.

EOS in banking will not just improve performance but can revitalize it. The Entrepreneurial Operating System can bring back the efficiency, clarity, and synergy the bank once had when it was a de novo.