The Cost of a Commercial Real Estate Loan

Most financial institutions never see the actual cost of originating their products. To do so would require at least a rudimentary funds transfer pricing methodology, and many banks have not invested the time to derive a workable framework. Understanding a product’s cost structure is the first step towards accurate pricing and, more importantly, process improvement. In this article, we focus on the cost of originating a commercial real estate loan to give financial institutions both a flavor for their cost structure and benchmarks to measure themselves.

Our Approach Towards Deriving the Cost of a Commercial Real Estate Loan

If you are a user of Loan Command, our relationship pricing model, then much of this is already done for you. However, if you are not, or if you want to get both more accurate and granular, then we turn to the Kohl Analytics Group, whose sole focus is to help financial institutions with profitability starting with building a funds transfer pricing methodology. We will use their data and methods for this analysis.

To derive the cost of a loan, you start with your sales and marketing costs and add to that the cost of taking an application and processing that loan to a decision. From there, you calculate your onboarding cost and credit charge to derive the total loan origination cost. You then divide that number by your total loans (and volume) booked and then divide that number by the expected weighted average life of the loan. Your product is the total loan origination cost per year per loan.

Once you understand your initial cost, you add your servicing cost to arrive at the total cost for originating, servicing, and managing a loan per year.

Cost of Loan Calculations

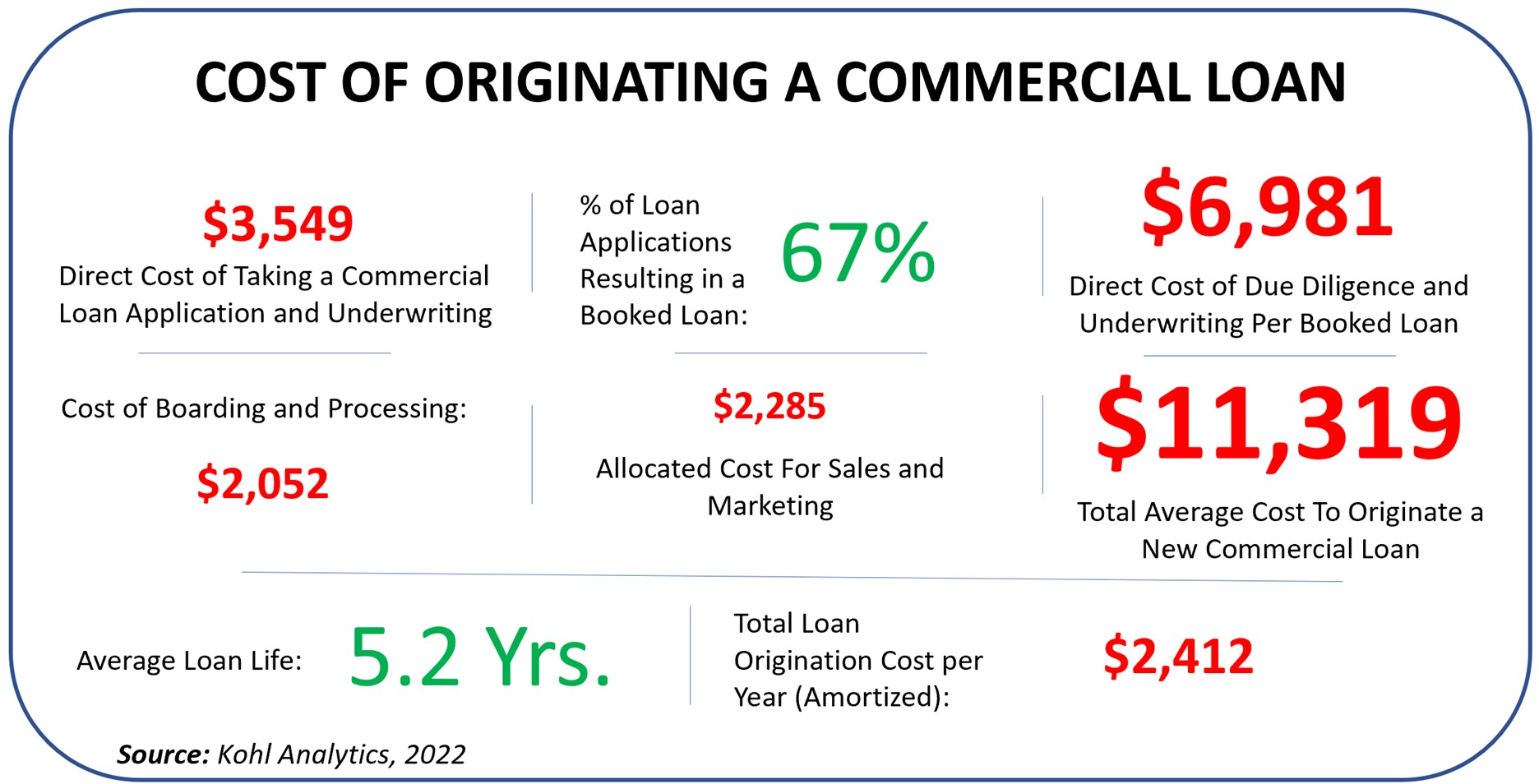

These costs vary by institution and approach, but they will generally get you in the right ballpark. It costs an average of $6,981 to book a loan, including all the amortized costs you have from handling loans that you didn’t approve or that were withdrawn. Add in the sales and marketing costs and the cost of onboarding and funding, and banks average about $11,319 per loan or an amortized amount of $2,412 per year (below).

To place that in perspective, this is for an average loan size of about $614,000. Once you get past one, five, and ten million, due diligence costs go up. Thus, the two standard deviations of this range go from a low of around $9,000 to a high of around $19,000 for larger, more complex loans in volatile industries such as hospitality, energy, or service firms.

As a side note, these costs drop by 10% to 50% for banks that employ business process automation, with an average of about 23%.

The Cost of Credit For a Commercial Real Estate Loan

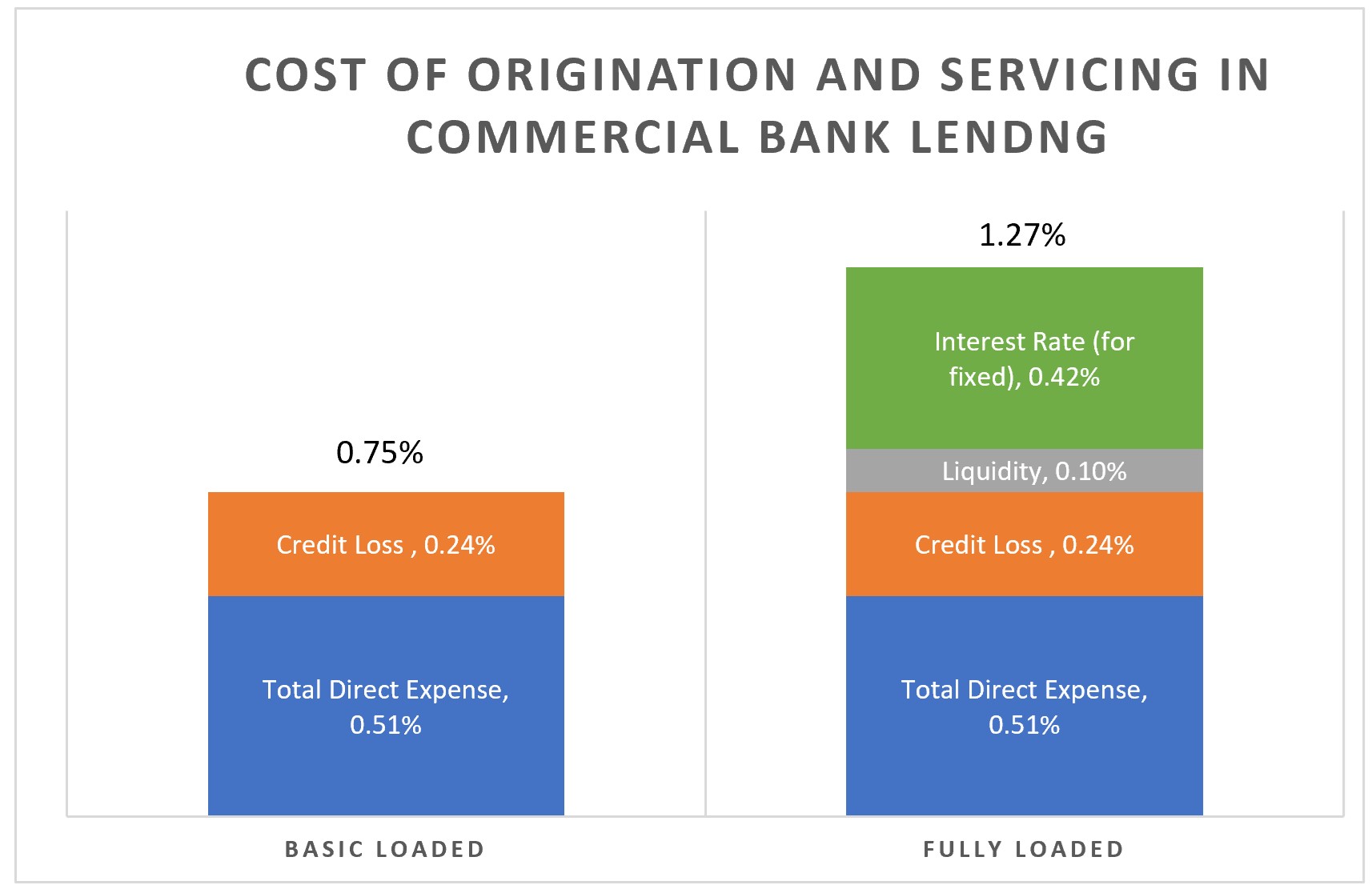

Of course, credit, interest rate, and liquidity risk in these loans need to be deducted. Just focusing on credit, the current environment is generating about 24 basis points (bps) in credit risk calculated to what we call “Economic Expected Loss,” which are current probabilities of default times loss given default times exposure at default.

Banks usually reserve to the point of one or two standard deviations of expected loss, so allocated reserve levels at most banks are well more than 24 bps and are closer to 1.00% to 1.32%. It is debatable whether these higher numbers should be in your cost calculations, but it is worth considering. By the same token, some banks consider a 10-bps liquidity charge and a net fixed rate risk charge for their fixed rate loans. Unfortunately, given today’s volatility, rising rates, and history of the market undercompensate for interest rate risk, this charge is near a record high of around 65 bps.

The Servicing Component of the Cost of Commercial Real Estate Loans

On top of the above, the servicing of a term commercial loan (not a construction loan or revolver) costs a bank about $629 per year in pure servicing costs (collection of P&I payments, rate change notices, and continued monitoring/management, plus $129 per year of amortized special handling cost to include working with special payments, collections, substandard handling, and any workouts. Add those two figures together, and the average commercial loan at a bank costs around $757 per year to service, or about $3,169 of the total annual cost of the loan, including amortized origination cost and servicing.

Putting This All Together

We can then express the above data in the form of a cost spread or charge in basis points. At a minimum, a floating rate loan costs about 75 basis points. Thus, if your average spread is +2.50%, your net margin is 1.75% before your cost of funds. The average bank has about a 62-basis point prospective cost of funds over the next five years (by our calculations). Including the cost of funds equates to a net 1.13% profit margin before taxes.

If that was a five-year fixed rate loan and you wanted to adjust for liquidity and interest rate risk (to account for the net interest rate volatility risk), then that margin would be about 61 basis points by our calculations.

As Kohl Analytics Group often reminds its clients – “You will not solve a problem you don’t fully understand.” Most banks have never seen this granular of data and, as a result, often misprice their loans. Almost as importantly, this data is instrumental for any “digital transformation” project being considered in the lending space. A bank must know its current cost structure before calculating its return on what a new process could save.

In the coming articles, we will look at other lending lines and deposit lines and then highlight some insight into automation using Kohl Analytics’ activity-based costing.