How to Build Better Deposit Performance – Size and Beta

Because of the option to add or remove deposit balances over time, deposit management is one of the more complicated endeavors in banking. Lending, by comparison, is largely a one dimensional supply vs. demand problem. Building better deposit performance is more complicated. Add a three month CD option for your customers and the duration of your money market accounts can noticeably get reduced. Change a fee or minimum balance requirement and duration materially shifts. In this article, we look at how size and deposit value are correlated and discuss ways that banks can have greater intent in building franchise value through deposits.

Better Deposit Performance – Size and Interest Rate Sensitivity

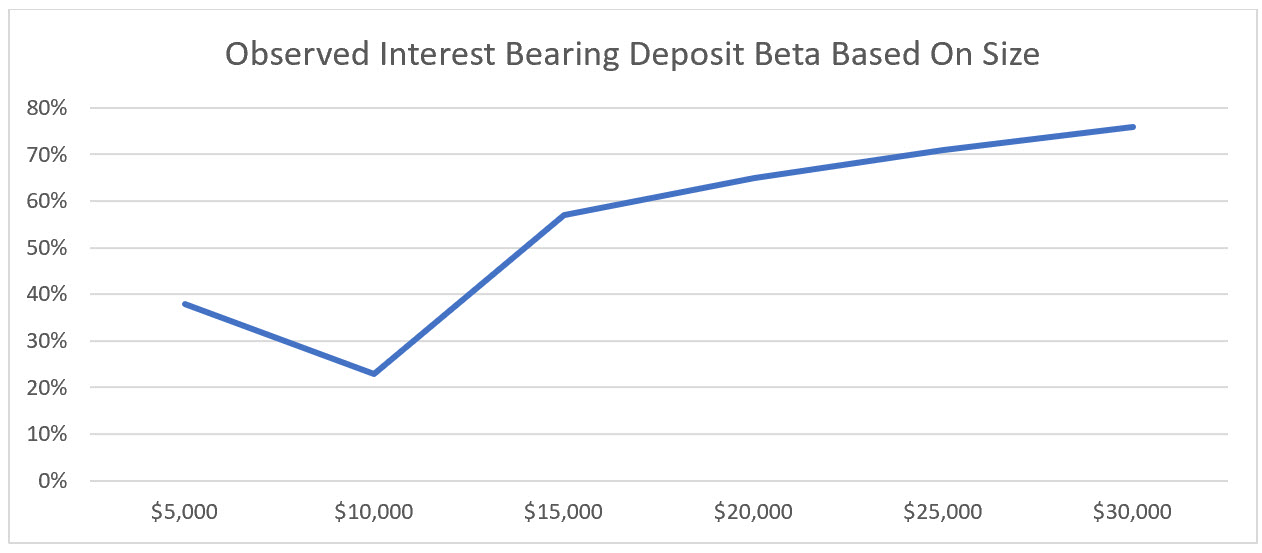

While not as much as loans, deposits exhibit a material amount of rate sensitivity based on size. The correlation of size and rate sensitivity for non-DDA, core, interest bearing deposits is about 40%. That is to say that about 40% of the interest rate sensitivity of an average deposit can be explained by size. This can be seen in the observed deposit betas below from a group of retail and commercial accounts.

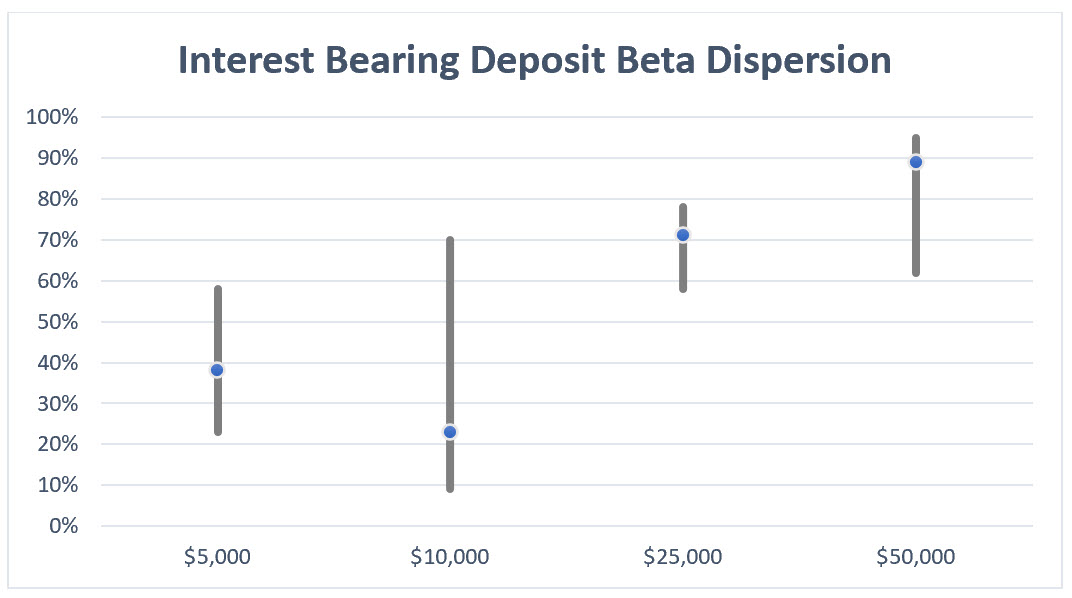

It is also important to note that when building better deposit performance, not all deposit size categories react the same way. While the $10,000 balance account holder tends to be less interest rate sensitive than the $5,000 balance account holder, there is more competition in the $10,000 balance category. As a result, rate promotions often swing beta widely. The $10,000 balance category can be the most volatile of any account size category which we observe (below).

Turning This Data Into Tactics

This data indicates a number of lessons for bankers when it comes to building better deposit performance. Here are our top five:

Segmentation: Bankers that have segmentation programs where they treat (market, price, etc.) their customers differently would do well to focus on the account holder with average balances around $10,000. Since this is a more dispersed group with a larger standard deviation, marketing dollars expended to manage the more rate sensitive customer would pay the highest return.

Alternatively, if you wanted to take deposit share from another bank, the $10,000-segment is an excellent segment to target as the wide distribution of account holders make the higher beta customers easier to dislodge. Not only that, this segment happens to be more valuable when they are transferred over since they exhibit less overall rate sensitivity than say the $50,000-segment.

Deposit Technology: Banks should be mindful before they add technology to higher-balanced accounts as technology tends to decrease duration by increasing interest rate sensitivity. Adding person-to-person or business-to-business electronic transfer options may be fine to a non-rate sensitive demand deposit (DDA) account but could be devastating to a high-balance money market account.

Product Development By Size: Banks that serve high net worth demographics where balances are higher than average would get the largest return on deposit products that serve to reduce interest rate sensitivity. In the same vein, duration buffering accounts are more important to commercially-focused banks than retail-focused banks. Health savings accounts, goal-oriented accounts, retirement accounts and cash management services all become more important as deposit balances grow.

Index Deposits: Deposit accounts that are tied to an index such as Fed Funds, Libor or Prime approximate a beta of 1. In other words, there is very little value in these deposits so banks should think hard about their need for funds vs. building value. Municipal deposits and wholesale funds are two of the most common examples. That said, these are highly efficient ways to raise funds. The fastest way to destroy value in a bank is to tie a money market or certificate of deposit account to an index. Not only do you increase your rate sensitivity and your cost, but these accounts tend to be relatively costly to administer plus they often cannibalize other less rate sensitive accounts.

Rural vs. Urban: Many bankers assume that rural deposits are less rate sensitive than deposits from metro or suburban areas. This is not always the case and should not be assumed. We have many rural areas of Florida where the beta is higher than it is in metro markets. While lower rural market rate sensitivity was true at one time when branch access was limited, the rise of online and mobile banking has served to make rural areas more rate sensitive (and service sensitive for that matter) than they were in the past. Further, traffic and housing patterns are such that more rural households now commute and tend to bank near their urban workplace as opposed to their home.

Competition: We will report more on this in the future, but the level of competition in your market does not always translate into greater sensitivity based on deposit size. Chase, for example, has dominant market share in many of their core Northeast markets but rarely serves to drive up deposit costs. Bank of America is the same way. While these banks present formidable competition because they have the largest market share, their presence does not serve to increase deposit costs for community banks. Alternatively, some credit unions, and banks such as Ally, Capital One, Goldman Sachs, Sallie Mae and others do serve to drive up deposit costs for all banks. This one reason why not all rural markets offer low-cost deposits. Metro markets that are dominated by Wells Fargo, Chase and Bank of America may exhibit lower rate sensitivity than some rural markets.

Before pricing deposits, it is helpful to understand the nature of your competition. If you wanted to take deposits away from Chase and you wanted to compete on price, that presents an issue as their deposit base isn’t that rate sensitive. It would take an average of 50+ basis points above their level to lure accounts over. Comparatively, if you need to take deposits away from a credit union or Fifth Third, a large bank that tends to have more rate sensitive customers, then it might take only 15 to 20 basis points above their level.

Deposit Mix: Finally, we saved the most important for last. Certificates of deposits have the highest rate correlations to any other non-indexed deposit product. Banks with high concentration in CDs would be served well to transition these customers to a less rate sensitive product or seek smaller balanced deposits to offset the rate sensitivity. Deposit mix is the largest single factor that banks can control to drive franchise value.

Putting This Into Action

If you have a passion for banking, there is nothing better than managing deposits and building your liabilities around better deposit performance. It is the best combination of science and art that can be found in our industry. When building your franchise, consider the relationship between deposit size, cost of funds and interest rate sensitivity. In a market where rates are rising, paying more attention to deposits is probably the fastest way to drive shareholder value.