The Data – 6 Action Items to Boost Bank Customer Profitability

Customer profitability is often talked about but rarely understood. We analyzed the commercial loan portfolio of a regional bank to determine what products, scale, cross-sell opportunities, and expected life translates to profitability. The results may be surprising to some readers. The granularity of this data reflects the state of the banking industry, and the lessons learned can be incorporated by most community bankers in their daily product pricing, marketing, and sales efforts.

The Bank

Our case study is a regional bank with over $40B in assets. We reviewed over 70k commercial relationships for profits after costs and adjusted for fund transfer pricing. The products included loans, deposits, treasury management, merchant services, private wealth management, and investment services. We analyzed which products and upsell results in higher profitability for the bank. We also considered the distribution of profitability across client relationships.

Customer Profitability Results

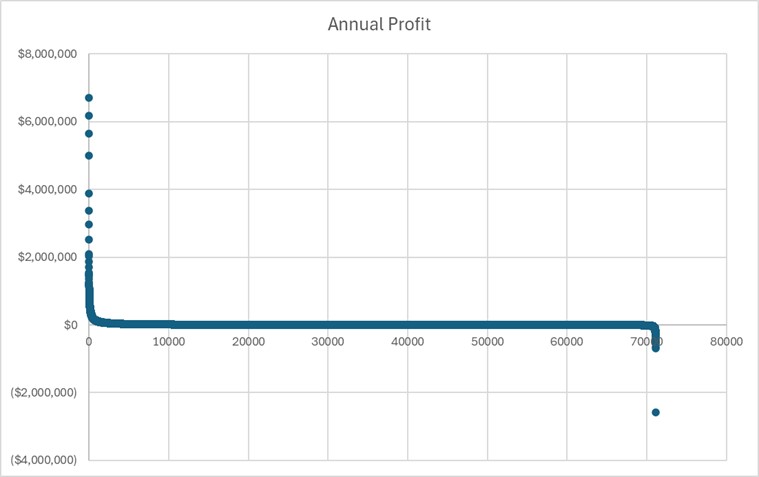

Below is a graph showing the distribution of profitability for over 70k commercial relationships at this bank. The clients on the left side are highly profitable for the bank, the clients on the right side are highly unprofitable, and the clients in the middle of the graph contribute little to profitability.

A few important observations about the data in the graph above as it related to customer profitability:

- Just 0.04% of all clients account for 10% of the entire profits at the bank, 1.56% of all clients account for 50% of the entire profits at the bank, and 7.56% of all clients account for 80% of the entire profits at the bank.

- The average commercial loan size is a little over $320k and the average deposit size is a little over $230k. These small average client relationships creates opportunities for the front line to decrease the bank’s efficiency ratio with upsell and cross-sell efforts.

- About 48% of all clients earn close to zero or negative profits for the bank. About 8.6% of all clients earn a negative profit for the bank and these clients subtract 10.3% of the sum of profitability for the bank.

- Theoretically, the bank could lose 90% of its least profitable clients and generate about 85% of its total profitability. The Bank also has 30% of all loan commitments to its bottom 10% of profitable clients – it has allocated a disproportionate amount of capital to clients that do not generate profits for the bank.

When it comes to customer profitability, the key for community banks is to be able to measure and identify profitable clients, products, regions, and portfolios so that profitable clients are retained, and unprofitable ones can be cross-sold, upsold, or transitioned to competitors.

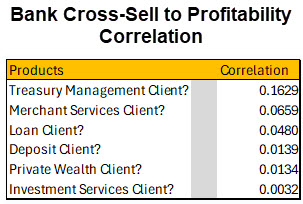

We next analyzed which products (cross-sell opportunities) were likely to be associated with more profitable accounts. This is in contrast with upselling of loans and deposits. Here we measured how any of the six bank products are associated with profitability for the bank. Our results appear in the table below.

It is clear that treasury management has the highest association with profitable commercial accounts and loans was a distant third. This is not surprising – treasury management products generates fee income, leads to lower cost and higher deposits, and extends the expected life of a relationship, which leads to more cross-sell opportunities. For many commercial accounts it will take a relationship manager two to five years to cross-sell treasury management products, but this product leads to longer lifetime value and more cross-sell opportunities. We believe that for a client to adopt treasury management services, lenders must commit the client to longer commercial loans. Commercial loans are the platform that holds clients at banks, and the longer the expected life of those commercial loans the higher the chances of cross-selling treasury management products and the higher the profitability for the bank.

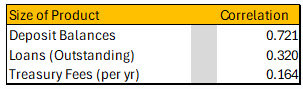

Next we analyzed the relationship between product size (a measure of upsell) and bank profitability. We analyzed how deposit balances, loan balances (outstandings), and annual treasury management fees influenced client profitability.

It is not surprising that while the existence of treasury management products leads to overall profitability for a bank, those fees, in themselves are not the driver of that profitability. Treasury management fees are modest, but lead to other cross-sell opportunities for the bank. Deposit balances are by far the highest correlated to profitability. Large deposit customers lead to more profitability than large loan customers. In fact, some of the largest loan customers account for negative profitability for the bank, and about 10% of the bank clients that have negative contribution to the bank’s profitability use over 30% of the bank’s loan capital – this is a large opportunity for the bank to increase profitability.

Putting This Data into Action

From the data, there are some clear action items for banks:

- More resources to sell and develop treasury management: Treasury management has one of the highest correlation of any bank product to profitability.

- Increase budget around deposit marketing: Deposit balance (low cost) has the highest functional correlation to bank profitability.

- Focus on customers that are payment heavy. The more payments, the more deposit balances and the more profitable the customer.

- Efficiency: Continue to improve efficiency through automation, AI, business platform improvement.

- Better loan structuring: Longer, larger, floating rate loans with more prepay protection.

- Customer Management: First, get more out of your top quartile of clients since these clients likely have more to give. Create campaigns to gain a larger share of wallet. Then work with other profitability segments on ways to increase profitability by cross-sell and upsell. Finally, let terminal unprofitable customers move to other financial institutions.

The results of this customer profitability analysis should be of interest to all community bankers. There are ample opportunities for the front line to add value by increasing lifetime value of commercial client relationships. Our study shows that the vast majority of bank profitability is generated by just 10% of clients and it is important to measure that profitability so that relationship managers can focus on retaining these coveted accounts and cross-sell and upsell to the less profitable clients. Further, the study reaffirms our belief that treasury management products are the most profit driving products for commercial accounts. Deposit upsell is the most important driver of profitability and much of a bank’s loan capital is squandered on clients that generate negative profitability for a bank. Lastly, and most importantly, we believe that longer commercial loans lead to higher bank profitability through cross-sell opportunities and lower average acquisition costs. We will be discussing these important concepts in future articles.