Does Scale in Banking Lead to Profitability?

There are many experts who claim that to achieve profitability, community banks (banks under $10B in assets) must gain scale by acquiring assets. On the surface that seems reasonable but does scale in banking result in better performance for community banks? The answer to that question can be analyzed both empirically and anecdotally, and we believe that the answer is no – for community banks, there is no material relationship between size and performance as measured by return on assets (ROA) or return on equity (ROE). Further, while we see no earnings accretion from community bank mergers, we do see a compelling case for refining the community bank business model to allow scale to occur organically at the operating level.

The Data for Scale in Banking

We can easily measure the correlation between bank performance (ROA or ROE) and bank size, and between efficiency ratio and bank size. If there was a persuasive case to be made for community banks getting bigger to enhance performance, we would see a strong correlation between bank size and ROA, and a strong correlation between bank size and efficiency ratio. The investment banking argument is that gaining size spreads the overhead cost of finance, treasury, compliance, audit, etc., resulting in lower efficiency ratio and higher ROA – unfortunately, the numbers do not support this argument.

For Q2/24, we measured the correlation coefficient between the efficiency ratio and ROA for banks between $100mm and $10Bn in assets, removing the top and bottom 10% of performance outliers. The correlation between the efficiency ratio and ROA is negative 0.74 – one of the highest correlations that we have seen driving performance (next to non-interest income and non-interest expense). This leads us to believe that community banks with a lower efficiency ratio can achieve higher performance. But does size lead to a lower efficiency ratio?

Analyzing the same data set for the correlation between asset size and efficiency ratio, we observe that the correlation is negative 0.11. There appears to be no relationship between community bank asset size and efficiency ratio. Further, the correlation between asset size and ROA is also not meaningful (at negative 0.02). Statistically, within the community bank sector, we conclude that while efficiency ratio may be a large driver of performance, asset size does not relate to either lower efficiency ratio or higher performance.

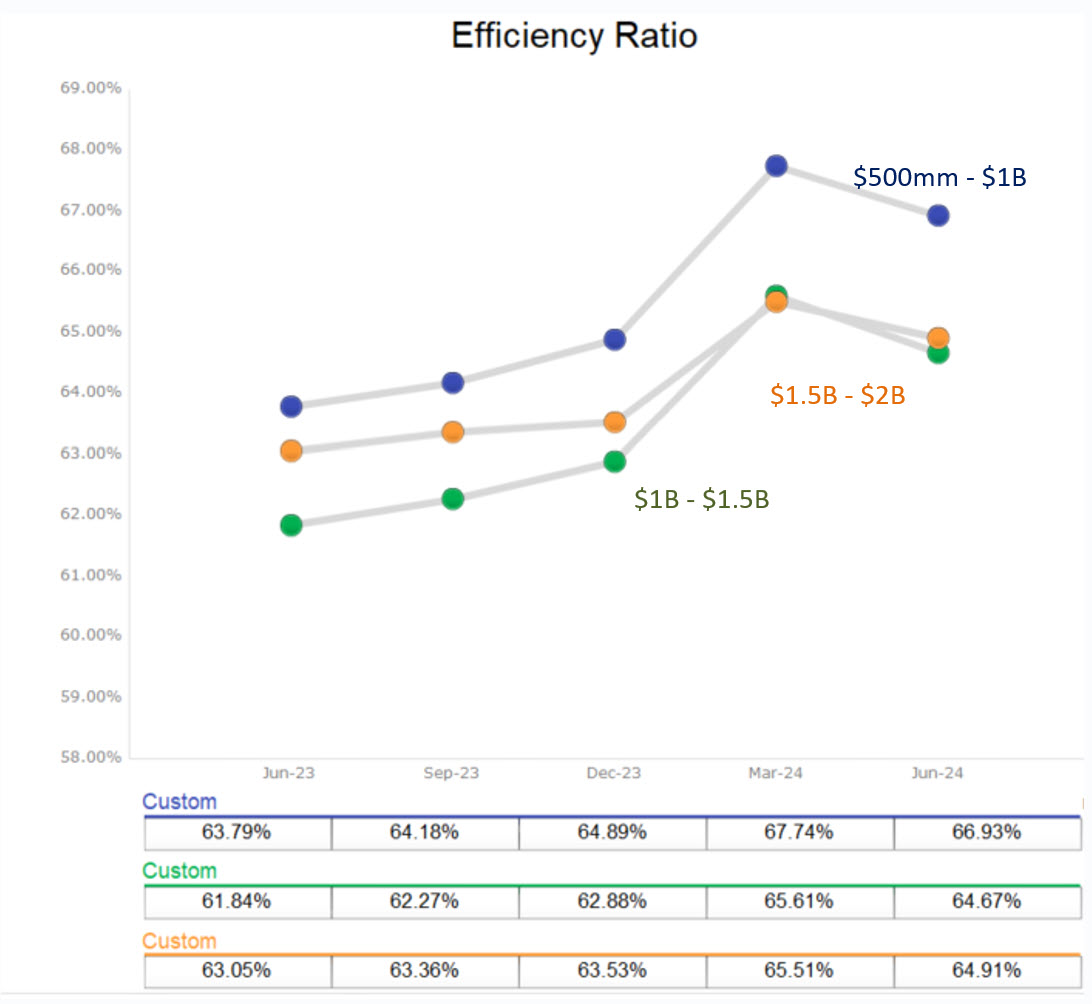

As further evidence, the graph below shows the efficiency ratio between three related asset bands of bank size. Banks in $500mm-$1B, $1Bn-1.5B, and $1.5B-$2B asset bands have remarkably similar efficiency ratios. We also observe similar ROA among the three bands of banks. Therefore, empirical evidence does not show that a bank, for example that is $1B in assets, can improve efficiency ratio or ROA simply by acquiring another institution to reach $2B in assets, because the average performance and efficiency ratio of $1B and $2B banks is similar.

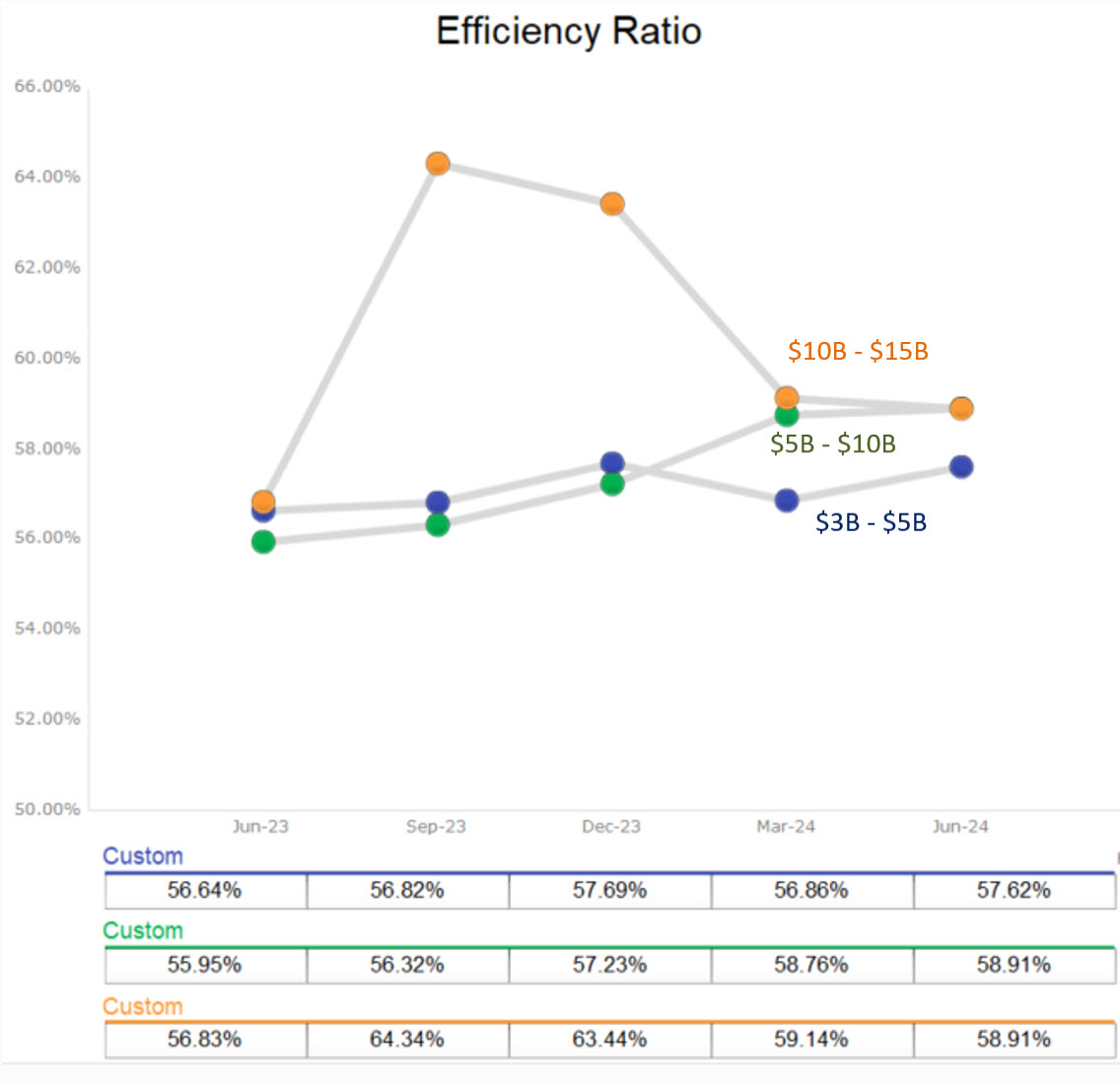

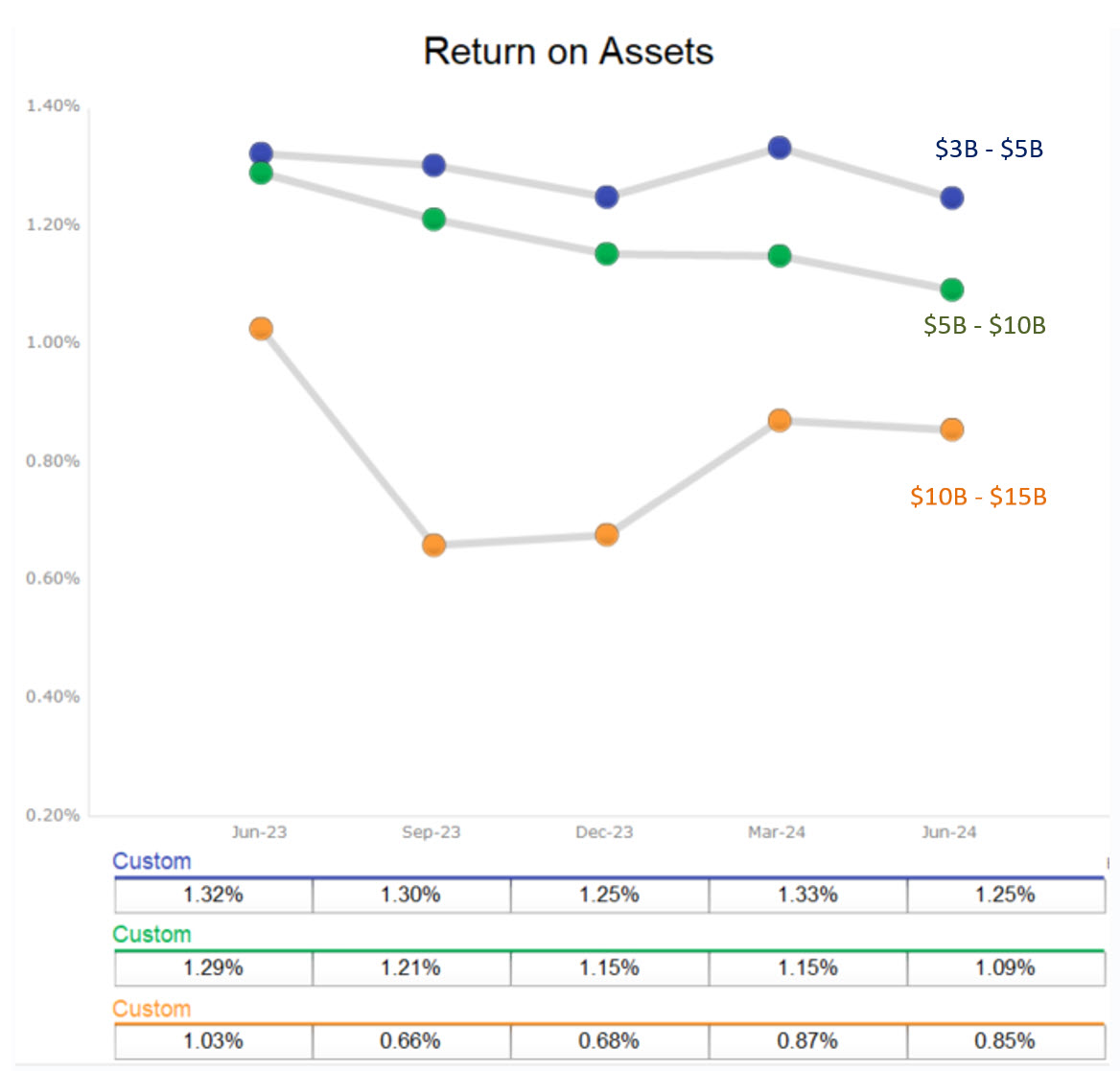

The two graphs below show efficiency ratios and ROA for larger banks. Again, we see no relationship between size and lower efficiency ratio or higher ROA – in fact, we see the opposite in this set of banks.

We postulate that combining two banks with similar set of products and business models does not lead to increased performance for several reasons. While true that some overhead is eliminated, additional overhead is created because of the merger. The merged institution may save some costs in removing some C-suite personnel and board seats, but the larger institution may now need an additional layer of management, or while a CFO is removed, a treasurer or controller is required. Larger banks also need more compliance, audit, and treasury personnel, thus negating much of the perceived cost-savings of a merger. If the basic building blocks of the two merged institutions are the same, we have rarely seen one plus one equal more than two.

Conclusion

Scale in banking may be a myth. There are other reasons to get bigger but profitability is often not one of them.

The M&A business is a large money maker for some investment bankers, however, the efficiency that scale in banking promises are mostly either ephemeral or not realized. There is scale that community banks can, and we argue must, gain on the operating side. This involves re-evaluating their business model and harnessing their front-line employees to achieve efficiency. It is a basic business strategy that most larger banks and some community banks deploy. It involves the basic strategy of understanding and measuring efficiency, profitability and unit costs to achieve optimal performance. The strategy does not require M&A activity, or a new system or new hires. We will describe that strategy in our next publication.