4 Winning Loan Tactics to Improve ROA

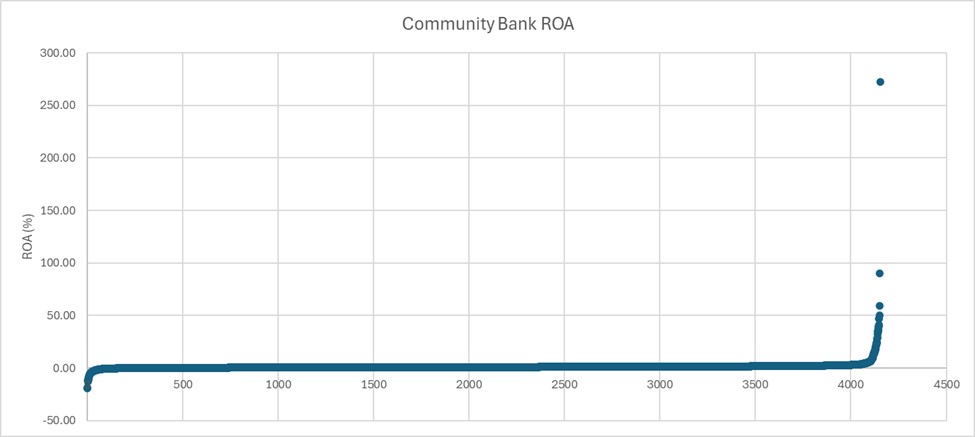

In Q2/24 the average return of asset (ROA) for community banks (under $10B in assets) was 1.08%. But within the community banking sector, performance varied among banks significantly and a large swath of banks need to improve ROA. While the average ROA was 1.08%, approximately 5.7% of community banks reported negative ROA. Another 16.2% of community banks reported a positive ROA of less than 0.50% – these are troubling results because the economy is growing, and non-performing assets are low by historical comparison. The bottom 10% of community banks averaged an ROA of negative 0.92%. However, the top 10% of community banks averaged an ROA of 6.62%. The ROA distribution for all community banks is shown in the graph below.

There were more outliers on the right side of the graph than on the left side. Such wide dispersion of performance, especially during a benign credit environment, demonstrates that some community banks can implement and execute on an effective business strategy. In this article, we distill what we believe are the top four strategic competitive advantages for community banks to outperform the market .

4 Winning Tactics to Improve ROA

Community banks that seek higher-yielding credits rarely outperform the market, and instead originate smaller average loan size, lesser credit quality, shorter lifetime value, fewer relationship cross-sells, and, ultimately, lower profitability. Instead, community banks that differentiate themselves from the competition are often able to outperform the market. Those banks that operate in affluent markets and target well-heeled clients benefit even further.

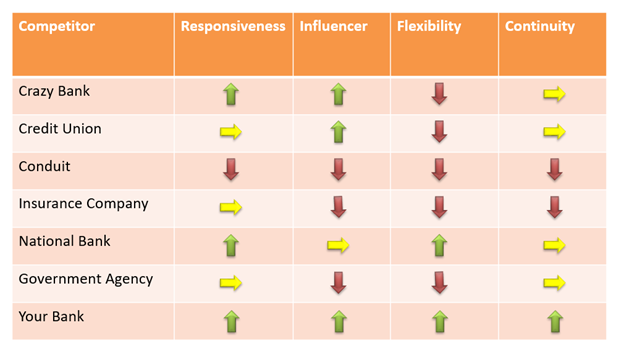

We identify four attributes that community banks utilize as a strategic competitive advantage. These four significant attributes can be successfully used to differentiate a community bank brand against competitors in the market. Borrowers find these four attributes valuable, and borrowers are willing to pay above market rate to purchase these attributes. It is important for community banks to support these four attributes, express to clients why they are valuable, and explain clearly to staff how these attributes are delivered to clients.

Community banks that can effectively differentiate themselves from competitors on these four attributes and deliver these attributes consistently to customers will improve ROA. The table below shows the four attributes and the possible positioning of these attributes against six conventional competitors.

- Responsiveness is the time a bank takes to accomplish an action that has an impact on the customer. That action can be the time to underwrite a credit, to produce a term sheet, to draft closing documents, or to fund a loan. Here community banks have a distinct advantage against much of the competition. Being smaller and nimbler, community banks can typically react faster than credit unions, conduits, insurance companies, and government agencies. Borrowers value certainty and a quick decision-making process. Community banks should benchmark timelines for each of the tasks listed above based on competition in their market. We work with high performing banks that can produce a term sheet within a business day of receiving the necessary borrower financials, take four business days to underwrite and approve a CRE or C&I credit (subject to necessary appraisals), take one business day to generate internal loan documents and can fund a loan within five business days from acceptance of the term sheet. On the other end of the spectrum, we see community banks that take three to four months from a commitment to funding. Your competitors for this attribute are the regional and national banks that have become very quick to commit borrowers and fund loans, as long as the loan fits neatly in their lending “box.”

- Influencer describes how the borrower can advocate and be heard for their credit needs. If the borrower can sit down and describe their business plans and needs to the decision-maker of the bank or take the credit officer on a tour of the factory, then the influencing factor is high. Here community banks have a large advantage over most of the competition, but credit unions and some larger banks may also excel in this attribute. Community banks understand their borrowers because they are so close (geographically and business relationship) with their borrowers. Borrowers like the local nature of a community bank decision-making framework and community banks need to broadcast this attribute to their customers and prospects. Especially during economic slowdowns and recessions, which vary by region and county, understanding the local impact is a big advantage for community banks.

- Flexibility describes the potential of the bank to work with a borrower even if the relationship does not fit perfectly into the bank’s business model or if the relationship changes because of credit issues. This is a fundamental attribute that community banks must not squander. One of the identified competitors is “Crazy Bank.” What we mean by this term are banks that make non-rational credit decisions. Many of these banks will be sidelined by the next recession and their ability to provide ongoing credit and liquidity needs to their customers will be tested. Healthy community banks can still be flexible working with borrowers in good times, and tough times. High performing community banks work with their relationship clients to help them make it through the next challenging economic period.

- Continuity describes the consistency of the relationship between borrower and lender. Here again, community banks can have an advantage. Borrowers like to deal with lenders that understand their business and have developed a trusted relationship. Borrowers do not want to educate a new lender on the job every couple of years because the bank is rotating relationship managers or because of employee turnover. National banks are notorious for this mistake. Further, if the economy in a specific geography takes a downturn, national banks, insurance companies, and conduits have the luxury of re-allocating capital to other geographies that demonstrate better. However, for better or for worse, community banks are tethered to a local community and do not move to other states. This certainty of relationship and consistency creates substantial value for borrowers.

Conclusion

The community banking model is not broken, and while the number of community banks is shrinking, many high-performing community banks will remain. To improve ROA, banks need to focus on making relationship more profitable and their bank more relevant. We have witnessed that community banks that can demonstrate to customers their excellence in the four attributes described above can obtain above-market return for the same loans, deposits, and fee business offered by their competitors. These attributes when properly positioned, explained to clients, and executed, can give community banks significant pricing advantages over its competitors.