How Loan Compensation Can Lead to Underperformance

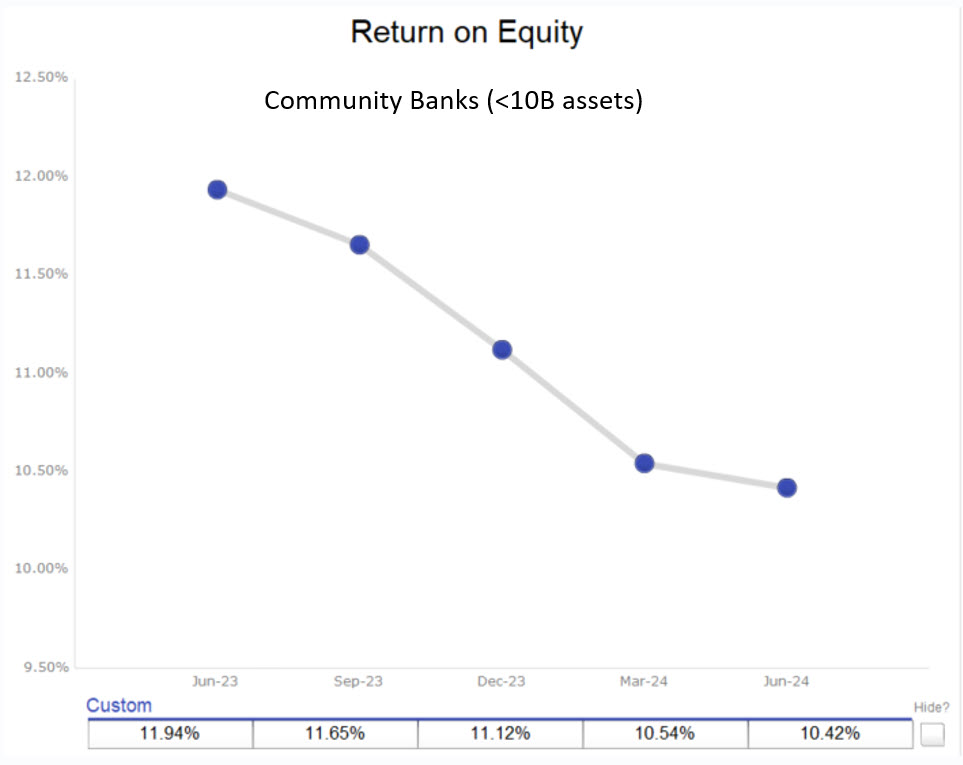

Charlie Munger said, “Show me the incentive and I’ll show you the outcome.” That is exactly what is happening in the community bank industry. Unfortunately, bank managers often give their lenders misguided loan compensation, resulting in suboptimal outcomes. In Q2/24, community banks (those under $10B in assets) were able to expand net interest margin (NIM) by 3bps but experienced a 12bps reduction in return on equity (ROE). (Return on asset reduction was also in line with this reduced equity return.) We’ll explain why we believe this is occurring and ways that community banks can reverse this trend.

The Data Around Loan Compensation

As shown in the graph below, the average ROE for community banks declined to 10.42% in Q2/24. In this current market, the average cost of capital for community banks is approximately 12.5%. Banks that earn over that amount can attract the required capital to continue to grow. Banks that earn under that amount will struggle to raise capital and will be pushed into consolidation. For banks that want to remain independent and those seeking the highest multiple on a sale, it is important to understand what aspects of the business model are hurting performance.

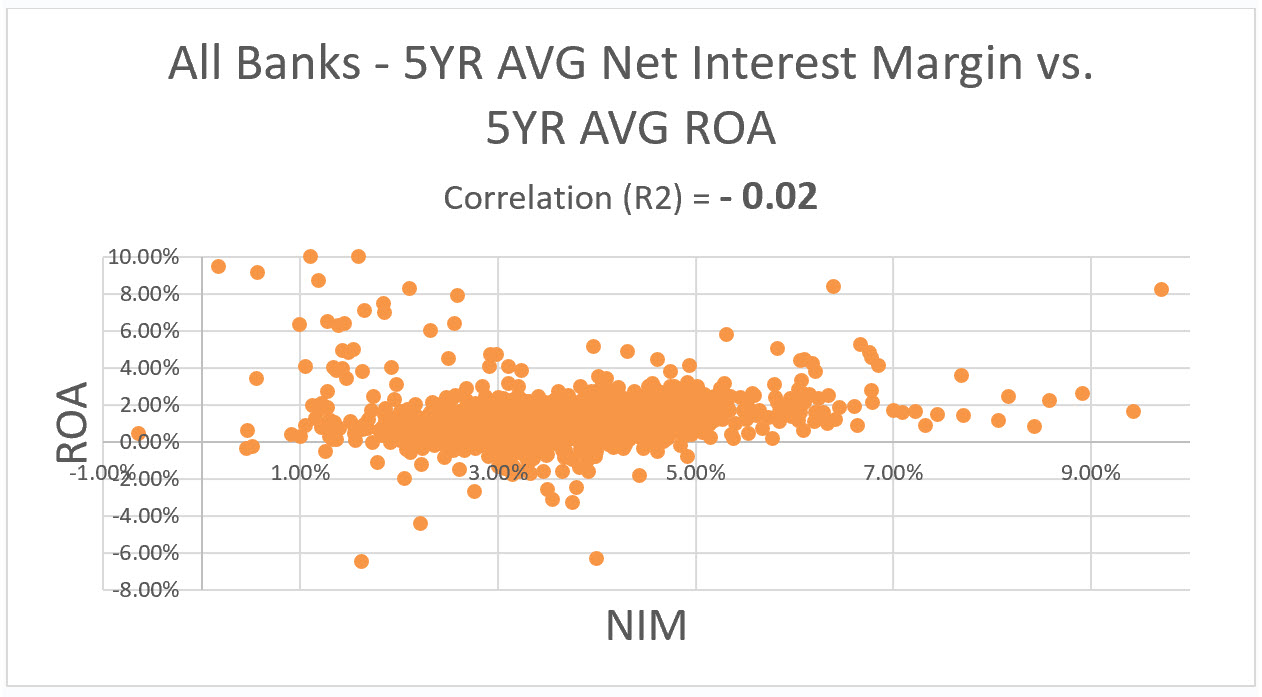

The typical bank analysis considers a bank in its aggregate (versus instrument level). In the aggregate, higher NIM (all else equal) leads to higher profitability. But on the instrument level for commercial loans, all else is not equal. We analyzed community bank performance over the last five years to evaluate the relationship between NIM and ROA, and we see no statistical correlation (R2 of about zero) – as shown in the graph below.

Most bankers are surprised by this finding, but they should not be. Commercial loans are heterogenous instruments and pricing to maximize yield (or increase the bank’s NIM) does not consider the following variables: risk, efficiency ratio (driven by loan size, loan term, acquisition cost, and maintenance costs), lifetime value, and cross-sell opportunity (such as cheaper deposits and fee income).

While many bank managers focus their lenders on increasing loan yield, the result is (not unexpected) lower ROE for the bank. Charlie Munger is proven correct. When bank management offers loan compensation based on production and NIM, underperformance is the result.

Measuring Risk-Adjusted Returns on Relationships Can Help

Because most community banks do not use a risk-adjusted return-on-capital (RAROC) loan pricing model like our Loan Command, the only variable that is easy to measure is loan yield – which leads banks astray. Because some community banks, and virtually all regional and national banks do use some version of RAROC loan pricing, the market is efficient enough that strong borrowers with sizable credits and those willing to provide a total banking relationship to a lender also obtain lower-priced loans and those banks with a RAROC model are willing to lend to such borrowers.

Price loans wide enough without taking into account cost and credit, and it is likely your bank will be adversely selected.

More Data Around Bank Performance

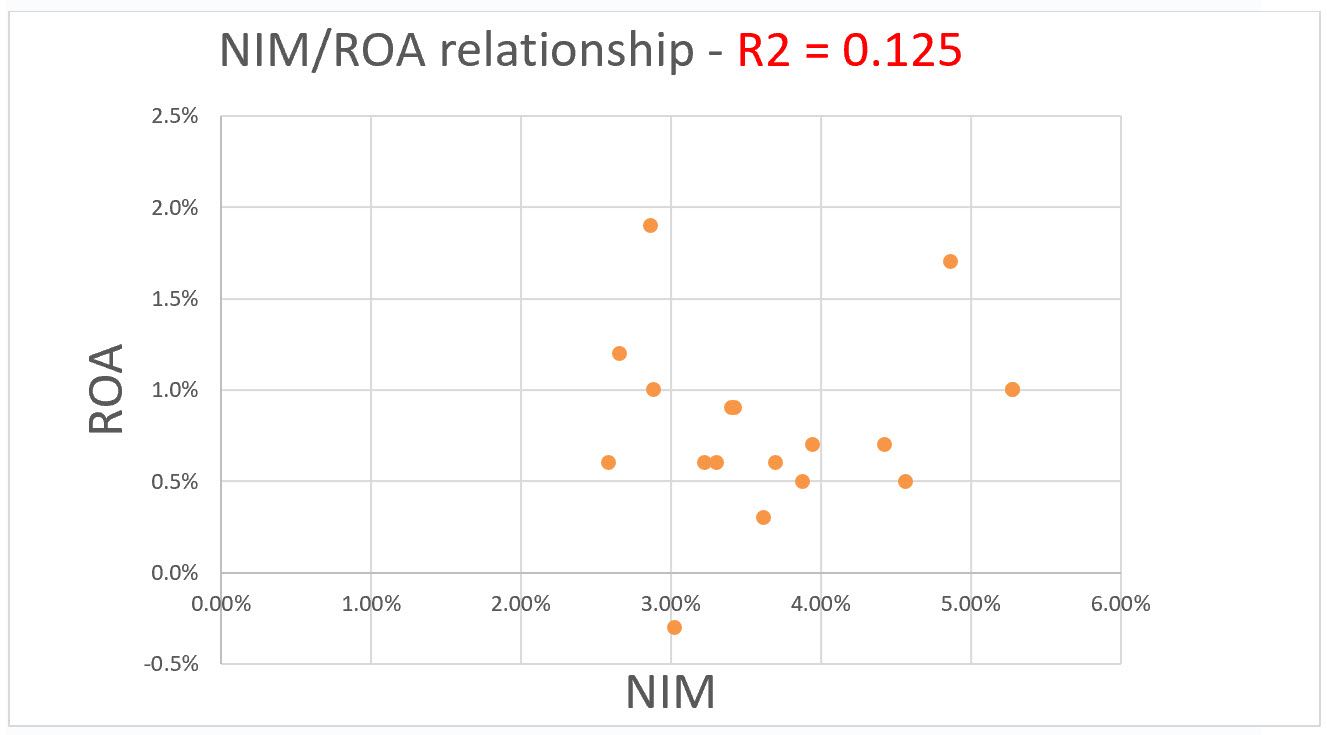

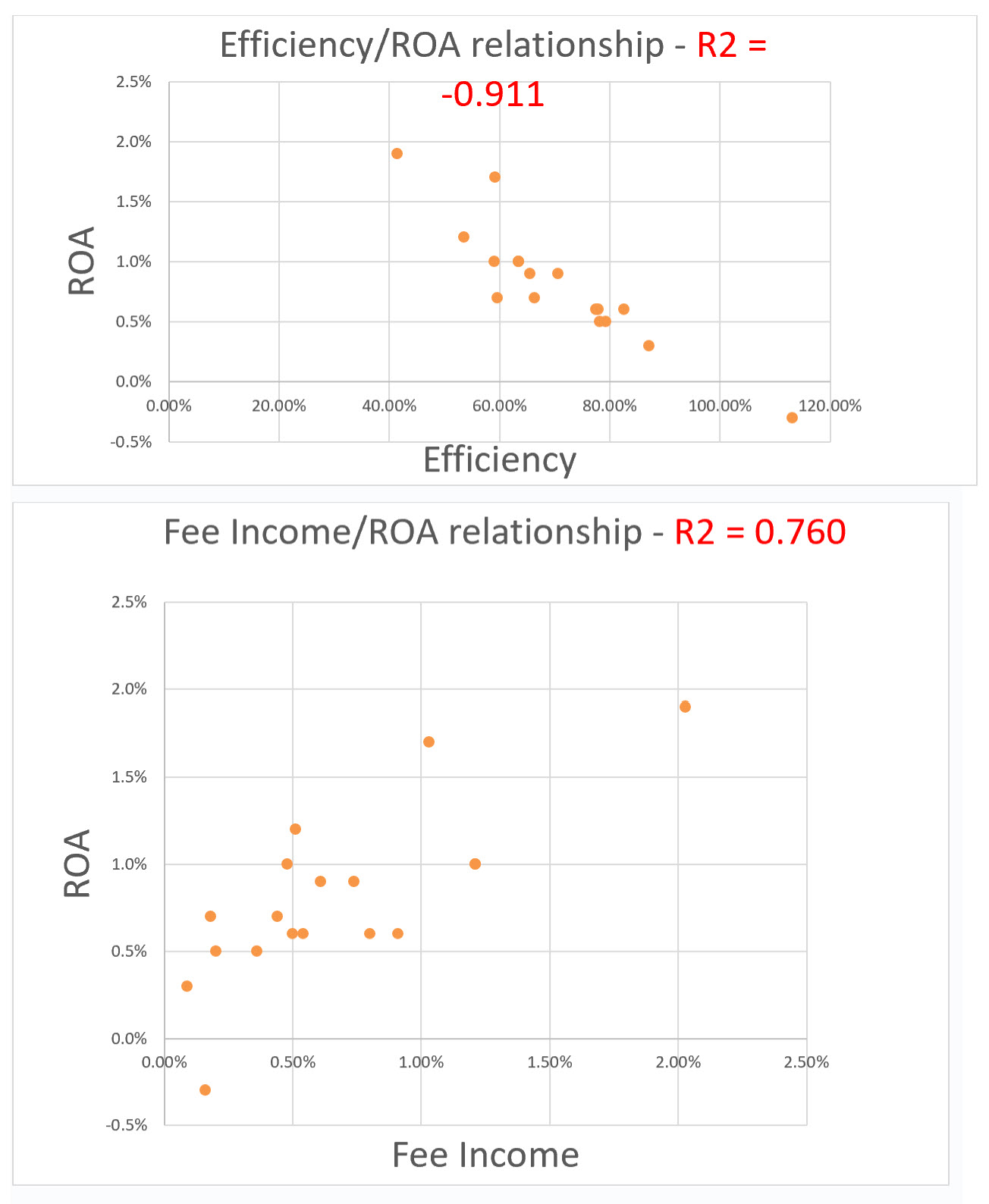

To prove this point on a concrete set of banks, we analyzed 16 peer banks within a state and looked at the relationships between ROA and NIM, efficiency ratio, and fee income. These were all community banks with comparable products and in the same market. While the correlation between NIM and ROA was not statistically meaningful (R2 of 0.125), the correlation between efficiency ratio and fee income (as percentage of assets) was -0.911 and 0.760 (respectively). For this peer group, and most of the community banks that we analyze, NIM does not lead to higher ROA/ROE, but efficiency ratio and fee income does. The graphs from our analysis appear below.

How Managers Must Adjust

It is crucial for community banks to apply RAROC pricing to loans and deposits and adjust loan compensation accordingly. The argument that “my bank is a price taker” is not convincing, because if competitors are mispricing loans or deposits, this is germane information for management. Just because your competitor is willing to deploy capita below its cost of funding, does not mean that your bank should follow. If your management team does not want to use a RAROC model, then the following criteria are important to consider for any pricing decision:

- Profitable customers lead to higher bank ROE.

- Credit quality is crucial at this stage of the business cycle.

- Banks need to seek highest and longest set of cash flows.

- Acquisition and maintenance costs reflect on bank performance.

- Larger and longer loans are more desirable.

- Expanding relationships opportunities are more profitable than steady or declining opportunities.

- Most important – fee income is critical to bank performance. In our long-term analysis of community bank performance, non-interest income as percentage of average assets consistently ranks as the top correlation to ROE/ROA with R2 of over 0.90.

Conclusion

Some bankers continue to put misplaced emphasis on NIM and this is potentially setting up their banks for challenging circumstances in the future – especially if the credit environment deteriorates or cost of funding does not ease. By understanding the drivers of profitability, banks can better use RAROC loan pricing tools to increase performance. Loan Compensation should follow suit. Instead of NIM, focusing on factors that drive loan profitability, such as credit quality, relationship value, business efficiencies, specialization, and scale, can help community banks thrive.