How Upsell and Cross-sell Impact ROE

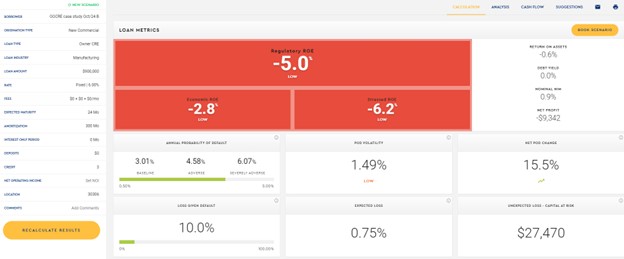

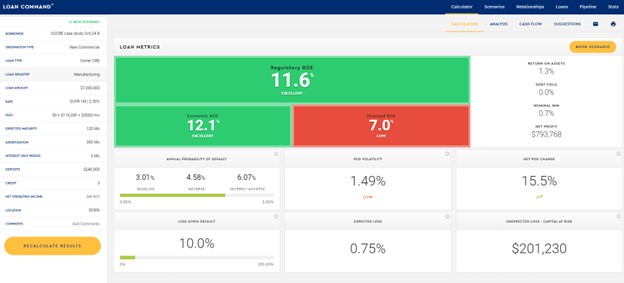

We recently worked with a community bank in the Southeast that wanted to win a piece of credit business for a manufacturing company. The manufacturing company had a long-time relationship with a national bank and the community bank lender was struggling to make inroads with the company’s CEO and owner. The CEO finally agreed to let the community bank make a pitch on $900m acquisition financing facility. The CEO indicated that to be competitive, the community bank needed to provide the loan at or below 6.00% fixed rate. The regulatory return on equity (ROE) for that loan would have been a negative 5.0% and the community bank was struggling with the viability of this transaction. Luckily, the community bank is using a risk-adjusted return on capital (RAROC) loan pricing model and using the power of cross-sell, upsell, and capital market understanding, the community bank was able to win almost the entire banking business of the company and generate an 11.6% regulatory ROE.

Upsell and Cross-sell

Upselling is defined as selling the client more of the same product in quantity, volume or time. In the banking industry, the time factor is extremely important. The upsell may occur at the initial purchase or subsequent purchases. Again, unique to banking, the subsequent purchases are crucially important to profitability. Cross-selling, on the other hand, is defined as selling the client additional complementary products or services. Again, banking is a special industry where some products may appear profitable and are not, or vice versa. Being able to quantify profitability and identify profitable customers is key to using upsell and cross-selling techniques in banking.

Analysis shows that the most profitable commercial clients at banks buy more than one product at those banks, and there is a strong positive correlation between profitability and number of products sold and the bank’s size of customer wallet. The banking industry is unlike many other industries when analyzing how cross-sell drives profitability. For the banking industry upselling and cross-selling has a high and disproportional impact on profitability. With proper tools and strategies, community bankers can upsell and cross-sell their products to maximize profitability.

The initial $900m loan proposal at 6.00% fixed resulted in a negative 5.0% regulatory ROE – an unacceptable return for a transactional piece of business. The RAROC output appears below. The low return is driven by the small loan size, low yield, short-term commitment (two years), no prepayment provisions, and no cross-sell business.

Here is what the bank did instead – the community bank pitched for the entire banking relationship, which included deposits, treasury management, and some investment services. The bank offered a 10-year loan commitment to increase revenue and enhance ROE, with embedded prepayment provision to increase expected lifetime value, and the bank gained hedge fee income. The bank made the financing conditional on the company’s treasury management and wealth investment business. Finally, the bank made the case that now was the time for the borrower to consolidate and term-out debt given level of interest rates and amount of uncertainty. The borrower was able to obtain the financing at just over 6.00% fixed rate (for 10 years) and the community bank was able to generate 11.6% regulatory ROE, with a growing local manufacturing company that had plans for future expansion and acquisition – further driving the community bank’s opportunities for upsell and cross-sell. The final structure’s RAROC loan pricing output appears below.

The Math

It is important to understand which cross-sell, upsell, or loan structuring creates or detracts value from the community bank’s ROE. The table below explains what drove the bank’s regulatory ROE from negative 5.0% to 11.6%.

| Cross-sell, Upsell, Structure | Results |

| Increase loan size to $7mm | Increasing the revenue base resulted in an increase of ROE from negative 5.0% to positive 2.0%. The bank’s fixed overhead costs for new loan booking makes larger loans more profitable. |

| Increase commitment to 10-yrs | Increasing the loan commitment term to 10 years increased ROE from 2.0% to 5.3%. Longer repayments result in longer revenue stream and ability to recapture upfront booking costs. |

| Embed prepayment provision | Prepayment provisions increase stickiness of the loan, resulting in a longer revenue stream and more cross-sell and upsell opportunities. In this case, we only captured the expected longer loan life resulting from a symmetrical prepayment provision, and this increased of ROE from 5.3% to 6.6%. |

| Deposits | This is one of the best cross-sell opportunities for community banks, and while the borrower diligently manages liquidity, the business requires about $240m in ongoing DDA balances. This cross-sell increase ROE from 6.6% to 7.2%. |

| Hedge fee income | The bank was able to offer an attractive fixed rate to the borrower through a loan hedging program at 2.50% credit spread. The bank also recognized a $116m upfront hedge fee, and this increased the ROE from 7.2% to 8.4%. |

| Investment and Treasury Management | The community bank was also able to generate almost $3m/month in additional fee income. While not every bank will have this fee opportunity, this cross-sell increased ROE from 8.4% to 11.6%. |

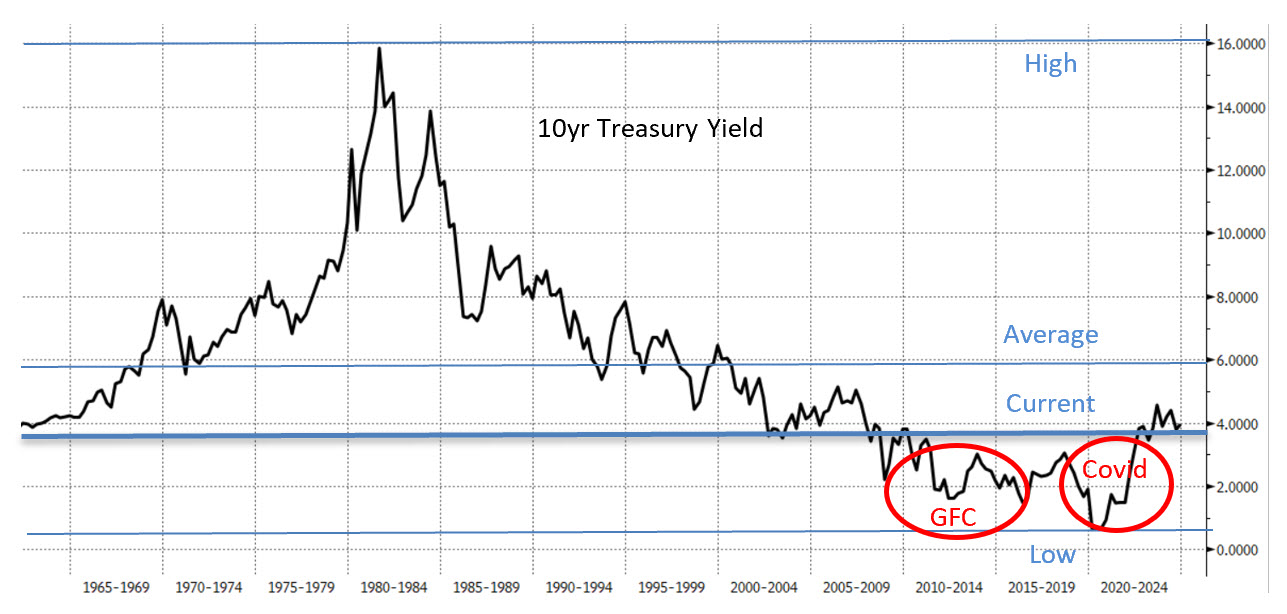

The lender at the bank used the graph below to explain to the borrower that while the Federal Reserve may be cutting short-term rates, long-term rates have approached their bottom compared to historical levels. The graph below shows the ten-treasury yield over the last 50 years. The average 10-year Treasury yield over the period is 5.83%, the current level of 3.91% is low in comparison (especially considering the extraordinary periods of the great financial crises and the Covid pandemic). The borrower is in the business of manufacturing and is looking for future acquisition targets. This financing will allow the borrower to add cash, substitute collateral on existing or newly acquired business, and retain the locked rate for the contractual term. This was a selling feature that compelled the borrower to go with the community bank. A banking relationship is a two-way commitment – both lender and borrower need to commit for a long term to make the relationship profitable for the bank.

Conclusion

Bankers that can press and pull the various levers of their product offering and see the ROE results will be able to outcompete their peers that do not have that ability. There are many moving parts to a banking relationship, and having the ability to creatively structure a value-added solution for borrowers results in more profitable and more enduring business relationship. Every community banker should have the tools at their disposal to measure the ROE and how various cross-sell and upsell opportunities influence profitability.