The Secrets of Expert Deposit Pricing Management

You can always tell a good banker by the way they handle their deposits. With loans, it’s hard to discern expert-level skills unless you know the market and the credit. Deposits, however, are pure. When we analyze a bank, it is typically the first thing we look for, as deposit pricing and structure are the metrics that tell you the most about the quality of a bank. A low cost of funds is just part of it. Almost equally important is the behavior or performance of a bank’s liability base with movement in interest rates. This article is about developing more of those expert-level deposit pricing skills.

Non-Expert Deposit Pricing Management – How To Destroy Bank Franchise Value

The best way to quickly destroy value is to peg a deposit product to an index such as SOFR, Prime, Fed Funds, or Treasuries. You also automatically get a failing grade in deposit management if you are one of those banks that say, “Our deposit rates will always be in the top 25% of our market,” or, “We will always be ranked 3rd in our market,” In all these cases, banks give up 100% of their ability to control their deposit performance and take on the market’s sensitivity (or worse, sometimes more than the market). Each bank faces a different cost structure, market, goals, and risk profile, so pricing to the market or other banks never makes sense.

The goal is the complete opposite – have the lowest cost of funds with the least interest rate sensitivity and the most positive convexity for your market and target customer base. When it comes to convexity, not only do you want a low-cost deposit base whose volume does not change with changing rates, but when volume does change, you want more deposits when interest rates go up and less when rates go down.

You should also be looking forward. This means not only looking ahead for interest rates and sensitivities, but you should design your deposit products and pricing not for the customers you have but for the customers, or the behavior, you want to attract.

The Big Secret in Deposit Pricing Management – “Relasticity”

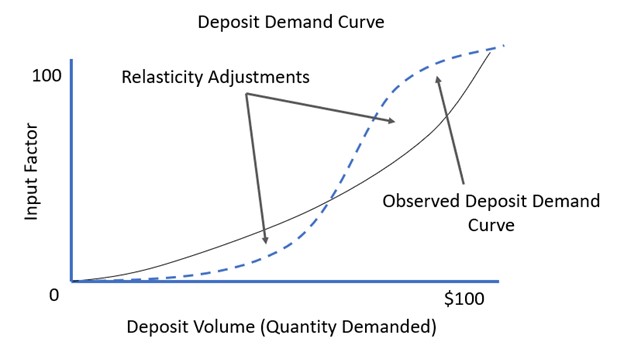

Elasticity is a concept that equates a change in rate to a change in volume. If you move rates up 1%, elasticity tells you how much will you increase your deposit volume in that product. However, this doesn’t tell the whole story when it comes to deposit management.

Dr. Dan Geller, a man who basically has a Ph.D. in deposit pricing, coined the term “Relasticity.” Relasticity is the adjustment to elasticity, positive or negative, that accounts for non-yield factors. Fundamentally, it is the recognition that only some customers in an addressable market are rate sensitive. The banker’s job is to separate those looking for a rate and those looking for another non-rate attribute such as safety, convenience, service, brand alignment, or similar.

Elasticity is best used for commodity-like products such as bonds, wheat, or oil futures. Elasticity does not capture behavior changes or the concept that customers may substitute products or take a different behavior path. Most importantly, elasticity is incapable of capturing negative or inverse relationships.

Traditional price elasticity measures only consider the relationship between interest rates and deposit balances when assessing demand, but this oversimplifies the situation. The economic environment, and its impact on behavior, is a crucial factor that can also influence the elasticity between prices and balances, even if the interest rate remains constant.

During the pandemic of 2020, for example, deposit rates dropped, yet deposit balances grew. Pandemic fear, added stimulus, and the curtailment of spending options caused a positive adjustment to deposit duration which was a negative adjustment to elasticity. Back then, the world was less interest rate sensitive and ran counter to almost every deposit model based on elasticity.

Conversely, as liquidity is running out of the banking system, rates are rising, yet deposit balances are dropping. On the surface, this is also a negative adjustment to elasticity. However, after adjusting for the systemic changes in liquidity, you get the opposite effect due to the fundamental behavior shift.

Inflation and the media attention around rates are causing a negative adjustment to deposit duration, which is a positive adjustment to elasticity.

Elasticity Attributes

- Designed for commodities

- No inverse relationship is possible

- Economy and behaviors are not factors

Relasticity Attributes

- Designed to adjust demand to optimize behavior

- Can be a positive or negative relationship

- Takes into account the economic/social environment and trends

The insight here is that deposit raising is more than simple linear economics. Deposit products and marketing attributes do not operate in a vacuum. Deposit offerings are impacted by the economic environment, competition, and, primarily, behavioral economics. As such, we include this behavioral economic layer as a mediating variable to help explain expected outcomes.

Forward Not Back

Too many banks use rate surveys to set their deposit pricing. The better methodology to use is to start with rate surveys and then take the time to understand the forward curve and understand how competitors and customers will react. This behavior forecast is what is missing in many banks’ analyses when it comes to rate setting and is the reason many banks overpay for their volume.

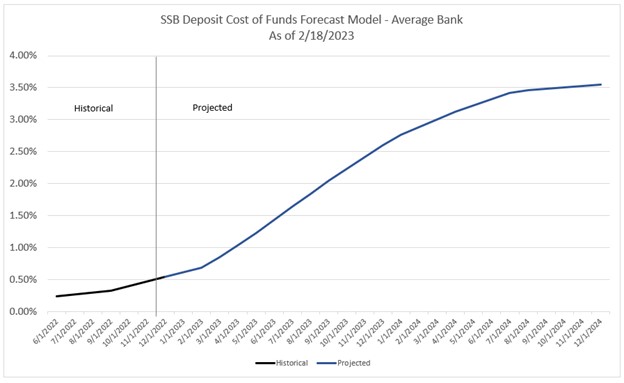

As can be seen, by the chart above, deposit rates are ticking up with every Fed move and as beta increases. The market is becoming more interest rate sensitive by the day. Since last year, several large banks have begun to increase rates, and we see more and more banks either increase rates or, in a few cases, drop fees. The chart above also predicts that deposit rates will continue to increase for the rest of this year and next. As such, banks should consider this and be proactive in deposit management.

From the forecast above, we can now see where deposit rates could go for any individual segment or market. We can leverage S&P Capital IQ Deposit Data and know what they are likely to do by looking at the behavior of deposit competitors in the past.

Choosing a Product – Your Best Defense in Deposit Pricing Management

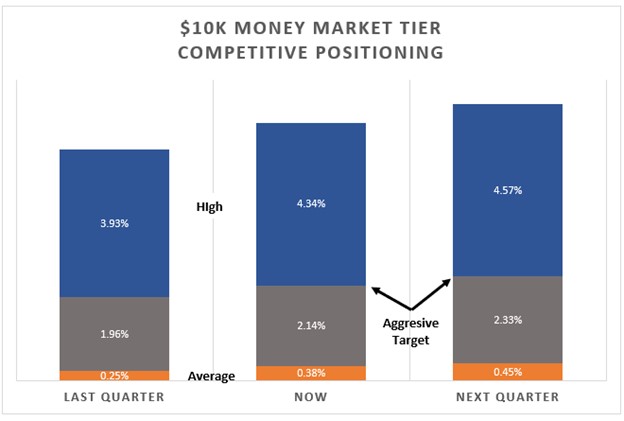

Not all deposit products perform the same for banks which is a topic for another day. However, for example, we will choose one of our favorites – the $ 10k tier of a money market account.

This particular class of product is competitive enough, so rate matters, but not so competitive that there is no room to compete on lower rates. Contrast this product to interest-bearing transactions or savings accounts where rate rarely matters in most markets. Alternatively, you can transact money market accounts to certificates of deposit where rate matters. Here, deposit sensitivity, duration, and convexity are such that performance is much less. As such, if you have to pay an extra ten basis points, you are not only going to attract more deposits in a money market account but derive better value.

By looking at the dispersion of rates in any given product, we can derive the low (lower bounds), the high (upper limit), and the average. By analyzing the Relasticity in any given product, we can also derive the “aggressive target rate.” This is a forecast derived from studying the sensitivity of any given market. If you have to pay on rate, this is your best value based on past performance, the number of banks surveyed, and a 98% confidence interval.

One key lesson here for deposit pricing management is that because of economic behavior, banks often overpay for funds. Customers are not universally elastic in their rate sensitivities within any given geography or customer segment. Convenience and brand, for example, play a huge part. By pegging a top rate or even trying to be in the top 25%, banks not only end up paying too much for deposit performance but also teach their customers and employees to be more rate sensitive, thereby compounding the problem in the future.

The secret here is to have a clear strategy and understand your target customer base. Are you trying to retain current balances, grow balances from your current customers, or are you trying to attract new deposit dollars? That clarity makes a difference when pricing. In today’s market, for example, for the $10k money market account, you need to be around the 50% to 65% level to retain balances. For the next quarter, this quantitatively means around a 2.33% minimum given average relasticities (depending on area and customer segment). We point out that this is likely lower than where many banks will set their rates. Banks may lose their most rate-sensitive customers from this product, but they are likely to retain the bulk of their value.

Unfortunately, many banks don’t have that luxury as they have not invested in their products, marketing, or brand. Here, you will likely have to pay up to 3.25% next quarter to retain the more interest rate-sensitive customers and possibly attract new balances from those customers. This is about 1% below where many banks will pay.

Without brand, marketing, and value-laden deposit products, banks will have to pay above 4.50% to attract new money next quarter. This will both cannibalize the existing customer base and attract more rate-sensitive customers.

Our main point here is that strategy drives pricing, and many banks overpay to retain customers and underpay to attract new customers. Instead of just looking at the competition, consider that you are better than your competition and price lower. You can quantitatively do this by offering personalized rates, testing the market, and then moving rates up if you have to. The goal is that you want to retain and attract the least rate-sensitive customers of the rate-sensitive customer cohort as possible. You want those customers that are rate sensitive but also value safety, brand, and convenience.

To our point, for every offering with an aggressive rate, you start to skew your customer base towards greater elasticity, and relasticity matters less. As such, your aggressive target rate needs to move up with each offering, destroying value in the process. This is why banks need to think long and hard about moving rates up. Once banks start paying in the top quarter of deposit rates, value gets destroyed at a faster and faster pace. At some point, deposit pricing management becomes exceedingly difficult as you become solely dependent on rate.

A Word on Geography

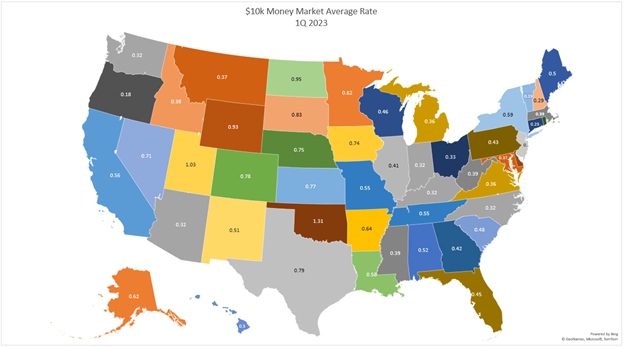

In this age of digital account opening, national marketing, and digital-only banks, geography matters less than it did five years ago. The reality is that geography does not matter as much as service matters. Deposit performance is not materially correlated to geography per se but correlated to service delivery and how that service treats the pricing of deposit supply. While service delivery often masquerades as geography, it is essential to know it is not a direct correlation. After adjusting for branches, geography often becomes statistically irrelevant. Customer demand behavior is largely the same throughout the country and is evenly distributed.

However, service delivery still matters and has an influence on geography. While it matters less these days, it is still statistically significant. Deposit performance and the number of branches per capital used to be 54% negatively correlated ten years ago. This correlation is down to negative 23%. The more branches you have per person, the more your customers want to use you and the lower the rate you need to pay to attract deposits.

There is also the aspect of competition. The more banks in an area, the more likely one or two banks will start a deposit rate war, and others will follow. It is important to note that aggressive rate competition comes in many forms. The worst markets are where the top rates are high, AND the average rate is high. This creates the most sensitivity (see OK or KS as an example).

Alternatively, FL, for example, has a few banks paying a high rate, but the average rate is benign. Some areas, like Guam, have a high average rate but a low top rate. On the other side, HI, NH, VT, VI, and RI are the most deposit rate-friendly states. The characteristic here is that these banks have low top rates, low average rates, and small standard deviations.

The takeaway lesson here for deposit pricing management is that bankers need to pay attention not only to the banks paying the top 10% highest rates but the average and the standard deviation. The greater the standard deviation, as derived from rate surveys, the more likely bankers can extract fewer interest rate-sensitive customers. However, before reaching that conclusion, bankers need to see if the standard deviation is dispersed around higher rates, as it is in OK and KS, or around lower rates, such as HI, NH, VT, and others. Different markets deserve strategies not because of the geography but because the service delivery in the area and the competition that occurs.

12 Deposit Pricing Management Lessons From This Analysis

The methodology above, when leveraging the data provides a handful of insights that can be gained that can put you in the top 10% of deposit managers. We will go into more detail in the future of each, but we wanted to highlight the lessons to start.

Never Index Your Deposits or Your Methodology: Tying your rate to an index or to a methodology, such as always being in the top 25%, abdicates any strategic deposit advantage and results in fast destruction of value as you increase deposit sensitivity.

Incorporate Behavior: Banks tend to overprice deposits because they ignore behavioral economic factors such as the need for safety, convenience, or brand. Conversely, most banks don’t spend enough resources on distinguishing their brand, which results in above-average deposit performance.

Rate is Your Least Effective Lever: When it comes to increasing deposit performance, rate is your least effective lever. Rate should be the last tactic used to attract deposits. Strategy, innovative product attributes, niche customer segments, and quality service are all multiple times more effective than rate when it comes to building deposit value.

Digital Only Banks Are Mostly Flawed: Without branches and with a new brand, most digital banks need to resort to rate to attract deposits. Rate brings interest rate-sensitive customers that often have short lives and little cross-sell. As a result, profitability and long-term performance suffer, given the cost of running these digital banks. As more banks acquire account technology to include account opening, personal financial management support, fiscal support (bill pay, treasury management, etc.), and virtual customer service, the more competition digital banks will have and the more they will need to spend on brand. For a digital bank to succeed, the most efficient way to do that is to leverage a combination of targeting a niche market and offering true banking innovation to the market.

Retention vs. Acquisition: Be clear on your deposit strategy. It takes less of a rate increase to retain your depositors than it does to attract new depositors and get them to switch financial institutions. For that matter, increasing balances for existing customers also take less rate than acquiring new customers. Be clear on your objectives when it comes to deposit pricing management, and your tactics will follow.

Understated The Role of Your Branches: It is a common mistake to conclude that just because all of your deposits come through your branches, you need branches. If you don’t have a suitable digital account opening and onboarding process, this will be true 100% of the time. However, the deposit market is quantitatively relying less on branches to gather deposits, and deposit technology is mattering more. This makes the ability to open, onboard, maintain and expand a banking relationship digitally paramount. Branches remain important, but so does deposit technology.

Product Innovation: The least costly way to achieve superior deposit pricing management is through product innovation. This is where good bankers can put their competition to shame when it comes to deposit management. We will be exploring this deeply in the future, but creating new products combined with new technology, such as payments, is the best way to raise balances. Product attraction is the surest way to decrease relasticity.

Customer Segmentation: Next to deposit technology and innovation, the next best way to raise cost-efficient deposits is through targeting specific customer segments. We will also be exploring this in the future, but the goal is to narrow the market focus to attract outsized balances relative to the effort. When looking at an addressable market, we will explore strategies in the future to segment out the customer base to find less interest rate-sensitive customers to decrease relasticity.

Personalization: Another aspect of this analysis is that every customer has a different level of rate sensitivity. It has just been in the last five years that banks have had the ability to offer a specific customer a deposit offer and for them to record the outcome. As such, banks have started to categorize their customers with an elasticity score and a categorization of the behavioral economic impact of other factors such as service and convenience. This is the new frontier of deposit pricing management as banks move away from a single rate for an entire product.

Brokered CD Use: A common trap is that bankers conclude they would rather pay customers brokered rates than have to go out and purchase brokered certificates of deposits (CDs). The above analysis points out why this approach is partially flawed. Brokered CDs help protect your core deposit base so you DON’T have to go out and find rate-sensitive customers. Once you attract rate-sensitive customers, a bank starts to erode profitability. Customers become more interest rate sensitive, hurting future performance. Rate-sensitive customers are fast to come on but slow and painful to exit. They either leave when you need them or cause more rate sensitivity on their way out. As these customers complain about rates, employees argue for more rates to retain these customers. Soon management is backed into a corner where they are now managing a more interest rate-sensitive customer base and a more rate-sensitive employee base than before.

Structure Matters: Rate is not the only direct factor when it comes to deposit products – tiers, length, fees, penalties, and terms also play a role. We will look at these factors’ attribution and how to position different products for different customer segments to optimize deposit performance.

Rate: Finally, every banker needs to know how to use rate effectively. As much as we can talk about service and convenience, it will come down to rate for many customers. In the future, we will explore how to determine if your customer is genuinely rate sensitive (some say they are and are not) and, if they are, how to best apply rate to do the least damage. We will look at what happens when we use rate for our most and least rate-sensitive customers.

Until then, bankers should understand that setting deposit strategy, tactics, and rates is not a static exercise. All three should be reviewed at every asset-liability meeting as the market, competitor pricing, supply, and demand change fluidly.

By understanding the past, looking ahead, and considering behavior, banks can lower their cost of funds while making their deposit base less sensitive – a result that will give you expert-level deposit pricing management skills.