Stablecoin Profitability – Driving Bank Profit

As banks contemplate their strategic options for stablecoin, it is worth understanding the business model that drives the profitability of the product to make the best decision possible against a sea of unknown factors. In this article, we explore the potential profitability of a bank-issued stablecoin and the analytic model that will drive profit.

The Basics of the Business Model – The Main Driver of Stablecoin Profitability

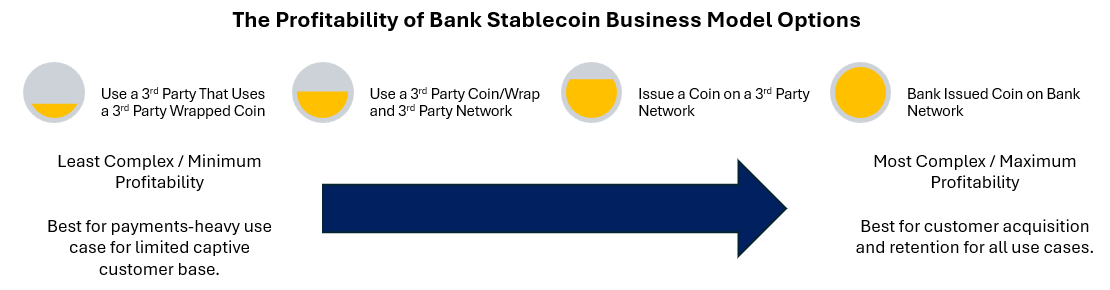

How a bank designs its stablecoin program rests on its use cases, strategy, and risk tolerance. The more volume and transactions a bank can drive, the more profitable it becomes to keep more core functions in-house.

No matter if your case is smart contract, domestic payments-based, a store of value, or a cross-border use case, the key to profitability rests on a bank’s ability to generate volume, produce fees, and arbitrage the interest in the reserve fund.

A bank can issue its own coin, join a consortium of banks to issue a single coin, wrap an existing stablecoin, use the coin of another issuer like Circle, Paxos, Ripple (etc.), or use a third party like Fiserv that wraps another coin but brings added infrastructure.

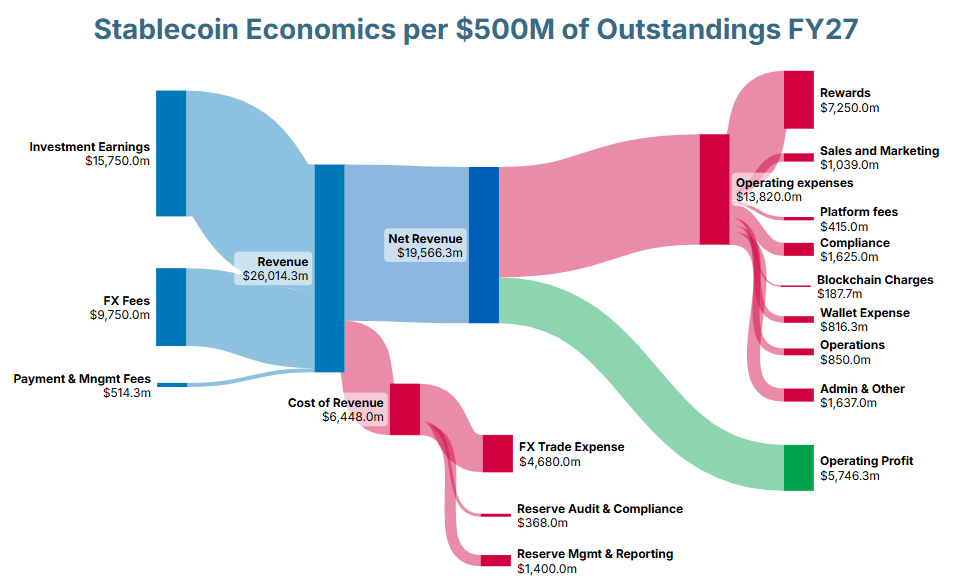

Below, we present a base-case economic model based on a $500 million portfolio of a U.S. dollar-backed stablecoin, with the bank issuing and managing its own coin, as well as managing the reserve balances.

For banks looking to partner, the economics become less attractive, but the trade-off is that the bank can reach the market faster, create more liquidity for its customers, and reduce risk by having a tested coin in the market. Partners will share a wide range of economics, ranging from 10% to 95% of the operating profit, depending on whether the bank has $10M of outstanding coin or $50B of outstanding balances.

Details of the Economics – The Five Truths

As you review the above, several concepts should occur to you. First is the interest arbitrage available from managing the reserve account and not paying interest. While it remains to be seen what the final regulations say about this, currently, non-Genius Act stablecoin issuers pay a “rewards” fee depending on volume.

Presumably, some semblance of this reward sharing would occur. This might resemble how treasury management analysis is structured today, with a straightforward fee rebate or a complimentary set of services, such as reduced foreign exchange and payment fees.

Regardless of the regulation, the fee structure should resemble, or be better than, the one above to begin with. The extent of the rewards will be based on stablecoin usage per customer. It will likely be a five-tiered (depending on average balance distribution) system similar to deposits, whereby the more stablecoin a customer has, the greater their share in the rewards. This interest arbitrage should dwarf the fee generation portion of the business.

The second aspect of economics is that until domestic programmable payment rails are more fully developed, the immediate use case for stablecoin is either as an international store of value or for global payments. Cross-border revenue will be the near-term driver of fee profitability because of the foreign exchange translation margin. The takeaway here is that in the near term, a bank’s strategic imperative rests on the number of customers it has with a non-US subsidiary or the number of payments a customer sends or receives in a foreign currency. The more international payments made, the more stablecoin balances and the more fees are generated.

The third truth to stablecoin economics is that the business is a perfect blend of fixed and variable expenses. The fixed expenses, to include compliance, licensing, infrastructure, and administration, are such that they are sufficiently high to prevent every bank from wanting to get into this business, but not so high as to prevent a bank with a sizeable international customer base from getting in. Any sized bank can enter the market, and it is likely that border-adjacent banks to Mexico and Canada, as well as banks near major international ports, can be as small as $400 million in assets and benefit from having a stablecoin.

The fourth truth is that the margins are sufficiently large to make this line of business attractive for most banks. Merchants are saving on interchange, giving banks an approximate 2% advantage against the card rails. Major brands will want to offer discounts to move funds into their stablecoin (issued by banks) to promote sales. These two factors will help lower the cost of customer acquisition for banks while the margins will be sufficient to promote sales, marketing, and product development.

Larger banks, capped by the Durbin Act, can now claim back some of the payment revenue that they had to cede. The economics are such that as rates go up, banks will be able to increase profitability both through interest arbitrage and through greater economic activity. This fits nicely into a bank’s current asset-liability framework. Further, payments, investment management, reporting, fraud management, and compliance are all existing skills and infrastructure that banks can leverage to launch the business. In essence, the bank is just taking on a new payment rail, albeit one with a tokenized asset, which will likely be its first.

Before we get to the fifth truth, it is essential to underscore the advantages of tokenized assets within a bank’s current infrastructure.

The Stablecoin to Tokenized Deposit Sweep Strategy

One strategic element of a bank-issued stablecoin is the ability to better manage deposits. Aside from the profitability, a bank can also offer a tokenized deposit utilizing the same infrastructure. By providing both a tokenized deposit and a stablecoin, a bank can better control its deposit base by efficiently moving funds between the stablecoin and a tokenized deposit.

This is done by raising the rate on the tokenized deposit so that it is greater than the rewards on the stablecoin. By making a tokenized deposit more advantageous, excess funds can flow back onto the balance sheet to be leveraged by bank operations. By lowering the rate, the reverse can happen.

This structure is similar to how banks currently utilize a money market fund sweep, but with greater efficiency (real-time funds movement) and lower costs to the customer (i.e., a higher return).

Why Containment Drives Profitability

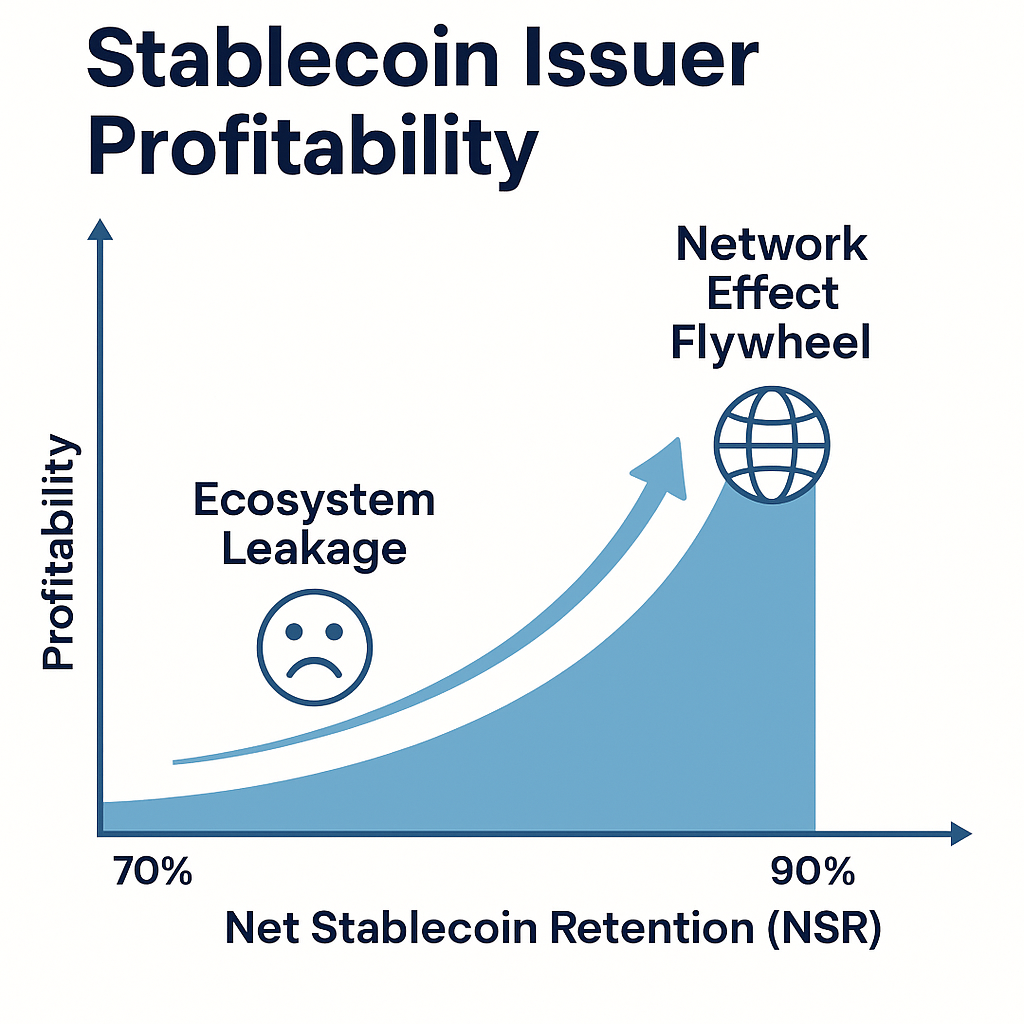

The fifth truth in the bank stablecoin model is that the more the bank keeps stablecoin outstanding, the more the bank and the holders of the stablecoin will make in the form of rewards. The multiplier effect in this business model stems from the duration and extent to which stablecoins circulate within the bank stablecoin ecosystem.

- If tokens are quickly redeemed into fiat, the bank’s ability to invest the reserve base is reduced.

- If tokens circulate across wallets, payment rails, and DeFi-like use cases within the bank’s network, the reserves remain intact, compounding profitability while transaction data adds secondary value.

In short, Issuance creates the balance, but retention inside the ecosystem creates the profit.

The KPI That Matters: Net Stablecoin Retention (NSR)

A suitable key performance indicator (KPI) for bank issuers is Net Stablecoin Retention (NSR). The NSR is the percentage of issued stablecoins that remain circulating within the bank’s ecosystem versus being redeemed for fiat.

The formula for NSR is as follows:

NSR = (Stablecoin Outstanding – Fiat Redemptions) / Stablecoins Issued

- High NSR (>90%) → Funds are sticky, the reserve portfolio scales, and profits compound.

- Low NSR (<70%) → Ecosystem “leakage” undermines earnings potential, and the stablecoin becomes a pass-through utility rather than a yield generation engine.

Tracking NSR across time gives bankers visibility into whether their stablecoin program is expanding the profit base or simply shifting deposits around.

The Analytics: Network Effects and Metrics

Stablecoin profitability is not linear. It scales with the network effect and is driven by the following attributes:

- Outstanding Volume: The greater the outstanding notional amount, the more profit a bank will make.

- Wallet Density: The more wallets a bank has inside the network, the greater the potential for transaction velocity and coin retention.

- Merchant/Corporate Adoption: As businesses accept stablecoins, redemption demand decreases, reserves grow, and fee-based services (FX, settlement, custody, and programmable payments) add to the profitability. This is the heart of the network effect.

- Interoperability within Bank Products: Integration with lending, collateral management, and payments keeps funds circulating internally instead of moving outside the bank.

The profitability curve, therefore, bends upward as adoption grows (below).

To manage NSR, banks will need to monitor the following contributing metrics:

To manage NSR, banks will need to monitor the following contributing metrics:

- Transaction Velocity (average daily transaction value ÷ outstanding stablecoin supply)

- Redemption Rate (fiat conversions ÷ outstanding supply)

- Reserve Yield Contribution (portfolio earnings ÷ stablecoin supply)

- Cross-Sell Rate (percentage of stablecoin users engaging with other bank products)

When plotted together, these metrics show whether the stablecoin program is stuck in a “low-circulation trap” or scaling into a “network effect flywheel.”

Putting This into Action

Coming up, we will be discussing architecting your infrastructure, bank consortiums, building the ecosystem, designing off ramps, working with exchanges, handling various blockchains, interoperability, security, fraud prevention and targeting the right customers. For banks, stablecoin issuance is both a foray into modernizing bank products and a profitability strategy but it needs to do many things right to be able to compete with the likes of the established stablecoins and the national banks.

The winners in stablecoin won’t be those who simply mint tokens, but those who design ecosystems where those tokens stay, move, and grow in circulation.

The base profitability of stablecoin issuance is compelling, with a clear KPI to drive long-term viability. Net Stablecoin Retention is the measure of whether your stablecoin is a balance sheet booster or just another payment instrument.