Case Studies in Loan Restructuring

We have been writing on the various strategies available to community banks when structuring commercial loans in this current challenging business and credit environment. With the flat and low yield curve, we have discussed how banks may offer commercial loans through the ARC hedge program using two different strategies: 1) embedded floors, and 2) forward starting floaters. Last week we witnessed two community banks close commercial loans – one on each of the strategies above. In this article, we will describe each loan, the economics for each structure, and a post-closing analysis on the pros and cons of each structure.

The Two Loans

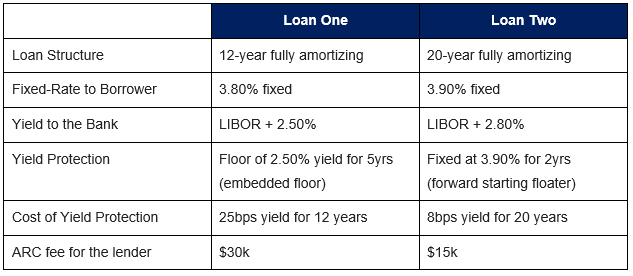

Loan One: The community bank had an existing loan that was originated in 2015 on a multifamily project. The loan was initially priced at 4.00% fixed and was scheduled to reprice later in 2020. The borrower was approached by other lenders to refinance the loan. The bank wanted to save the loan and agreed to reprice the remaining term (12yrs) at prevailing (lower rates). The borrower wanted a fixed rate for the remaining term, for the remaining balance of $2.5mm. The bank agreed to offer the borrower a rate of LIBOR + 2.50% for the remaining term, fixed through the ARC program. However, the borrower would pay the fee associated with a zero LIBOR-based floor for five years in the form of a higher loan rate. The bank would earn LIBOR + 2.50% for the 12-year term, and LIBOR would not be less than 0.00% for the first five years. The cost of the floor was 25bps for the life of the loan, and the fixed-rate to the borrower was 3.80%. The LTV on the loan was 52%, DSCR was 1.21X.

Loan Two: The community bank had an agricultural client with a broad relationship. The customer was looking to refinance some existing credit facilities and add new money for the purchase of farm real estate. The borrower wanted a 20-year fixed rate on a $2mm loan, and Farm Credit was interested in providing financing to the borrower at competitive rates. The bank wanted to save the loan and agreed to price the credit at LIBOR + 2.80%, on a 20 due 20 fixed-rate structure, but the bank would receive the fixed rate for the first two years – a forward starting floater structure. The cost of the forward structure was 7bps in the form of a higher rate to the borrower, and the fixed-rate to the borrower was 3.90% for the entire 20-year term. The LTV on the loan was 50%, and the DSCR was 1.98X.

A summary of the economics of the two loans appear in the table below.

Pros and Cons

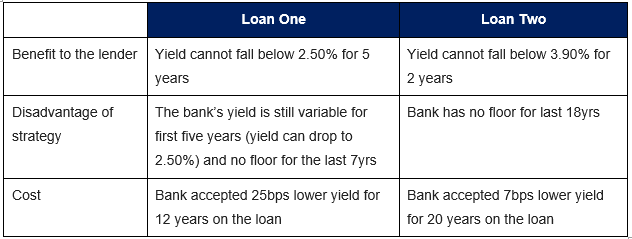

Both banks were able to retain profitable and creditworthy customers and protect the loans from competition for a long time. With an effective prepayment provision, both customers are now unlikely to refinance these loans at another institution. Both borrowers were able to take advantage of low prevailing rates to lower their monthly loan payments, thereby creating a more reliable credit for the bank. Both banks recognized additional non-interest income (the ARC fee) that is recognized immediately in income to increase the banks’ profitability. However, the banks took a different approach to protect themselves from decreasing short-term interest rates.

The pros and cons of each yield protection strategy are outlined in the table below.

The borrowers pay the cost to add yield protection on hedged loans; however, it is a competitive market, and community banks must decide on the tradeoff they are willing to make between yield over the life of the loan and the cost of structuring any yield protection. It is still a competitive market for profitable borrowers – especially existing customers with low leverage. Banks have a tradeoff between higher yields and yield protection (embedded floors or forward starting floaters). Different bankers will come to different conclusions on how to structure their loan yields, but there are at least three important considerations.

First, banks need to address the probability of interest rates declining from this level and the term of that decline. No one can predict future interest rates. However, banks need to assess the term of yield protection best suited for their view. As an example, in the extreme, if a banker believes that interest rates drop below zero and stay there for the term of the loan (either 12 or 20 years), then extending loans to almost any obligor is a questionable credit decision because perpetually low-interest-rate are not congruent with a stable economy.

Second, banks need to quantify which borrowers are worth retaining and which should be allowed to refinance. Loan size, cross-sell opportunities, credit quality, and lifetime value of the customer must drive that decision using a RAROC (risk-adjusted return on capital).

Third, it is essential to consider the cost-benefit of yield protection. Because the yield curve is flat, the cost of the forward starting floater is marginal. However, the embedded floor is a tricky instrument to understand. Some bankers believe that embedded floors offer protection that provides value to the lender should rates decrease. However, the lender is always better off for the floor to never pay – i.e., the lender’s yield is still higher if interest rates never go below the floor strike level. Just like home insurance, the homeowner is always better off not make a claim but let the policy expire without the need for a payout. Therefore, the essential reason to use a floor is when the lender cannot afford for that specific loan’s index to below the strike level of the floor, and the lender requires the floor as catastrophic insurance. Further, the embedded floor is even less effective than it ostensibly appears because the lender pays a premium for the floor. That premium must be subtracted from the floor strike – in our example, the 0.00% LIBOR floor is really a negative 0.25% floor because that is the cost of the floor premium.

Conclusion

Community bankers need to be prepared to lend in an abnormally (but probably temporary) low rate environment where the best borrowers are interested in locking their cost of funding for extended periods. The further challenge is that in a flat yield curve environment, borrowers do not pay a premium for longer-term fixed rates. Most importantly, for community banks, now is a time to retain the highest credit quality credits that can pay their contractual loan payments without modifications or forbearance. The best way to maintain borrowers today is to require some form of meaningful prepayment protection and protect the bank from rising interest rates in the future.