6 Steps To Be a Better Trusted Advisor During This Trade War

There have been few times in modern memory when small businesses and middle market companies faced so much uncertainty in the market. With recent DOGE government spending cuts, escalating trade tensions, immigration reform, and the implementation of tariffs, U.S. businesses find themselves navigating complex economic waters. This week, for example, is a critical time to help clients as a trusted advisor leverage lines of credit to move supplies and purchases forward, potentially avoiding the higher tariffs that have been paused until April 2.

These conditions not only impact business operations but also raise critical questions about liquidity, creditworthiness, supply chain stability, and growth strategies. In this challenging environment, bankers have an unparalleled opportunity to step forward as trusted advisors, providing valuable guidance, innovative financial structures, and prudent risk management to support both their bank and commercial customers.

Step 1: Get a Leader

The first move is to appoint a banker to lead the effort of managing news flow, insight, and execution. Appointing someone in Credit might be a workable idea. This lead should be responsible for providing weekly briefings to relationship managers and serving as a resource to help manage information flow and troubleshoot challenges.

Step 2: Triage and Open Client Communication

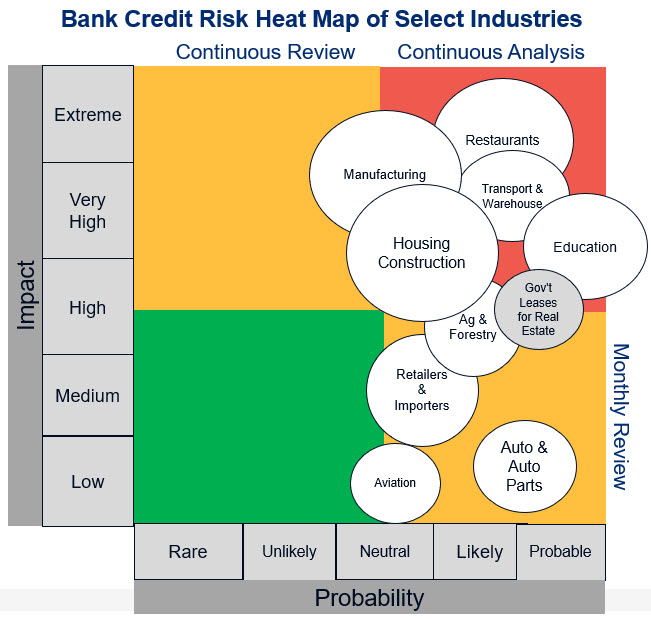

Starting with your highest credit exposure in key industries, such as manufacturing, every relationship manager should understand where their clients are exposed and what the residual risks are from the array of market changes.

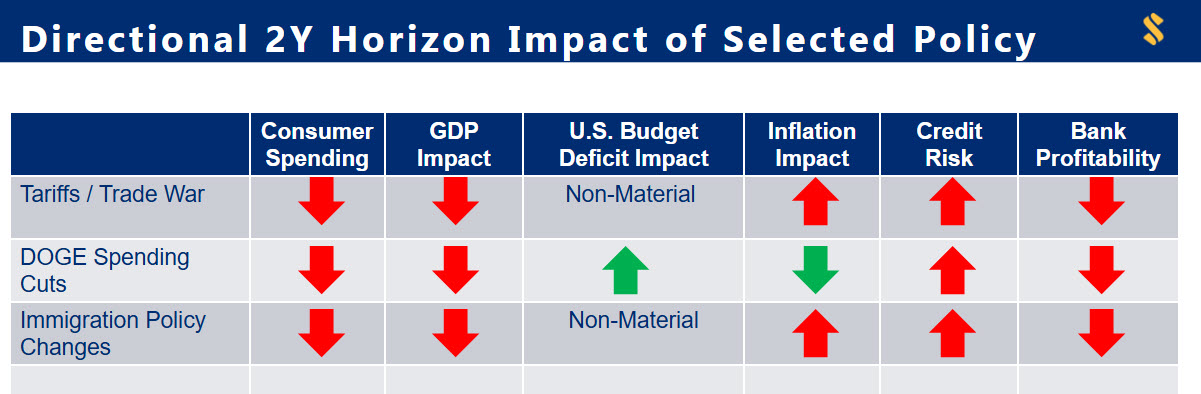

The primary focus is on how business cash flows are affected. Bankers can accomplish this by actively engaging in conversations that identify critical business concerns, such as reduced revenue due to spending cuts on DOGE impacting federal contracts, disrupted supply chains resulting from trade wars, and margin pressure caused by tariffs. Understanding clients’ strategic objectives and the threats they face allows bankers to position their banks as strategic partners offering solutions and guidance.

Step 3: Conduct a Credit Risk Assessment and Management

In turbulent economic times, rigorous credit risk assessment becomes even more essential. Bankers must balance their supportive role with the obligation to safeguard their banks from unnecessary exposure. Effective risk assessment begins with comprehensive due diligence, which involves obtaining an update on financial performance, evaluating operational efficiencies, assessing management strength, and forecasting industry trends influenced by labor force constraints, DOGE budget cuts, and trade tariffs.

In particular, bankers should focus on:

- Evaluating how government spending cuts directly impact the client’s revenue streams or profitability, mainly if the business relies heavily on public-sector contracts.

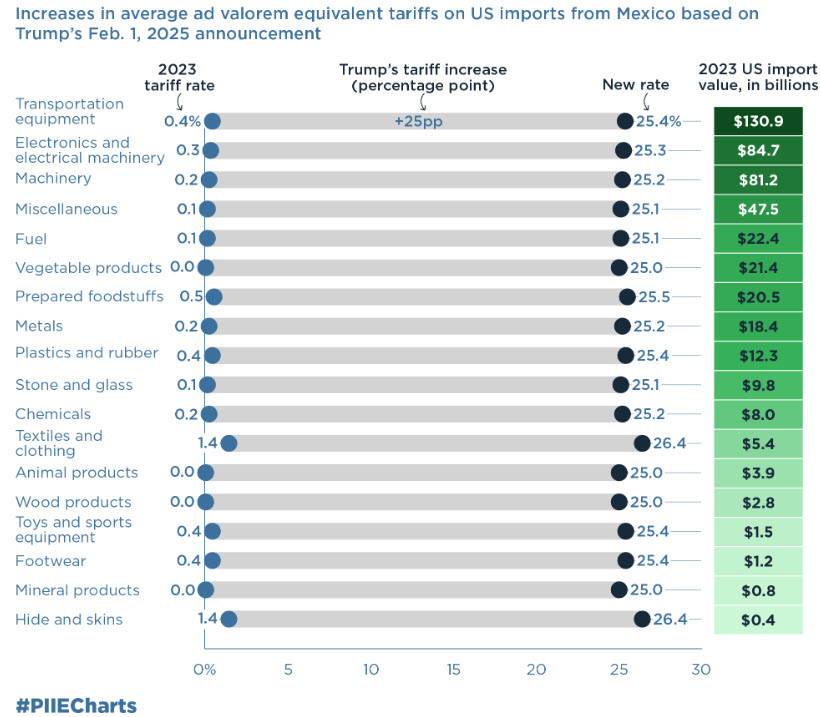

- Examining supply chain vulnerabilities exposed by current trade policies, including dependence on imported raw materials or overseas manufacturing.

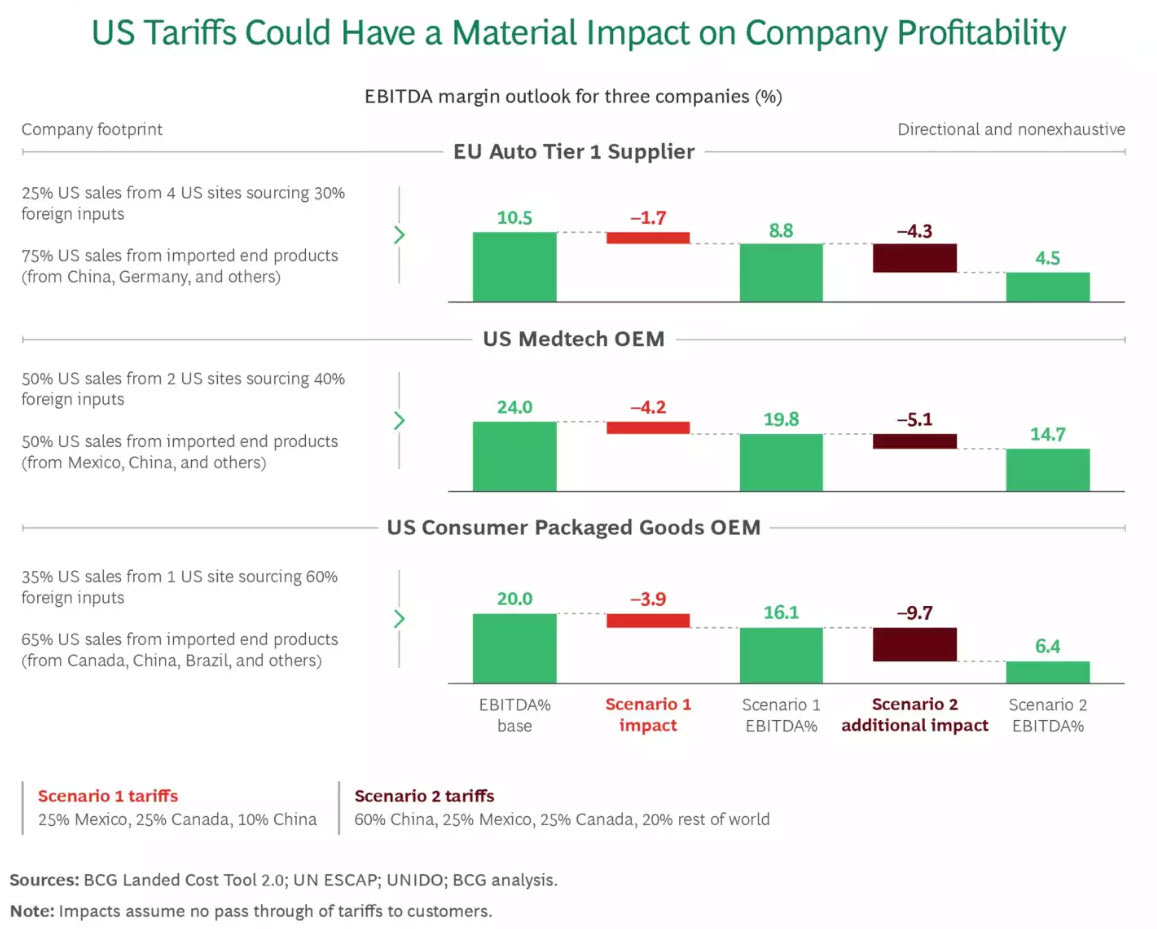

- Where this trade war has changed a company’s cost structure – New port taxes, increased shipping container, higher insurance and transportation costs, in particular. On again, off again tariff changes make determining your future cost of goods difficult. The more materials impacted, the more a company’s cost structure can be impacted.

- Stress-testing cash flow projections under scenarios of increased input costs, fluctuating demand, or delayed payments.

- Leverage the board of directors to collect information, analyze the risks and help with customer outreach.

- Utilize technology around AI and embedded finance to help gather and synthesize data.

Bankers who perform rigorous assessments will be equipped to identify potential credit deterioration early, thereby enabling proactive discussions with clients about necessary strategic or operational adjustments.

This tactic pertains to real estate managers and developers as well. At present there are some 543 government leases that have been slated for non-renewal and/or termination through DOGE. 432 of these are office buildings and many of these have bank loans on them. These buildings are concentrated in cities like D.C., New York, Atlanta, Phoenix and Los Angeles. Some of these leases are just for a partial floor, but some are for entire buildings. On average, we estimate the average lease is for about 15,000 of space, or about 10% of a building.

Banks need to track this risk not only if they have exposure to these buildings with government leases that could potentially be terminated, but for the impact of additional office space on the market. For major metro areas such as D.C. or Atlanta, the maximum impact could be between 10 and 20 basis points of vacancy in the market. However, for smaller markets such as Ft. Collins, CO; Montgomery, AL; or, Boise, ID, the increase in vacancies could be impacted as much as 1%.

Banks are encouraged to reach out to their commercial real estate investor customers to see how these potential government lease cancelation could impact credit and liquidity.

On a broader scope, tariffs, immigration reform and government spending cuts hit a variety of industries. Some of the most critical are outlined below. Homebuilders, as an example, purchase a material amount of goods that get impacted by tariffs to include lumber, steel, and appliances. Cargo and trucking companies get hit hard as port fees jump and imports slow down. Spending cuts to higher education are devastating colleges while restaurants get hit a number of ways.

Step 4: Expanding Credit and Structuring Appropriate Loan Facilities

As a trusted advisor, bankers must structure loan facilities that closely align with their clients’ evolving financial realities and strategic objectives. Loan facilities should not only support immediate liquidity requirements but also accommodate the projected impacts of DOGE cuts, tariffs, and broader economic shifts.

Appropriate credit management might include:

- Are lines of credit needed, or do existing lines need to be expanded to help the customer’s performance? Many customers are in the process of pulling forward purchases before the April 2 deadline to enjoy better effective pricing. Although the April 2 deadline may be extended further, the conversation remains the same. It is highly probably that existing credit lines may not be sufficient. Inventory levels should expand to capture the non-tariff pricing. While a three month inventory is common for many industries, those levels are expanding to six months.

- Term loans structured with covenants that account for shifts in profitability margins due to increased trade tensions or reduced governmental spending may need to be reworked or exceptions granted in the short-term. Clients that have downstream customers that purchased goods right after the holiday season to restock inventory at a set price may now be experiencing compressed margins due to tariffs due to the delayed delivery. It is important to have these conversations around covenants early to bring relief before a default occurs.

- Revolving facilities or seasonal financing tailored specifically for businesses affected by cyclicality or fluctuating inventory demands exacerbated by trade uncertainties.

By collaborating closely with clients to understand the full context of their financial requirements, bankers demonstrate that their commitment extends beyond simple lending to genuinely partnering for success.

Step 5: Talk About Real Estate

For the appropriate client, having a longer-term horizon about how they might want to onshore their manufacturing facilities is a good place to drive value around commercial real estate financing. Building new facilities, relocating existing locations or partnerships are all now common conversations, particularly for middle-market customers.

Step 6: Get Strategic to be a Trusted Advisor

Outside of real estate, there are a whole range of conversation to be had as it pertains to hiring, reducing cost and managing the supply chain. The ongoing trade war and DOGE budget cuts, while challenging, create opportunities for bankers to deepen client relationships. Bankers can leverage their expertise by:

- Diversify Supply Chain: Discussing how the customer can diversify their supply chain. What other clients of the bank would benefit from an introduction in this regard?

- USMCA: The United States-Mexico-Canada Agreement (USMCA) is a trade agreement between the U.S., Mexico, and Canada. This agreement replaced NAFTA back in 2020 and has become more critical than ever. It aims to facilitate trade, promote fair competition, and enhance protections for labor and intellectual property. Certification under USMCA enables companies to benefit from reduced or eliminated tariffs when trading within North America. Bankers can assist clients in obtaining USMCA certification by:

- Providing Information and Resources: Educating clients on USMCA eligibility criteria, compliance requirements, and potential benefits.

- Facilitating Connections: Referring clients to qualified trade compliance experts or consulting firms specializing in USMCA certification.

- Certification: Assisting in analyzing the economic impact of certification, ensuring it aligns with strategic financial planning and risk management practices.

- Education For Economic and Market Intelligence: Providing market intelligence and industry insights that clients might not readily have access to, helping them navigate uncertainty. Conducting workshops or informational sessions to update middle-market clients on economic developments and risk management practices.

- Network: Introducing strategic partnerships or recommending external specialists in international trade, tariff mitigation strategies, or operational optimization.

- Pricing: Pricing and margins become more challenging with tariff changes. Companies may be considering an accounting methodology change or need help with more sophisticated pricing methodology such as dynamic or cost plus pricing.

Such value-added services underscore the bank’s commitment to their clients’ well-being and solidify their role as trusted advisors rather than mere providers of capital.

Enhancing Your Skills as a Trusted Advisor

Many small, mid-sized, and middle-market companies lack the extensive financial management resources that larger corporations enjoy. Consequently, businesses often rely heavily on external counsel, CPAs, and their trusted advisor banking partners. As economic uncertainty intensifies, enterprises are looking to their bankers for expertise beyond conventional lending services.

The current climate of DOGE spending cuts, trade conflicts, and tariffs has created significant stress for middle-market companies, but it has also opened the door for bankers to demonstrate strategic value. By proactively identifying client challenges, conducting rigorous credit risk assessments, structuring thoughtful financial solutions, and pricing loans accurately, bankers strengthen client relationships and protect their institutions.

Commercial clients are keenly aware of the value of trusted advice, particularly during times of economic volatility. Bankers who effectively fulfill this advisory role not only mitigate their banks’ exposure but also solidify their positions as indispensable partners in their clients’ strategic success. The result is a mutually beneficial relationship that endures beyond economic cycles and solidifies a foundation of trust and collaborative growth.