Get Your Performance Report For Your Bank

Now that we have all the 2025 data for the banking industry, we spent some time working with Amberoon, sifting through the data, the trends, and the insights to produce a dashboard and in-depth report on almost every community bank in the U.S. Beyond metrics, this is our first iteration (now in beta form) of scaled intelligence that goes to the heart of bank performance. We are eager to receive your feedback and will provide this analysis at no cost at the end of this article.

Growth Insights

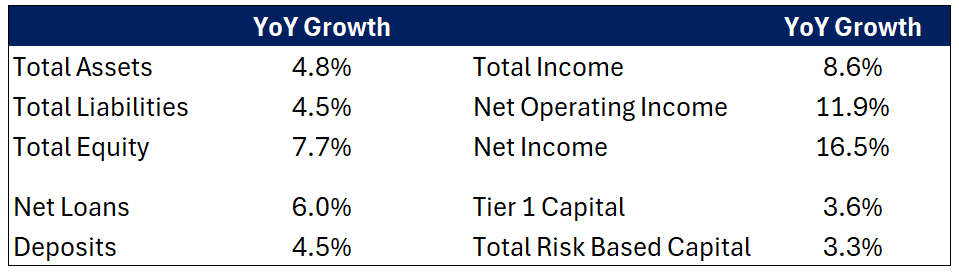

We provided our preliminary insights HERE for community banks with total assets under $20B. For the industry, growth came in a little slower than the numbers below, against a backdrop of forecast 4.2% GDP growth, which should serve as a baseline for banks without regional estimates aligned with their footprints.

The takeaway here is that it was a strong year for banks, as operating leverage improved and they monetized their balance sheets faster than they chose to build capital. This value harvesting isn’t bad, but it’s an admission that banks are choosing not to reinvest earnings and build for the future. Considering we are facing greater M&A opportunities, AI, less regulatory pressure, stablecoin, tokenized deposits, faster payments, and the strong need to drive efficiency below 40%, we believe this strategic positioning is shortsighted. Further, we are closer to the end of a business cycle than at the beginning, so increasing reserves isn’t the worst idea, particularly given higher market volatility.

NIM and Deposits

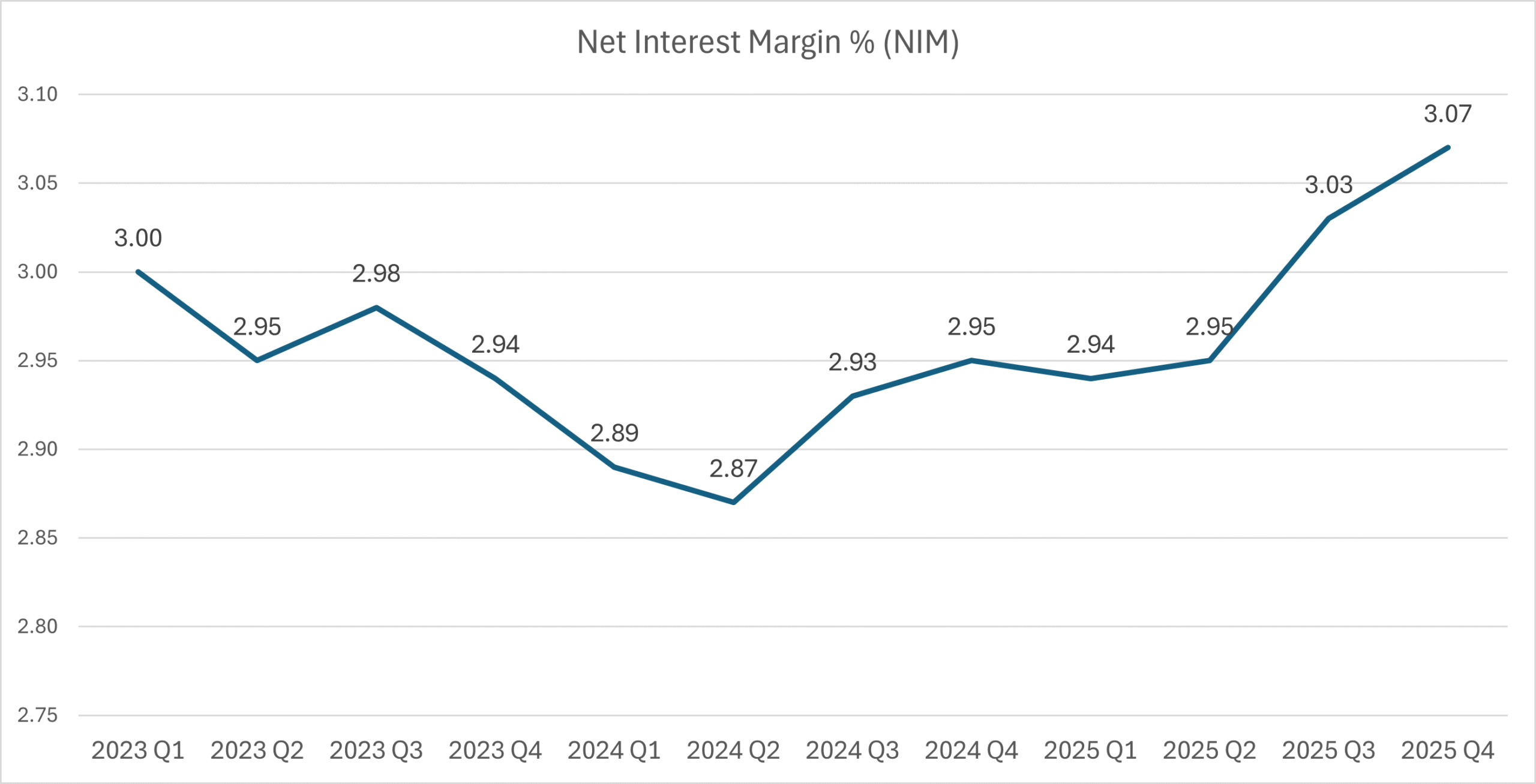

NIM improved four basis points for the quarter and 12 basis points for the year. This is against the backdrop of a 75-basis-point reduction in the Fed Funds target rate. Most banks waited for the Fed to move rates despite lower market rates since 3Q 2024.

You can see a stark difference in deposit tactics here between banks above $100B and banks below. Community banks not only didn’t adjust ahead of the Fed but were also slow to adjust money market and CD rates after the rate cuts, fearing a run-off. Only a quarter of community banks leveraged deposit market data or even bothered to move rates down. Had the other 75% of the market tested or used deposit data, these banks would have found that higher negative sentiment and less deposit competition after July 2025 would have allowed for lower rates than posted. To top it off, the average community bank failed to shorten CD maturities starting in late 2024, so when the rate cuts occurred in 2025, these banks hampered their liability responsiveness.

Larger banks, by comparison, were much more aggressive in managing money market and CD rates. These larger banks were able to extract 71 basis points from their larger CDs over $250,000 and 57 basis points for CDs under $250,000.

2026 is setting up much the same way, with growing negative sentiment and the specter of three rate cuts built into the forward curve. Now is the time to start restructuring your deposit rate to get ahead of Fed rate cuts and be more responsive to market conditions.

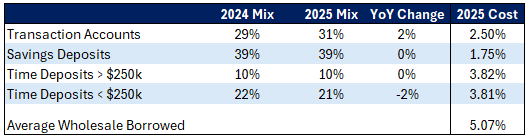

Deposit Mix

When it comes to deposit mix, banks lost about 10% of their core deposits to money market funds, fintechs, and investment alternatives. Lower rates stemmed that flow, and banks likely increased their transaction accounts by 2% over the year.

Core deposits-to-total assets fell slightly to 65.0%, compared to 65.3% for last year. Non-core deposits (above $250k) rose to 9.4% of total assets, up from 8.2% last year. Listing service deposits and brokered deposits also fell.

Loans-to-deposits rose to 66.0% for 2025 from 65.1% for 2024.

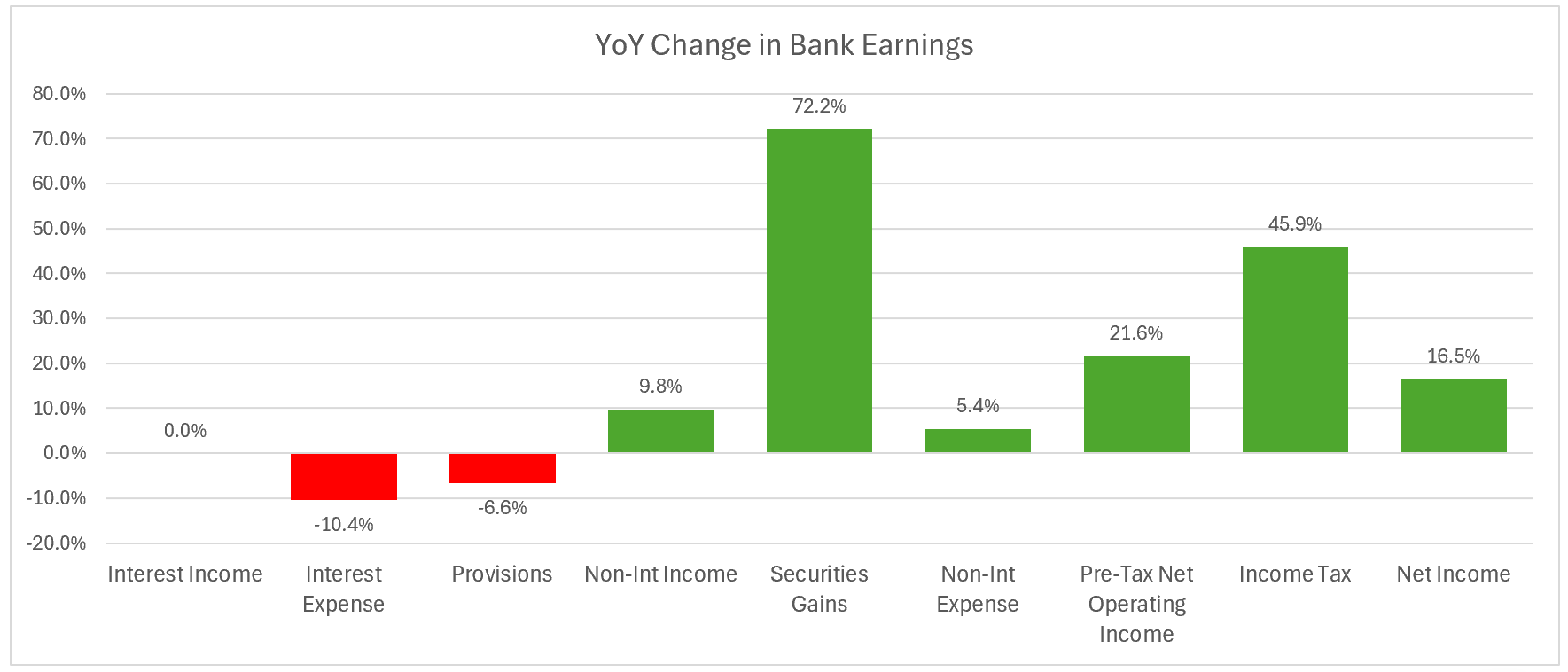

Bank Operations

Pre-provision net revenue increased to 1.92% vs. 1.72% for 2024. Because of these earnings, efficiency ratios dropped to 56.2% compared to 57.8% at the start of last year.

For the industry, return on equity came in at 12%, up from last year’s 11%. Return on assets was the same, at 1.23%, or better than last year’s 1.10%.

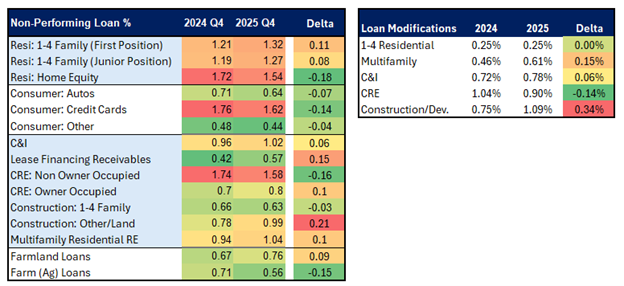

Credit Quality – Caution is Warranted

Credit quality remained about the same in 2025. Non-performing loans-to-total loans improved from 0.98% in 2024 to 0.96% at the end of 2025, non-accruing loans ticked up one basis point to 0.69%, and loans 30-69 days delinquent fell as a percent of loans from 0.63% to 0.60%. Unfortunately, little solace can be gleaned from these numbers, as looking under the hood, we see that loans past 30 days delinquent increased some 12.7% from Q3 to Q4 – a warning sign.

Going more granular, we see credit quality slippage at credit card banks and at banks with total assets under $500mm.

You can see the shift in credit changes by asset class below. Note the deterioration of non-residential construction as a potential harbinger.

Capital and Liquidity

Accumulated other comprehensive income (AOCI) fell to 0.57% of total assets, down from 0.97% of last year due to the fall in rates. Along with better deposit management, now is the time to stay more floating on the asset side to protect against yield curve steepening and the inflationary impact on market rates.

Bank equity capital increased from 10% of total assets to 10.3% in addition to a greater payout for dividends and share repurchases.

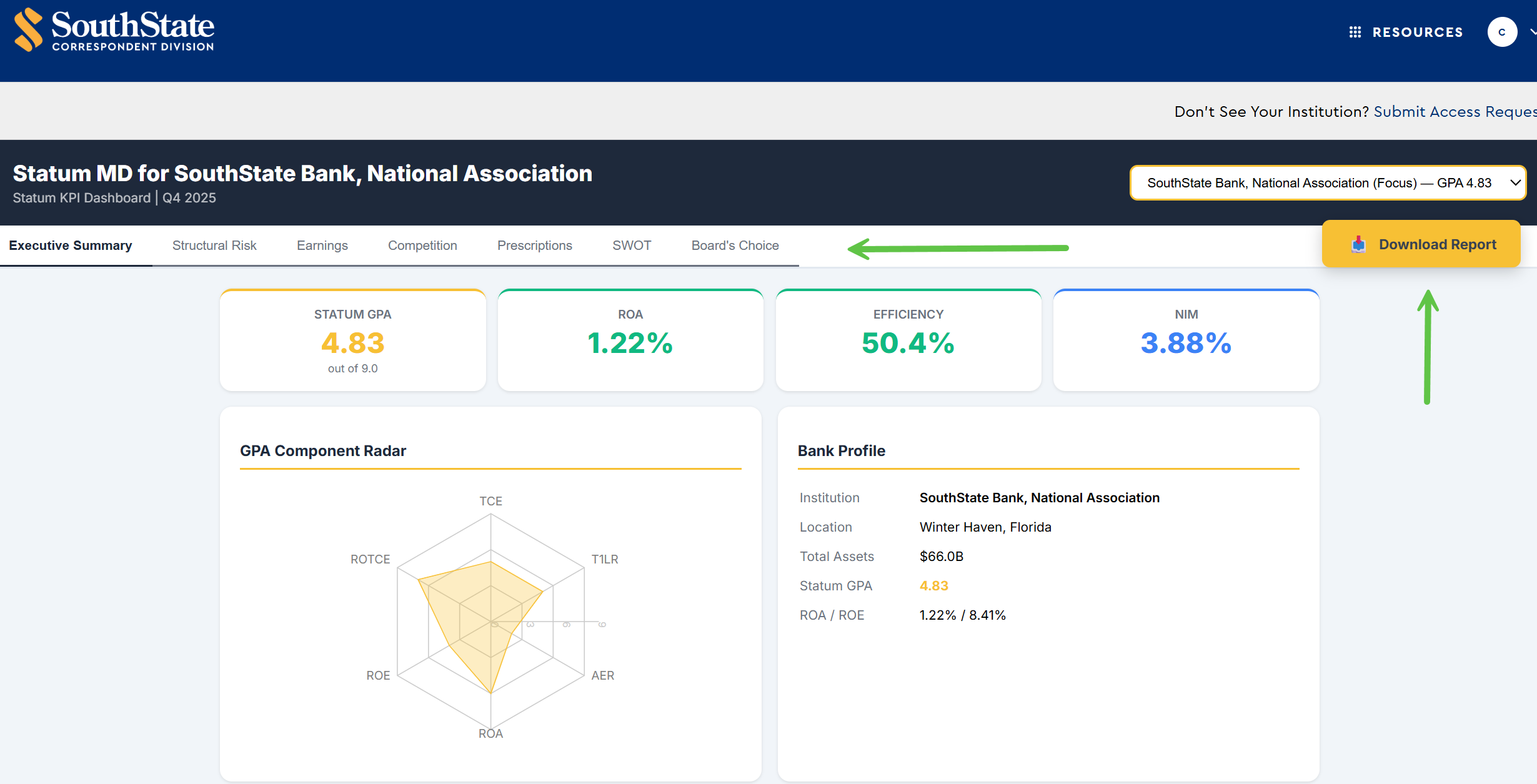

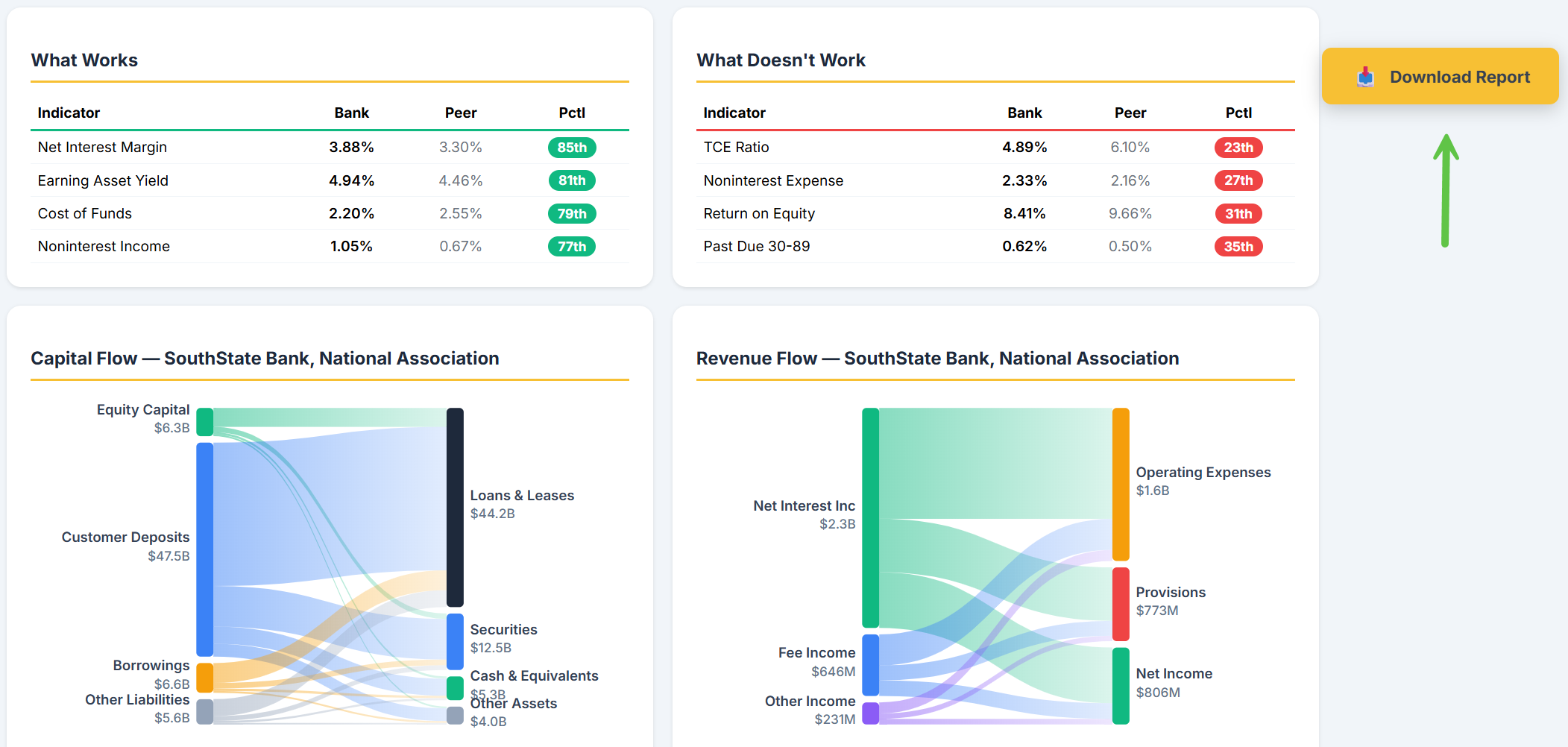

Get Your Bank’s Analysis

We have prepared an analysis (in beta form) of almost every community bank in the industry. We are still refining our accuracy and recommendations but we think you will find the report interesting in its forecasts and insights.

This dashboard and approximately 20 to 30 page report are targeted at the board and executive management and covers the following:

- Executive summary of findings

- Trends compared to the industry peer group

- Structural risk of the bank

- KPI forensics

- Health score

- AI and technology assessment

- Competitive position, landscape, and SWOT analysis

- Recommendations on challenges, opportunities, priorities, and what choices management might consider.

If you already have access to our Resource Center (now called CommandHQ), then click HERE. If not, you will be asked to register with your bank email address, and then you can download your report.