Understand This Key Insight Into Bank Efficiency and Profitability

In our previous article (here) we analyzed the data on community bank M&A and performance, and we concluded that there is no relationship between community bank size and profitability, as measured by return on equity (ROE). While superficially it makes sense that bigger is better, size itself does not lead to better bank performance. Combining two banks may lead to some elimination of overhead, but this gain in efficiency and scale is often overstated. The larger, merged institution usually creates more complexity, additional management layers and requires more non-revenue producing personnel, thus negating much of the perceived cost-savings of a merger. While there is no correlation between bank size and performance, there is a strong correlation between bank efficiency and performance. In this article, we explore a key insight.

While size isn’t correlated to profitability, operating leverage is. This is to say there is growth and then their is quality growth that increases operating margins. The key insight is to understand how growth translates into bank efficiency. We believe that high performing community banks are gaining efficiency with customer-facing employees, superior process workflow and an efficient technology architecture and not because of larger bank size. For this article, we will focus on customer facing employees.

Better lenders and deposit takers are generating more revenue and more income per employee. We believe that every community bank needs to focus on the drivers of performance and adjust their strategy so that customer-facing employees maximize their potential and drive more revenue and income to the bank.

The Data Around Bank Efficiency

To understand our analysis into bank efficiency, we measured the correlation coefficient between the efficiency ratio and ROA for banks between $100mm and $10B in assets at negative 0.74 (one of the highest factors driving community bank performance). We analyzed various community bank asset bands (under $10B size). We excluded specialized bank (bankers’ banks, credit card banks, etc.). We divided each asset band into three categories – two lower performing categories with ROE under 10%, and one outperforming category with ROE over 15%. We will show graphs for community banks in the $1-3Bn asset bands, but all community bank band sizes we considered demonstrated similar results. Top performing banks, on average, pay higher salaries to their employees, but those employees generate more revenue and more income for the bank.

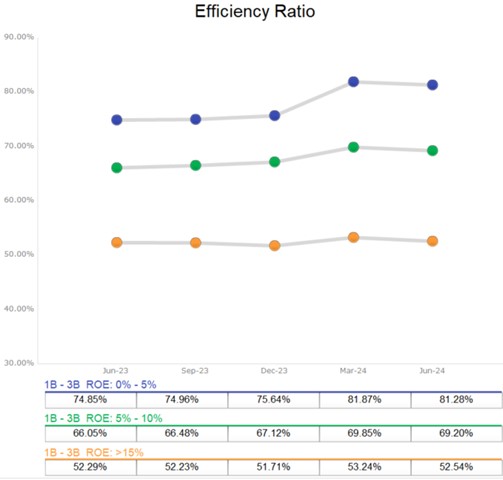

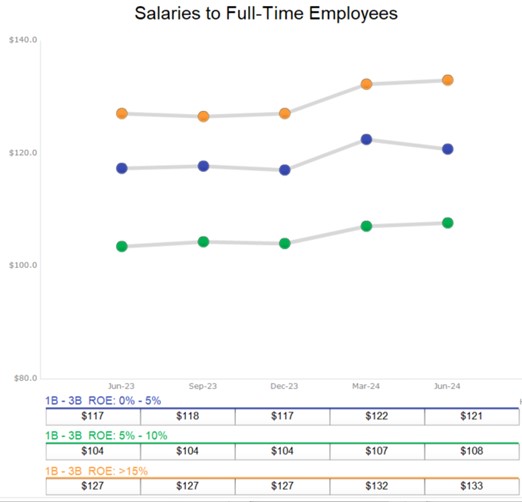

The first graph below shows the efficiency ratio for banks between $1B and $3B in assets. Top performing banks (over 15% ROE in the gold line) demonstrate a markedly lower efficiency ratio but pay their employees a higher salary (second graph below).

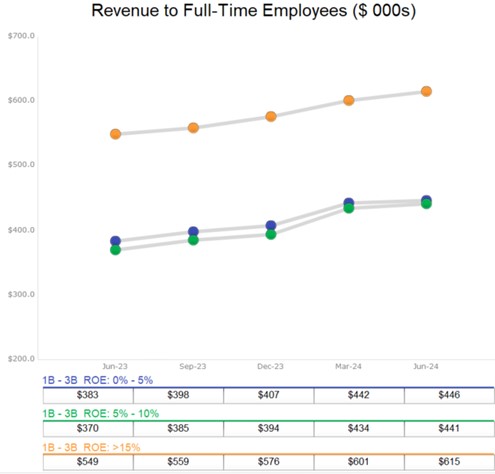

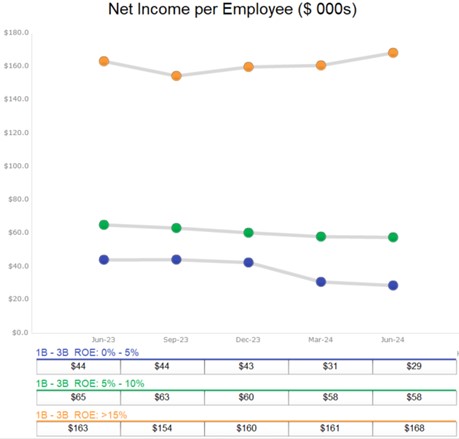

The chief difference between these three bank categories is that outperforming banks are generating more revenue and income per employee as shown in the two graphs below.

Application to Community Banks

Based on our analysis and our experience working with thousands of community banks, we believe that bank executives need to strategically build their business model to maximize front-line efficiency – that means employees must be positioned to increase revenue and income. However, adding more accounts to each employee achieves the opposite result. Each employee must be apportioned accounts strategically to maximize revenue and income.

We will outline the strategy for commercial lending, but similar steps can be utilized for deposit gathering, consumer lending, or wealth management. First, we believe that it is crucial for executives to distinguish the differences between relationship building (where trusted advisors add value) and transactional business (where volume is key). A trusted advisor is someone who understands what clients want and how to help them get there. The trusted advisor role is not a squishy soft concept, but instead a clearly defined and action-oriented mindset.

We believe that trusted advisors cannot manage more than an average of 20 to 40 commercial banking relationships – there simply is not enough time to understand the customer’s goals, business model, and competitive and economic environment for more accounts. Most relationship managers at community banks manage more than 100 commercial banking relationships – making them order takers and detracting them from being trusted advisors to high value accounts, those accounts that can generate more revenue and more income.

We do not recommend that community banks shed excess accounts from their balance sheets. Instead, managers must realistically assess which employees have the aptitude and knowledge to deliver trusted advisor service and allocate high value accounts to these bankers. While not every commercial banker will be a trusted advisor, those that are not will still add value by managing a larger portfolio, albeit with less sophisticated needs and less servicing, cross-sell and upsell potential.

We have seen this strategy work at various community banks where commercial bankers with underwriting and advisory expertise manage 20 to 40 accounts with an average relationship size of $2mm to $10mm. While portfolio managers will manage 100 to 200 transactional accounts with an average relationship size of $250k to $500k. This allows bankers with the applicable expertise to concentrate on more sophisticated relationships, which allow more cross-sell and upsell opportunities. Accounts that have less revenue potential are overseen by portfolio managers.

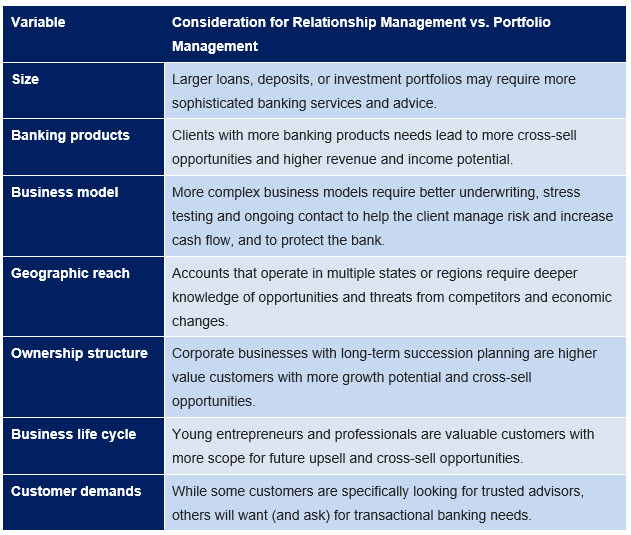

The table below outlines what variables executives may use to apportion accounts between relationship managers (trusted advisors) and portfolio managers (who manage transactional accounts).

Bank Efficiency Conclusion

While community bank consolidation will continue in the near future, efficiency at community banks is gained on the front line, not at the C-suite. Combining two banks with poor operating efficiency is unlikely to enhance performance. Executives must be able to apportion accounts to the right front-line employee to gain operating leverage which will improve bank efficiency and drive higher profits.