Deciphering Bank Customer Intent with AI in 4 Steps – Part 1

If you are conducting bank strategy or marketing around demographic information, at best you are being lazy and ineffective. At worst, you are being sexist, ageist and a bunch of other names that can hurt your culture and reputation while wasting your marketing budget. In this age of data, getting to the Holy Grail of marketing – understanding the intent of what the customer – is a three-month project away. In this article, we show you the path to do this and some of our insights that you can use to improve bank profitability.

If you want to throw money at the problem, and you should because the return on investment is in the mid-triple digits, almost any good marketing agency can set you up. If you don’t have the budget, no problem and then you need one good bank marketing person and someone that knows Python and a little web design.

The Importance of Customer Intent

When using demographic information, we can only guess at what a particular cohort of 60+ million people want. We assume that every Boomer cannot handle technology, and every Millennial wants to get married late. These are falsehoods that we have been spoon-fed to make understanding and campaign execution easy. You can pull all your customers with birthdates between 1981 and 1996 and assume that want to start saving for college for their kids. Meanwhile, those 40-year-olds already have it figured out and those 28-year-olds may have other priorities.

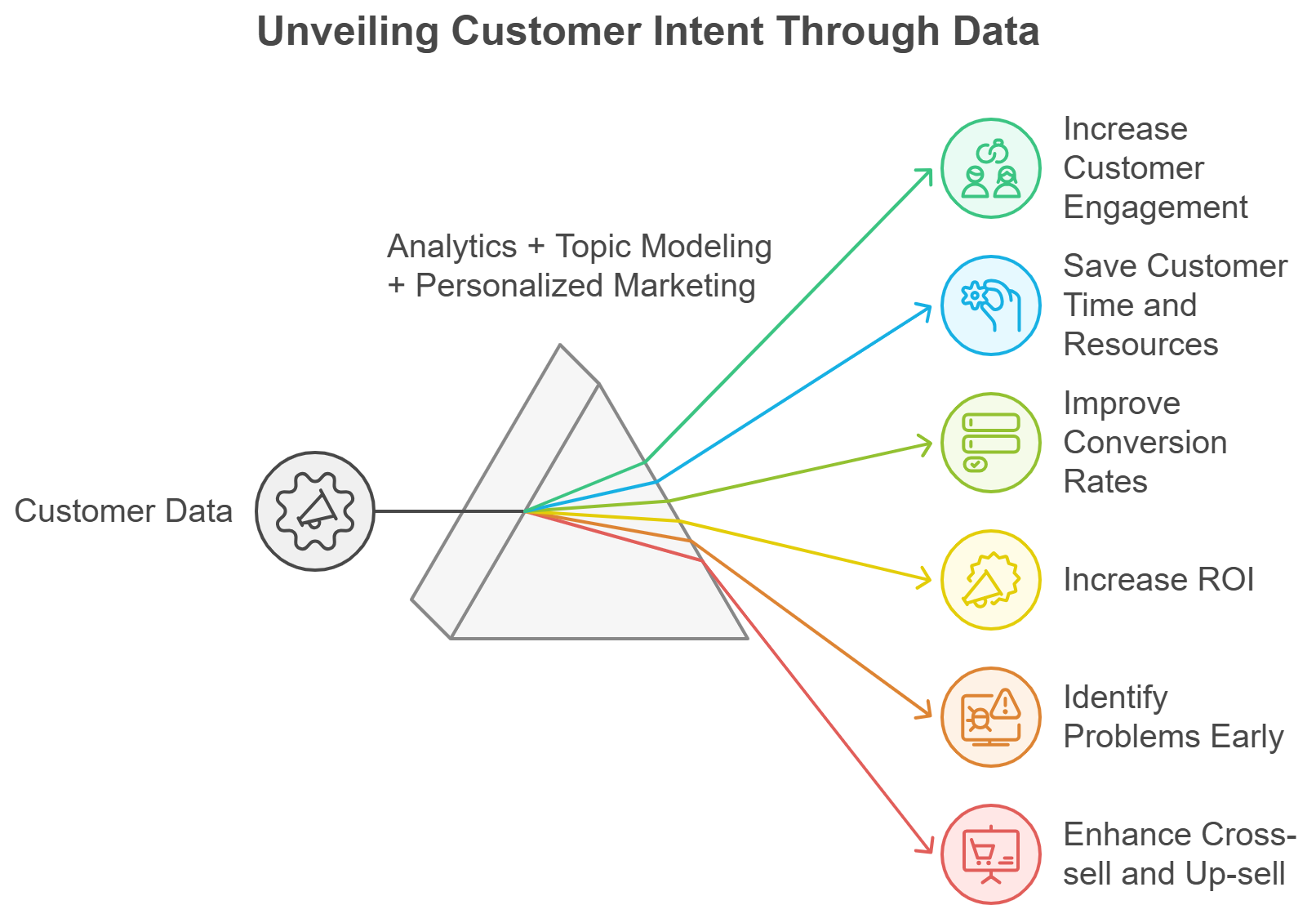

We now have tools at our disposal that can tell us what each one of our customers are thinking, no matter their gender, age, income, address, or culture. Using intent data, we can not only stop wasting our customers time, but we can increase engagement at the inflection point of when the customer is about to decide about a financial product. By having a true 360-degree view of the customer, we can figure out when that 19-year-old influencer is ready to buy a house or when that 65-year-old is ready to use instant payments on the bank’s mobile app.

While we are going to be talking about marketing data from websites and campaigns today to keep things simple, soon, more and more banks will be leveraging transaction data from payments, credit information and third-party information to even do a better job at discovering intent.

Step One: Driving Customer Intent Data

First you need the data from the start of your customer journey to develop intent. This is the same effort you will need to have a set of modern personalization tools so Step One needs to be done eventually in order to stay competitive. The goal of this step is to provide content your customers or prospects want to look at and a way to gather their identity at every turn.

This is exactly what we do when we offer an e-book to you such as the 12 Strategies To Help Your Bank Succeed in 2025. We worked hard to put this content together and we offer it in exchange for having a chance to market to you. If you download this content, you send a signal to us that you care about banking. If you care about banking, then you are a potential customer we want. If you don’t read our articles and don’t download this content, then chances are we don’t want you as a customer.

As a marketing strategy, most of our resources are spent trying to get customers to look at content (on our website, social media, newsletter, email, partnerships, etc.) and then testing if they like it or not. By consuming our content, you self-select and do much of our heavy marketing effort for us. Knowing who is not your customer is equally important as knowing who your customers are.

This brings us to our first two insights which we learned through experimentation and artificial intelligence (AI). One is that e-books are one of the most effective marketing tools banks have to not only generate leads but leads that convert at higher rates than other techniques such as webinars and in-person meetings.

Our second insight, taught to us by AI, is that if we tell you what we are doing about why we want you to download that e-book, then you are more likely to do so. This is second level meta, but by being transparent, our trust level goes up in your eyes and you are more likely to provide your email address. This is not a “trick” but effective marketing. We provide you free insights AND some tools such as our risk-adjusted relationship pricing model and ARC, our hedging program to help you achieve your goals of allocating capital more effectively. If you do not like our tools or do not need them – no problem.

Other website items to gather data include a robust search function to get more detail around what customers are looking for, more calls to action, interactive calculators, forms to collect information and analytics.

Step Two: Topic Modeling

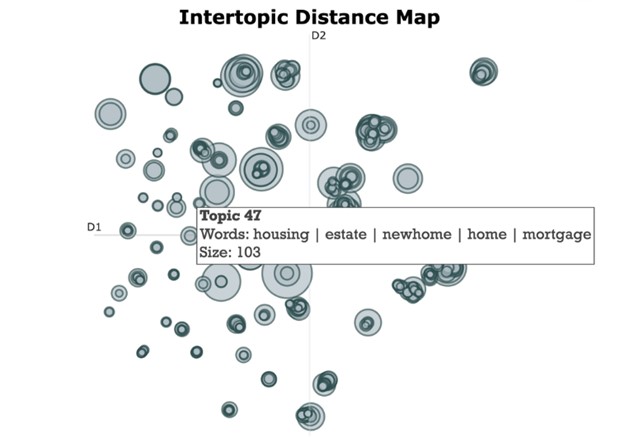

Now that your website, email campaigns, social media and other marketing efforts are generating data around products and topics, now we need to make sense of that data. While there are a number of off the shelf tools, this can be done using “k-clustering” in Python or, if you want to be more cutting edge, using an open-sourced modeling technique called “BERTopics” (just show this to your developers). These tools distill the content and pathways that customers have been interested in into topics, reduces these topics to the important ones to the bank and then relates these topics together.

By clustering, you leverage the power of traditional AI to peer into customer behavior. We can now visualize various banking topics to see how related the topics are to one another. The customer segment in our example below, are clearly looking for not only a mortgage but a mortgage for a new home.

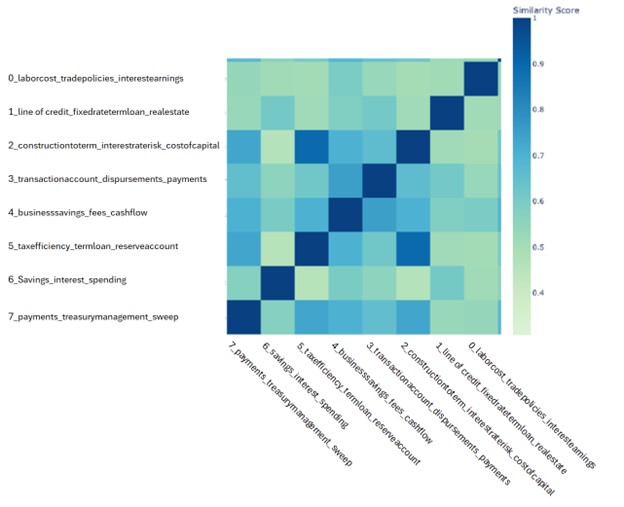

We can also turn this data into a heatmap that can show the topic clusters and the adjacency to other clusters. We can create these heatmaps for any set of topics depending on our objectives. For example, we might want to understand the mind of our commercial customers. We can pull just those topics, and the data classified under commercial customers and map it such as the graphic below.

From this, high level stories start to emerge. We can start to see topics that are important to commercial customers such as labor cost, tax efficiency, construction to permanent loans, cash flow management and various forms of savings. In the middle of the above graphic, we can start to see stories around businesses that are particularly concerned with transaction account structures, disbursements, business savings and cash flow.

Up to this year, this AI generated data was good enough launch a myriad of marketing campaigns that would be a double digit increase in lift over generic marketing. Using this data, we can now do a better job at generating content and marketing to more relevant topics.

However, this is just the tip of the proverbial iceberg. In the past year, the great unlock as been generative AI.

Next Up

If you want your bank to compete in the future, building out your website and marketing efforts to generate data that can point to customer intent is critical. As AI goes more mainstream, this data will be easier and easier to decode and drive insight to not only better understand your customer but be more effective at meeting your customer’s unspoken needs.

In the second and final part of this series next week, we will show how using generative AI can add deep context and insight into the above data. We will then use these insights to build campaigns and gauge effectiveness.