Balance Sheet vs. Collateral Finance – What is the Difference?

Most bankers understand that they are in the business of keeping loans versus making loans. Originating new loans drains bank resources with acquisition, processing, and onboarding costs. By identifying the right customer at inception and structuring the appropriate products, community banks can create a long-term, growing banking relationship. Short-term loan commitments decrease cross-sell and upsell opportunities and create lower switching costs for borrowers. On the other hand, longer loan commitments increase cross-sell opportunities, especially for deposits, because as free cash flow accumulates, it leads to deposit opportunities for the bank if the loan is used to finance long-term business assets. It is with this background that we discuss the difference between balance sheet lending vs. collateral finance.

What is Balance Sheet Versus Collateral Finance?

A balance sheet loan is based on the strength of the borrower’s balance sheet and business model (the loan can still be secured by collateral). Balance sheet loans can be retained by the borrower with changes to collateral, term, pricing, and even borrower entity if the bank can underwrite these credit changes. Balance sheet loans lead to longer and more profitable relationships.

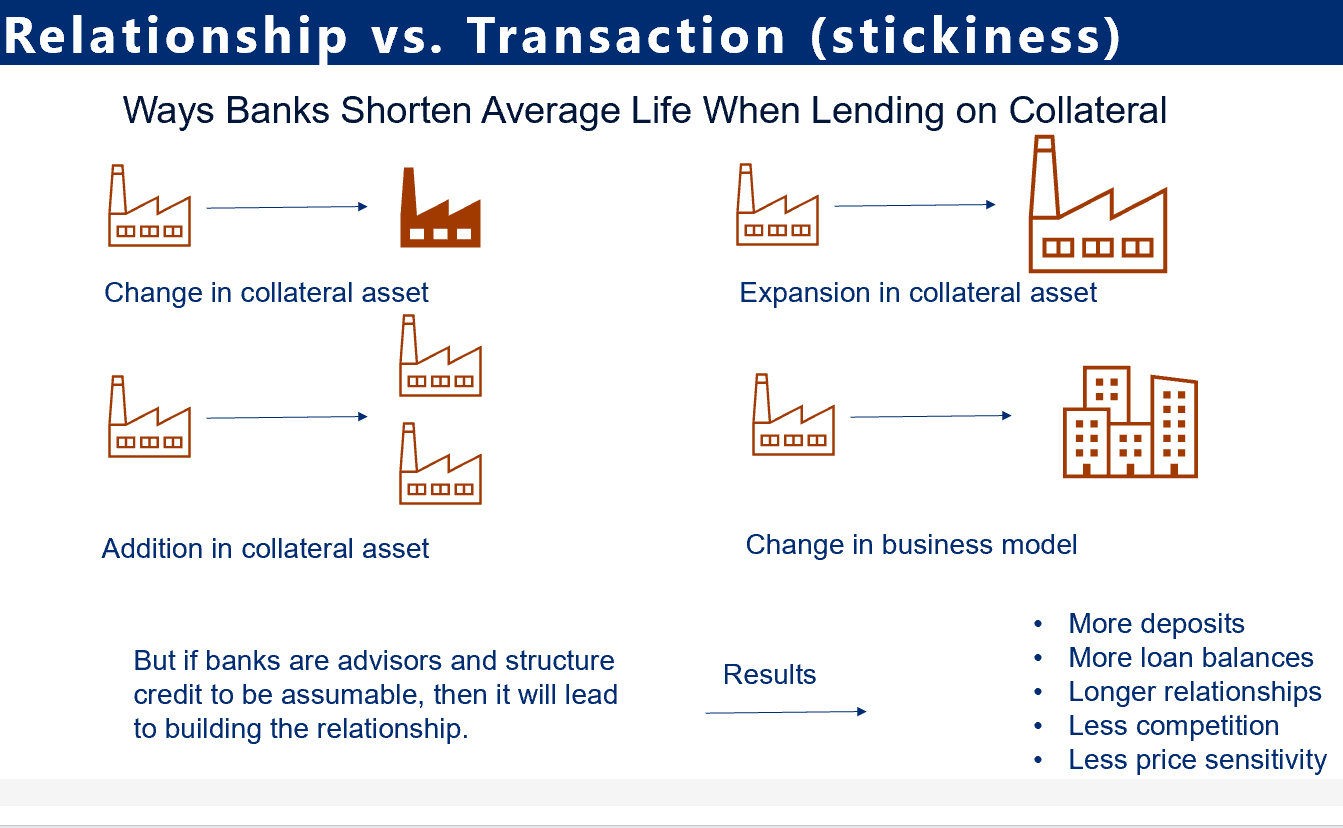

Conversely, a collateral-based loan is structured with planned obsolescence. It is shorter and less valuable to borrowers and less profitable to the bank. These loans are tied to a specific piece of collateral and are structured to be called by the lender with any of the following: borrower change, collateral change, modification to term, cash out financing, change to business model, or business expansion. This lending strategy decreases average loan life and diminishes the client’s affinity with the bank.

However, it doesn’t have to look like that. Bankers can build relationship growth into their products such as making their loans assumable and adjustable.

A Case Study

We would like to highlight an example of a balance sheet loan managed by a community bank that we work with. The lending institution is a sub-$1Bn community bank that originated a strong investor CRE loan in 2019. The loan was initially $6mm, 15-year credit priced at SOFR plus 2.50% to the bank, and 5.90% fixed rate to the borrower (using the ARC hedging program). The bank recognized $124k in hedge fee income using the ARC program at origination. The loan was secured by 19 real estate properties, comprised of retail, multifamily, and senior housing. The DSCR was over 2.0X and the LTV was 64%. The relationship was profitable for the bank and generated 21% ROE – driven by NIM, fee business, and certain deposits.

Over the course of six years, the borrower substituted and released collateral (with the bank’s approval). This year the borrower wanted to consolidate additional CRE properties with the bank and increase the loan size to $9mm and push out the maturity to a new 15-year commitment. Because the bank structured the loan as balance sheet financing, the bank was able to accomplish the following:

- Keep the rate on the initial $5.6mm (amortized from the starting $6mm) at 5.90% but add $3.4mm at current market rates. The borrower chose to blend the rate with a final 6.71% fixed rate for 15 years.

- Add an additional pool of assets to secure the loan (another 8 properties).

- The bank’s leverage was still below 70% LTV and DSCR was close to 2.0X.

- The bank expanded its relationship and generated another $80k in hedge fee income.

- The borrower found it unappealing to request an RFP from another bank given that its initial $6mm loan was below market rate. But the bank was yielding an at-market rate of SOFR + 2.50%.

By using a balance sheet instead of collateral-based loan, the bank was able to improve its performance in the following ways:

- The bank found it easier to defend its existing loan from competitors. There was no bidding war for a client that was targeted by many other lenders, both community banks and national banks.

- The bank increased its loan commitment and extended the term, which improved profitability.

- The bank was able to offer a simpler and more cost-effective closing process for the borrower.

- During the next 15 years of the loan’s life, it is highly likely that the borrower will grow its business and increase the loan size and extend term again – offering the bank additional fee and margin opportunities.

- This relationship will be cemented through many years of consultative banking services. The bank will have additional opportunities to cross-sell, upsell, and create customer loyalty and greater price insensitivity.

- Short-term, collateral-based loans are typically transactions. Each transaction or project is put to bid and is won or lost primarily based on price and leverage. For banks that want to compete on price, bidding on transactions or projects makes sense. However, when a bank structures a solution for a long-term business, it provides value that supersedes any short-term project. This bank identified the right client and provided the appropriate corresponding financing structure.

Conclusion

Collateral finance can burn resources. By identifying the right client and lending needs, community banks can structure balance sheet loans instead of collateral-dependent credits. These loans allow community banks to extend the expected life of a commercial loan, reduce competitive pressures, and enhance upsell and cross-sell opportunities. Hedging programs can be a valuable tool to create such balance sheet loans and create a longer and stickier relationship.