Deposit Profitability – The Operating Cost of Your Deposits

A couple of weeks ago, we delved into the origination and operating costs of manufacturing commercial loans (HERE). In this article, we delve into deposit profitability and highlight the cost structure of deposits. The goal here is to give bankers that don’t utilize a funds transfer pricing and activity analysis methodology a glimpse into the cost of producing the most popular deposit categories. Understanding a product’s cost structure is the first step towards accurate pricing and, more importantly, process improvement.

Our Approach Towards Deriving Deposit Profitability

Like loans, if you are a user of Loan Command, our relationship pricing model, then much of this is already done for you. However, if you are not, or if you want to get both more accurate and granular, then we turn to the Kohl Analytics Group, whose sole focus is to help financial institutions with profitability. They start with building a funds transfer pricing methodology and then track activity to assign the appropriate cost. We will use their data and methods for this analysis.

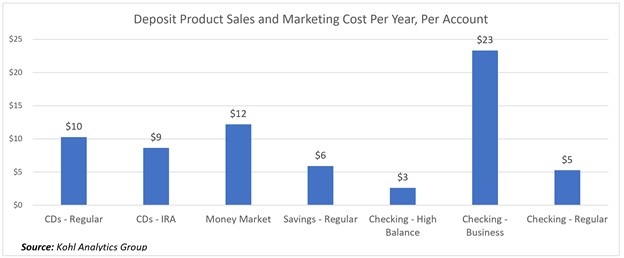

Cost of Deposit Sales and Marketing

To derive the foundation of deposit profitability, you start with your sales and marketing costs. This expense category includes direct marketing expense, sales/branch expense allocated to selling deposits, and the cost of employee sales efforts (including management overhead) associated with cross-selling. The per year, per depository account cost of deposit sales and marketing by-product, can be seen below:

A couple of items jump out at you when analyzing the above data. First, it makes sense that banks spend the most marketing dollars on business checking and money market accounts. Business checking offers the most significant balances, highest convexity, highest duration, and lowest price inelasticity of any deposit product. It also is the one product in banking that has the highest correlation to cumulative lifetime profitability. If there were ever a product to invest marketing dollars into, it would be the transactional business account.

The money market account is the second most invested-in product in sales and marketing. Here, bankers do an odd dance of competing profitability issues. On the one hand, you want a rate high enough to attract balances and keep the balances away from certificates of deposits (CDs). Still, on the other hand, you can’t market on rate so much that it destroys deposit profitability performance.

The trick to marketing money market accounts is to spend enough money to clarify your message that the account is all about giving customers the best of all worlds. It pays more than a checking account but provides more flexibility than a CD. Here, bankers need to decide which account plays this role – money market or savings – and then be clear with your message about which you want your customers to use.

The final takeaway is that bankers usually spend too much on marketing CDs. High-balance checking (see above) seems like the correct investment since attributes like reward points, rate, or other attractive characteristics do much of the heavy sales lifting. CDs are much the same way. If marketed and sold correctly, your money market account usually has a longer duration than the bulk of your CDs. Thus, it rarely makes sense to spend additional marketing dollars to either attract new rate-sensitive customers via a CD offer or cannibalize your money market accounts and essentially pay to get worse profitability performance.

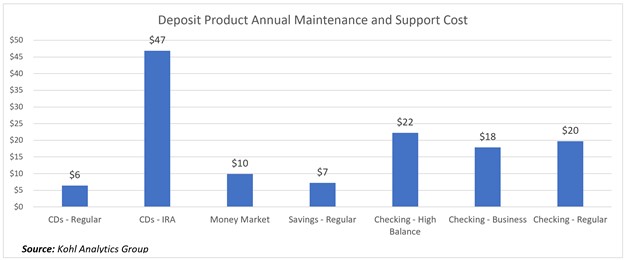

Deposit Profitability: Annual Maintenance and Support Costs

Next, we look at the account maintenance and support costs. This category (below) includes the cost associated with the opening and closing of accounts, plus general account support. In addition, this cost segment includes the cost of pursuing fraud and negative balance management.

From the above, you can see one of the main reasons to invest in digital account opening – its many automated processes.

Digital account opening, in addition to saving the customer time and extending your footprint to drive account volume, the above data details the direct costs that can be saved as the expense in each category can be reduced by 33% or more. This point is further reinforced when you consider that checking, particularly business checking, has the highest variability in costs. This is true between banks and within a bank, as certain accounts, such as those owned by non-US citizens, can have wildly higher costs.

Further to this point, banks often purchase online and mobile account applications without thinking about account maintenance. This is a tactical mistake. Ongoing account issues, address updates, adding a beneficiary, and similar tasks comprise a material amount of ongoing deposit costs. Smart banks will either choose a partner that can handle online/mobile self-service account maintenance or create adjacent customized processes to support deposit account self-service.

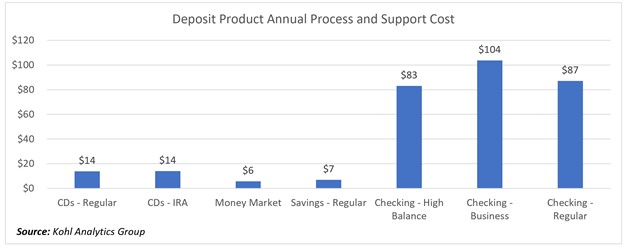

Next, we take the cost of labor and direct expenses associated with transaction processing to include handling exemptions.

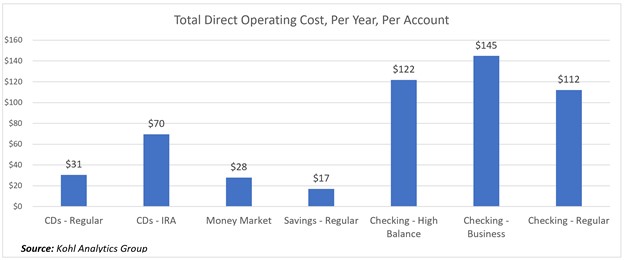

We put all three of the above cost categories together, and we get the below total direct operating cost per year per account of each deposit product.

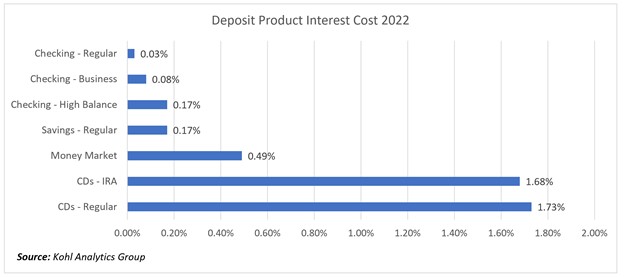

Interest Cost

Adding in interest cost by category starts to change the deposit profitability picture. Bankers can better understand the cost of having CDs versus products like savings or transaction accounts.

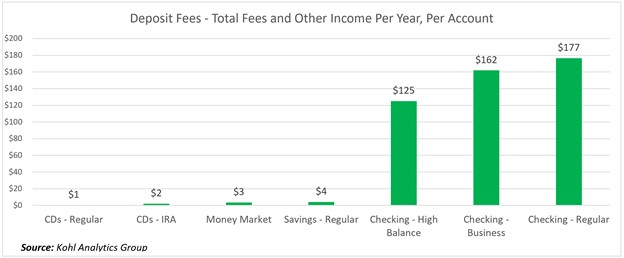

Deposit Profitability: Fee Generation

Now comes the interesting part. Once you consider fees, the profitability picture changes. Transaction accounts, like checking, generate a material amount of fees (below). As such, it makes more sense to invest in marketing and product development than it might CDs.

Like processing costs, checking products tend to have the widest fee variability. Banks that have not looked at their fee structure in a while are encouraged to do so, as that is a major aspect contributing to this variability. When looking for additional fee revenue, starting with checking and then going to the IRA accounts are the two largest sources in the deposit world.

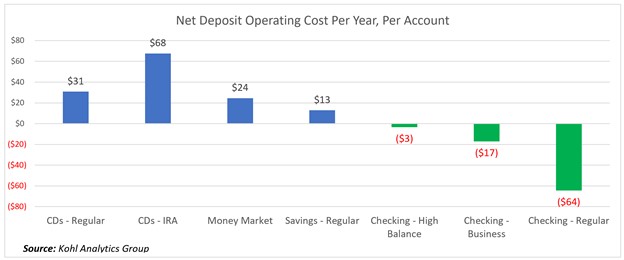

Add fees to the total direct cost, and you get the cost profile below.

From the above chart, you can start to see the profitability profile on accounts such as checking compared to CDs, savings accounts, or money markets. This chart also highlights the importance of exception handling and fee waiving. Not only does granting exceptions and waiving fees force the bank to forgo income, but they also drive up the operating costs. The takeaway is that banks want to be crystal clear on their fee waiving actions and have a process for efficiently handling these exceptions.

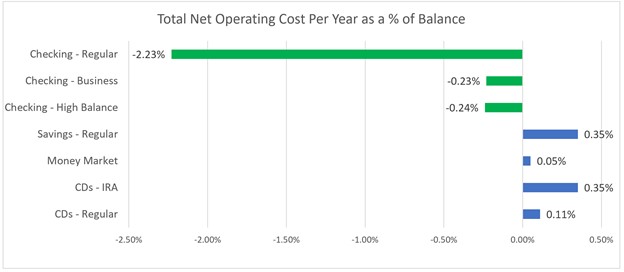

Adding Balances to Deposit Profitability

Once you start to divide costs by deposit balances, the definitive picture emerges.

Putting This Insight into Action

From the above data, several conclusions can be drawn. First and foremost is the importance of managing pricing and deposit account performance through product design and marketing. Second is the growing importance of online and mobile account opening and maintenance. Not only can digital account opening immediately reduce your processing costs, but it is also critical for balance building and footprint expansion.

Another important aspect here is that as more banks handle more products digitally, banks without these functions will have less flexibility in pricing. As traditional branch deposit gathering slows, the marginal cost for these banks will continue to increase. The difference in operating costs between digitally opened/maintained accounts and traditional branch accounts will continue to widen. As it does, banks without digital account opening will be driven into the hands of acquirers for lower and lower price multiples.

The third lesson from this data is the importance of channeling customers into more profitable products such as transaction accounts. While almost every bank knows this, few have products and promotions geared towards referrals, account transfers, and additional account openings.

A final takeaway is the importance of deposit balance building. Similar to our first point, while every bank knows this, few banks attempt to optimize their return on investment (ROI) by increasing marketing budgets to focus on balance-building campaigns. This is the single easiest campaign to roll out and one with the highest ROI, yet most banks overlook balance-building campaigns.

Here, money market accounts, followed by IRA accounts, high-balance checking, and business checking, have the most significant marketing account balance sensitivity. Targeting clients to bring money over from other banks, or to increase their IRA balances, will likely offer the best marketing ROI.

As Kohl Analytics Group often reminds its clients – “You will not solve a problem you don’t fully understand.” Most banks have never seen this granular of data and, as a result, often misprice their deposits and don’t invest enough in product design and marketing.

Hopefully, this article helped you better understand your deposit costs and have given you actionable insight into how to improve profitability.