Choosing a Bank Hedge Provider

The economic consequences of Covid-19 have altered average credit quality and created a flat and shallow yield curve. Community banks are working diligently to support their local communities and survive in these challenging times. One tool that many community banks have utilized in this business environment is a loan-level hedging product. There are several benefits to community banks in using a loan-level hedging program, but how does a community bank choose a safe solution? We have created a four-part test to help community banks make a smart decision in picking a hedge provider.

The Benefits

First, let us consider the benefits of a loan hedging program for community banks. In talking to community bankers, here are the main reasons provided:

- Improved Credit Quality: Banks can stabilize the borrower’s DSCR.

- Eliminate Interest Rate Risk: Eliminate margin compression when interest rates rise.

- Meet Competitive Pressures: National and larger regional banks are specifically targeting better borrowers for 10, 15, or 20-year fixed-rate loans.

- Protect Existing Loans: Average commercial loan prepayment rate is 25%, without a hedge but only 3% with a hedge. Now is not the time to lose your best borrowers.

- Cross-sell: Locking borrowers into longer-term loans creates a stickier relationship.

- Lending Discipline: Sensible pricing methodology is part of a loan hedging program, and some hedge providers also offer a loan pricing model.

- Generate Fee Income: Hedge fee income for commercial loans can range between 25 to 200bps of the loan amount, and the fee is commonly recognized immediately in the period received. This added income can make loans much more profitable for community banks.

Community Bank Test for Hedge Providers

There may be dozens of criteria to use when choosing a vendor; however, we have distilled the top four that are crucial for community banks to consider for a hedge provider.

First, the hedge provider must be managing its balance sheet to create a neutral position and not take a speculate on derivatives. Below is a public note from a hedge provider that reported income from interest rate movement (a speculative portfolio position):

The increase in noninterest income in 2020 was primarily the result of derivatives risk positions that resulted in a positive, non-cash MTM of $17.6 million on the derivatives portfolio following an unprecedented decline in long-term market rates.

All providers should provide full and understandable disclosure about their hedging activity, and community banks should seek vendors that can manage their risk properly.

Second, the hedge provider must be an FDIC insured institution and structure its hedges as a qualified financial contract (QFC). FDIC regulations afford QFCs certain rights and protections that will accrue to the hedge end-user (a community bank or a community bank borrower) if the hedge provider were to fail and the FDIC becomes the receiver. We see substantial risk to community banks in dealing with non-FDIC hedge providers or those that do not offer QFC protection – think Lehman Brothers.

Third, we believe that community banks should be suspect of vendors that require service exclusivity. There are certain services and products that require substantial setup costs, integration costs, and upfront resources, but providing a hedging solution is not that type of product. We believe that community banks should choose a path that offers the most operational flexibility. While the vendor’s services may be optimal today, business or economic changes may require a different path in the future. We believe that there is no reason to sign an exclusivity agreement with any hedge provider.

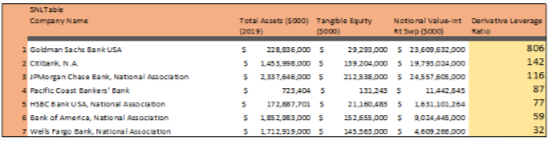

Fourth, community banks can easily assess the health and safety of the hedge provider by considering one simple ratio – derivative leverage ratio. Hedge providers will not typically disclose a full assessment of their derivative portfolio; however, every bank is required to disclose information that can be used to calculate the derivative leverage ratio, which is the ratio of total notional volume divided by tangible equity. This capital ratio is used to assess the possible riskiness of a hedge provider. More sophisticated entities can handle a higher ratio because they possess system and managerial sophistication to manage the risk. Our rule of thumb is that any derivative leverage ratio over 20 requires an expert understanding of derivatives and risk management (typically found at the national banks). Below is a table showing the seven highest derivative ratios for FDIC insured institutions.

Conclusion

There are some substantial benefits to community banks in using loan-level hedging, and like every vendor analysis, community banks must understand how to assess the vendor’s capabilities and risks.