4 Reasons Why You Could Be Losing Money on Exception Deposit Pricing

You set deposit pricing targets, and invariably, you must deal with customers (and bankers) who want to exceed those targets. While this primarily occurs in certificates of deposit and money market accounts, it also occurs in savings accounts, analyzed transaction accounts, and interest-bearing transaction accounts. The question is – when do you grant an exception, and at what level? In this article, we provide a framework for managing exception deposit pricing and highlight what the pricing frontier looks like.

Reason 1: Your Bank Does Not Have Clear Exception Deposit Pricing Handling Goals

While understanding your goals sounds obvious, it is often not. Banks, of course, will usually articulate that the goal of granting deposit pricing exceptions is to secure the lowest-priced deposits.

However, actions usually point to other objectives. If it were just about deposit performance, then the best course of action to secure the lowest-priced deposits would be to let the customer move to another financial institution.

What bankers usually mean is that they want to – retain the client and the deposit volume at the lowest possible deposit price. This is a horse of a different color, as often the unstated goal is balancing a vague customer satisfaction level against an ambiguous set of deposit performance metrics.

A bank has four dimensions to optimize: price, sensitivity, satisfaction, and deposit volume. A bank can optimize around one or all four goals. The problem becomes more difficult as the number of goals increases, making it harder to optimize the equation.

Whatever the case, a bank should be clear on what goals it wants to achieve and what priority. A bank should also recognize that some of the goals are mutually exclusive. The higher the price it pays for a deposit, the higher the interest sensitivity (beta) will be in the current period and likely in future periods as well.

Here, a pricing model is invaluable. There is little excuse to not have one. We offer our basic risk-adjusted return on capital (RAROC) model, called Loan Command, free (HERE). A model can help you understand the profitability of a relationship and how deposit pricing is impacted by price changes, not just in the current period but also over time, for the expected life of the relationship.

Reason 2: Your Bank Does Not Know Customer Profitability

Like Reason 1, a bank needs to understand the profitability of every customer it is trying to keep. Again, banks need a RAROC model to see if it is covering its cost of capital.

Before managing exception-priced deposits, bankers need to determine if their actions align with their overall profitability goals. It is not uncommon for bankers to pay to keep unprofitable customers on the balance sheet.

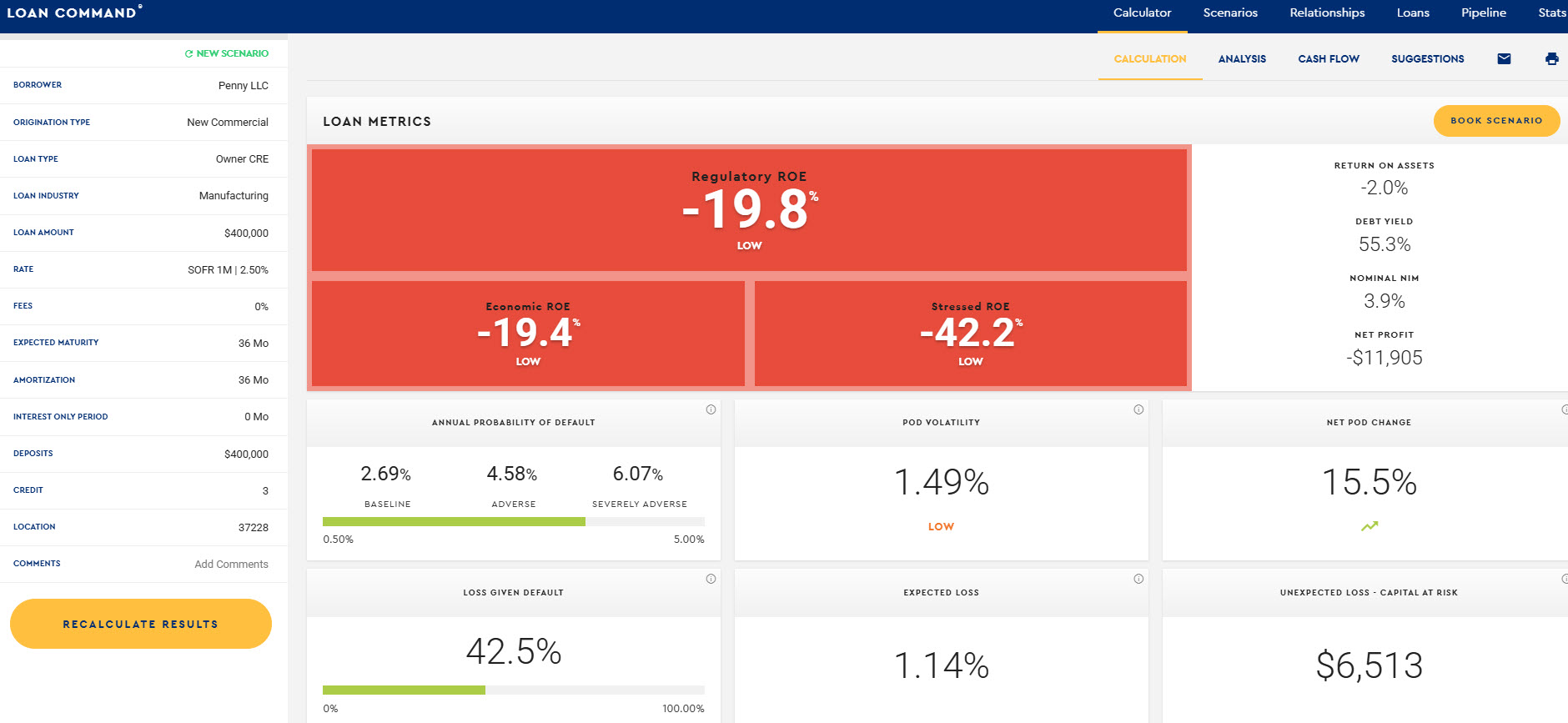

Customers with material operating accounts are the reason to raise exception pricing in business savings, or money market accounts to protect that operating relationship. Unfortunately, it is far too common to have and enable rate-sensitive customers. These customers want a 2.50% credit spread on their $400k three-year loan while wanting 4% on their money market account. Bankers high-five each other, thinking they brought in a “self-funding relationship.” They crow that they will make 6.60% on the loan and 4% on the deposits and think to themselves – “I will make a 2.60% margin. That is not great, but not bad.”

The net interest margin is a misleading concept and can lead bankers away from performance. The reality is because this bank is not considering cost and risk, they will lose money on BOTH the loan and the deposit, and that relationship will cost the bank $12,000 and produce a risk-adjusted return of -20% (below).

Reason 3: Not Understanding Your Breakeven or “Walk-Away” Price

What bankers often underappreciate when pricing deposits is the future of rates.

A banker may offer a 4% rate today, citing the logic that short-term wholesale funds are currently at a 4.50% rate. If you calculate the lifetime value for that deposit at 4%, the bank will earn a NEGATIVE 51% on its capital, hurting franchise value.

One problem is that the bank is not considering onboarding and maintenance costs. Depending on the structure and average size of the money market account, it is likely an additional .05% to 1% of capital and expense cost to manage the deposits and operations (this includes fraud costs). Thus, that 4% rate might be an effective cost of 5% to the bank or more expensive than wholesale funds.

Of course, the larger issue is the forward curve. The forward curve is expected to drop, and if it does, that 4% deposit will become increasingly expensive.

Bankers will argue that they will go back to the customer and reduce their rate accordingly. This is largely true. Bankers are good at this. However, to our earlier point, it takes resources to constantly be going back to the customer and adjusting their rate. Your cost structure is more likely to approach 1%. Due to this added manual friction, bankers are often slow to adjust rates down for price sensitive customers. Customers often do not appreciate the market’s movement in rates and may become even more rate sensitive.

If you look at the normal rate of manual exception adjustments, it is usually on the order of two to three times a year and often with a 60+ day lag.

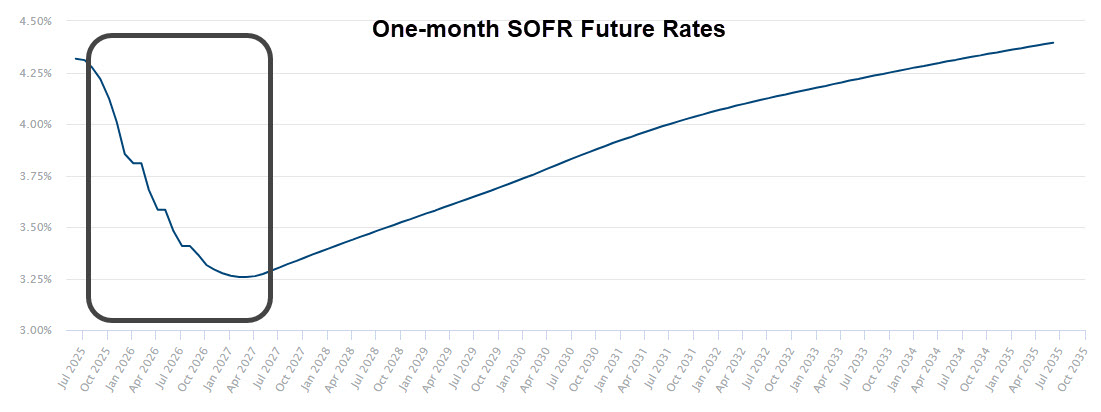

Thus, if it wanted to eliminate the lag and the forward curve plays out as expected, a banker would have to manually adjust the rate some 14 times between now and the end of next year as it keeps the spread to SOFR constant and moves that 4% rate down to a 2.97%.

If your bank follows the normal pattern and adjust this 4% exception rate down three times over the next year, the cost and the lag will likely result in a -17.6% return. A banker may still want to do this because of other profitable business or the potential future profitability of the customer, but it should know what that 4% exception-priced rate is costing the bank.

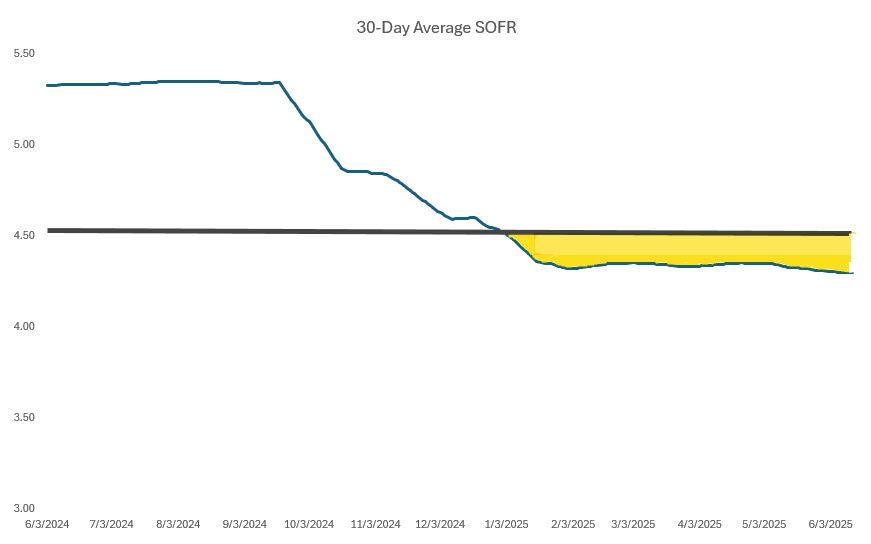

We can look at this through a historic lens, if you offered a 4.5% rate to a customer in August of last year and have not moved the rate down, somewhere around January, you started to lose money (in yellow below).

If you are exception pricing at 4%, or even 3.5%, in this market, you are likely losing money on the account because you are not taking into account your maintenance expenses, risks, and the cost of manually adjusting rates when the yield curve is downward sloping.

As a benchmark, in today’s market (below) for the average bank, exception pricing needs to be on the order of 2.30% for a money market account to take into account cost, the manual lag, and your cost of capital. That level will currently produce a risk-adjusted return of approximately 12%. For publicly traded banks with a lower cost of capital, that breakeven benchmark level is closer to 2.65%. The faster you are willing to adjust the rate, then the better performance you will achieve and the higher the rate you can offer.

If you are thinking to yourself – I would not keep any customers if I exception priced at those rate levels, this brings us to our final reason.

Reason 4: It is Expensive to Exception Price Against a Downward Sloping Yield Curve

Exception deposit pricing is cheaper when rates are rising and more expensive when rates are falling. This ties back into our profitability point. Far too many banks don’t use a risk-adjusted pricing model to price their deposits. These banks price irrationally and then look at the rate surveys and argue that they need to price at 4% because that is what the competition is doing.

Deposit pricing if filled with irrational actors without a model and without a deposit strategy.

As can be seen below, there is a material probability that we could be facing lower rates. Worse, is the fact that volatility remains elevated making rate bets potentially more expensive over time and adding risk, in the form of cost, to high-yield promotions and exception pricing.

Up Next For Exception Deposit Pricing

Now that we have the problem identified around deposit exception pricing, in a future article, we will cover how to better manage balances, interest rate sensitivity, and customer satisfaction at the individual customer level. We will highlight how some customers appear rate sensitive and are not.

We will also discuss how technology such as an offer management system and machine learning can pay for itself when exception pricing and offering deposit promotions. An offer management system, combined with machine learning, automates exception pricing to ensure you are adjusting rates in a timely, but advantageous, manner.

Exception deposit pricing takes understanding and discipline to optimize pricing and get the most out of your deposit base. Clearly articulating your goals, tracking customer profitability, and being able to calculate the value of your deposits will help banks better match the customer with the price.