How QT will Impact Cost of Funding in 2024

Most market participants are focused on just one monetary policy tool available to the Fed – short-term, federal funds rates. However, the other critical monetary instruments available to the Fed are quantitative easing and tightening (QE and QT, respectively). While the Fed’s current actions on QT have been deemed long-term, slow-moving, and compared to watching paint dry, after years of QT, the impact is real and is affecting money supply and bank’s cost of funding (COF). Bankers must understand the relationship between money supply and their bank’s COF. Even if the Fed does not increase the Fed Funds rate or even decreases the rate in the future, continued QT is expected to put pressure on the cost of funding in 2024.

Quantitative Tightening

The Fed engaged in QE (buying Treasuries and mortgage-backed securities) in response to the great financial crises and then escalated this policy tool during the pandemic. However, in the middle of 2022, the Fed started shrinking its balance sheet in response to inflation running well above its long-run target. The Fed continues to shrink its balance sheet at $95B/mo.

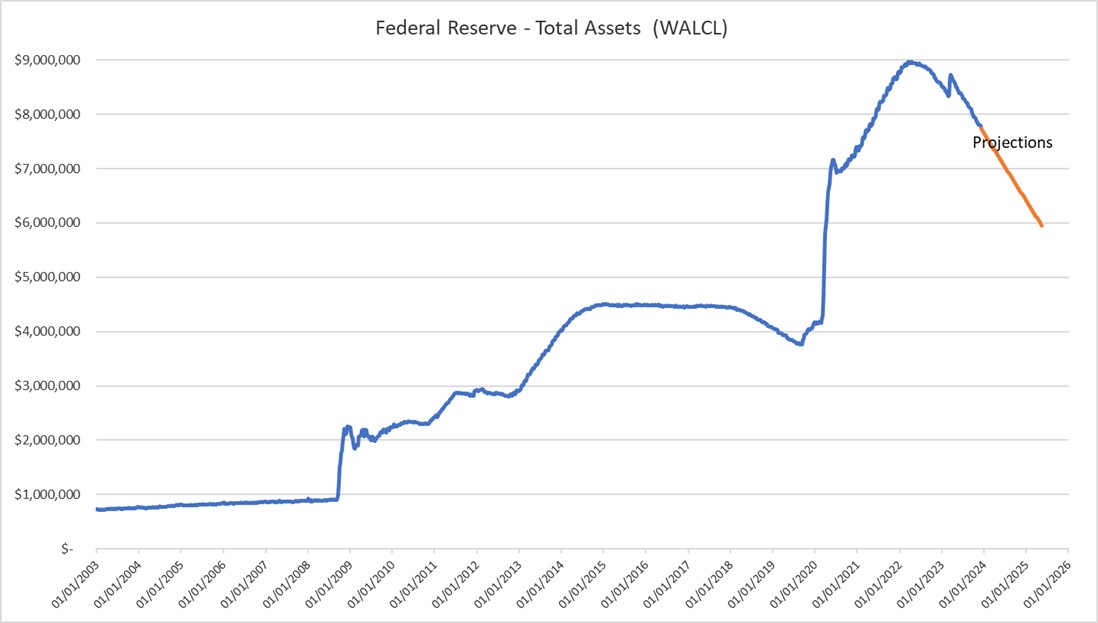

The current QT contrasts with the 2016 QT when the Fed started draining its balance sheet two years after its first rate hike. The tightening was only $50B/mo. and was paused shortly after that. The tightening process in this cycle is expected to be faster and larger than in the previous cycle. It will put pressure on the industry’s COF for an extended period after the Fed pauses rate hikes or even decreases short-term rates. The graph below shows the Fed’s balance sheet and projections for the middle of 2025.

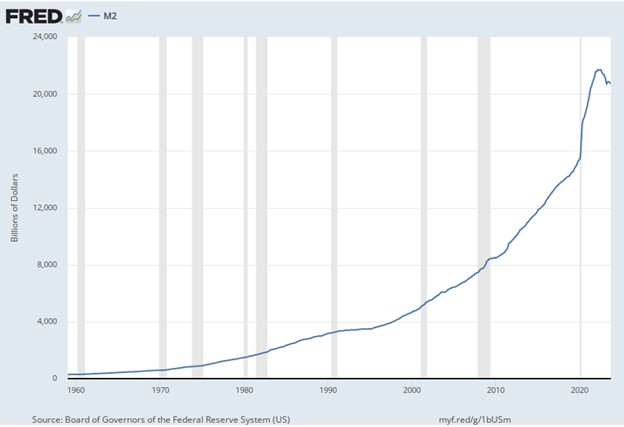

QE is the process of increasing assets and liabilities on the Fed’s balance sheet – the Fed buys securities and creates a liability, and that liability is reserves or cash balances that banks hold at the Fed. QT is the opposite, where the Fed sells securities and drains cash held by banks at the Fed. The current QT is mainly on automatic pilot, causing the M1 and M2 money supply to shrink for the first time since the Fed kept this data (1959). The graph below shows the M2 money supply from 1959 to October this year.

How QT will Impact The Cost of Funding For Banks in 2024

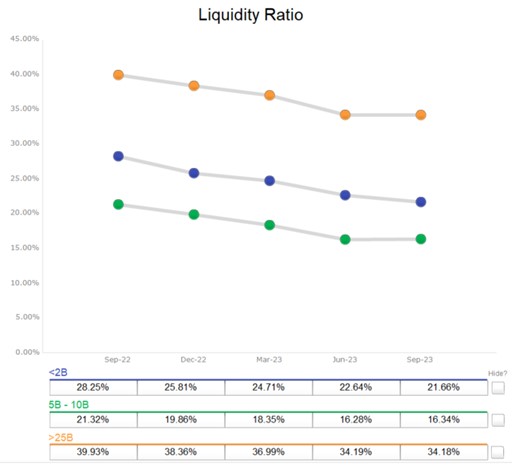

The decrease in the money supply will put continued pressure on banks’ liquidity ratios (as seen in the graph below for three groups of banks, assets under $2B, $5-10B, and over $25B) and increase dependence on non-core deposits, resulting in increased COF as long as the Fed continues to drain its balance sheet.

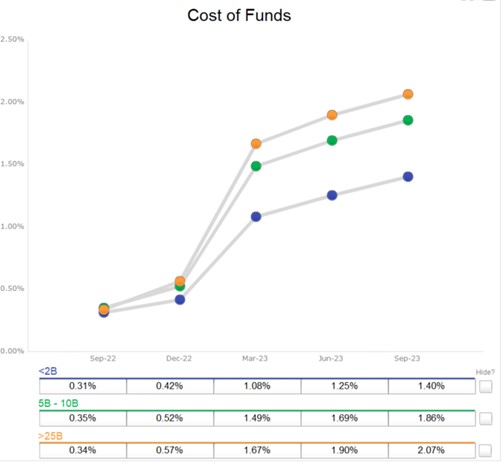

The graph below shows COF for the same three groups of banks. Community banks’ COF increased 18bps in Q3/23 sequentially, while the Fed has been on pause since July. Unfortunately, as the Fed continues to drain liquidity from the market using QT, community banks’ most formidable challenges in managing COF lie ahead.

Conclusion

If the money supply continues to decline (and quantitative tightening continues), banks will experience funding pressures even if the Federal Reserve cuts rates. This will result in a cost of funding in 2024 that is higher than in 2023 for most banks. Community banks can do much to design and execute deposit and asset pricing strategies properly. In an environment where interest rates are steady but COF continues to increase, community banks must find ways to preserve net income, especially fee income. Here is how we see successful community banks outperforming their peers:

- Increase the duration of client relationships. Longer relationships lead to more stable interest-bearing deposits and more non-interest-bearing deposits.

- Increase product engagement and duration. Community banks must connect their products to the client’s balance sheet instead of pieces of frequently bought and sold collateral.

- Prepayment protection on credit facilities can enhance client retention. All too often, banks negotiate this attribute away in the course of competing for and negotiating the loan.

- Owner-occupied commercial real estate (CRE) often affords banks non-interest-bearing or low-interest-bearing accounts. This client segment is highly sought after, partly for this reason. Furthermore, these commercial deposits have positive convexity – increasing balances in rising interest rate environments. To compete for this business, banks must be able to measure risk-adjusted return on equity on a relationship basis.

- Creating competitive products to cross-sell is key to retaining customers. Clients with more than three products at a bank are shown to be longer-term clients and are likelier to be less interest-rate-sensitive depositors. The cross-sell benefit for banks is not just additional revenue but additional stable deposits.

- Finally, all the above pieces are challenging to measure, analyze, and assess. Management’s decision on pricing, strategy, and product offering becomes futile without a commercial loan pricing model that can capture the benefit of deposits, cross-sell opportunities, retention estimates, and lifetime measure of cash flow on an instrument and product level. High-performing banks implement robust pricing models to help them make decisions leading to lower costs, lower beta, and longer-term deposits.