The Secrets of Seasonality When Marketing Bank Products

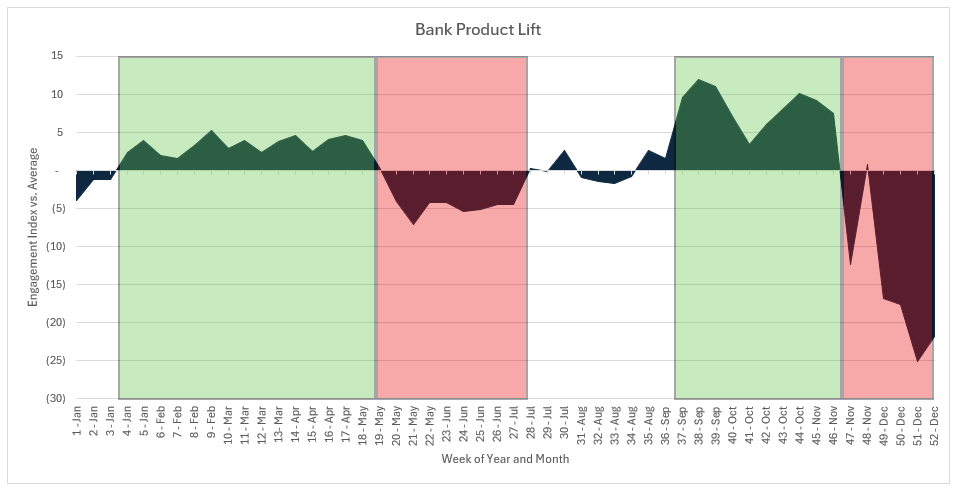

When it comes to bank marketing, there is usually a good time and a bad time to market bank products. Marketing during December, for example, is expensive and 40x harder to convert customers compared to September. Marketing savings, money market, or certificate of deposit accounts during tax time is a good move, while marketing treasury management during tax time is a bad move. In this article, we provide our chart pack of the best, and worst times, to market popular bank products.

Our Marketing Bank Products Methodology

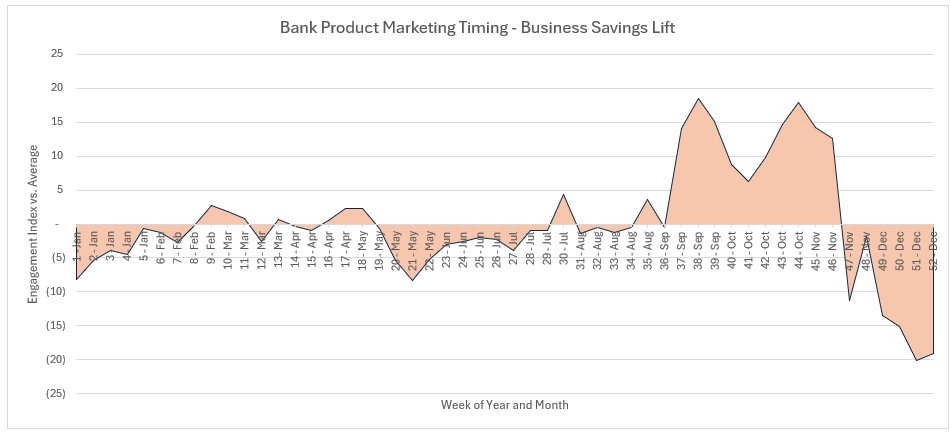

We took the last five years of conversion and click data, created an index and then weighted for the most current years. A score of zero means it is an average time to market a bank product while a positive score is a good time, and a negative index score is an inefficient time. On the X-axis we charted the week of the year and the month.

Some Insights Around Marketing Bank Products

- No Market December: The first rule when it comes to marketing bank products is that December is the worst time of the year to market. Not only is digital marketing expensive and mailboxes are full (both physical and email), but consumers and businesses do not care. It is 20x harder to get engagement compared to average for bank products. As a rule of thumb, banks should pull all paid product marketing in December and focus on organically generating engagement around the brand or the community.

- Go Market September: Starting the second week in September and through October is the single best time to market bank products. Households and businesses are thinking about their performance and year-end goals. After summer vacations, people want to keep the good times going and think how can they afford the next one or improve their job performance to ensure the next vacation. Here, marketing themes around year-end performance and financial improvement resonate well. In addition, this time is also peak wedding season, and my households are opening up joint accounts. Finally, fall is the harbinger of winter, so businesses and households usually increase spending, investments and manage other financial transactions before winter arrives.

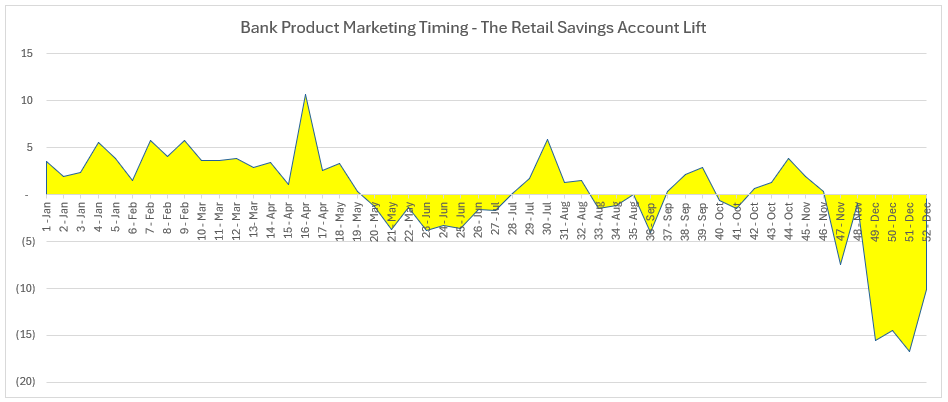

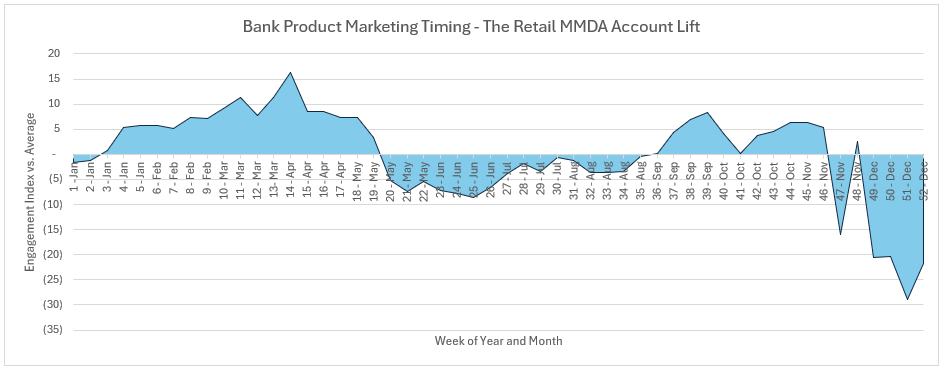

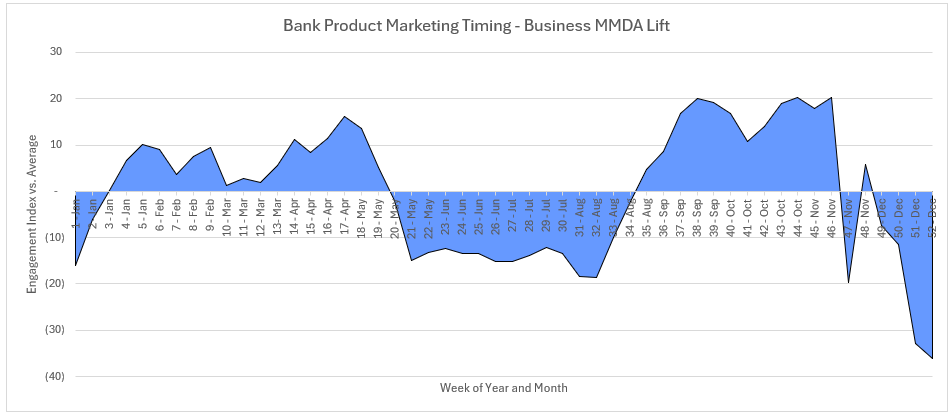

3. First of the Year and Tax Time for Savings Accounts: The first of the year is usually any time to market (below) interest bearing accounts to include savings and money market deposit accounts (MMDA). Even better is to execute one of the best deposit marketing campaigns that can be done – promote the savings of tax refunds into a savings, money market, health savings account or 401(k). This tactic can produce 5 to 10x more conversions than average. It is likely the marketing campaign with the highest consistent ROI. Sadly, only around 15% of banks utilize this tactic.

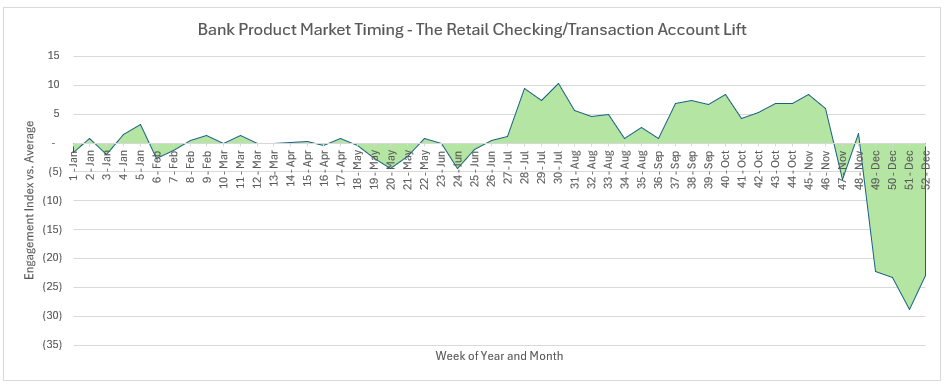

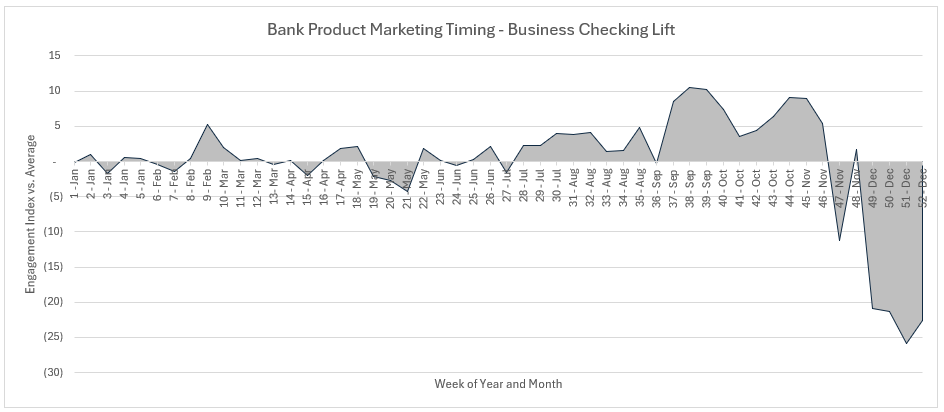

- Summer is for Checking: Summer is a time of travel, spending and summer jobs all needing a banking relationship. New checking activity surges during these months. Banks do well marketing student accounts to high school and college aged kids while an upgraded “graduate account” for those young adults entering into the workforce and likely needing to transition from their parent’s accounts or get an additional banking product such as a credit card. Travel related features such as an international debit card, fraud alerts and overdraft protection all do well in summer months.

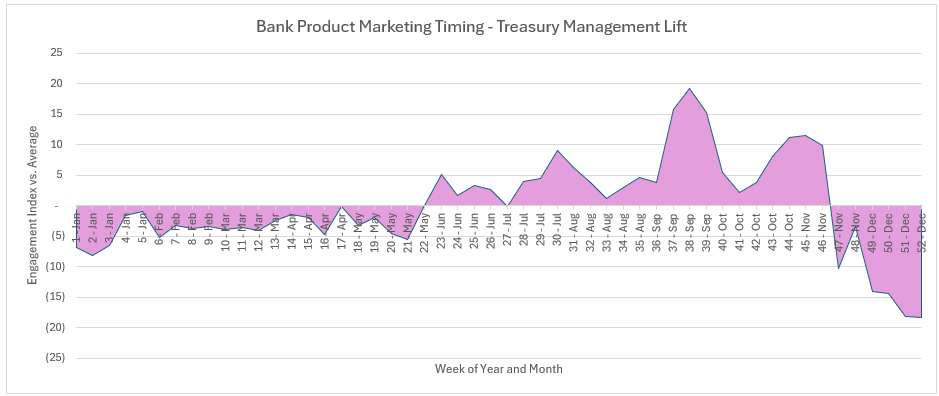

5. The Treasury Management Back Half: New treasury or cash management account marketing success is largely a back-half of the year phenomenon. Businesses are busy executing their strategic plan and doing their own marketing to get the year going. It is not until late May do most CFOs pick their head up and look around for a new banking relationship. New business formation spikes in January, March and June which also attributes to new treasury management account opening. A large business that forms in January, goes through fundraising in March and needs to move from a checking account to a treasury management suite by June or July.

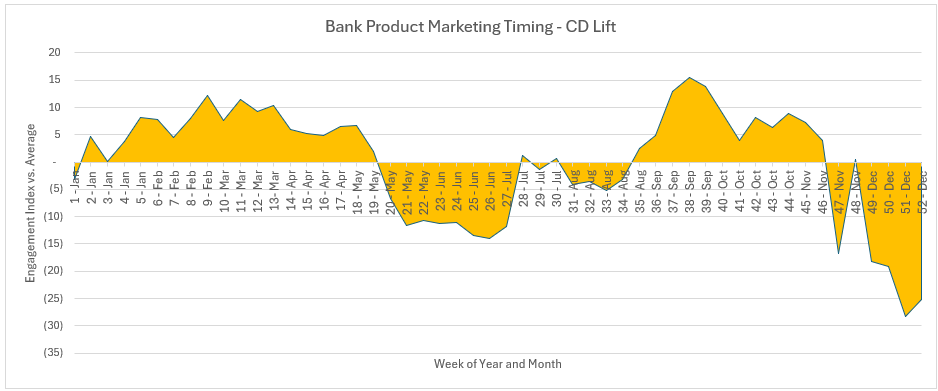

6. When Marketing Rate – Its On or Off: Whenever you market a product with rate, it is either easy or hard depending on the rate and the environment. CD marketing, for example, is best during September or during the first of the year. The higher interest rates are, the easier (more engagement and conversions) it is to market any yield bearing product. When short-term rates are at 6%, conversions are easier than when rates are at 2%.

In addition, the higher the rate is on the product, the easier it is to market. Marketing a 4% money market account takes less resources or has higher conversions that marketing a 2% money market product. Behavior marketing triggers are all about intermediate savings and investment return.

The buyer of a CD is different than a buyer of a transaction account or treasury management. Understanding the difference will help craft the CD promotion. While we are on this topic, marketing business accounts with rates, such as the business money market account, largely has the same seasonality and behavior drivers.

- Business Accounts are Purchased Not Sold: Except in September and October, marketing-driven engagement for business checking and savings (below) is difficult. There is some positive variation around quarterly tax dates, a couple spikes around Summer, but Sept. and Oct. are the best times to market these products for reasons stated above. Saving for contingency planning, reserve/replacement accounts, or setting aside emergency funds are all duel business transactional accounts and savings account promotions that work. If you are going to market one, you should market both starting in July and have it run through the first week in November.

Putting This into Action

Marketing bank products has a seasonal rhythm. Understanding this cadence helps bankers better leverage depositor behavior to drive more efficient marketing campaigns and more effective marketing.

Marketing resources are scares. By aligning marketing efforts with consumer and business behavior throughout the year, banks can significantly improve engagement and conversion rates. Whether it’s leveraging tax time for savings accounts, capitalizing on summer for checking products, or focusing on September and October for business accounts, timing is a critical factor. Ultimately, recognizing and adapting to these seasonal rhythms empowers bankers to create more impactful strategies, ensuring resources are invested where and when they will deliver the greatest return.