Here is What We Learned at CBA Live

The 2024 annual Consumer Banking Association conference (CBA Live) took place in Washington, D.C., over three days last week. Overarching topics (by word count and sentiment) include the imperative for greater consumer protection, the required more significant effort to fight fraud, rapid innovation (particularly in A.I.), and the need to keep evolving your workforce. We gathered notes from 47 presentations spanning more than 38 hours of education. We talked to close to 100 participants and present the themes and takeaways to keep you up to speed on what is happening in retail banking. If you attended, you now have crisp notes broken down by topic. If you missed CBA Live, then by investing 20 minutes of reading, you can distill three days of top grade banking education into the most critical lessons.

CBA Live Review

If you are on the retail side of the bank, this is one of the better conferences of the year to attend. This year, close to 1,700 were in attendence. The diversity of topics, the inclusion of bankers in most of the panels, the lower levels of product sales, and one of the best mixes of large and small banks make this conference a must for retail bankers. While other retail conferences do a better job in certain areas—branch, compliance, innovation—the CBA does an excellent job of providing a landscape of trending topics.

Below are the major themes and takeaways in order of our perceived impact on bank stakeholders.

Deposit Management

While deposit discussions were less popular based on the number of presentations (two), deposit management is likely an effort that has the largest direct impact on the bottom line. This is particularly true in an environment when most banks counted on margin relief by April due to expected rate cuts that have yet to materialize.

Retail deposit forecasting has become increasingly challenging, with significant fluctuations in total retail deposit growth and direct bank growth, making predictions less straightforward than in the past.

Andrew Frisbie of Curinos highlighted some critical takeaways:

- CD Maturities: The average bank has about 9% of its Certificate of Deposit (CD) balances coming due each month. CDs with higher annual percentage yields (APYs) above 4% are expected to constitute a large portion of all maturing balances in 2024 (~81%). Banks can expect to lose about 15% of these deposits to other banks due to attrition. Proactive management is critical to understanding the profitability of each customer with the CD coming due, the deposit sensitivities, and the maximum rate the bank is willing to pay. Those CD holders who stay will do so because of brand, loyalty, convenience, or rate. The trick is to know which one drives the choice.

- Checking Runoff: Checking continues to suffer runoff in the industry, with high-balance checking running off the most. Low balance checking has runoff at a near-term record pace due to inflation.

The Economic Outlook & Credit

Interestingly, CBA Live had three economic presentations – each with a different outlook. They ranged from the ever-popular Mark Zandi of Moody’s discussion of what amounted to the current market consensus outlook. Joseph Mayans of Experian was more optimistic than the market, while the NFIB Research Center view presented by Bill Dunkelberg was more dour than the other two.

The consensus was that the U.S. economy continues to outperform recession expectations, supported by solid consumer spending and a robust labor market. However, challenges like potential inflationary pressures and credit market stress warrant caution.

Here are some essential takeaways from the economic and credit-related presentations:

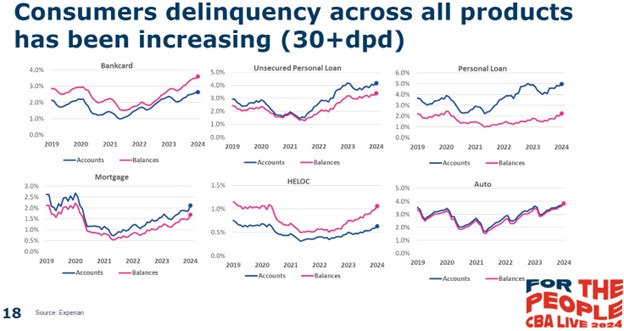

- Consumer Financial Health: Although overall debt loads are low, there is a growing stress among consumers with less than prime credit scores, highlighting potential areas of concern in consumer finance. Consumer delinquencies across all products are increasing (below). 60-day delinquencies are now rising past recession levels.

- Default Management: Carrie McQuerrey-Funk (U.S. Head of Collections & Recovery at DLL) and Michael Orefice (CGI) discussed the deepening financial strain among consumers due to cash tightening (inflation impact) and higher debt levels. Banks were urged to use financial data in collections for early detection. That is, banks need a strategy to have a more comprehensive view of the customer beyond credit score. Banks should have models that focus on customer data collected by the bank and then translate that into the risk by loan origination year (vintage). Banks should consider providing budgeting tools to not only help the consumer plan their future but to gain access to verified income and expense data. Banks can use this data to then help with default management decisions.

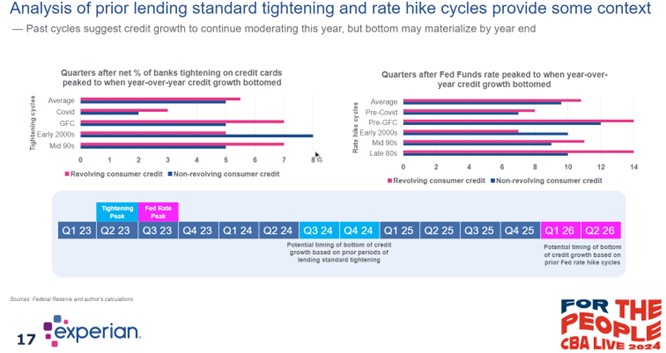

- Credit Market Outlook: Delinquencies have risen above pre-pandemic levels for most products, with certain segments of consumers showing increased stress, possibly impacting lending standards and credit growth. Given past cycles, the bottom of the credit cycle could be in Q4 of this year, with banks feeling the full impact by Q1 2026.

A.I. Is Everywhere – Its Use and Regulation

It has been more than a year since generative A.I. has caught bankers’ attention. However, this was the first conference they we attended where A.I. was mentioned in a majority (about 55%) of the presentations. CBA Live presentations ranged from a general overview of A.I. and how it will change bankers’/consumers’ lives, to a heavy dose of how banks should think about a regulatory framework. Several presentations implied that generative A.I. is on the precipice of altering the current banking business model. The thought provoking concept at the conference was the debate over how banks will manage customers that are essentially A.I. agents or how to manage customers that are heavily influenced by A.I. As such, banks may need to shift their marketing, technology and customer service approach. Here are other key insights:

- Integration of Advanced Technologies: The application of A.I. in credit access and the potential for modernizing audits suggest a trend towards leveraging technology not just for efficiency but also for achieving strategic objectives like financial inclusion and risk management.

- Fraud: Just like generative A.I. makes bankers experts in new fields, it also does the same for criminals. “Do-it-yourself” synthetic I.D. creation is on the rise, as is using gen A.I. to assist in social engineered scams.

- Audit: Automating the audit process through gen A.I. was a popular initiative at large banks to gain accuracy and productivity.

- Discriminatory A.I. Models: Nicholas Schmidt (CTO SolasAI, AI Practice Leader BLDS) and Eric Sublett (Partner Relman Colfax) discussed the importance of having fairness tests and documented explainability in any AI-assisted model that impacts adverse action, product selection, or pricing. Regulators are closely watching the use of gen A.I. for potential inaccuracies, ineffective assistance, biases, and consumer rights issues. There was an interesting discussion around these points on new methodologies like changing variables, regularizing for fairness, and adversarial de-biasing that can help offset some of this regulatory risk.

- Consumer-Facing A.I.: Stiene Riemer and Barric Reed of the Boston Consulting Group (BCG) contended that most banks are not ready to harness gen A.I. fully. While the technology opens new revenue streams for banks, increases banker productivity, and shifts the bank business model, there are blind spots in how banks are handling responsible practices, and ethical considerations of A.I.

- Credit A.I. Models: Mike Agarwal (Upstart) discussed how traditional credit models often fail to differentiate between risky and creditworthy borrowers. A.I. models are significantly more predictive at separating risk. A.I. models approve a higher percentage of minority and low-to-moderate-income borrowers, offering them lower rates of interest. The risk here is obviously the importance of a fair lending process involving legal, compliance, and machine learning integrity teams.

Small and Medium-Sized Businesses (SMB) and Payments

How to create a better SMB experience was a hot topic at CBA Live this year. It seemed more banks are getting serious about creating a distinct experience for their small business customers instead of treating them like retail or pure commercial customers. Shruti Patel (EVP Business Banking at U.S. Bank) and Matt Wilcox (Fiserv) presented the $70B revenue potential for banks across five small business profit pools: card, fee income, merchant acceptance, lending, and deposits. There are 33.2 million small businesses in the U.S., and 55% of them bank at the top four largest banks, while 13% of them bank at community banks (the rest bank with regional banks or credit unions). From an Aite-Novarica study last year, 65% of small businesses are finding financial products outside of banking (there are 140 fintechs that focus on small business), 81% consider payments important, 65% believe instant payments are essential, and 19% will consider switching financial institutions in the next two years.

- Fintech Payment Service Growth: PayPal used to have a 17% market share in 2020 and now has 32% in SMB payments. Inuit went from 6% to 23% over the same time frame. Banks, however, dropped from 64% to 45%.

- Not Consumers: In the same study cited above, 66% of SMBs think it is “important” or “very important” to have small business-tailored solutions from banks, not repurposed consumer products.

- Payment Hub: The financial institutions that made up the Digital Banking Advisory Forum voted on the key desired features and almost 60% of them wanted a payment hub for their bank customers. The next closest requested feature was business self-enrollment at 18% followed by a SMB dashboard at 12% and open banking at 12%.

- Needed Products: SMBs cited cash flow forecasting reports, payment reminders, expense reporting, instant payments, the ability to create invoices, more efficient bill pay, links to payroll, integration into accounting software, the ability to manage account/payment permissions, the ability to pay invoices with card or bank account, and links to social media as functionality that they are missing from community banks.

Compliance, Audit & Risk Management

Vendor management, banking-as-service, and general risk management were the most popular topics at the conference. Most CBA Live presentations revolved around the increasing complexity of risk management frameworks and compliance obligations, spurred by both traditional financial risks and emerging digital threats, alongside heightened regulatory expectations for enterprise risk management and third-party oversight.

- CFPB on Credit Cards: CFPB Director, Rohit Chopra was one of the keynote speakers at CBA Live and used his time to focus on consumer credit cards and its $130B of interest and $25B in fees the cards generate. The Director discussed the current CFPB’s focus in making credit card programs more competitive, less complex and more transparent. Interestingly, the Director presented data that showed community banks have been offering lower rates than the top 25 card issuers. Unfortunately, illegal marketing practices have been steering consumers towards a select group of major card issuers while making it difficult for consumers to compare cards. In addition, the CFPB discussed excessive late fees, the need for better reporting by banks, enhanced credit portability and the desire for more consumer education. If you are a bank and have a card program, Director Chopra’s complete transcripts is worth a read (HERE).

- Vendor/Partner Management: Michelle Macartney (Bridgeforce LLC) and Chuck Ely (USAA) discussed how regulatory pressure is stronger than ever on banks to manage third parties. While many banks do take a risk-based approach, the current trend does not appreciate the risk enough. Common issues this year include outdated contracts, difficulty in replacing significant relationships, emphasizing the need for better relationship planning (better adaptability), and having pre-planned strategic exit strategies.

- Enhanced Focus on Diversity and Inclusion: Initiatives like the Appraiser Diversity Initiative signal a growing commitment by banks to diversity, recognizing its value in fostering a more equitable and inclusive financial ecosystem.

- Regulatory Attention on BaaS: Susan Seaman (Husch Blackwell LLP/Partner), Janet Hale (FTI Consulting/Senior Managing Director), Jessica Dury (The Bancorp Bank N.A./Director Lending Counsel) highlighted the continued increased scrutiny from regulators on fintech partnerships and how banks still are not understanding their oversight limitations, risk of integrating operations, compliance/fair lending issues, and data protection.

- Remediation: Anthony Gibbs (Protiviti) and Robert Maddox (Bradley) highlighted the increased regulatory focus on how banks handle the remediation processes around inaccurate disclosures, fees, practices, and product suitability issues. The “gap” between regulatory expectations and bank practices, as detailed in CFPB Bulletin 2020-01, means that banks need to think about around identifying root causes and doing a better job at preventing recurrence. Many banks have the quality of talent, but not the capacity in talent to assist in irradicating cases.

- Credit Reporting: Deanita McCall (Bank of America), Sara Laskoski (Guidehouse), and Christian Hancock (Bradley) discussed the critical aspects of credit reporting and disputes, including the importance of , the Fair Credit Reporting Act’s role, and the primary drivers of complaints. Credit reporting complaints have reached historic highs, primarily driven by incorrect information and dispute process issues. Recent enforcement examples highlight issues with furnishing inaccurate information and the need for better bank investigation of disputes. The banking industry will likely see amendments to Reg V (Fair Credit Reporting), including expanded definitions and new requirements, which will affect how consumer

- Elevating Enterprise Risk Management & Risk Culture: Damian Plioplys and Hernando Garcia of KPMG explored the current regulatory shift towards heightened accountability and governance in risk management. One underappreciated key here is to demonstrate a bank culture/values and compliance behavior in line with the quantification of residual risks. They stressed the importance of sustainable processes, effective risk coverage, and dynamic management of risk through business transformations. They underscored the importance of self-identification, timely mitigation, reporting/internal discussion consistency, and robust risk assessment processes.

- Audit: Bankers are learning to have a better appreciation for the role of modernizing audits. Better tools will help in identifying and mitigating risks more effectively, especially in areas like cyber security and data privacy. Bankers should adopt a continuous improvement mindset for audit processes, leveraging feedback and data analytics to refine audit strategies over time.

Fraud

Fraud was the most talked about aspect of banking at CBA Live this year. The general feeling was that banks are still a step behind the criminals.

- Rising Fraud: Melanie Jordan (Zions Bancorporation), Shantelle Johnson (Arvest Bank), and Kathleen Peters (Experian) highlighted how fraud is increasing despite the best efforts of banks to arrest this trend. Banks are still struggling to manage the digital banking experience and seamless customer service with security, privacy, and fraud protection. One challenge is that commercial customers are not fully grasping the risk of fraud. Account push or wire transfer payment fraud, transactional payment fraud, and identity theft are among the most encountered fraud events. Successful banks are countering these trends with physical and behavioral biometrics and secure elements in mobile wallets. Enhanced security measures and identity verification will improve trust and reduce fraud in the future.

- Payment Fraud: Chris Como (FIS) detailed how a large percentage of U.S. consumers (about 41%) are hesitant to use mobile payment methods frequently due to security concerns. 8% of consumers have been payment fraud victims. Fraud alerts have been effective in limiting fraud at banks, with 34% of the fraud alerts being accurate. 83% of consumers feel more secure if fraud alerts are offered. 24% of small businesses hope to offer a biometric secured payment option in the next six months.

Human Capital

Talent management was a significant theme at CBA Live. There was recognition of the critical role workforce management plays as a key driver of banking success. The trend is to focus on emotional intelligence (E.Q.) and the better alignment of staff resources with customer demand as banks adapt to digital and gen A.I.-enabled channels. Servant leadership was also a hot topic, as was how it plays a role in navigating organizational change, fostering a culture of innovation, and enhancing employee engagement in an era of digital transformation.

- E.Q.: Chris Kay, Jeremy Zeman, and Todd Lingle (Caldwell) discuss how a high E.Q. is critical for understanding and motivating people. A high E.Q. is central for a servant leader and allows them to better focus on others’ development, have a keen sense of community, and build long-term organizational health. Successful banks are now benchmarking servant leadership effectiveness within organizations.

- Collaboration: Marjorie Old, the Director of talent at FICO, discussed a 2017 Harvard Business School study that showed collaboration fails due to: institutional silos 67% of the time, failed vision from leadership 32% of the time, and senior managers not wanting to give up control another 32% of the time. Successful collaborators are described as not being threatened by conflict, open to feedback, intellectually humble, clear, kind, and taking responsibility for themselves. Bankers need to be more curious than defensive about their positions and departments while sharing their intent, actively listening, and helping others to share their thoughts. Bankers were encouraged to read Crucial Conversations (Patterson, Grenny, McMillan, Switzler)(an SSB favorite) and Radical Collaboration (James Tamm).

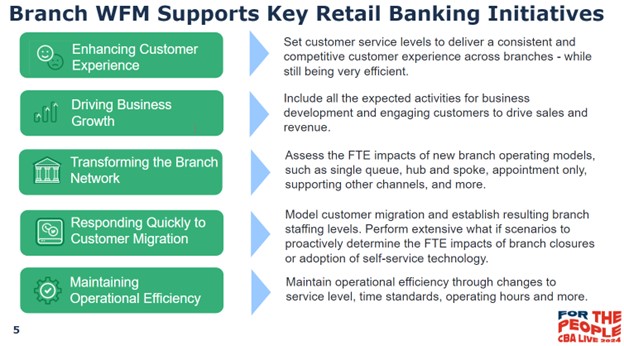

- Branch Workforce Management (WFM): Kimberly Cole (SVP and Director of Retail Operations, Fifth Third Bank), Rebecca Judy (SVP and Director of Distribution Operations, PNC Bank), and Jackie Hudson (General Manager Branch Workforce Solutions, Verint) discussed strategies for successful workforce management in retail banking, particularly within branch operations. These strategies include defining expected customer service levels, providing the appropriate capacity to achieve sales goals, making use of a customer-facing appointment scheduler, supporting work-from-home FTEs, sharing resources across the branch footprint, and creating a more flexible workforce.

CRA Regulation

Three presentations and two material keynote mentions revolved around the modernized Community Reinvestment Act (CRA) and the need for banks to modernize CRA audit approaches. CRA themes at CBA Live reflect how banks must continue to take a proactive stance toward ensuring compliance while also seizing opportunities for strategic CRA growth within the new regulatory framework.

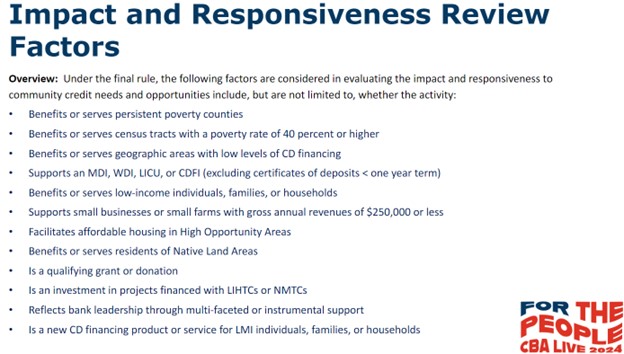

- New Rule: Vonda Eanes (Office of the Comptroller of the Currency/Director Fair Lending & CRA Policy), Pamela Freeman (Federal Deposit Insurance Corporation/CRA Program Manager), and Lisa Robinson (Board of Governors of the Federal Reserve System/Lead Supervisory Policy Analyst) discussed the new final rule (since paused last week by a Federal Judge) with its introduction of 11 community development (CD) categories that provides better clarity on qualifying activities. The final rule offers greater certainty on eligible activities and recognizes those responsive to community needs, especially for low-to-moderate-income individuals and small businesses. Regulatory agencies will make it easier for bank compliance to include initiatives around maintaining a public list of illustrative qualified CD activities and have a process whereby banks can request confirmation of an activity’s eligibility.

- CRA Storytelling: Nathalia Artus (Atlantic Union Bank), Stephanie Cameron (KeyBank), Roddell McCullough (First Financial Bank), and Anthony Weekly (Truist) argued for the notion that part of banks’ CRA issue lies not in their activities but in their storytelling of their activities. They emphasize the importance of effectively communicating a bank’s community reinvestment activities and leveraging stories to tell for regulatory compliance. Digital platforms now make it easier than ever to include leveraging gen AI. Senior executives need to play more of a role in shaping and communicating the CRA story.

The Imparitive of Innovation

The need for banks to innovate was a common recurring theme at CBA Live. Banks are just beginning to gain speed and make progress against fintechs as many institutions are better at meeting the shifting paradigms of customer service and engagement driven by digital platforms and social media. Banks are doing better with personalizing the customer journey and leveraging data for deeper insights into customer needs.

- Collection and Recoveries: John Sanders (Bridgeforce), Lynne Labrador (Telrock Systems), Sean Clark (Provana), and Andrea Ranieri (Symend) showed how automation can help in collections and recoveries, emphasizing modernization efforts and consumer trends towards self-service. Enhancing automation and self-service efforts is critical now, given the looming potential for higher defaults.

- Home Equity: Banks are being disrupted by a rash of fintechs (Figure, Spring EQ, Hitch, Better, Rocket Mortgage, and Loan Depot) that have end-to-end digital processing, go up to 95% loan-to-value and can fund in as little as seven days (21-day average). Most origination fees are around 5%. Banks are also facing competition from fintechs (Unison, Point, Hometap, and Unlock) These advances are not debt, so there are no interest rates or monthly payments.

- Fintech Partnerships: Elizabeth Garber (FIS Fintech Accelerator) focused on the importance of innovation in consumer banking through partnerships with fintech startups to develop enterprise-ready solutions. She suggests partnering with up to 10 fintech startups to pressure test ideas, ensuring solutions are ready for enterprise deployment.

Customer Experience

Several presentations at CBA Live explored the impact of new market entrants, including fintechs and non-banking lenders, on the competitive landscape, stressing the need for traditional institutions to adapt through innovation.

- Small Business Cash Management: Lynetta Steed (Valley National Bank), George Noga (Ignite Sales), Joe Chasteen (Huntington Bank), Mark Valentino (Citizens Bank), John Madrigal (Valley National Bank), and Ken Patrick (Ignite Sales) discussed the growing cash management needs of small businesses, emphasizing the importance of understanding and addressing these needs through banking services. A significant portion of small businesses seek tailored financial advice and literacy programs. The majority of the largest banks have some form of digital guidance for small businesses, underscoring the shift towards digital advisory services.

- Personalization: The discussion on making the shift from volume to value through personalization strategies illustrates a significant trend toward deepening customer relationships and enhancing customer lifetime value. This theme reveals a strategic pivot towards utilizing data and analytics to deliver tailored banking experiences and services. Brandon Larson (EVP Channels) and Sarah Welch (Managing Director Personalization) discussed the rising costs of acquiring new customers, lower retention rates, and the diminishing returns of traditional revenue streams. Banks would be well served to score their prospects and better target their message using personalization.

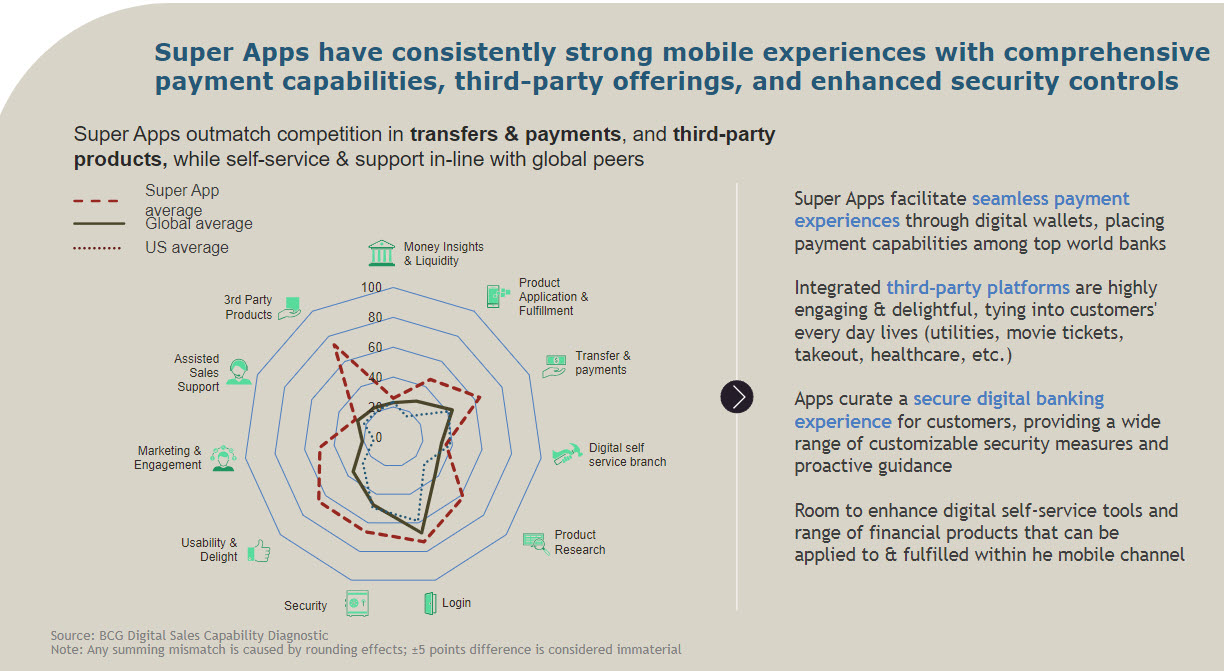

- Journey Orchestration: Ryan Curley and John Thomas of Boston Consulting Group (BCG) and Relay Network, respectively, told how U.S. banks are closing the gap with global leaders in digital banking. Understanding how digital formats affect consumer behavior can inform better customer journey orchestration. The integration of social media insights can enhance customer engagement and service delivery in banking. At present, consumers spend 30x more minutes on social media than their banking app. Banks can better use graphics, video, format, personalization, headlines and workflow to create a more addicitive banking experience.

- Consumer Economics and Digital Transformation: The analysis of customer acquisition costs, digital account opening, and the digital shift in banking services spotlights the economic pressures and opportunities within digital banking. This theme highlights the evolving nature of customer engagement and the critical role of digital platforms in the industry’s future.

Auto Lending

Three CBA Live presentations talked about trends affecting auto dealers and lending, including regulatory environments, the impact of the FTC’s Vehicle Shopping Rule, and the growth of electric vehicles (E.V.s).

- Market Trends: Mark Pregmon (Vice President of Consumer Lending, USAA Federal Savings Bank) and Melinda Zabritski (Head of Automotive Financial Insights, Experian Automotive) presented how new registration volumes are slowly increasing, with fleet registrations reaching their highest volume since 2020. Used vehicle registrations are declining due to low volumes and higher prices.

- Financing Trends: There has been an increase in cash transactions, resulting in 1.2 million fewer financed transactions, signaling a significant shift in how consumers are purchasing vehicles. The average loan rate for new cars was 6.92% in 2023, and for used cars was 11.59%. These higher rates are driving payments and defaults up. Bank loan-to-values (LTV) are 104.8% and 95.2% for used vehicles (Experian data).These LTV levels are more conservative than many non-bank lenders.

- Leasing and Loans: Off-lease volume is expected to decline while captives and credit unions continue to dominate loans. Subprime loan originations have decreased significantly, impacting the auto finance landscape.

- Consumer Credit and Delinquencies: The median credit score for auto finance has steadily increased, but delinquencies across all products are rising, with more accounts rolling into higher delinquency status. This trend is particularly pronounced among Gen Y and Gen Z.

- Repossessions: Overall repossessions are climbing, with a noticeable shift in near-prime repossessions, which have doubled as a percentage of all repo balances since 2019.

- Regulatory Changes: Michael Gilbert (Associated Bank/National Credit Manager), Robert Gage (Hudson Cook LLP/Partner), and Kenneth Rojc (Nisen & Elliot/Managing Partner – Auto Finance Group) discussed the recent Toyota Financial Services consent order highlighting issues with compliance and the importance of adhering to settlement terms. The regulatory environment is becoming more challenging. Recent CFPB efforts are focusing on stopping overcharges on add-on products, miscalculation of refunds, and deceptive marketing practices.

Don’t miss next year’s CBA Live annual conference. It is packed full of education and networking and is one of the premier conferences in our industry.