2026 Bank Marketing Lessons from Mamdani

No matter what you think of NY Mayor Zohran Mamdani’s politics, his campaign is worth studying for bank marketing lessons. Bank marketing has entered a new phase, and many institutions are not ready for it. For decades, banks have relied on a familiar playbook: website, emails, branch signage, events, sponsorships, and the occasional brand refresh. That approach worked when attention was abundant and trust flowed naturally to institutions. In 2026, neither condition exists. In this article, we explore the changes to bank marketing no better highlighted by Mamdani.

A year before the election, Mamdani was polling at just 1% and this 34-year old unknown state assemblyman was endlessly mocked. However, on Election Day he dominated other candidates with a 51% of the vote vs. former NY governor Andrew Cuomo. More impressively, he was able to put together more than 100,000 volunteers that captured 78% of the Gen-Z vote.

Running a higher performance bank now takes not only good credit and profitability management, but the ability to earn customer attention, relevance, and trust at scale. The lesson for banks is clear: marketing must evolve from product promotion to brand storytelling.

Banks Are Competing in an Attention Economy

Like banks, most political campaigns make ample use of social media. However, Mamdani’s team didn’t just post, they produced cinematic content complete with eye catching backdrops and actions capturing a single message.

The social media posts were not polished advertising but iPhone-shot clips that appeared natural. They featured their customers, New Yorkers, with real world problems and paired the content with trending songs and memes. They collaborated with influencers like Subway Takes, The Kid Mero and Emily Ratakowski to promote concepts that resonated.

A volunteer came up with the idea of a series of “Hot Girls for Zohran” posts as a play off the popular Hot Girl Summer, Megan Thee Stallion and Nicki Minaj song. The campaign was rolled out just as the Maga Republicans co-opted the song with a message let “beautiful women be beautiful.” The Hot Girls for Zohran flipped the script with a simple message of “let all women be beautiful” and featured everyday women making a difference for New York. The simple message resonated and garnered four million views.

Bank customers, both commercial and retail, rarely wake up thinking about banks. They wake up inside a variety of feeds, streams, and messages curated by algorithms optimized for engagement, not credibility.

This matters because attention is now the gatekeeper to everything else. You can’t explain your loan value if you are ignored. Banks cannot cross-sell deposits if they are invisible and they cannot defend margins if their brand is worthless.

The Rise of Kalshi

Kalshi is a current brand that exemplifies this trend. Kalshi is a U.S. based betting app that captures attention by providing gambling opportunities that are more than just sports. Users can bet on the economy, science, politics, and various events. When you are not betting, you can store your savings earning a 3.25% interest rate. The app has treated gambling like banking and their marketing campaign took a page from Mamdani – Meet your customers where they are.

The app rose to popularity and became the number one finance app by showing its customers having fun “investing” in their views while making betting probabilities easy to understand.

What “Meeting Customers Where They Are” Really Means

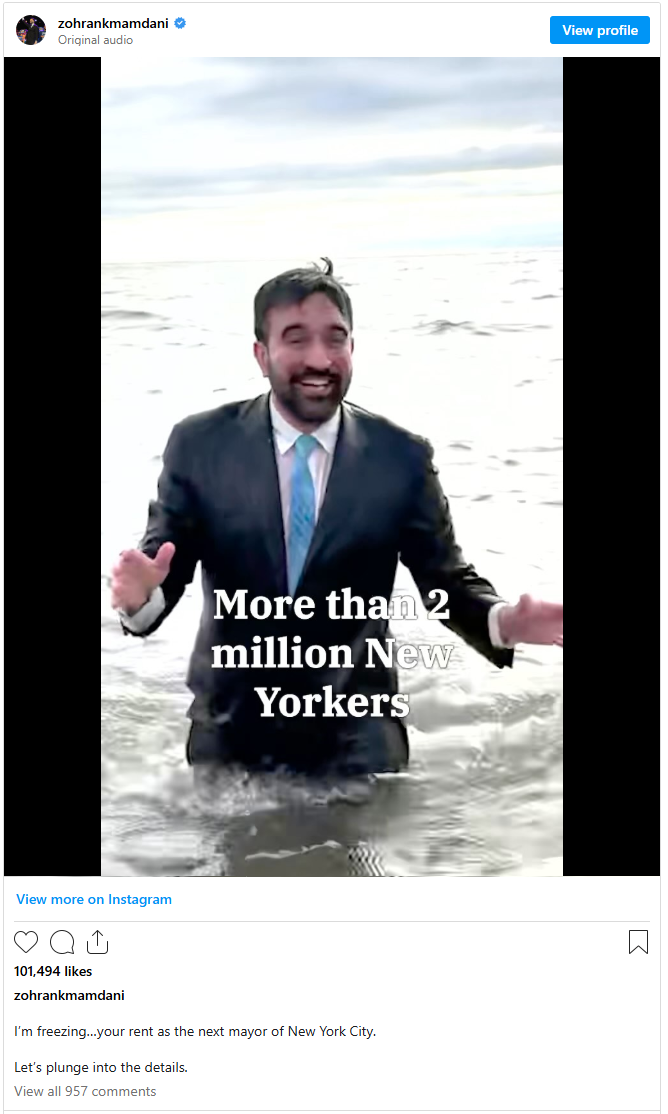

It was New Year’s Day 2025 and Mamdani showed up at the annual Polar Bear Club Plunge on Coney Island where he proceeded to jump in the 40-degree ocean along with the rest of the Polar Bears emerging soaking wet to talk about freezing rents. Sure, the post was cringe, but in addition to turning that crowd of 1,000 on the beach into fans at some level, the post received more than 800k views at the time – an impressive feat for a nascent campaign. It was a double win.

The most important change banks must make is philosophical. Marketing can no longer be treated as a distribution channel for product or community announcements. It must be treated as a strategic capability that shapes how customers experience the bank long before a product conversation ever occurs.

For banks, this does not simply mean opening a TikTok account or experimenting with short-form video. It means understanding context. While political rivals were chasing press endorsements and touting their policies in speeches, Mamdani produced a content engine. Instead of traditional “ads,” there were TikTok and Instagram stories that were short, full of energy, authentic and emotionally fluent. He published clips were he was being heckled. When one New Yorker shouted him down and called him a communist, he corrected them and said it was pronounced “cyclist.” The clip went viral.

If you are a banker and rationalize that you are not on the campaign trail and you can’t reproduce a clip like that, you are missing the point. Many of Mamdani clips took off because they resonated. He used self-depreciating humor often playing into his lack of experience, young age, and socialist orientation. His clips were authentic and largely around a single affordability message. Banks can do the same thing when they meet their audience discussing topics that they fear – the high cost of living, savings, or managing cash flow.

Mamdani’s core platform – NY is too expensive, wasn’t novel. He set himself apart by how he delivered the message. Instead of talking about products or policies, Mamdani looked directly at the camara and highlighted how his customer base was being disenfranchised. He related to their fear of not being able to afford a home and start a family. He validated their frustrations and instead of delivering lectures about savings, he showed empathy. This ended up resonating more than any other politician and turned a theme into virality.

Authenticity Is the New Risk Control

Commercial clients may be consuming content on LinkedIn, podcasts, and industry-specific newsletters—not product PDFs. Small businesses may be learning about cash flow, fraud, and payments from peers and creators, not bank webinars. Retail customers may trust explainer videos more than disclosures.

In 2026, effective bank marketing will:

- Translate complex financial concepts into simple, visual narratives.

- Use real customer stories instead of abstract product benefits.

- Design content for sharing, not just compliance.

The banks that win will not push harder—they will feel more native to the environments their customers already inhabit.

Mamdani took his camara to a Knicks playoff game last Spring to interview fans. He showed his excitement and their love for New York. He never mentioned a policy or a trouble, just the joy of local professional sports. In doing do, he aligned himself within the cultural zeitgeist of the time, not just an observer. How many banks would think to do that?

Mamdani didn’t steal attention, he amplified it. He showed that he was “one of them.”

Banks often worry that modern marketing feels risky. In reality, inauthentic marketing is the bigger risk.

Customers today are extraordinarily sensitive to tone mismatches. Polished but empty messaging erodes trust faster than silence. Overly corporate language signals distance, not safety.

Authenticity does not mean being casual or unserious. It means being:

- Clear about what your bank does and why it matters.

- Consistent across channels and touchpoints.

- Human in how value is explained.

In 2026, customers will trust banks that sound like they understand real financial pressure—cash flow volatility, fraud anxiety, affordability, and political uncertainty. This is not a time for generic slogans, tag lines, or messaging, but a time to show you understand your customer base.

From Product Campaigns to Platform Thinking

One of the biggest missed opportunities in banking marketing is the failure to think in platforms rather than campaigns. Campaigns end. Platforms compound.

Banks should be asking:

- How does our marketing reinforce our payments capabilities?

- How does our content support treasury, liquidity, and risk conversations?

- How does our brand show up consistently across digital banking, relationship managers, and client communications? What current trends are we amplifying?

That Kashi app is the rage. How can banks tap into that and show the other side that gambling is NOT banking. When marketing reflects those realities, it stops feeling like advertising and starts feeling like signal.

The 2026 Banking Marketing Mandate

By 2026, successful banks will have made several clear shifts:

- From features to outcomes – Marketing will focus on what clients can do better, not what products are.

- From volume to resonance – Fewer messages, stronger identity, higher recall.

- From institution-first to customer-first storytelling – The bank becomes the enabler, not the hero.

- From static branding to living presence – Content evolves with culture, not annual planning cycles.

This is not about chasing trends. It is about recognizing that trust today is built through relevance and repetition, not reputation alone.

The Strategic Implication for Bank Leadership

Marketing can no longer sit downstream of strategy or a passive exercise. It must be embedded within every facet of the bank. Let Marketing drive product, not the other way around.

Banks investing heavily in payments modernization, AI, data, and digital platforms must ensure their marketing communicates those investments in ways customers understand and care about. How will it make them better?

In 2026, the banks that outperform will not be the loudest or the cheapest. They will be the most understood. To succeed, banks must:

- Meet customers where they already are.

- Speak in a culturally fluent voice.

- Prioritize trust through consistency, not claims.

Profitability, regulation, capital, and risk management will still govern the future of banking. Growth, however, will be decided elsewhere—in feeds, conversations, and moments of relevance.

Banks that learn to market like modern brands will not just attract attention. They will earn trust, loyalty, and durable relationships in an increasingly crowded financial landscape.

Mamdani went from a candidate few heard of to winning by a landslide in one of the most competitive election markets in the U.S. He did this by using the same marketing techniques community banks can use to set themselves apart. Instead of showing products and community involvement in 2026, show that you understand your customer.