The Impact of Reciprocal Tariffs on Community Banking

“Liberation Day” brought a 10% baseline tax on all imports plus a 15% to 49% tariff rate on a defined set of nations (below). The move shook the markets, threatening to upend much of the architecture of the global economy and fueled broader trade wars. The recent uncertain shifts in trade policies, particularly increased tariffs on imports from China, Canada, and Mexico, have introduced specific uncertainties for community banks. Tariffs can have unintended consequences such as increased inflation, and decreased GDP growth and employment. However, for community banks, these challenges can also present some opportunities. Community banks clients often serve local and national business, and community banks will see opportunities to strengthen and expand partnerships with these clients.

In the coming days and weeks it will be interesting to see how this plays out. On one hand, these tariffs could touch off another round of retaliatory tariffs and responses forcing the Administration to further double down and sending the economy into a recession (or a further recession depending on the numbers). Trade partners may band together wanting to cause the U.S. more market pain. An emergency rate cut now becomes a possibility.

On the other hand, game theory would indicate that you want to be one of the first trading partners to strike a bilateral trade deal. No one benefits from a trade war and forcing the U.S. into a deeper position only hurts your economy more if you are a major trading partner. When you consider the method these tariffs were calculated (off the percentage of trade imbalance for just goods), and some of these tariffs apply to uninhabited locations such as the Heard Islands, you might conclude that this is more style than substance, find it easy to strike a trade deal and the markets come roaring back.

Regardless, we will be experience and talking tariffs for the foreseeable future and this talk will bring volatility to the markets and uncertainty.

Impact of Tariffs

There is no sugarcoating the obvious. Tariffs are taxes imposed on imported goods, increasing their prices for domestic consumers and businesses. In an interconnected global economy, tariffs not only affect international trade but also have effects on national inflation and economic growth.

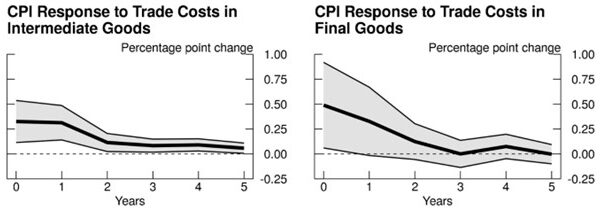

According to research from the Federal Reserve (here), increased trade costs, particularly on intermediate goods, lead to persistent inflationary pressures. Intermediate goods—such as semiconductors and raw materials—are essential inputs for production. When tariffs drive up their costs, businesses pass those costs to consumers, leading to higher prices for goods and services. These studies suggest that a 10% increase in tariffs for intermediate goods leads to a 0.3% rise in CPI inflation within the first year and this inflation effect can last for over five years. In contrast, the same increase tariffs on final goods, can cause 0.5% CPI inflation within the first year, but this inflation effect has a shorter impact of about three years (see graphs below).

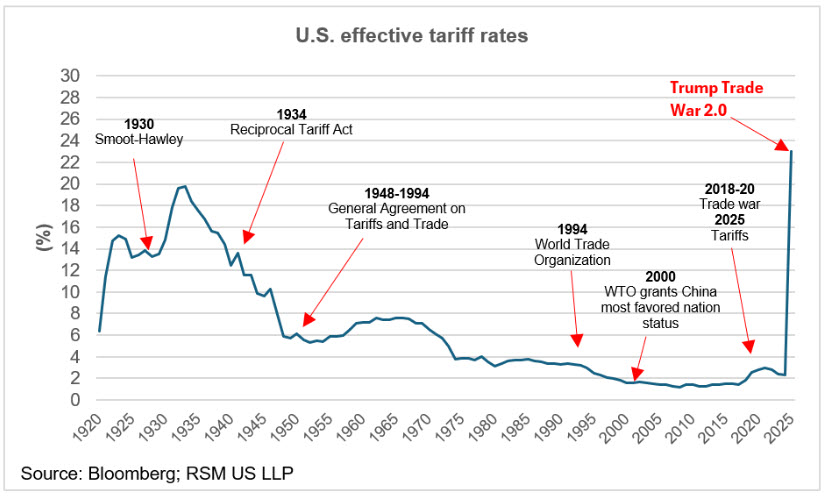

The impact of a trade war on GDP growth can be significant. These are the highest effective tariffs we have seen in modern history. Should they remain in effect, a prolong trade war with Canada, Mexico, and China could reduce GDP growth, especially if expanded to European imports (modeling by RSM economists indicates 0.3% to 1.0% growth decrease over 12 months).

Employment effects of tariffs are more complicated to predict. But historical evidence from the 2018–2019 tariff increases shows that U.S. manufacturing employment was negatively impacted, particularly in sectors dependent on Chinese imports. Rising production costs led some companies to downsize or relocate operations outside the U.S. Additionally, the tariffs’ effect on inflation eroded real wages, as higher prices for goods reduced consumers’ purchasing power. However, tariffs can protect targeted domestic jobs, especially those that compete directly against international imports.

Trade policies that lead to retaliatory tariffs from trading partners can lead to more severe economic repercussions in inflation, GDP growth, and employment.

There is also the element of uncertainty. Pharma, lumber, semiconductors and other critical sectors were skipped but rumors are that is only because sector specific tariffs have yet to be finalized.

Monetary Policy and Tariffs

The Federal Reserve’s dual mandate of price stability and full employment becomes challenging in an environment where both inflation and unemployment increase. The forward markets are now grappling with pricing the Fed’s response to potential consequences of a prolong trade war. In the short run, we look for equity markets to turn bearish and Treasury bonds to rally.

However, if tariffs lead to persistently higher inflation, the Fed may respond by tightening monetary policy and this could lead to a prolonged period of stagflation. The worst-case scenario for the banking sector may be low (likely negative) GDP and rising borrowing and funding costs. Absent trade negotiations leading to easing of tensions, banks should be prepared for sustained inflationary pressures and a slower growth trajectory.

Opportunities for Community Banks

Tariffs aim to encourage domestic production and reduce imports, and this especially reflects on small businesses, which make up the majority of community banks’ clients. We covered in detail the 6 Steps to Be a Better Trusted Advisor During This Trade War but here is a recap of the business development opportunities where community banks can focus:

- Lending and Credit: As businesses face cost pressures from higher tariffs on raw materials and goods, they may need additional financing to manage cash flow and maintain operations. Community banks can offer short-term and bridge loans to help clients cover increased costs until supply chains stabilize and working capital loans to support clients in managing operational expenses amid fluctuating costs. Community banks’ more personalized approach to lending decisions can offer tailored solutions to businesses that might struggle to secure financing from larger banks.

- Expansion and upgrade: Tariff wars often push businesses to seek domestic suppliers to reduce dependency on international trade. This shift creates an opportunity for community banks to support businesses in reshoring manufacturing operations, investing in local supply chains, or expanding domestic production capabilities.

- Promote Local Economic Development: A tariff war can shift economic dynamics in a local region, leading to potential growth in domestic industries. Community banks have an opportunity to collaborate with local governments, economic development agencies, and trade organizations to support initiatives that promote local businesses. Community banks can anticipate incentive programs and government credit support that encourage businesses to invest in local supply chains and production. There will also be opportunities for public-private partnerships to drive regional economic growth and job creation.

Conclusion

It is still too early to tell how this trade war will play out. Undoubtedly, many nations will respond in kind and many will posture and capitulate. China could devalue its currency again. Volatility will surely spike and markets will be unsettled. These gyrations mean that now is the time to talk to customers.

We are not advocates of fabricated uncertainties that lead to wait-and-see business responses because this strategy can often lead to self-inflicted economic wounds. We are also pro-growth and believe that policy tools should be used to promote long-term economic growth and prosperity, and that growth is not a zero-sum game on an international arena. Broad-based tariffs do not lead to an environment that fosters economic stability, competitiveness, and long-term growth.

While a tariff war presents economic uncertainties, it also creates significant opportunities for community banks to deepen relationships with local businesses, offer strategic financial solutions, and support domestic economic growth. By positioning themselves as essential partners to small and medium sized businesses, community banks can expand their market share, drive long-term community development, and reinforce their role as pillars of local economic resilience.