5 Tactics for Managing Deposit Exception Pricing in This Age of AI

Every bank has some percentage of deposits that they “hand” or bespoke price. Exception pricing occurs when a rate sensitive customer requires a higher rate to maintain or grow their deposit balances at the bank. Deposit exception pricing is both an art and a science and, in this article, we discuss five tactics that will help you better optimize your bank’s pricing to improve bank performance. We will review how to score accounts, figure out what rate to apply, capture sentiment and look at technology that can help this entire process.

4 Reasons Why You Could Be Losing Money on Deposit Exception Pricing

In a previous article (HERE), we covered the four reasons why deposit exception pricing is a challenge. We covered:

- Balancing the four possible goals of deposit pricing.

- Why understanding customer profitability is critical.

- The importance of having tools to be able to price deposits considering cost, risk and future rates; and,

- Why facing a downward sloping yield curve is the worst time to exception priced deposits.

We now adopt these concepts and provide a framework for how to manage the practical application of deposit exception pricing. These steps are highlighted in the below diagram, and we will break down each separately.

Capturing Prospective Deposit Pricing Sentiment – The Qualitative

The most glaring error that most every bank makes is the inability to capture the customer’s sentiment on a prospective basis. When we look at Scoring next, we will explore how to do this from a data perspective, but data trends are usually a lagging indicator. It is better to be able to understand the customer’s mindset to deduce interest rate sensitivity BEFORE you manage deposit pricing.

Despite the rise of generative AI, for the time being, having a human do this is likely best. Having a conversation with the customer and manually scoring the importance of liquidity, service/convenience, interest earnings, competition and outlook and then rating the “propensity to move money” on a scale of -100 to +100 is a good starting point.

A customer scores 100 if they constantly discuss rate, have balances at other competing banks, have shown a willingness to move those balances, and don’t value the service/convenience that your bank provides. Conversely, the customer will score a -100 if during conversation they have never brought up any of the above or have shown an indication not to care about any of the above.

We will cover the numerical scaling in the next section, but the takeaway here is to be able to derive some methodology and system to ascertain the interest rate sensitivity of the customer and record it for calculation.

A good place to handle this information is within your CRM system whether it be Salesforce, HubSpot, Dynamics or others. Every time a relationship manager does a quarterly check-in with the customer; they update the score.

To get more methodical about capturing sentiment, banks are encouraged to start experimenting with artificial intelligence (AI), machine learning (ML) and generative AI (Gen AI). Several companies are on the verge of cracking this code. What you ultimately want is for the AI to capture and score sentiment on a consistent and methodical basis. This can be done after reviewing the AI-transcripts with the customer in a physical conversation or can be captured by a chatbot during a service interaction.

AI Sentiment analysis for deposit rate sensitivity is aspirational for now but look for us to cover this in the near future to update banks on the state-of-the-art sentiment methodology.

Scoring – Using Your Big Thumb to Machine Learning for Quantification

Now that you have the sentiment captured from the customer, the next critical piece is to find out what the balances say to you. This effort is an understanding of price and demand sensitivity that we often talk about as price elasticity.

This can be done in a variety of ways, from simple to complex. On the simple side, a banker can look at the balances against a series of applied interest rates and see how the balances fluctuate. The more the balances increase when the given rate goes up, the more interest rate sensitive they are likely to be. A customer might score a quantitative 100 if you provided a higher rate and they moved a chunk of money from another institution.

Conversely, they might score a -100 if their balances are randomized and aligned with their transaction volume. This is why payment customers are so valuable as to process a lot of payments, customers need larger balances that tend not to be rate sensitive.

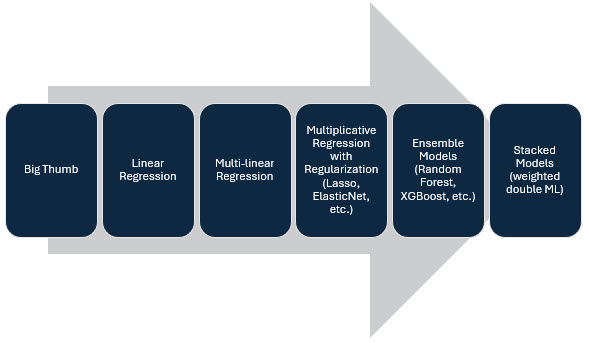

Starting in the late 1980’s sophisticated banks would use a simple linear regression on looking at balances and rates to calculate the correlation or R-squared of the two numbers. While this statistical approach had its limitations, it was simple and directionally accurate.

By the 1990’s banks graduated to multivariate linear regression looking at a range of variables to calculate sensitivity. This turned into a variety of refined linear techniques until the rise of machine learning in banking around 2010.

Now, every sized bank has access to python code that can be used to build a variety of sophisticated models very inexpensively. For complex customers or customers where the data is sparse, it is now common to use a variety or “ensemble” of models and then weight them to see which model set provides the best accuracy and predictive power. Customers that have seasonal cash flow, are highly sensitive to rate movement or have global operations that are influenced by global rates, currency values and events (like tariffs) are best handled this way.

The customer sentiment can now be combined, weighted and averaged into the quantitative calculation to arrive at a composite score. This is the combined interest rate sensitivity of the customer and produces a scale like the below.

If you look at this score bank-wide, the average customer is NOT all that rate sensitive and scores a -28. An average transaction-heavy customer might score -48. On the other side of the spectrum, a customer that is attracted to rate often scores 32 while a customer that is attracted to a high-yield offer scores around 60.

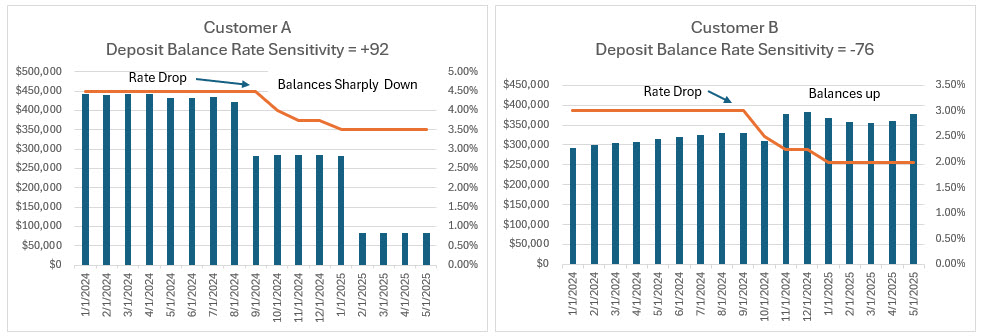

Below are two practical applications of scoring in action. A bank drops the rate for Customer A and this account complains and moves money to another bank. This customer scores a +92 as they are highly rate sensitive. The good news is that banks know how to get these balances back and what is important for this customer. A bank can decide if it wants to pay this customer a 4.50% to achieve higher balances or let balances go and increase profitability of the account. In comparison, Customer B undergoes a downward rate adjustment and balances go up. This inverse correlation results in a high negative score of -76. This is a customer worth investing in and finding more of through look alike marketing.

Calculating Balance Sensitivity

Now that we understand how rate-sensitive a customer might be, we next want to know the “so what.” While two accounts may have the same deposit rate-sensitivity, one might bring in an additional $100 million in balances while the other might increase balances by only $12,000. In the real-life example above, Customer A has balance sensitivity of about $360,000. This is important to know if the bank needs balances in the future or to invest in trying to make this customer less interest rate sensitive (which is often a difficult task).

Understanding this balance-sensitivity helps bankers better manage the risk of certain pricing actions and the potential of the account.

Similar to scoring, calculating the balance sensitivity can be done with a banker’s ballpark estimate, looking at the standard deviation of the balances, or using more machined learned approaches to take a variety of variables into account and predict what is the range of potential balances that could be won or lost by offering a certain deposit rate.

Applying The Methodology – What Rate to Offer

What emerges is a prioritized list of accounts according to the bank’s objectives. Banks that just want to build low sensitive balances might offer non-rate promotions to accounts that have negative scores. Banks that are looking to build balances at any cost would start with the highly sensitive customers that have large balance sensitivities. These might be your municipal deposits as an example.

Like scoring and balance sensitivity, figuring out what rate to offer spans the gamut between using the banker’s expert opinion (aka the “Big Thumb” approach) to using weighted ensemble machine learned models.

One of the best approaches to solving this challenge is also simple and it falls into the category of experimentation. Instead of relying on sophisticated models, the banker can offer a rate, wait and see how the balances change. Using this methodology, a banker can quantitatively know the lowest rate that needs to be applied in order to achieve the desired balances.

Pricing Management Technology

We have discussed some of the common machine learning models available to any bank. There are also a variety of vendors/partners that have available models as well as a complete system to handle both pricing and offer management. There are also a variety of professional service firms that can assist with deposit exception pricing.

Want To Be More Effective?

Come to our Deposit Conference that we are hosting with S&P Global. We will not only cover many of these topics but will have a variety of tools available to you to help with optimizing deposit exception pricing and be able to introduce you to a variety of vendors/partnerships that might augment your capabilities.

Register below (or HERE) and if you can’t make it, stay tuned to this blog as we go more in depth about using AI to better manage deposits for performance.