How To Use “Strategic Product Communication” In Banking

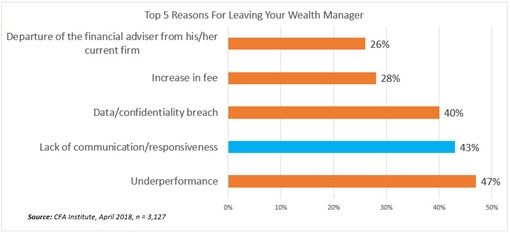

A survey from the CFA Institute caught our attention on why wealth management clients leave. 47% of the respondents said they left because of the poor portfolio performance. That makes sense. But, do you know what the second highest reason for leaving your wealth manager was? Communication. 43% of the respondents left because of the lack of communication. That got us thinking about how we can improve communication with our commercial customers. In this article, we look at the data to highlight how to use “strategic product communication” to increase customer retention and usage.

The Importance of Communication

Few bankers would dispute the importance of communication. It is the hallmark of building great teams and great organizations. We have never run into a banker that has disputed that communication is important for customer satisfaction, engagement and retention. The data we referenced above bears this out and as you can see in the full data set below. Communication is more important when it comes to retention than if you have a data breach. It is also 50% more important than if you increase fees.

Let that sink in.

You are probably scared of the potential loss of customers should you have a data breach and likely scared of what could happen to customers if you raised fees, but shouldn’t bankers be scared of not communicating enough with their customers in regular times?

Applied To Banks – Strategic Product Communication

In the past, we have highlighted the importance of “transactional communication.” Transactional communication are emails and notifications such as balance alerts, countdowns and “thank yous” that are related to a particular transaction or set of transactions such as a payment, account opening or loan closing.

In this article, we look at another form of customer communication called “strategic product communication.” This is information about a particular product that the client already uses. The goal of this communication campaign is to make the customer smarter about a particular product or service. The hope is to have a more educated customer that will result in more engagement, better satisfaction, and greater usage.

We found it didn’t matter the form of the communication as all channels ranked nearly equal in their effectiveness – in app push notifications, emails, phone calls, visits or webinars. Each communication was geared around teaching the customer more about the bank’s product. This may be a treasury management feature that is available but not being used, information about how to renew a loan or the education on how to use a line of credit for acquisition purposes.

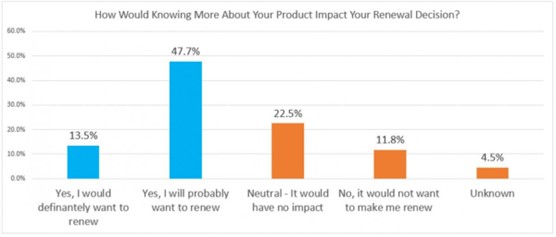

To test this, we took a sample of line of credit customers and asked them their thoughts about renewing the line of credit once they received more product information. More than 61% of the customers reported that strategic product communication that increases product knowledge would impact their likelihood of renewal.

Now, this data may vary by customer type, bank product, economic cycle or other variables, but we suspect there will always be a strong correlation and causation between strategic product communication and satisfaction/usage.

In past academic studies that looked at products like computers and other electronics found that the correlation around product knowledge and retention are consistently around the 70% range with a high (91%) statistical fit. We have reason to believe that banking is directionally no different.

One phycological element that drives this is that the customer expects a marketing message. When they get a message that adds value to their lives without additional cost, they attribute that goodwill to the bank’s brand. This goodwill creates trust and more trust equals more attention on a bank’s products.

Putting This Into Action

The action item here is simple –create an initiative to increase strategic product communication with your customers. Part of the attraction here is that the effort is inexpensive. Before you go off and invest in artificial intelligence and data mining, knock out the simple things first like increasing strategic product communication.

Create an email drip campaign, for example, that provides users of commercial bank services with more product knowledge over the course of the first year of usage. Make your customers smarter and more confident in your product and greater profitability should follow.