Fixed Rate Loan Risk – Rethinking The 5-Year Offering

For decades community banks have taken on fixed rate loan risk mostly through the offering of five-year, fixed-rate, commercial term loans. This is probably the most popular structure for real estate-secured term credit at community banks. Now may be the right time for community banks to abandon this strategy – both for the borrowers who want to eliminate repricing risk (for good credit reasons) and for banks that are taking unwanted duration risk.

Fixed Rate Loan Risk – Bank Behavior

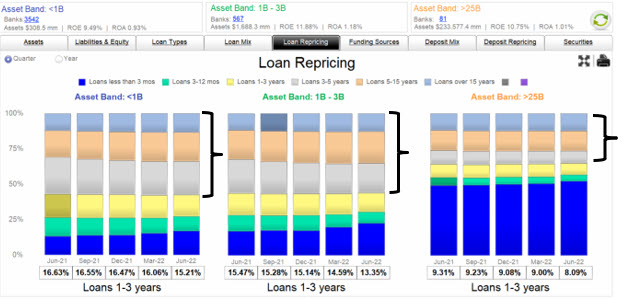

A carry trade is when lenders fund short and lend long. This trade has historically worked for banks when interest rates are generally falling – in the last four decades. However, the carry trade carries a substantial risk to lenders when interest rates and cost of funding (COF) increase. The graph below shows loan repricing buckets for three asset-sized groups of banks: under $1B, $1B to $3B, and over $25B in assets. In summary, smaller banks have a higher percentage of fixed-rate loans than larger ones. This difference is especially pronounced for five-year fixed-rate commercial term loans. In contrast, larger banks have more loans in the variable bucket.

The Fixed Rate Loan Issue

The signal from central bankers is that interest rates will be higher for longer, and excess liquidity from the banking industry will be drained in the next two years. That means that those five-year fixed-rate loans (and longer durations) will hurt the bank’s NIM as COF rises. The biggest problem is that short-term rates started rising this year from almost zero, and nearly every bank’s COF can only go up from here and not down. That duration risk seemed reasonable when central banks were broadcasting their desire to keep interest rates near zero, but now that risk is magnified for banks when interest rates are rising.

How to Measure Duration Risk

Bankers need to be cautious about adding loan duration at this point of the interest rate cycle, but how should bankers measure the risk of fixed-rate loans? The correct and most direct way is to use the concepts of the economic value of equity (EVE) and measure how COF changes that fixed-rate loan’s value.

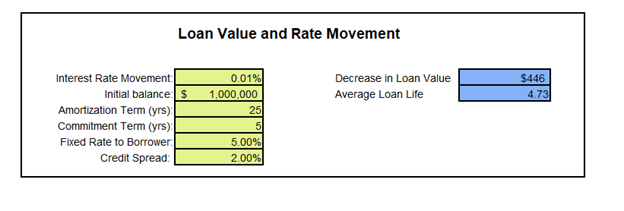

Each basis point increase in COF decreases the lifetime value of a fixed-rate loan to a bank. The longer the fixed rate, the more sensitive the EVE. The output below shows the economic value of a 1bp increase in COF for a 25-due, five-year fixed-rate loan. That value is $446. We can calculate that value for different structures.

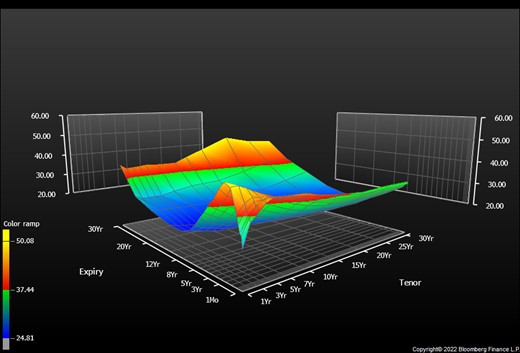

The next step is to model how far rates may move up or down to incorporate the risk of EVE into the bank. For that, we use the volatility surface of interest rates for different maturities. A graph of the volatility surface is shown below.

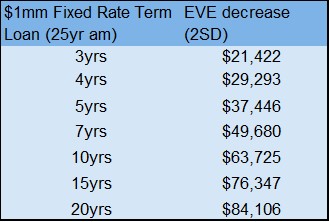

From that volatility surface, we can calculate the probabilities of rates rising or falling and their impact on the EVE of a fixed-rate loan. We use two standard deviation rate movements to measure EVE, as that confidence level is common for value-at-risk measurements for most banks. The table below shows the EVE of various fixed-rate loans with two standard deviations increase in interest rates and COF.

What this table shows is that a two standard deviation increase in rates decreases the EVE of a $1mm five-year fixed-rate loan by $37,446, or about 3.7% of the loan amount. The value of a 20-year fixed-rate loan decreases by 8.4% under a similar EVE calculation. Another way of stating this is that a $1mm five-year fixed rate loan is worth only $962k to the bank after the EVE adjustment.

Most bankers will point out that these fixed-rate loans protect the bank when interest rates are falling, as they may do in the future. However, that is not what happens empirically. Because few of these term loans have prepayment provisions, and almost none have enforceable prepayment provisions when collateral is sold, when interest rates fall, the vast majority of credit-worthy borrowers simply refinance their loans. This has been the pattern in almost every decreasing interest rate environment. The upshot is that banks are creating negative convexity in their loan portfolio – allowing borrowers to refinance fixed-rate loans when rates are dropping and getting extended on fixed-rate loans when rates rise.

Conclusion

In past articles, we have talked about the credit, sales, repricing, and prepayment risk of five-year adjustable rate loans (HERE). Much of that risk applies to five-year fixed-rate loans as well.

The five-year fixed-rate loan worked when central banks tried to outdo each other with monetary and quantitating ease. It appears that that chapter of financial history is now passing. Moreover, with the expectation of central banks rapidly draining liquidity in the banking industry, this is not the right time to extend loan duration. Community banks must create a solution that can work for the borrower and the bank’s balance sheet.