What We Learned At Our Lenders Lunch

For the last few years, SouthState Bank Correspondent Division has been hosting lender lunches across the country. At these events, we invite local executives and lenders to discuss what drives community bank performance, we highlight challenges and opportunities for community banks, bankers have a chance to network over a short period (and eat lunch), and most importantly, we provide key tools and concepts that bankers can implement immediately to increase performance and outcompete larger banks. We would like to describe the key takeaway from our recent event and we would like to offer our lender lunch in your location – just ask us to come to your town next.

Lenders Lunch Material

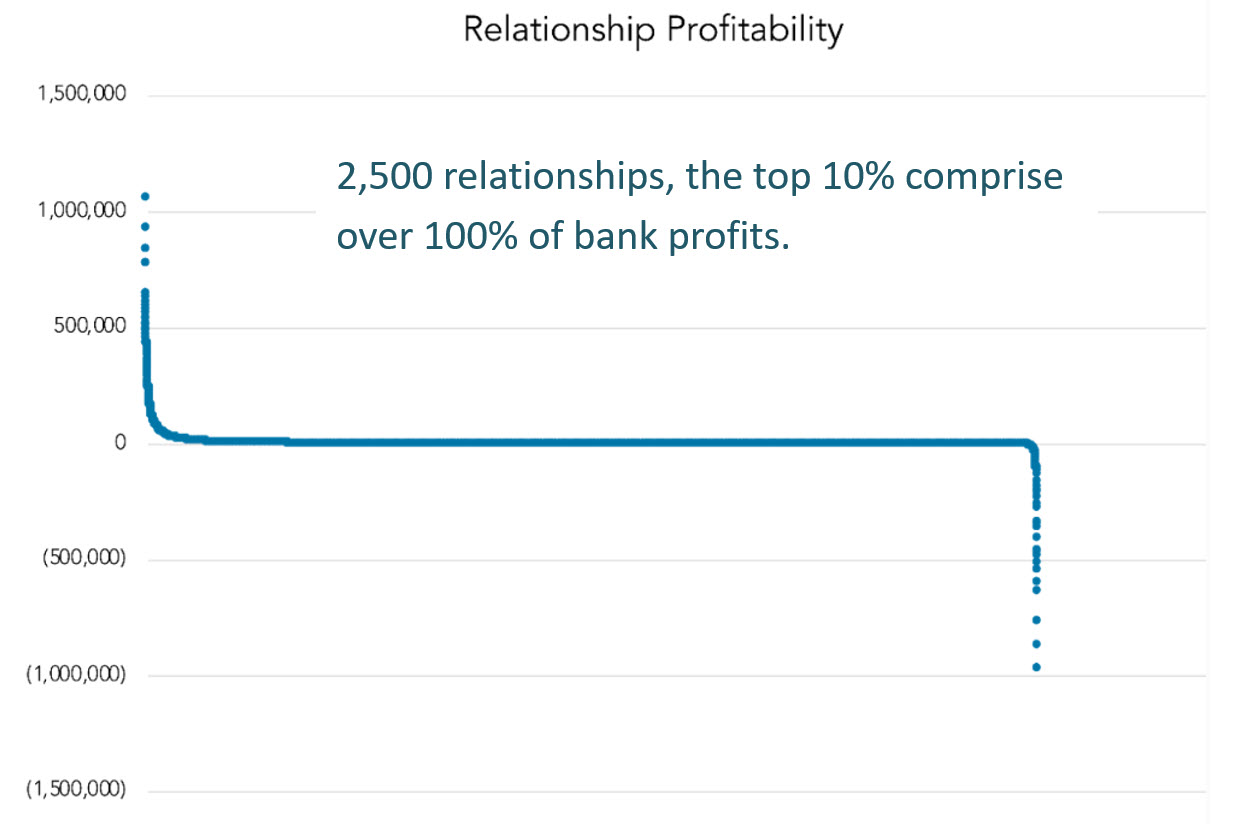

We typically host these lunches for 10 to 20 banks and have anywhere from 20 to 40 bankers in attendance. However, we have also agreed to host the event for a single community bank with their executive and front line staff. At our lender lunches, we host C-suite, lenders, strategists, and deposit officers for one to two hours. We start our sessions by describing the banking landscape, the competitive environment, and the current opportunities for commercial credit and deposit gathering. For example, we highlight that the 80/20 profitability rule does not apply in banking. Instead, for most community banks, 120% of profits are generated by 10% of clients, and the other 90% of customers deliver negative returns for a community bank.

The key for community banks is to be able to measure and identify profitable commercial clients, products, regions, and portfolios so that profitable clients are retained, and unprofitable ones can be cross-sold, upsold. Below is a graph showing a distribution of profitability for 2,500 commercial relationships at a community bank. The clients on the left side are highly profitable for the bank, the clients on the right side are highly unprofitable, and the clients in the middle of the graph contribute little to profitability.

We outline how the competition (including SouthState Bank) is pricing and structuring loans and deposits and how certain banks manage to generate outsized fee income. We then compare the performance of the banks in attendance with various peer groups.

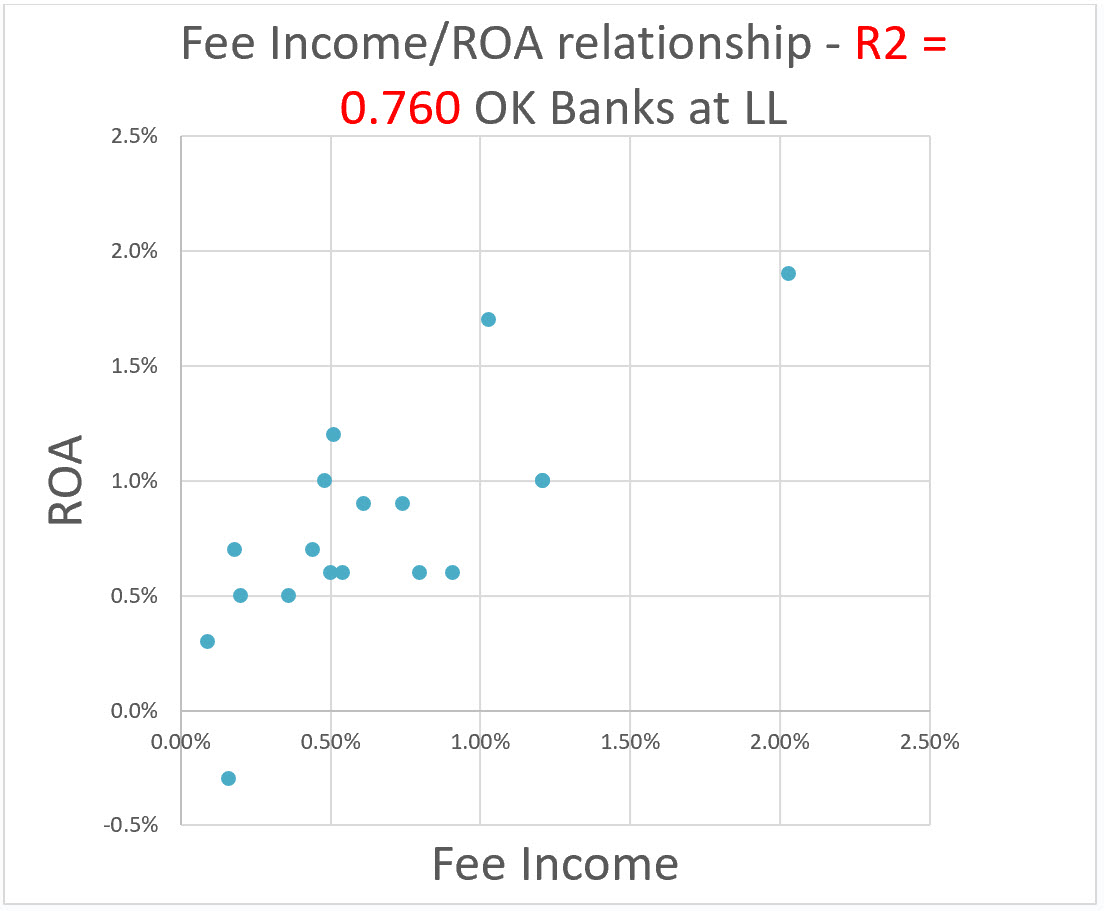

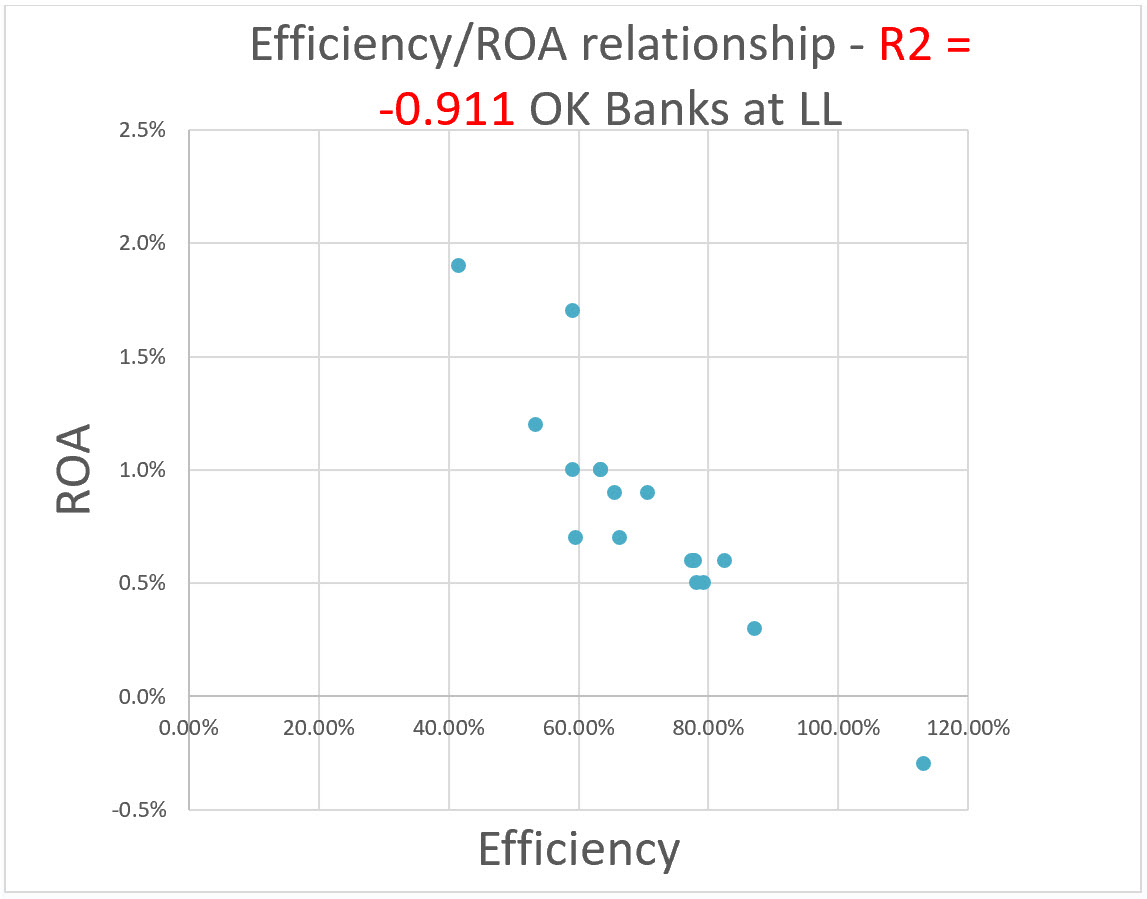

Next, we show what variables bankers can adjust to drive performance (ROA/ROE) – we look at net interest margin (NIM), asset quality, deposit mix, yield on earning assets, asset and liability duration, efficiency ratio, and non-interest income, and we superpose the current yield curve to highlight current opportunities.

For example, below are two graphs from a recent lender lunch showing the relationship between ROA, fee income and efficiency ratios for the 17 banks in attendance. These graphs were then followed by concrete ways that the bankers in the room can immediately implement tools to increase fee income and decrease their efficiency ratios.

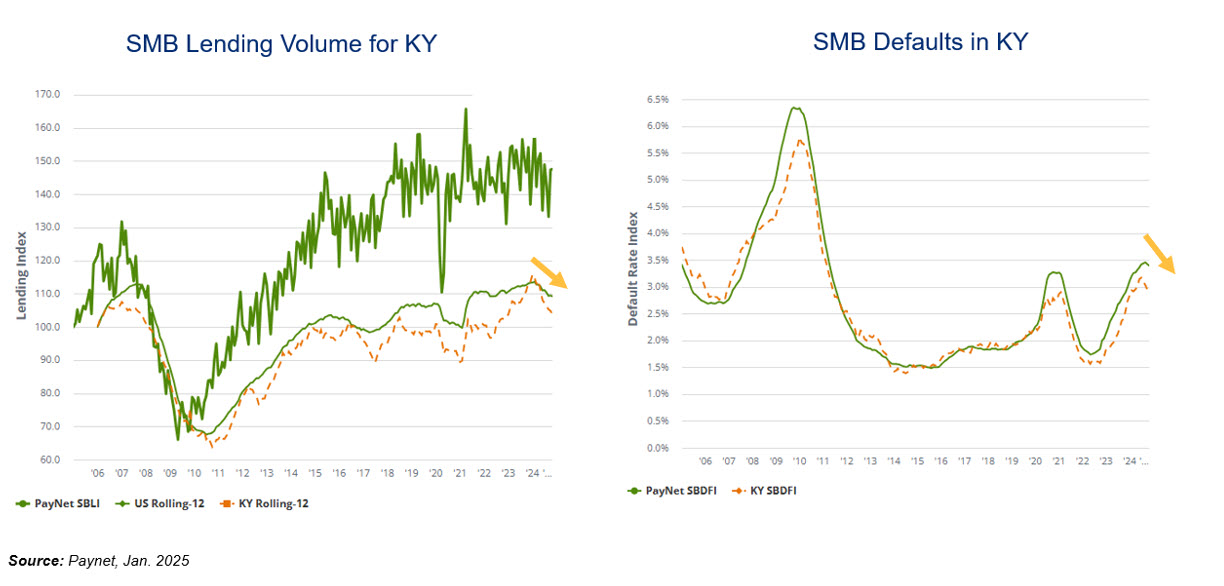

At most of our lender lunches, we also touch on three key concepts that all bankers should be familiar with: risk-adjusted return on capital, fund transfer pricing, and risk-reward tradeoffs. We then dive into key credit and pricing trends in the region or city that we are attending. For example, for the recent event in Kentucky, we discussed lending volumes and default rates in that state (see graph below), and then went on to highlight trends in different loan categories (we usually discuss office, multifamily, retail, industrial, hospitality) and finish the credit discussion with the top and bottom credit quality NAICS industries in the state.

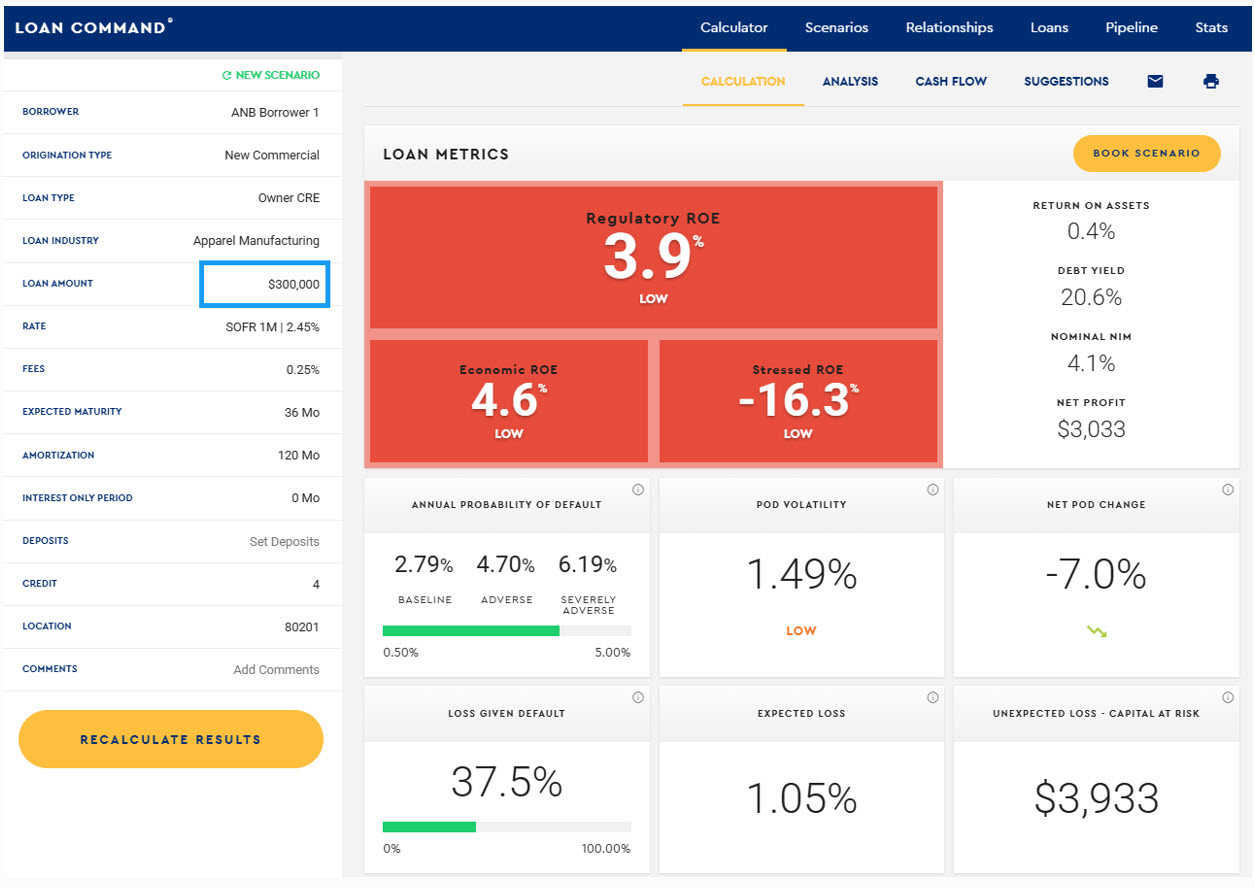

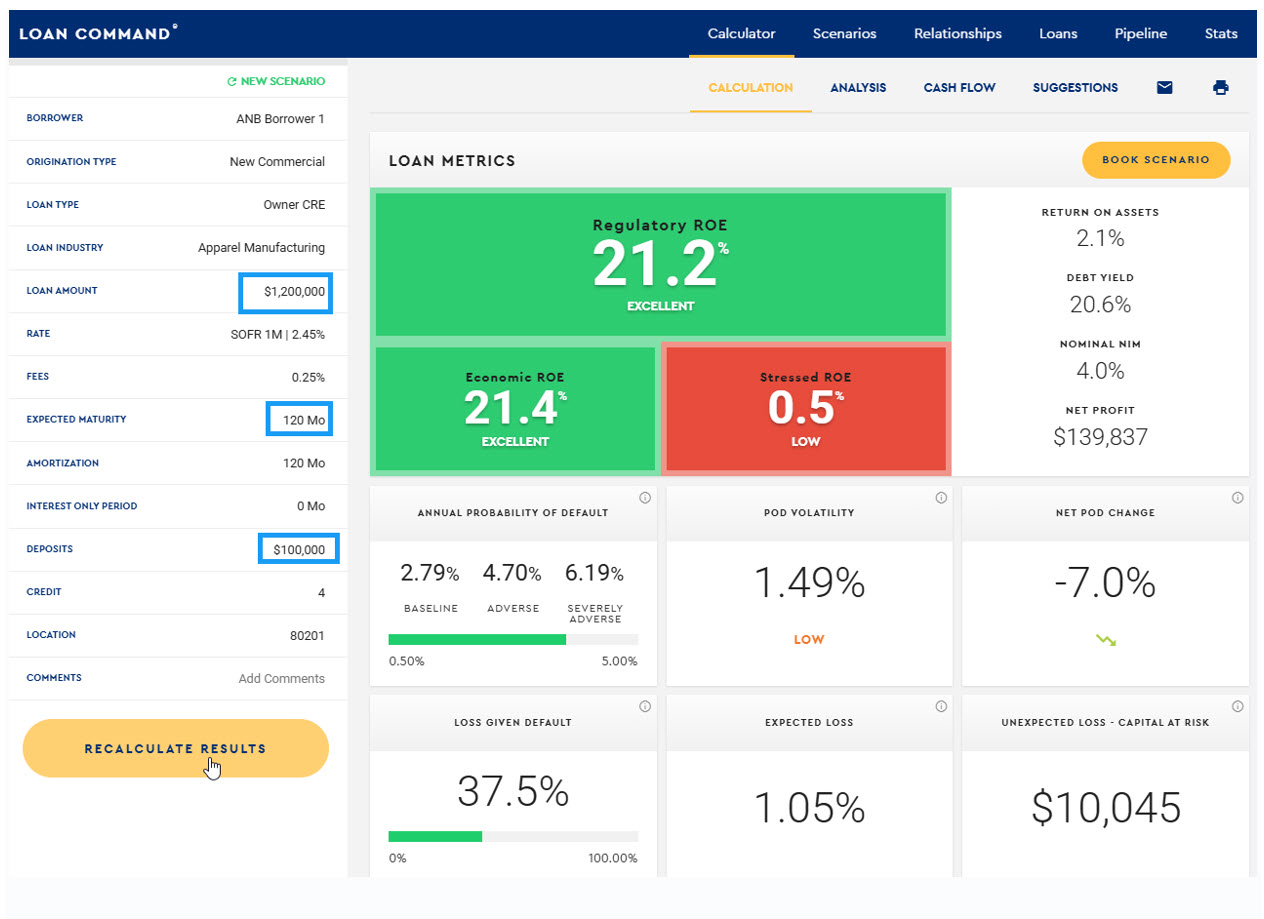

We spend some time talking about how SouthState Bank approaches pricing and credit. How SouthState relies on our Assumable Rate Conversion program to generate more fees, eliminate non-compensatable risk, and mitigate credit risk. We highlight the tools that we use (like Loan Command) to take an average credit from a 3.9% ROE and turn it into a 21% ROE by using cross-sell, upsell, fee generation, and lifetime value enhancement, as shown in the two graphs below.

However, the most essential material is shared by bankers in the room who provide ideas and feedback based on their experience and their client demand. Bankers interact with each other, ask us questions, challenge assumptions, and network with each other. The community bank landscape is a state-by-state or county-by-county market. Therefore, we feel it is important to get local and talk about local trends.

Why This Matters to You

There are ample (probably too many) banking performance conferences that are national in scope and offer fuzzy tools for community bankers. The format of our Lenders lunch is to keep things local, focused on one community bank market, and to provide immediate actionable tools that bankers can implement immediately to increase performance – without restructuring the bank, hiring new employees, or undergoing a workforce reduction. We host our lender lunches for multiple banks or a single bank (depending or requests and our availability). Let us know if you want us to attend at your bank or city.