Why Prepayment Penalties Matter in 2023

Prepayment penalties on loans always drive value. However, in 2023, loan prepayment provisions will be essential tools for commercial banks. Loan prepayment provisions lower prepayment speeds (especially in a stable or declining interest rate environment) and drive higher return on assets (ROA) for banks. In this article, while we have discussed how to sell prepayment penalties in the past, we now look at their current importance.

Why Use Prepayment Penalties?

There are four main reasons why prepayment provisions increase profitability for banks. The four reasons are as follows:

- Decrease the value of the option held by the borrower to repay the credit when interest rates or credit spreads are lower.

- Increase the lifetime value of the relationship.

- Increase cross-sell and upsell opportunities.

- Reduce negative selection bias in an economic downturn.

Options For Prepayment Penalties

Banks use four standard prepayment provisions for commercial loans. The first is a step-down, and it is by far the most common prepayment provision used by community banks. For example, on a 5-year loan, the bank may charge a 5,4,3,2,1 prepayment. The borrower pays the number (expressed as a percentage) times the loan amount corresponding to the year of prepayment. The advantage of this prepayment provision is its simplicity.

The second prepayment option is a lock-out. This provision prohibits any prepayment during a specified period. This provision is rare, but we see it utilized in municipal financing, but commercial borrowers rarely accept it. The third prepayment option is defeasance. This provision is used extensively by insurance companies and conduits. This provision is disadvantageous to borrowers and rarely correctly explained to clients. We have never seen a borrower presented upfront with a termination scenario for a defeasance – if they had, they would never take the loan.

Finally, more sophisticated banks, instead of using a prepayment penalty, use a symmetrical breakeven provision. This provision trues up or creates a neutral cost/benefit for a prepayment based on interest rate movements. From an interest rate movement perspective, the bank and borrower become indifferent to prepayment whether rates are higher or lower. The provision better aligns with the lender’s and the borrower’s interest rate sensitivity. It is a standard provision at most national and larger regional banks that offer long-term fixed-rate financing.

Which Penalties or Provisions to Use

Having some prepayment penalties or provisions in a commercial loan is an excellent first step for community banks. However, not all forms of prepayment provisions accrue equal benefits to the lender. The competitive reality is that lenders and borrowers heavily negotiate terms, conditions, and pricing for almost every loan. Prepayment provisions are straightforward for borrowers to negotiate away for two reasons – first, other competitors are willing to concede them, and second, the provision is not internally compelling to the borrower. For a lender to successfully negotiate a prepayment provision (or any loan provision for that matter), the lender must convince the borrower that the competition will also insist on a similar provision or (but preferably “and”) that the provision is in the borrower’s interest. The prepayment provision may be in the borrower’s interest if there is a direct benefit (for example, a lower rate) or an indirect benefit (for example, future portability of the loan).

Below is a paraphrased transcript of how many negotiations evolve between a lender and commercial borrower:

Borrower: Why do I need to pay you 5% in the first year (declining to 1% in the fifth year) to prepay the loan?

Lender: I can lower that to 3%, 2%, and 1% instead.

Borrower: But why is there any prepayment provision?

Lender: The bank has costs to underwrite, book and fund the loan. We cannot allow our loans to prepay just because you may find a better deal elsewhere. We have overhead costs for originating loans that are not captured by the 15bps loan origination fee that the bank charges.

Borrower: Would there be a prepayment provision if the loan were adjustable rate instead of fixed?

Lender: No, we do not charge prepayment provisions on adjustable-rate loans.

Borrower: Doesn’t the bank have the same underwriting, booking, and funding costs for a floating-rate loan?

Lender: [long pause] I’ll see what I can do.

The lender ultimately agreed to withdraw the prepayment provision because it was not defendable.

Takeaways

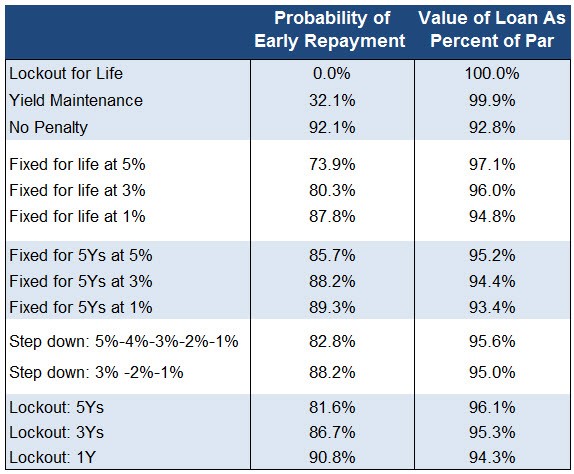

In a competitive loan market, obtaining an appropriate prepayment penalties or provision takes effort, but it is crucial for profitability. In a future article, we will consider what form of the step-down provision makes sense for banks (is a 3,2,1 on a 3-year loan equivalent to a 5,4,3,2,1 on a 5-year loan?), how to measure and quantify the value of that step-down, and how to compare the value of various step-down numbers to a symmetrical breakeven prepayment.