How Customer Turnover Is Hurting Bank Performance

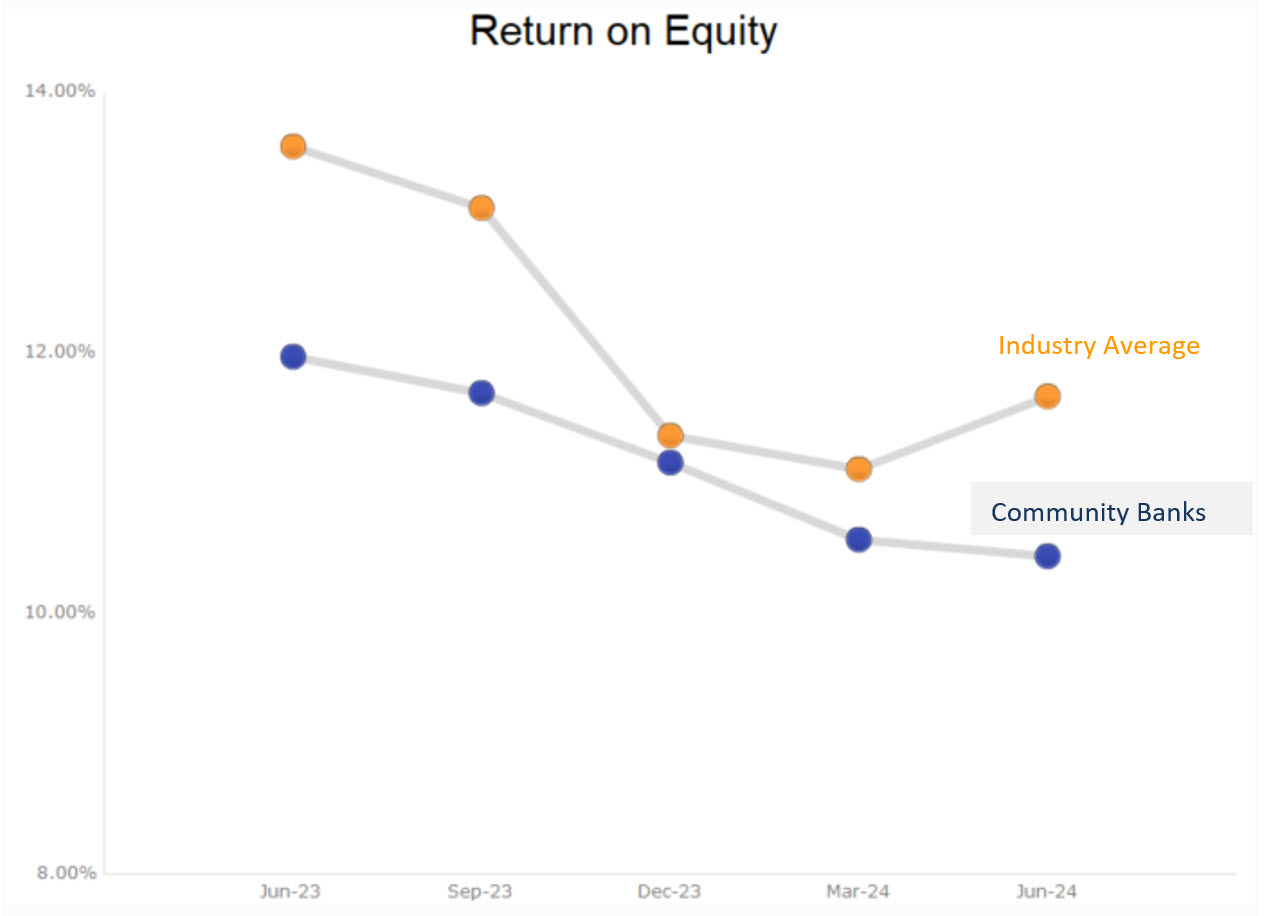

In Q2/24, the average return on equity (ROE) for the entire banking industry increased to 11.67% (from 11.11% in the previous quarter). However, for community banks (under $10B in assets), the ROE declined to 10.44% (from 10.57% in the previous quarter). When we analyze the causes of the decline in ROE for community banks we see one important factor – it is not cost of funding, or asset yield, but rather, we believe that higher efficiency ratio is hurting community bank performance, and we believe that higher customer turnover of larger accounts is on major root cause.

The Data

In Q2/24, the number of FDIC insured community banks declined to 4,104 (a decrease of 27 community banks for the quarter). While more than half of all community banks reported QoQ increase in net income, the ROE for community banks decreased and further diverged from the industry average as shown in the graph below. Additionally, 6.7% of all community banks had negative ROE for the quarter.

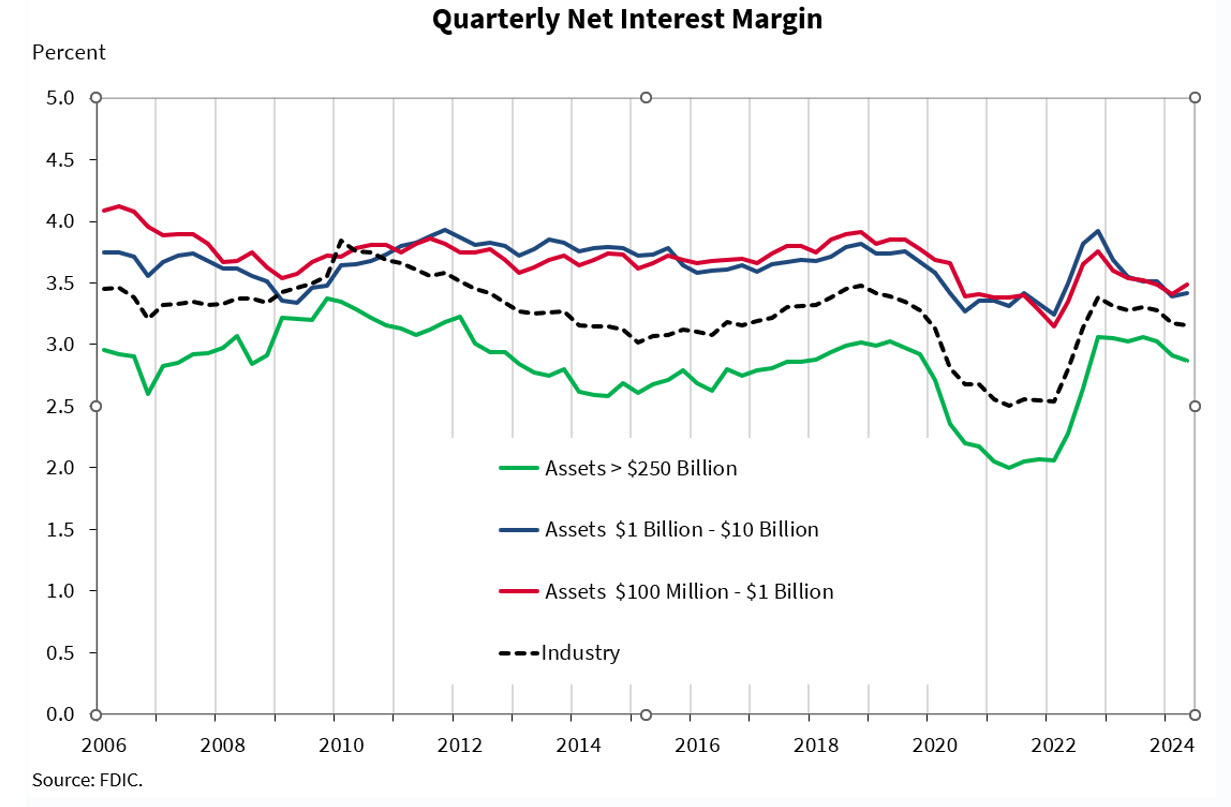

To explain the driver of community bank performance as measured by ROE, we can look at contributors to change in income. In Q2/24 NIM at community bank increased 7bps to 3.30% (above industry average of 3.16%). While the industry is witnessing a decrease in net interest margin (NIM), community banks are demonstrating an increase (as shown in the graph below). The decline in community bank performance is not driven directly by NIM pressure.

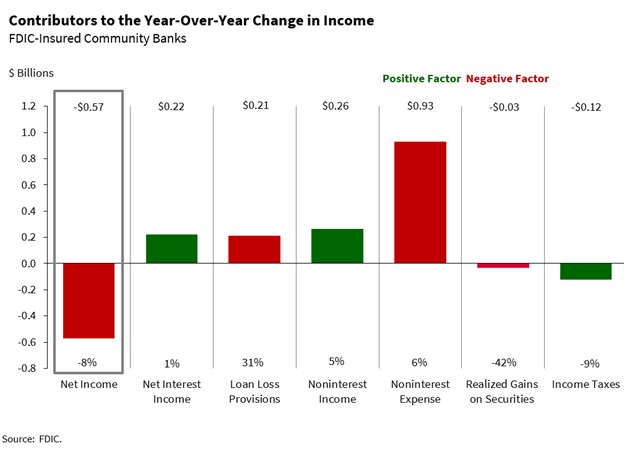

Instead, what is driving pressure on community bank ROE is a high efficiency ratio. In Q2/24 the average industry efficiency ratio was 57.65%, but for community banks that ratio was 63.82%. That ratio has increased by almost 2.5% in the last year for community banks. Analyzing this ratio further, we glean that community banks pay less in salaries, and premises and equipment. The issue is, in large part, that non-interest expense at community banks is still eroding income, and we believe this is because community banks’ average customer relationship term is too short. The graph below shows the contributors to year-over-year change in income for community banks (note the significant increase in noninterest expense).

The Solution for Lowering Customer Turnover

We believe that average customer relationship term is one of the biggest drivers of efficiency ratios, and the reason for this is that longer relationships may lead to the following results:

- Additional loan balances through business growth.

- Additional deposit balances as a cross-sell opportunity.

- Greater size of wallet – which leads to higher switching costs and more fee income.

- More efficient underwriting.

- Greater trusted advisory and greater pricing power for the bank.

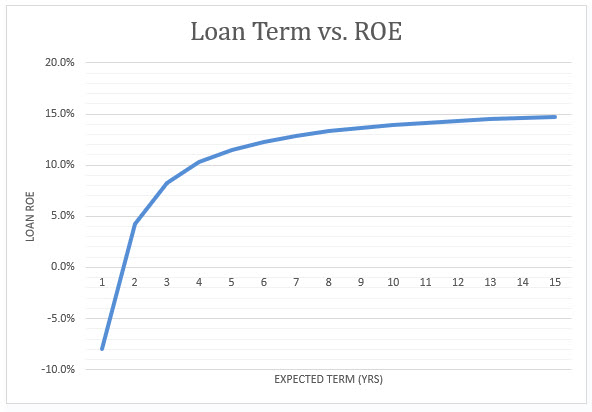

- Higher ROE – the graph below shows the same loan adjusted for expected repayment term. This graph does not incorporate any of the factors above, it simply demonstrates the relationship between term and ROE for the same credit. As term increases, banks recognize greater income over time as the cost to source, underwrite, book and fund a loan is spread over a greater period.

Many community banks simply measure the loan yield when making a loan pricing decision, and do not consider the impact of expected relationship term. This practice may increase NIM but not bank performance. Catering to short term commitments creates higher churn, higher efficiency ratio, and in turn lower profitability as measured by ROE.

While community banks cannot force customers into longer commitments than the client may need, banks can choose clients with longer relationship desires. We see many opportunities for community banks to expand relationships with clients that have stable, long-term hold assets that they would like to finance with longer term credit facilities. Those credit facilities are priced more competitively in the market, but even with the lower yield they can lead to higher bank ROE.

Conclusion

We believe that many community banks would benefit from a pricing model that can identify the relationship between customer cost, customer relationship term and ROE (such as Loan Command). With the same overhead (employees, and premises and equipment) community banks can generate higher return by lowering customer turnover, extending relationships and increasing customer lifetime value. As community banks pride themselves on relationship building, focusing on long-term, stable credit facilities may be beneficial to ROE, even if it hurts NIM.