Why Banking Strategy Should be Simple but Difficult

Bankers love easy. Who doesn’t want an easy way to have a more profitable bank? We also love to keep things simple. It is a common refrain. Compounding the problem is that in banking, we often think that “simple” and “easy” as synonymous. In this article, we will touch on innovation, technology and banking strategy to show why banks tends to overemphasize ease, familiarity and convenience instead doing the difficult task upfront that will ultimately keep things simple. Simple, we will show, often leads to a better customer experience, enhanced reliability, better profitability and clearer purpose. Keeping things simple, is difficult.

The Confusion Between Easy, Difficult, Simple and Complex

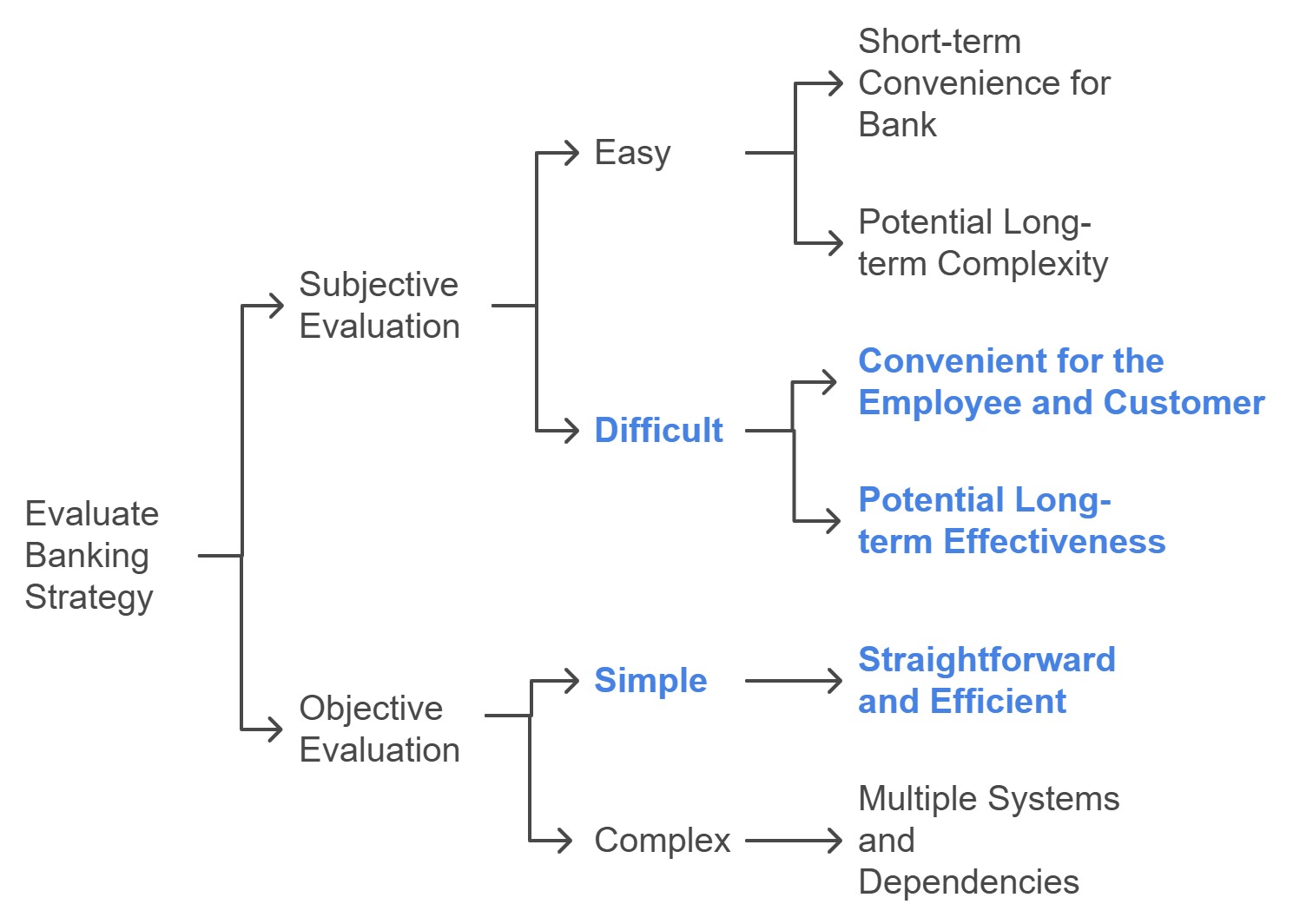

When we think about “simple” efforts it means that the item we are describing is not complex. Simple goals are straightforward, one-dimensional and focused. Simple goals have limited dependencies and largely stand alone. “Easy” is used to describe goals that you already know how to achieve and are nearly at hand. Long-term goals are rarely described as “easy.” Simple and easy are not the same thing.

Getting married is relatively easy – you grab someone and apply for a marriage certificate. However, marriage is objectively complex, and a successful marriage is more so.

Relying on your core system for a strategy, might be easy, but it also might be complex. Partnering with a variety of fintechs might be easy, but it also might be complex.

Easy and Difficult Are Subjective

When a bank talks about their strategy being “easy,” or “difficult” it is important to realize they are being subjective. It is their opinion that is subject to perspective. Talent acquisition, for example, might be easy for one bank, yet hard for another. Instant payments might be difficult to start, but become easy after you know what you are doing. “”Easy” and “Difficult” are just a matter of perspective. As ten banks about if something is easy or difficult, and you will get a variety of opinions.

Simple and Complex Are Objective

On the other hand, “simple” and “complex” are objective in nature. If there are multiple systems, many dependencies and requires specific talent, the effort is most likely complex. Ask ten banks about a strategy and mostly likely they will all agree if the effort is simple or complex.

We Like What is Easy

The biggest problem with “easy” is that when we choose the easy path, we are often doing so for our own immediate convenience instead of thinking about the convenience of our customer or employees. We reject a hedge program because understanding, getting a new program approved and rolling the program out is hard. It takes effort. However, what a hedge program does is make it easy for your customer to have any loan they want from one year to twenty years. It allows employees to not worry about interest rates by eliminating the risk and complexity of trying to manage a balance sheet.

The same is true for hundreds of services at the bank. We keep payment channels separated, and we don’t build a payments hub because separate payment channels are the status quo. Keeping the status quo is always easy.

We use different know-your-customer, identity and fraud workflow with different products instead of taking the time to create one process and then using across all account opening, beneficiary authorization, and payments approval workflow.

The paradigm we go down as bankers is that we often do what is convenient in the moment thinking that we are keeping things simple when the actual path leads to future hardship and complexity. Creating and executing on a strategy that is “simple,” tends to be difficult.

To be clear, complexity isn’t bad, it just has more risk and is harder to manage. As a rule, a simple strategy has less variability and is easier to predict. When possible, simple should be chosen before complexity. When it comes to banking, we tend to subscribe to the Albert Einstein quote where he once said, “Everything should be made as simple as possible, but not simpler.” When designing a banking strategy, the complexity of a strategy should be judged on a long-term horizon and seen through the eyes of the customer first, then the employee. Whether that strategy is simple or difficult, should be a secondary consideration.

How Making Things Simple Applies to Banking Strategy

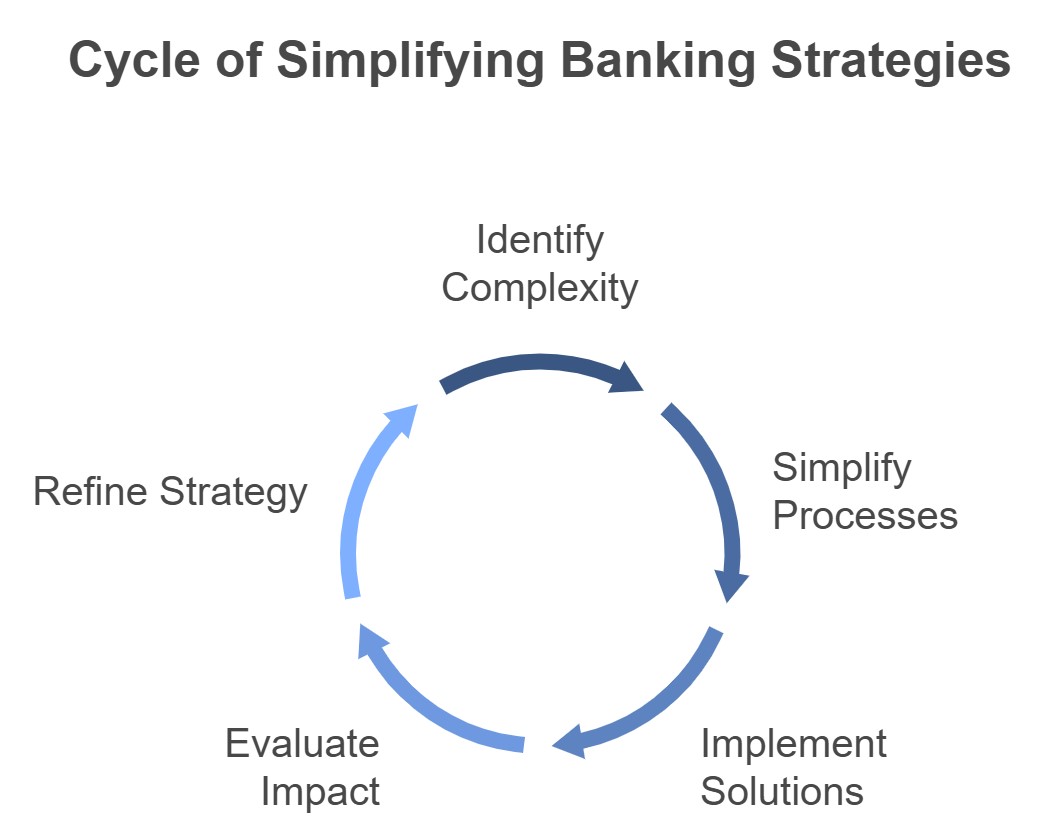

How often does this happen at your bank – when a project isn’t moving fast enough, we often add new layers of management, people or procedures. The result is a larger, more dysfunctional project. Instead, we should often think of simplifying the strategic path – reduce objectives, reshape the team or try a new approach. Instead of pushing a bad position, banks should often consider starting over in a new direction utilizing what they learned. If you determine you have both a bad product and a bad vendor, banks should always consider starting over. This is not always the fastest or most efficient route, but it leads to more sustainable success.

Banks can only do so much with limited resources. Because resources are limited, banking strategy needs to be laser focused on becoming more effective at making the bank more relevant to the customer in a profitable manner. When banking can make a process both effective and efficient, it should then make that process reusable and shareable, so it doesn’t have to reinvent the wheel each time that process is required. To become both effective and efficient, banks need to build banking platforms (lending, deposits, wealth, mortgage, trust, etc.) that can span silos and that vendors can build on. Allowing your bank to connect various composable process with APIs and integrated connections is the path to building an “irreducible core” set of products and services.

Making Hard Things Easy

The key to making hard things easy in banking is to take the time to gain understanding of a given problem and then figure out a solution that will solve the problem now AND into the future. We often hear that a bank is “too small to ___________.” Where the blank could be to have a model that calculates risk-adjusted profitability, having a payment hub, having a customer relationship management (CRM) system, or a thousand of other things. Banks often use size as an excuse before fully understanding the problem and fully understanding both the near-term and long-term risk/reward profile.

A CRM system, is undoubtedly difficult to set up and get bankers to use. However, a CRM is a much simpler solution than not having a 360-degree view of your customer and having your customer data stored in hundreds of places. A small bank is where you start building an effective and efficient organization. A small bank unwilling to tackle the difficult task now for the sake of simplicity in banking strategy, will likely find that the task become exponentially more difficult as a larger bank.

In fact, the presence of any one of these additional systems early in a bank’s development forces the bank to maintain simplicity. Having a CRM or data warehouse solves the question of where all data should live. Having instant payments solve the problem of making checks, wires, and ACH available in every application. Having the ability to calculate risk-adjusted profitability solves the critical problem of how to allocate capital across customers, regions, and products. Solve a problem once in a bank and then scale the solution to span the enterprise. Refine the process over time taking complexity out of the system with each improvement.

The Omni-Channel Mistake in Banking Strategy

The “omni-channel mistake” is our best example of doing something that is seemingly easy and simple but is really difficult and complex.

The average bank tries to be all things to all people. In almost every conference, banks and vendors talk about “serving the customer where and when they want.” We have the mistaken belief in this industry that we should serve the customer in the branch, on the phone, on the computer and on mobile all with equal capabilities. This is a mistake. We are making our life more difficult.

For starters, your mobile, online, branch and call center should all have the same view and workflow. Account opening, product onboarding and maintenance all should follow the same process. This is an example of simplifying a challenge to make things easier in the future. Creating a federated workflow for these processes is difficult, but the result is a banking strategy that is simple.

While there are 50+ vendors that can help with account opening and onboarding, only a small handful can do so across the consumer and commercial side plus span multiple products while being able to be implemented within all channels. Choosing your banking strategy wisely will pay off handsomely in the future.

While we have discussed this in-depth HERE, certain projects have an outsized impact on the future of the bank. Part of a healthy banking strategy should be to focus on developing processes that gain a bank operating leverage.

Banking needs to do less, not more. We don’t need different ways to initiate a payment or to open an account depending on the channel. We need one good one.

Bankers also need to be active in directing the customer the way we want. Managing an omni-channel experience is not a passive effort where we build each channel and let the customer choose. Unfortunately, we don’t have the resources for that.

We should build a single quality workflow that is built with the customer and employee in mind. We then adapt this workflow as best we can to each channel and then spend resources training and marketing as we direct customers to the preferred channel. This is the path to create that irreducible core and then refine it so it becomes a competitive advantage. The result will not only be a more effective and efficient experience but a solution that will both grow with the bank AND grow the bank.

7 Ideas to Design a Banking Strategy Around

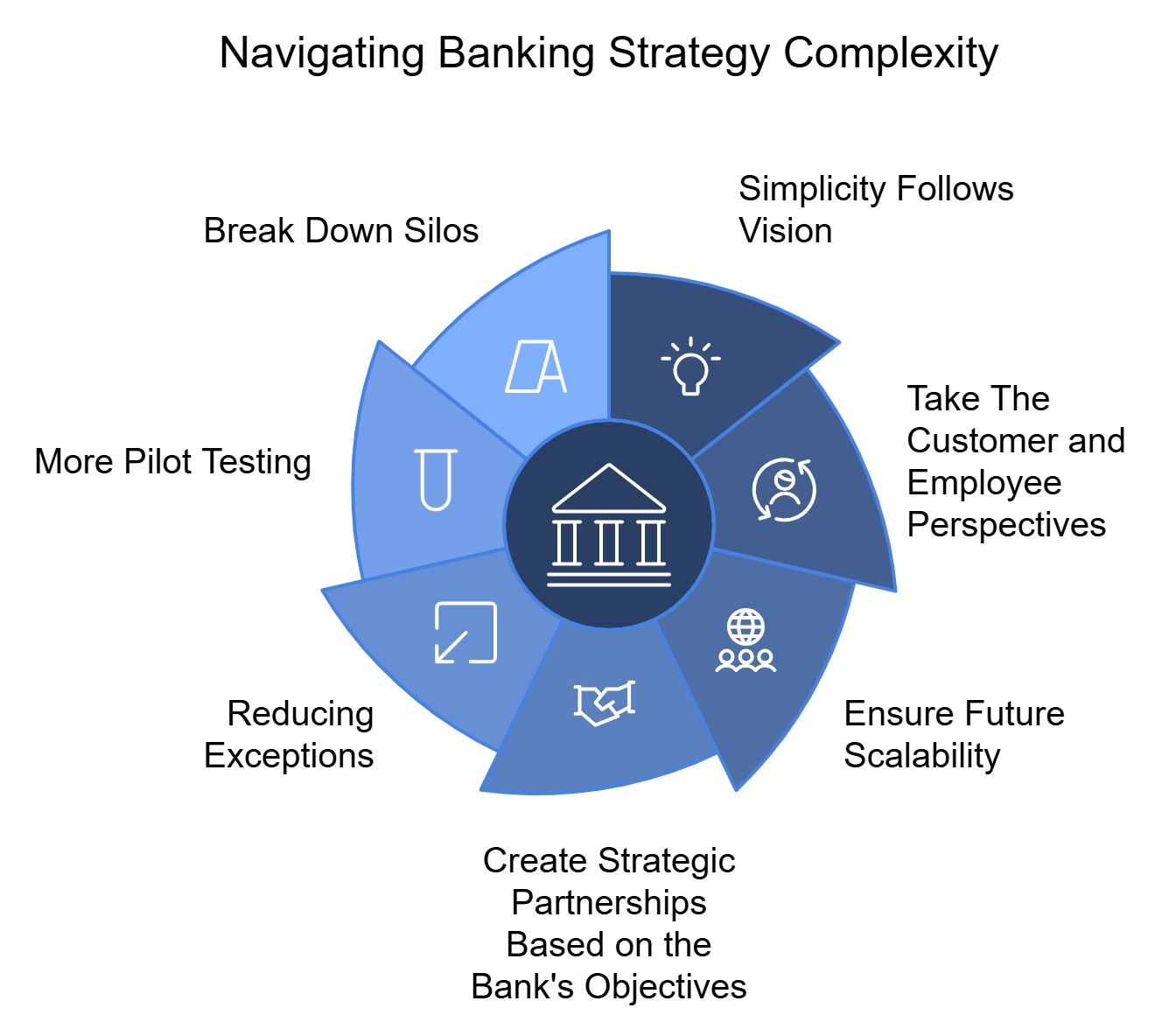

The following are seven overarching concepts that can guide your bank in developing effective strategies and tactics.

- Simplicity Follows Vision – Without a vision or an articulated problem to solve, creativity will counterintuitively be stifled. Put a fence around a playground and children will use all the space. Take the fence away and children will only use the middle of the playground. Limits make bankers feel safe. The goal of bank management is to allow enough freedom to explore but not too much were bankers feel unsafe. Without a clear vision and constraints on how to solve the problem, bankers will bring unarticulated assumptions to the table creating conflict and hindering progress. Create a vision, set the constraints, and let bankers solve the problem.

- Take the Customer’s Perspective, then The Employee’s and THEN the Bank’s – Customers and Employees Are Complex. Banks tend to create solutions that are based on policies and procedures instead of customers and employees. Emphasis platforms and solutions that can adapt to customers and employees instead of bank policies and procedures. Customers and employees will always change faster than policies and procedures.

- Build to Scale – We need to standardize the way we handle our processes to include onboarding, account opening, KYC, fraud mitigation, data analytics, reporting, audit, and thousands of other processes. Solve a problem once for a variety of use cases and then leverage that solution across the organization. Creating a single process that spans the enterprise is always more difficult, but it is also a simpler solution.

- Partner Wisely for The Future – Choose partners that have flexible platforms that allows banks to be agile into the future. Solutions should look ten years out. Partner with firms that can accommodate your composable processes instead of using their processes. This means more of an open banking approach to data and products. Generative AI is the latest example of this. Every vendor is utilizing a different large language model (LLM) and some are even creating their own. Banks don’t need 600 different versions of ChatGPT running around their bank and they certainly don’t need a dozen customized LLMs. It will all be too difficult to govern and test. Banks need a limited number of tested and governed GPTs that can span multiple products and use cases. Banks should consider vendors that can adapt to a variety of LLMs including their own in-house version of a standardized LLM.

- Stop the Exceptions – We must limit our bespoke ways of accommodating customers and employees. While we try to do the right thing, we usual add a layer of complexity and increase our costs. Instead of solving the problem with a adaptable platform, we create a series of band-aids. As a banking strategy, think platforms before one-off solutions.

- Do More Pilots – Go hands-on more often. Many banks have a bias towards quick fixes instead of taking the time to understand the problem and the universe of solutions. Create the time and resources to get to the root of banking problems, set your requirements and then go out and evaluate multiple solutions to see if they fit your needs. Use prototypes and simulations where appropriate to better understand the problem and potential solutions. Take time to understand how these solutions adapt and scale into the future.

- Break Sown Silos – Traditional banking believes in specialization, so we have created legacy silos. While teams within these silos are efficient at their task, they often lack effectiveness. They impose a knowledge disability for the enterprise by design. If you doubt this, consider how few resources we devote to our most profitable products – deposits. Banks often unknowingly wall deposits off only to starve the area from product design, performance analytics and marketing resources. Banking needs more cross-functional teams (HERE) that focus on enterprise key performance indicators (KPIs) instead of the metrics of the silo.

Putting this Into Action

By keeping the above seven strategy design principals in mind, bankers can create an organization that will grow and be competitive because of its design. Remember that the difference between “easy” and “difficult” is one of perspective and understanding. Banks can make simple strategies easier by learning more about the fundamentals of a strategy and considering the multiple ways to achieve the stated goals instead of adopting someone else’s high-level solution because it is easy. When it comes to banking strategy, often the simplest path forward is also the hardest.