Reciprocal Deposits – How to Own this Company to Reduce Cost and Risk

It is not every day that you get to own a portion of a banking vendor without putting capital in upfront. ModernFi, a company that provides reciprocal deposits providing access to insurance through network banks (subject to certain conditions) and competitor to legacy deposit networks, is in the process of building a bank-owned consortium to help banks reduce cost and risk. In this article, we present our case for why your bank should be part of this company and why you should move quickly to be in the best position.

Background

ModernFi is working closely with Gene Ludwig, the 27th Comptroller of the Currency, former vice-chair of Deutsche Bank, and co-founder of Promontory Interfinancial Network. Promontory sold to Blackrock in 2019 (Blackrock changed its name to IntraFi), and Mr. Ludwig co-founded Canapi Ventures, a leading bank fintech fund. Canapi invested in ModernFi and Mr. Ludwig became an advisor to help them build the future of deposit networks. To do this, ModernFi and Mr. Ludwig formed a bank consortium, called the “National Bank InterDeposit Company” (NBID) where participating banks have a profit share, sense of ownership, and oversight of the network.

Ownership – Become a Participating Member

For a limited time, banks now can be “participating members” whereby they share in the economics of the firm to the extent they use the firm. No upfront capital investment is required. The more a bank uses the program, the more it participates in the profit and the ownership.

If this corporate structure sounds familiar it is almost the same structure that MasterCard and Visa used.

Here’s the case for joining today.

The Coming Need for Reciprocal Deposits

Since the liquidity crisis of the Silicon Valley Bank and First Republic days, having insured deposits is now critical against the backdrop of social media and short sellers. The largest national banks are too big to fail but community banks are still vulnerable.

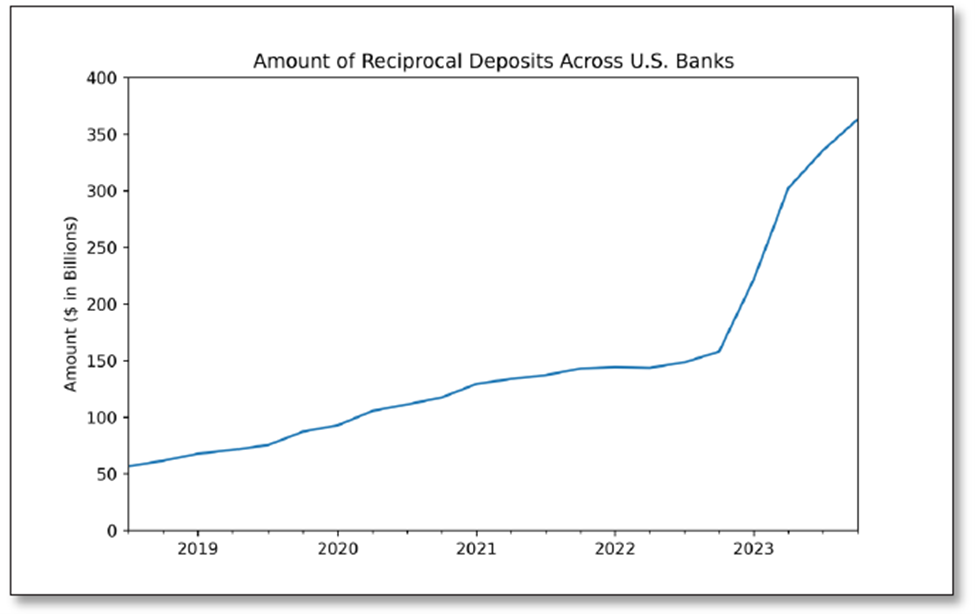

- Uninsured deposit flight is accelerating: Reciprocal balances have more than doubled to ≈ $400 billion in just two years—a hockey‑stick growth curve you can see in the graphic below.

- Legacy reciprocal deposit providers hold a near‑monopoly. One network dominates reciprocal flows, dictating pricing and product road‑maps. That concentration raises single‑vendor risk and stifles innovation.

If you do not have the ability to offer access to competitively priced aggregate deposit insurance, your best commercial, municipal, and nonprofit clients will migrate to the too‑big‑to‑fail banks when there is a stress event.

Lower Your Cost – NBID Flips the Economics in Your Favor for Reciprocal Deposits

NBID is structured as a for‑profit LLC owned by its member banks. Instead of dividends, members get 50 % of all net revenue generated by the network.

For the first 200 banks that sign, pricing is three basis points for the first four years which are likely compared to 12 basis points your bank is likely paying now. That is a 75% reduction in cost on the surface.

If you are a $1Bn-asset sized bank and have $40mm in reciprocal deposits, that would be a net savings of $56,000 per annum, with a potential $640,000 estimated equity gain should NBID have a liquidity event in the future.

As your bank grows, your potential savings and potential equity return grows so it would benefit you to lock in your position now as your return will likely only increase.

Enhanced Governance, Control, and Transparency

Members receive regular reporting on performance, budget, and risk.

By design, the Board is composed of banks from various size categories from below $1Bn in assets to above $100 Bn in assets. Board members currently include representatives from: Comerica, Huntington, Zions, Valley National, Key Bank, OceanFirst, Byline Bank, Raymond James Bank, First Federal Bank each providing governance likely aligned with your bank’s interest as well.

Participating members also get a voice in attribute and new product development further giving your bank some control over the future roadmap.

Stand Up NBID Alongside Your Existing Program

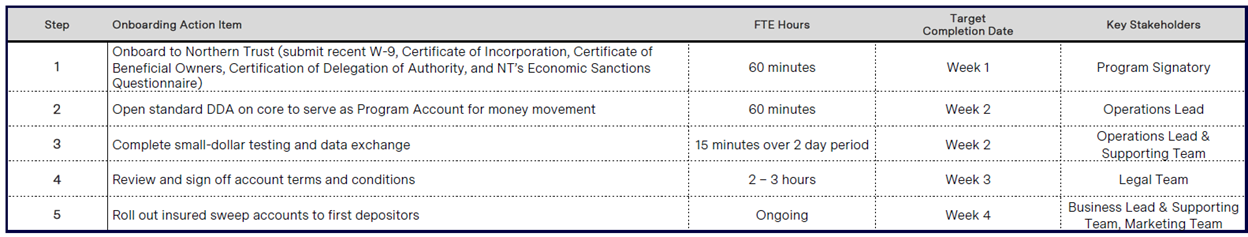

Operationally, onboarding mirrors your current network. Below are some operational attributes.

- Custody with Northern Trust—simply submit standard KYC documents.

- Open one DDA on your core to act as the program account.

- Small‑dollar test & data exchange—done in a couple of days.

- Minor Terms & Conditions addition to add NBID as a reciprocal deposit option.

- Roll out to initial depositors—often within four weeks.

NBID can run in parallel with legacy deposit networks, so you avoid disruption while you migrate high‑value accounts.

API‑First and Integration Tech That Drops into Your Digital Banking

The network operator, ModernFi, is cloud‑native and API‑first. Existing integrations with major cores and digital‑banking platforms, to include Q2, Fiserv, Jack Henry, Apiture and others. These integrations and APIs will allow your bank to:

- Open insured‑sweep accounts inside your current online banking user interface.

- Offer access to up to $10 million in instant deposit insurance coverage at launch, targeted for next month, scaling to $100+ million as the network grows.

- Automated reconciliation, reporting, and balance movement.

Setting up the program usually takes two to six weeks and looks like the commitment below according to NBID:

Interested in Reciprocal Deposits? Don’t Wait

NBID is targeted to officially launch this month. If you are interested in joining and reviewing due diligence materials register HERE and we will do the following:

- Send you an overview presentation going into more detail.

- Provide you with your bank’s potential savings and calculate your ROI.

- Highlight the risks of managing and integrating multiple programs.

- Provide you with a VIP introduction to the ModernFi/NBID that will:

- Set up a demo to show you the product and answer any questions.

- Provide you with a full set of due diligence documents.

- Discuss an integration plan

- Provide training, marketing materials and technical support.

- Provide a dedicated Success Manager to support the bank.

There is no obligation to learn more and even signing up to be an NBID Participating Bank. Signing up gives you the OPTION to participate in the future and ensures the program is in place BEFORE you need it.

This is a unique opportunity to participate in a bank-owned consortium, lower your cost and participate in both the governance, but the potential equity upside as well.

Register today to learn more.