An Idea For Improving Deposit Balances and Profitability Given Falling Rates

During a regulatory exam, one of the first questions you will be asked these days is your percentage of uninsured deposits to total deposits. The concern is grounded in the SVB/First Republic 2023 liquidity crisis and data that shows higher balance accounts are more interest rate and risk-sensitive than lower balance accounts. In this article, we will look at the data around building deposit balances and how it relates to performance. We show how community banks can dramatically increase their franchise value by better-allocating marketing and sales dollars.

Deposit Management Context

When the Fed moves rates down, it is a signal to smart bankers to spend more time and resources fixing your deposit performance and make your customers, and your employees, less interest rate sensitive.

When rates fall, two things happen that are important for bank executives to note. One is that margins start to compress by 25% of the Fed’s movement. This is to say that for every 25bps in target Fed Funds rate reduction, banks can expect to suffer a 5 bps decrease in margins lagged by approximately 6 months. This makes the effort around managing deposit balances more impactful than when rates are rising and margins are expanding.

The other thing that happens is that customers become less interest rate sensitive and are less likely to move balances or complain with falling deposit rates. The economic slowdown that normally comes with a Fed reduction in rates make customers more safety sensitive and less likely to move accounts in times of economic stress. Further, as rates move lower, customers are less likely to care about the additional 40+ basis points of additional return that it takes on average, to get a rate sensitive customer to move banks.

Deposit Performance by Balance

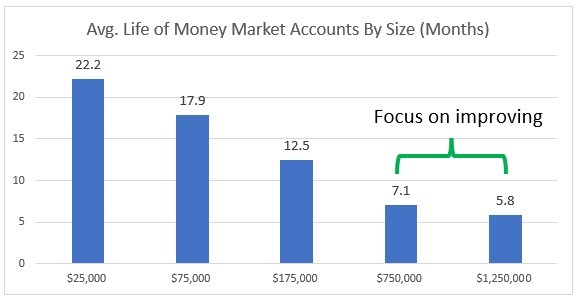

By way of an example, below is our current decay data of money market accounts based on account size. As you can see below, without interventions, the average small balance account will stay with a bank for four to five years with an average life of almost 25 months. This is more than three times the life of a money market account that has average daily balances above $1mm.

Apply rising rates, externalities like increased social media advertising by national banks (which is currently happening) or a credit shock to the deposit holding institutions, and the average life numbers shrink dramatically. Further, as more and more banks promote online and mobile account opening, we also expect these numbers to shorten by at least 20%.

We also want to note that a money market account is fairly representative of a bank’s deposit base. Non-interest-bearing accounts, of course, have much longer average lives, while CDs have much shorter average lives. Regardless of the type of account, the above balance sensitivities hold true for just about every account type, every geography and every customer demographic. For example, while banks in the Southeast and Mid-Atlantic regions of the U.S. have more competition for money market accounts thereby making the above numbers less than the above, they exhibit similar differences.

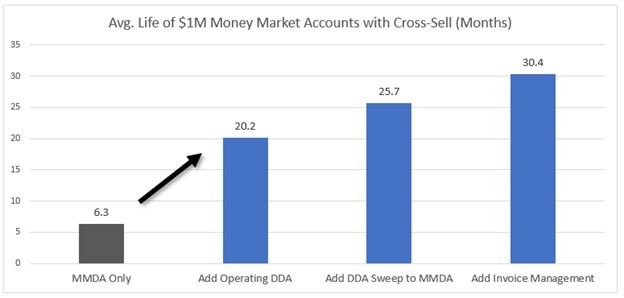

While cross-selling helps improve retention, it also helps keep your bank keep in front of the customer while suggesting product that might help their situation. This, in turn, increases their satisfaction with the bank. Greater satisfaction combined with the usage of other products, spurs the customer to move balances from other banks to you. Thus, by cross-selling, not only are you improving the average life of the account, but also the over all profitability from both balance building and fee generation.

Putting This Data into Action to Drive Deposit Balances and Performance

This data suggests that if you were going to spend money on customer retention, you might want to start by targeting those customers with over $500k in balances. Some banks, for example, do nothing more than having their CEO call the largest depositors twice per year to check-in and thank them. This alone can have a material impact on retention, helps build deposit balances and is fairly inexpensive.

Of course, one of the best moves is to cross-sell other services – other deposit accounts, alerts, mobile banking, cash management. For example, adding and connecting an operating DDA account to the MMDA account extends the average life significantly. Add other components, and retention shoots up even further. Below is an example of the before and after snapshot of a $1mm money market account once you start adding other product connections that boost account longevity.

That increase in retention by more than five times is worth almost $18,000 to the average bank in a static environment and multiple times that in a rising rate environment. Spending sales and marketing dollars on these accounts can provide one of the better returns in bank marketing.

Before you spend your sales and marketing resources haphazardly, all the while being concerned about slowing deposit growth, consider getting more focused on how you spend your effort. Targeting high balance accounts to improve their average life is one of the best uses of bank marketing dollars there is in a falling rate environment.