How to Better Advise Commercial Clients About Rates in 2024

Many economists and analysts predict that the Federal Reserve and other central banks will start easing monetary policy in 2024. Many bankers and borrowers are convinced that a recession is imminent despite no clear evidence for such a conclusion. How should lenders discuss interest rates in 2024, and what advice should relationship managers provide their clients about banking products? First, we believe the market to be a poor predictor of future economic states. Second, we believe that relationship managers understand banking products that can help their clients, and good bankers have an insight into their clients’ businesses; therefore, bankers should advise in areas of their purview and expertise.

Why Forecasts Are Often Wrong and Rates in 2024 Will Be Difficult to Predict

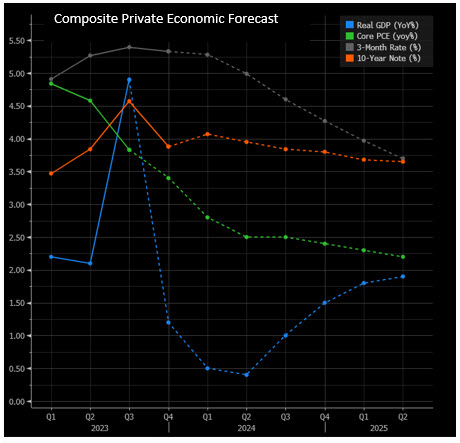

Below is a graph of the composite private economic forecast for the US economy for the next two years (in dotted lines), showing real GDP growth, core PCE, and 3-month and 10-year government interest rates.

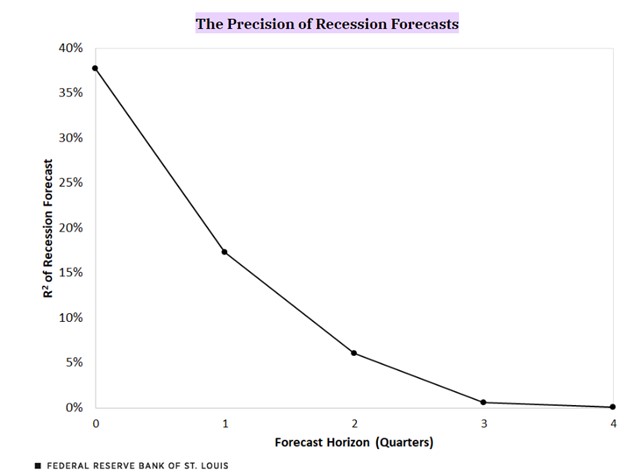

Despite GDP forecasts above zero percent, economists, on average, are forecasting a 50% probability of a recession in 2024. A recent 2023 paper from the Federal Reserve Bank of St. Louis studied the predictive prowess of economists. The paper concludes that quarter-ahead recession forecasts are fairly accurate, but the economists’ precision of forecasts beyond one quarter falls dramatically. The graph below shows the precision of recession forecasts over a four-quarter forecast horizon. Forecast precision falls dramatically from an R-squared of 38% in the first quarter to just 0.1% for the four quarters ahead. Economists can barely predict major economic developments beyond one quarter.

We often hear from talking heads that 2024 will shed more clarity on the economy, but this is not true. For every turn of an economic corner, there will be many more unknown corners. Therefore, we can expect no more clarity in 2024 than in 2023.

Why Forecasts Are Inappropriate For Clients

Forecasts typically extend to one or two years – even though anything beyond one quarter is a guess. Unfortunately, even a one or two-year forecast does not fit commercial clients’ time horizons. The average deposit expected life is seven years, the average commercial loan is four years, and the average expected life of a significant commercial banking relationship is almost 10 years. Therefore, maximizing value for the borrower and the bank cannot be done by predicting the economy, interest rates, liquidity, and market pricing over a short period when the expected life of the relationship is so much longer. Taking advantage of predictions for the next quarter or two may eliminate the optimal choices for the next 10 years.

How Bankers Should Advise Clients About Rates in 2024

We believe there are four broad areas where bankers can advise clients that are not predicated on trying to predict the future.

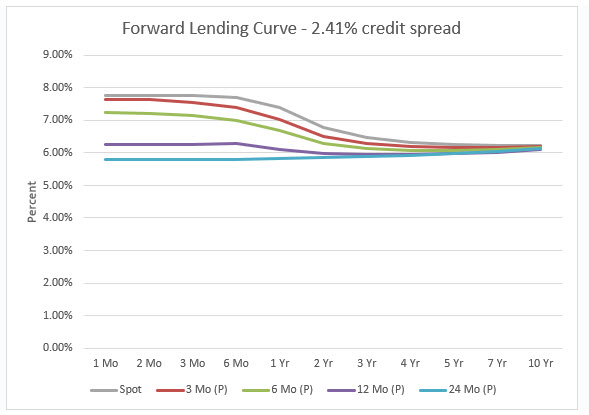

- Bankers must be able to present the current (spot) and forward interest rate lending curve to clients. No one can predict the future accurately, but using market expectations is the best place to start. Below is a graph showing the forward lending curve from one month to ten years using the same assumptions we made for the spot (current) yield curve. Based on the market’s expectations, this graph shows the borrower’s expected loan rate for various loan terms in three, six, 12, and 24 months. A good lender should be able to produce a similar graph or convey this information in simple terms when discussing rates in 2024.

- Bankers should also make borrowers aware that the market represents our best estimation of where interest rates will be in the future, but the market is consistently wrong. The lending curve above is the best measure of expectation, but borrowers must factor in dispersion around the forecasted mean. That dispersion is about 95bps for one standard deviation in today’s market. Therefore, borrowers should consider the consequences and their options if rates are 190bps (two standard deviations) higher or lower than the forward curve predicts.

- Bankers have a good insight into their client’s business models and personal goals. Bankers should focus their advice based on this knowledge. What would happen to the borrower’s business if rates are higher or lower by 190bps? Would the borrower qualify as a bankable credit, would the borrower’s liquidity change? How would rate movement affect the borrower’s balance sheet, cash flow, and income? The second parameter is the expected timeline for financing. For example, suppose the borrower wants to finance the business for the foreseeable future, or is intent on growing the business and expanding, or has succession planning. In that case, the financing maturity should more closely match the longer duration of those needs.

- Bankers may have and share a view of the economy, but they should not try to sell their views to their clients. The focus should be on helping prospects and clients understand their needs and risks and provide insight into the borrower’s business and how the bank’s product can reduce the borrower’s cash flow risk and increase profitability. Trusted advisors will suggest another bank’s product if that is a better solution for the client.

Conclusion

We do not believe that 2024 will be a year that provides any more clarity on the future for bankers and borrowers. There is no reason that another quarter or year will shed light on future events that are impossible to predict. We believe that effective and successful community bankers are foremost trusted advisors. Since we have not met anyone who can predict the future, when talking about rates in 2024, lenders should focus on helping borrowers understand what can be more easily forecasted. Lenders provide the best value by analyzing the borrower’s balance sheet, cash flow, and liquidity positions and offering products to help borrowers reduce business risk and increase profitability.