What You Need to Know About Moody’s Banking Sector Review

Earlier this month, on August 7, 2023, Moody’s Investor Services (“Moody’s”) published a banking sector review. That publication was referenced in the media as a US bank rating action, with a downgrade to ten larger banks (and a negative outlook to 11 other larger banks). However, that publication, directly and indirectly, identified three discrete risks affecting community banks. We will outline what we think community bankers should glean from this publication.

Risks to the Community Banking Sector

Moody’s identified three risks to the banking sector, including risks to community banks. The three risks are: 1) rising funding costs to erode profitability, 2) reduced capital at small banks compared to larger banks, and 3) elevated commercial real estate (CRE) credit risks. While Moody’s reviewed the risks across the entire banking sector, substantial analysis focused on the community bank space.

Rising Funding Costs

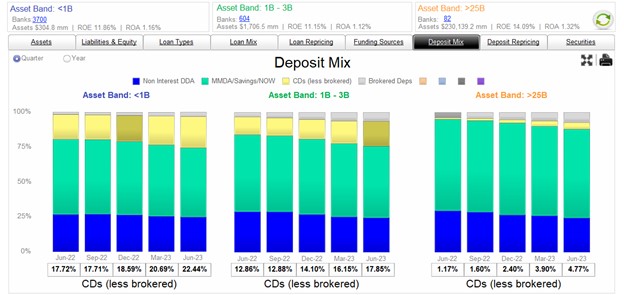

In Q2/23, the industry’s cost of funding rose rapidly. While most banks’ deposits were flat or down slightly, the mix of deposits changed – certificates of deposits (CDs) increased, and demand deposit accounts (DDA) decreased. Moody’s identified quantitative tightening and bank failures, not just Fed rate actions, as the impetus to the rising cost of funding. The graph below shows the deposit mix for banks with assets under $1B, $1-3B, and over $25B. The trend of decreasing DDA balances is evident and common for all bank sizes. However, smaller banks are increasing CD funding much faster than larger banks (yellow band in the graph below). Smaller banks have increased reliance on CD funding by approximately 5%, and now CD funding comprises 20% of deposits.

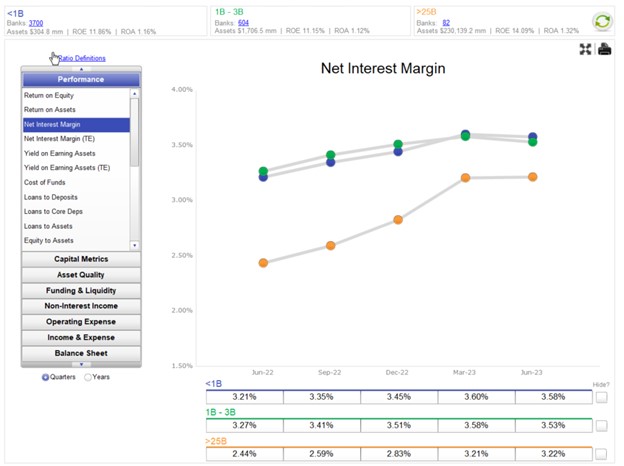

By relying on retail CDs, banks cannibalize their lower cost of retail funding and increase their deposit beta. This risk magnifies margin erosion for those banks that hold fixed-rate securities and loans. This trend is precarious at the end of a Fed Funds tightening cycle as quantitative tightening (Fed balance sheet reduction) continues because deposit beta increases, but loan betas fall, resulting in decreased margins. The graph below shows net interest margin (NIM) for three asset-sized bank groups. Smaller banks rely more heavily on NIM for revenue, and NIM compression will have a larger comparative negative impact on community banks. As deposits reprice faster than loans, banks with more retail interest-bearing accounts will experience more funding strains and lower NIM.

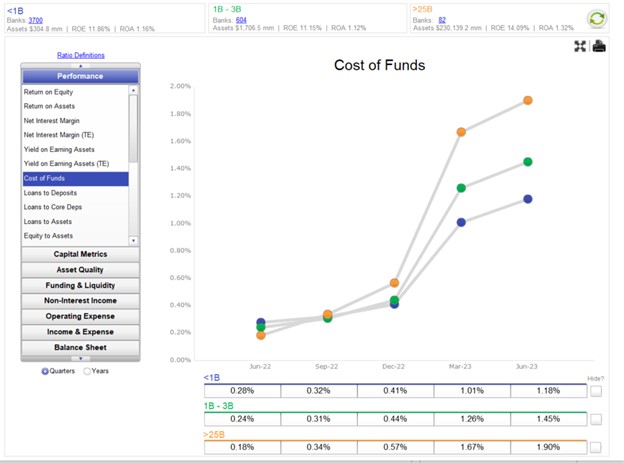

The larger NIM at community banks is not the result of better asset yield but lower current funding costs at community banks. Asset yield is similar for the three asset-sized bank groups, but as shown in the graph below, community banks currently have a cost of funds (COF) advantage relative to larger banks. Community bankers often lament the COF advantage at national banks – but the numbers do not support this view.

Reduced Capital for Community Banks

This is the more nuanced analysis in Moody’s banking sector analysis, but one that requires understanding. As larger banks are expected to hold more capital for regulatory reasons, smaller banks become comparatively riskier, especially with continued margin erosion leading to lower profitability and lower internal capital growth from earnings. Moody’s views this as credit negative for investors in smaller banks, thereby raising the required return on equity (ROE) / return on assets (ROA) at smaller banks relative to larger banks.

While some view increased capital requirements at larger banks as a positive to smaller banks’ competitiveness, this conclusion is too simplistic. Prudential requirements to hold lower capital for community banks leads to higher risk for investors, increasing ROE requirements and creating more pressure on community banks’ earnings. We recently published an article concluding that the average community bank’s cost of capital is 12.5% (here). By increasing capital requirements at larger banks, regulators will indirectly increase capital costs at community banks.

Elevated CRE Risks

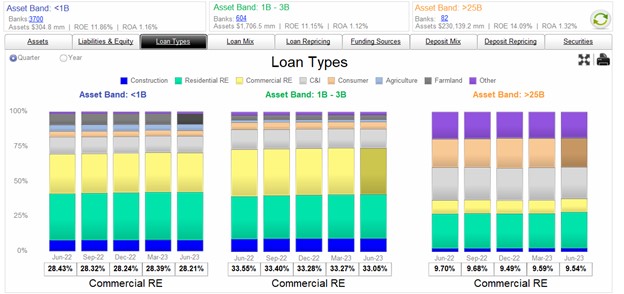

Moody’s points out that the banking sector’s stress was almost exclusively in funding and interest rate risk tied to monetary policy tightening. However, the next recession will come, and asset quality will deteriorate. Moody’s identifies CRE exposure (specifically construction, office, or land development) as a critical credit risk for community banks. The graph below shows the CRE concentration (in the yellow band) for the three asset-sized bank groups. Community banks have substantially more relative exposure to CRE loans than larger banks, posing certain risks to community banks.

First, Moody’s further points out that CRE lending has not been a good source of core deposit funding for many banks. Second, CRE is particularly vulnerable to ALM pressures, as those loans are typically fixed-rate and require some interest rate hedging strategy. Third, Moody’s identifies refinance risk for community bank CRE lending – as loans mature, if the existing lender does not offer an extension, few other sources of capital exist to provide credit (in the bank and non-bank CRE lending industries). There are significant rollover risks for CRE loans maturing in the next 18 to 24 months. Community banks should not rely on larger banks or non-traditional private or public lenders, increasing exposure to this category.

Banking Sector Takeaways

While Moody’s published an industry analysis, much of the discussion centered around risks common to community banks. We see four specific actions that community banks can take to mitigate the risks identified in the Moody’s analysis, as follows:

- Community banks must develop strategies that avoid rotating retail depositors from non-interest-bearing accounts into CD products. Banks must avoid competing for hot local money so that interest-insensitive depositors are not cannibalized.

- Loan growth will be challenged, and any asset growth will be less profitable as incremental COF increases in the near future. Community banks must better harvest existing borrowers and refinance those credits into higher earning margins. There are many ways to accomplish this, but with an inverted yield curve, a bank’s highest reward is converting fixed-rate loans into floating-rate yields through loan hedging.

- It is more important than ever for community banks to measure RAROC for each loan, deposit, and relationship as target return becomes more critical with a higher cost of capital and lack of asset growth.

Banks may not want to add additional CRE exposure, but their existing exposure should be structured to avoid rollover risk. Banks should ensure that credit terms extend at least five years or longer to allow borrowers to avoid refinancing risk and to enable the borrower to amortize more principal. Any existing CRE loan maturing in the next 24 months should qualify for preemptive refinancing and term extension.