We Can Improve Your ROA – Test Us

The banking industry’s average return on assets (ROA) for Q1/25 was 1.16% – an improvement from the prior quarter and the one before that. Community banks between $100mm and $10Bn in assets recognized 1.13% ROA. Community banks are facing several primary challenges. If your community bank management team aims to improve your bank’s financial performance, then we might have an interesting proposition for you.

Improve Your ROA – Understand Where You Are

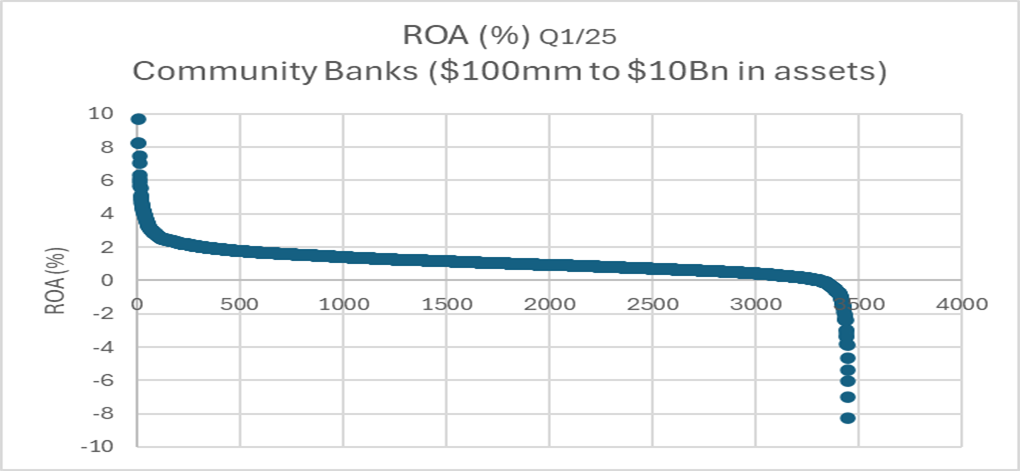

The graph below plots ROA for all community banks between $100mm and $10Bn in assets. While the average ROA was 1.13% (for 3,452 banks), there were 1,618 banks (47% of all community banks) below 1% ROA, 550 banks (16% of all community banks) below 0.50% ROA, and 4% of all community banks had negative ROA.

Improve Your ROA – The Challenge for Community Banks

Community banks, by virtue of their size and community concentration will face unique industry challenges. By most projections, GDP is expected to grow more slowly in 2025 and 2026. This will impact community banks more sharply if we witness a downturn in agriculture, manufacturing, or real estate. There are other challenges facing community banks as follows:

- Commercial real estate and multifamily delinquencies have increased over the past year and past due and nonaccruals rate in CRE is at its highest level since 2014.

- While the average net interest margin (NIM) for the industry in Q1 2025 was 3.25%, community banks managed a higher 3.46%. However, this margin advantage is under threat with continued battle for liquidity and loan yield pressures.

- Regulatory relief for national banks will put additional competitive pressures on community bank’s margin and income.

- National and regional banks are investing billions annually in digital transformation. From AI-based credit scoring to real-time payments and omnichannel customer service. Community banks cannot absorb the cost of this innovation on their own.

- Some community banks have not developed the infrastructure and tools to measure performance on an instrument, geography, unit, or branch level. This may create inefficiencies and misallocation of capital.

Our Proposition – The Summer Performance Series – Book Now

We are motivated to help community banks succeed and thrive. If your bank management team would like to reach 1% ROA (or higher), we are offering virtual and in-person meetings to analyze your bank, and provide actionable recommendations to your senior management team to reach your earnings goal.

We are offering approximately 30 banks an opportunity to participate in our Summer Performance Series (a no-charge streamlined community bank analysis). We aim to improve your banks ROA by at least 25 to 50 basis points to reach 1.00%. We will start with a questionnaire and public information analysis. We will then conduct a short exploratory interview with senior management. After collecting information and analyzing your bank’s performance, management expertise, competitive landscape and your differentiators, we will present our actionable recommendations to management. We will not make M&A recommendations, nor will we make recommendations that require personnel changes or RIFs. We will also not pitch specific products or services (although we can rank or make recommendations on best of breed solutions).

Our recommendations will encompass some of the following fields:

- Core infrastructure.

- Talent investment – either existing employees or new hires for deposit gathering, lending function, tech knowledge or advisory skills.

- Deposit pricing and structuring.

- Treasury management marketing.

- Loan structure and pricing.

- Adopting risk management, risk adjusted earning measuring tools, funds transfer pricing, and activity-based costing.

- Expanding non-interest revenue streams and businesses.

- AI development and infrastructure build.

- Efficiency management.

- General process and workflow analysis.

If your community bank is willing to evolve, and measure specific product value creation, then our no-charge consulting proposition may interest you. We analyze hundreds of banks each year, formally and informally. In this Bank Sumer Performance Series our aim is to keep the community banking industry vibrant, relevant and competitive. While we often sell products or provide a service for a fee, we would like to give back to the industry by providing a fast-track analysis to a few dozen banks where we can make a difference in their financial performance (and continued independence).