8 Concepts to Know Before You Reduce Deposit Rates

Should the Federal Reserve move their target Fed Funds rate down later this year, many bankers will immediately match the move and drop their deposit rates. While counterintuitive, this may be the exact wrong move if you want to optimize long-term bank profitability. This article explores deposit management tactics in a falling rate environment that can enhance bank profitability. Specifically, we will detail some best practices when you reduce deposit rates.

The Context of When You Reduce Deposit Rates

To highlight these concepts, we will discuss how to reduce deposit rates after a Fed rate cut. There may be many times when a bank reduces its deposit rates, but moving after a Fed cut is the most common. For easy illustrative purposes, we will assume the Fed makes a 25-basis point (bps) reduction in its Fed Funds target rate, and banks need to lower their cost of funds while also improving long-term deposit performance.

Concept 1: Know Your Objectives For Moving Rates

We want to emphasize our above statement as this is where many bankers go wrong from the start – they are unclear on their objectives. Trying to reduce the cost of funds immediately is a different objective than improving deposit performance, improving the customer experience, or retaining the most deposit balances. A bank should state, in writing, what its goals are and the priority of those objectives for all employees to see. In this manner, a banker makes their “leader’s intent” clear for all to follow.

Concept 2: Dropping Rates is Different Than Raising Rates

It is important for bankers to realize that the art and science of raising deposit rates differs from lowering them. In a period of falling rates, a bank’s goal shifts from stimulating demand to maximizing profitability while minimizing customer attrition and balance erosion. A bank wants to preserve profitability while shedding its most rate-sensitive customers when raising rates. When rates fall, banks need to focus on improving profitability, keeping balances, and retraining their most rate-sensitive customers. This effort to manage falling rates takes more resources, which is counterintuitive.

Concept 3: Stop Moving Rates When the Fed Moves Rates

When rates are moved concurrently with the Fed, it implies that the bank’s rates are based on the Fed and not the market. A bank’s loan rates are based on the market and independent of the Fed; why should deposit rates be any different? For risk mitigation, the goal is to have your liabilities match your asset performance.

When banks move deposit rates in conjunction with the Fed (up or down), they truncate deposit duration, thereby hurting future liability performance. This movement causes a large portion of the deposit base to move away from being market-driven and become more correlated to an administered rate that may or may not reflect market conditions.

Banks should move deposit rates according to the funding costs in the market. For some banks, that might be the Fed Effective (not the Target) rate, and for others, it might be three-month SOFR. Banks need to understand the “key rate durations” of their deposit base or what market instruments have the largest impact on deposit supply and demand.

How often a bank moves its deposit rates is up to each bank based on its risk and performance tolerance. While a topic for the future, for the sake of our analysis today, we will assume a bank moves rates after Target Fed Funds changes but not until the key rate instrument adjusts close to the Fed Funds Target changes. While this might be one and the same, it is often not. Regardless, the takeaway is to adjust more frequently than the Fed based on market conditions but not so often as to remind customers that rate is important. The goal is to add a layer of unpredictability while better matching assets to liabilities.

As a concept, banks need to do whatever they reasonably can to lower their cost of funds and the interest rate sensitivity of their deposit base. Only THEN should banks create loan structures that match the deposit base. Many banks do it the other way around and get into trouble.

A bank has limited options for structuring deposit duration and convexity while nearly unlimited options for purchasing investment securities and structuring loans. Hedging assets is easy while hedging deposits is very difficult. To improve bank performance, start with deposit optimization and end with investment optimization.

Concept 4: Be Unpredictable When You Reduce Deposit Rates

Game theory is the study of strategic interactions among rational agents who have conflicting or cooperative goals. In game theory, being predictable can be a disadvantage, especially when facing customers, employees, and competing banks who can exploit your behavior to their advantage. For example, in rock-paper-scissors, if you always play rock, your opponent can easily beat you by always playing paper.

Similarly, in banking, if you always reduce your deposit rates in a predictable manner, such as following the Fed’s Target rate changes, you may lose customers or profitability to your competitors who can offer better rates or incentives.

By being predictable, you also signal to your customers and employees that your deposit rates are not based on your own needs but on the Fed’s policy. This reduces a bank’s leadership position in the market and potentially its brand. By stating that your deposit rates move with the market, customers and employees build more loyalty and trust in the leadership of the bank and rely on the bank to inform them about rate movement and market conditions.

Over time, many customers will not have the focus or energy to track a bank’s rate moves if not immediately tied to the Federal Reserve. These customers will become more accepting of the bank’s leadership during times of rising or falling interest rates, which is one major aspect of being less rate sensitive.

Concept 5: Don’t Drop Deposit Rates at Once

By far, the largest mistake bankers make when they reduce deposit rates is to drop rates immediately after the Fed moves the target Fed Funds rate down. If the Fed drops its target rate by 0.25%, banks will often move their top deposit rate down 0.25%. When banks do this, they reinforce interest rate sensitivity to their customers and, more importantly, to their employees.

Customers have more rate sensitivity right after the headlines of a rate shift make their rounds during a news cycle or social media wave. By dropping rates immediately, and for the full amount, rate sensitivity increases. Banks that wait for the media hype to subside do the opposite.

Moving rates immediately down by the exact amount of the Fed’s rate decrease create a beta of one when the long-term goal is to reduce your deposit beta or interest rate sensitivity of the deposit base. A single move also does not enable calibration of the environment.

The better move when a bank moves to reduce deposit rates is to lag the rate reduction and break the move up to accomplish a better outcome. For example, if the Fed moves its Target rate down 0.25%, then a bank should consider lagging its first rate move until later in the month. Then, a bank should consider moving rates 11 basis points, 9 basis points, and then 8 basis points spaced 30 to 45 days apart, but time each move to occur near the end of a statement cycle.

Rate-sensitive customers will check with the bank and find out the bank is not moving as much as they feared. Most customers will stop checking after the first move. Those customers who keep checking and have an issue with a bank’s 28 basis point move should now be tagged as rate sensitive. Banks can then decide if they want to decrease their rate drop on an exception basis for this customer or not. Further, this customer should now be tagged and managed as one of the more rate-sensitive customers.

When this cycle is done, banks will find that they have gained 28 basis points of value, instead of 25 bps. AND have decreased rate sensitivities for the next cycle. Banks that make multiple moves in their rate adjustment can better calibrate to the environment while training customers to expect multiple adjustments.

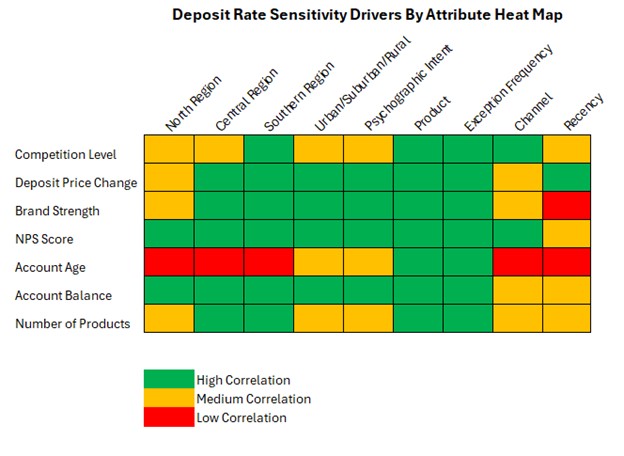

Concept 6: Apply Rate Changes By Segment, Test & Optimize

Bankers should aim to learn about interest rate sensitivities by various customer segments. Different industries, geographies, products, and customer types have different sensitivities and should not all be treated the same. By moving rates simultaneously, banks rob themselves of a valuable feedback loop to garner information about elasticities and beta. By moving rates three times instead of one time, banks have multiple times to test how rates impact various segments.

Moving rates from 0.03% to 0.15% out of the 0.28% target reduction goal allows a broad test to apply to various segments to assess customer reactions. From here, deposit pricing strategies and tactics can be adjusted accordingly. Continuously analyze demand elasticity to understand the impact of price changes on deposit volume and customer behavior. If deposits shift or move to another financial institution too sharply, banks may need to reevaluate the deposit rate decrease.

Concept 7: Apply Cuts by Beta When You Reduce Deposit Rates

Hopefully, a bank has done its homework and understands the rate sensitivities of its deposit base by customer type, geography, and product. Rate adjustments also depend on the starting level. Moving rates 28 basis points is easier when an account receives a 5.25% high-yield deposit rate vs. a 50-basis point deposit rate in a savings account. We will talk in terms of absolute rate movement for the sake of example, but banks should adjust these suggestions based on their own situation and current rate structure.

For a case study, let’s assume your bank has three customer segments with known elasticities.

Segment A: High-yield or exception-driven deposit customers with a high beta (elastic demand) – rate-conscious customers who are in high-yield products, urban territories, or in exception pricing may exhibit a deposit rate elasticity of 1.5%, meaning that a 1% rate reduction in their deposit rate will result in a 1.5% decrease in deposit balances (or more complaints before the reduction).

This segment will be quick to move money to a competitor or into an interest-bearing product with higher rates such as a money market account or certificate of deposit. For this group, banks may want to start out with a smaller rate decrease on the order of 0.05% to gauge the impact.

Segment B: Moderate beta customers such as customers in moderately priced savings or money market accounts, suburban territories or low-sensitive industries (like manufacturing) may exhibit elasticities of 0.5% meaning that a 1% reduction in deposit rates will result in a 0.5% decrease in balances. Here, banks may want to initially move rates ten basis points and then monitor balance changes and complaints.

Segment C: These low rate-sensitive customers care more about product attributes and services than they do rate. Payment-heavy accounts and many treasury management clients are an example of this segment. This group of customers may exhibit elasticities of 0.2%, or that a 1% deposit rate reduction may only result in a 0.2% decrease in deposit volume.

Each segment should be followed up by another round of rate increases the following month, with the amount of change adjusted accordingly.

From a return and dollars perspective, we can run a simulation on $1B of interest-bearing funding broken down by three customer segments – high, medium, and low beta. Here, we compare two scenarios – a single adjustment and a multiple dynamic adjustment. For the single adjustments, we try to drop rates 25 bps except for the lower rate accounts where we can only get 15 bps as to not to increase interest rate sensitivities.

When deposit runoff and wholesale funding are considered, the single adjustment tactic results in a cost of funds of 1.99%, including a funding gap of $43 million. Beta for this tactic started at 45% but then increased to 49% as customers became more rate sensitive. While part of this beta increase is a result the media impact of the Fed moving rates, part of the increase stems from the bank implying that they will move rates in conjunction with the Fed. When the Fed makes its next move (up or down), bank customers will assume the bank will do the same.

Alternatively, by conducting multiple dynamic adjustments, the interest-bearing cost of funds is 5 bps lower at 1.94%. Beta is improved, going from 45% to 44%. This tactic increases margin compared to a single adjustment and drives more than and estiamted $610,000 of savings to the bottom line per $1B of interest-bearing funding.

Dynamic pricing lowers risk as well. At each step, a bank can look at balance changes and monitor customer sentiment. Should the customer base react more than expected, a bank can adjust.

Concept 8: Apply Rate Changes by Margin

If a bank doesn’t know the elasticities of a customer segment, applying by margin, or deposit value, is the next best proxy. Let’s assume you have the following segments:

Segment A: High-yield or exception-driven deposit customers – These customers are likely to have the lowest margins (for example, net interest margins below 2% in this market), indicating that this segment demands low loan spreads and high deposit rates. Banks can assume that these are its more rate-sensitive customers. Assuming a bank has a need to retain this customer, then for a 0.25% market decrease, a bank may only want to apply a 0.07% decrease in deposit rates due to the implied elasticities of this segment. The critical item is to test the .07% decrease in deposit rates and then monitor volume and complaint reaction.

Segment B: Here, moderately rate-sensitive customers or moderately rate-sensitive products such as a business savings account or money market account may get a rate reduction of 0.09% if short-term rates adjust down 0.25% after a Fed Target rate cut.

Segment C: Higher margin customers are likely to be less rate-sensitive and should be the segment where the bank targets the highest service level. This segment has potentially lower price sensitivity and can absorb a more significant deposit decrease. Here, an initial rate move might be 0.12% for a 0.25% rate movement.

While deposit rates should be allocated to segments with known rate sensitivities, to the extent these betas or elasticities are unavailable, using margins is the next best tactic. Over time, the goal is for the bank to lower rates as much as it can in a series of rate moves while keeping the customer happy.

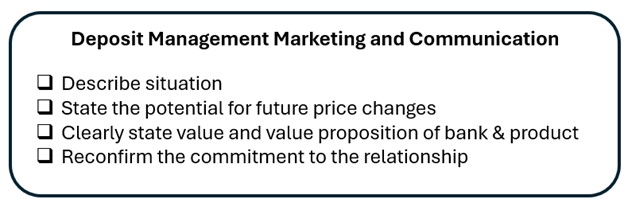

Concept 9: Timing, Marketing and Communication

Banks often underappreciate the role of marketing and communication regarding deposit rate changes. Banks usually assume that employees and customers have a better understanding of interest rate movement than they do. Education is critical.

Banks need to start now with their employees, teaching each of them that the goal when rates fall is a dual mandate of improving profitability while mitigating the customer’s negative effects. Ahead of any rate move, the bank should clearly communicate that, should the rates move lower in the market, the bank will be forced to lower deposit rates in order to manage margins and make further investments in products and customer service. Waiting to communicate until you move rates makes customers and employees more rate sensitive. Separating the message and the drop in deposit rates dampens the impact.

When rates fall, banks should take the time to emphasize their service quality, value proposition, balance sheet quality, and convenience. To the extent that banks can also introduce product or service enhancements that are on the horizon, all the better. Some banks actually save product and service announcements up to announce when they have to change rates.

Putting this Into Action

Train customers and employees to be less rate-sensitive while garnering much more data.

Banks can mitigate the impact of rate changes on their deposit base by focusing on customer and employee education, service quality, value proposition, product innovation, and moving to dynamic pricing utilizing multiple adjustments. Banks can become less predictable and adjust pricing based on market movements instead of Fed movements. Banks can reduce risk and become less predictable by adjusting deposit rates more frequently.

By utilizing these tactics, banks can reduce customers’ sensitivity to rate fluctuations, increase their loyalty, increase retention, and boost profitability. Additionally, banks can collect more data on customer preferences and behavior to optimize their pricing strategies and product offerings.