How To Improve Uninsured Deposit Performance

Focusing on uninsured deposit performance is a hot topic among investors, analysts, and regulators. The concern is grounded in data as higher balance accounts are more interest rate and risk-sensitive than lower balance accounts. While every bank is now tracking the general metric, only a few banks monitor deposit performance in the category. That is a mistake, as this segment is likely the segment where you can quickly improve deposit performance. In this article, we will look at deposit performance data related to high balances and show how banks can dramatically increase value by restructuring relationship-based products and better-allocating marketing/sales dollars more efficiently.

Uninsured Deposit Performance – By Balance

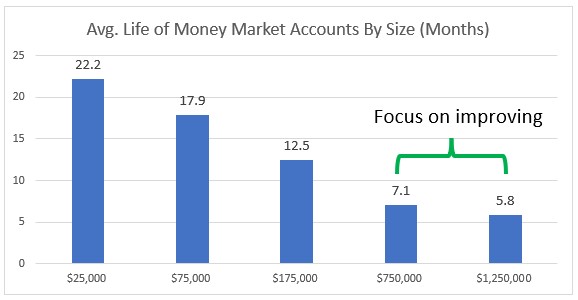

By way of an example, below is our updated decay data of money market accounts based on account size. As you can see below, without intervention, the average small balance account will stay with a bank for four years with an average life of around 18 months. This is over three times the life of a money market account that is over $1mm in balances.

It should also be noted that the average life of largely uninsured deposit balances of $750k and over is about 22% less than last year. To place that decrease in deposit performance in perspective, that is a loss of $1.8 million of franchise value per $10 million of money market deposits.

Apply further rising rates, social media amplification of rates or risk, general sensitivity to safety, greater competition, or a credit shock to the deposit holding institution. The average life numbers shrink dramatically. Further, as more and more banks promote digital account opening and payments (like the forthcoming FedNow), these numbers are projected to shorten by another 10%+.

We also want to note that a money market account’s performance is representative of a bank’s deposit base. Non-interest-bearing accounts, of course, have much longer average lives, while CDs have much shorter average lives. Regardless of the type of account, the above balance sensitivities hold true for just about every account type, every geography, and every customer demographic. For example, while banks in the Southeast and Mid-Atlantic regions of the U.S. have more competition for money market accounts, thereby making the above numbers less than the above, they exhibit similar differences.

Marketing to Improve Uninsured Deposit Performance

This data suggests that if you spend money on customer retention, you should target customers with over $500k in balances. Some small banks, for example, do nothing more than have their CEO call the largest depositors twice per year to check in and thank them. This alone can have a material impact on retention and is inexpensive.

Larger banks can do this with regional leadership and put accounts on a drip email campaign that will serve to increase brand awareness – letting customers know how the bank is helping the community, its commitment to service, and more about the bank’s “personality” or culture all help to emotionally tie the depositor to the bank and providing e-books, webinars, checklists, calculators, or other engagement tools also all help to increase the duration, convexity, and average life of deposits, particularly uninsured deposits.

As you set marketing plans and budgets, consider that just this simple act of outreach and branding increases the average life by about 2-4 months. That is a value of approximately $50k per year per $10 million of deposit balances. Considering an ongoing branding campaign costs around $3k in content cost and time, that is almost a 17x return alone, just based on how it positively impacts the performance of uninsured deposits.

Product Design to Improve Uninsured Deposit Performance – Prioritize Balances

Then there is the issue with relationship product design. This is one of the great mysteries of community banking. Almost every community bank touts its commitment to the relationship. Still, only some offer products that serve and are priced to build relationship value for the customer and the bank.

It starts with articulating a strategy. When interest rates were low and deposits were plentiful, many banks emphasized generating fee income over deposit balances. Ironically, many banks never stopped telling their teams that deposit balances are the new gold and to deemphasize fee generation if it means a tradeoff of balances. Deposit value now dwarfs fee value, yet many management teams are still worried and compensated on fee generation. If a bank still needs to set a clear message to its teams, now is the time to emphasize that deposit performance and credit should be the top two priorities in the bank.

Banks also need to take another look at how they treat fees strategically and then look at every product to see how it can be used to build a relationship. Payments, remote deposit capture setup fees, upfront loan fees, monthly deposit account maintenance fees, check imaging fees, data exchange fees, treasury pay alert fees, reporting fees, sweep service fees, lockbox fees, HSA accounts, 401k savings, bank-at-work bundles and a host of other bank products should be reconsidered and restructured to promote relationship product bundling. To be clear, none of these fees are bad, only that banks need to be careful when a fee inhibits balance building and performance. Banks need to consider forgoing fee income to promote cross-sell and retention of uninsured deposit balances.

Cross-Sell to Improve Uninsured Deposit Performance

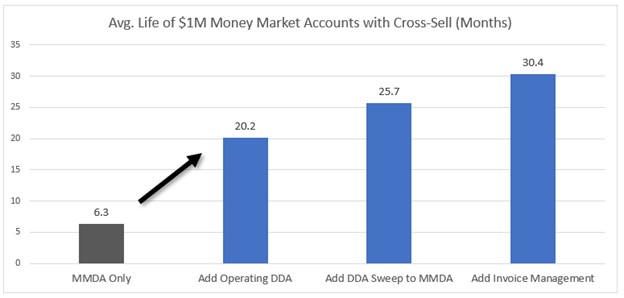

Of course, one of the best moves is to cross-sell other services – other deposit accounts, alerts, mobile banking, cash management, treasury management, and financial intelligence. For example, adding and connecting an operating DDA account to the MMDA account extends the average life significantly. Add other components, and retention shoots up even further. Below is an example of the before and after snapshot of a $1 million money market account once you start adding other product connections that boost account longevity and performance characteristics.

That increase in retention by more than three times is worth $238k for every $10 million in deposit balances at today’s rates in a static environment. Value goes up should rates continue to rise, deposit competition increases, and liquidity becomes dear – all of which are highly likely to occur. Investing resources and capital to align relationship products better and then spending marketing dollars on promoting the bank and cross-selling can provide one of the better returns in bank marketing.

Before you spend your marketing and product design resources haphazardly, all the while being concerned about slowing deposit growth, consider getting more focused on how you spend your effort. Targeting uninsured deposit accounts to improve their average life is one of the best uses of bank marketing and product design dollars in a rising rate environment.

Other Resources

Join us as we brainstorm with Steve Wofford, the CEO of Kohl Analytics, where we will get more granular around deposit modeling using machine learning. We will look at money market, DDA, and savings account, discuss asset-liability considerations, and highlight the degradation of deposit performance in this current environment. This will be on April 26th at 4 pm ET. To register or learn more, go HERE.

In addition, look for further articles around fee setting, relationship product bundling, deposit pricing, and deposit product design, all with an eye toward the need to build non-rate-sensitive deposit balances.