The First Step For Raising Deposits

If you are looking for insight into how artificial intelligence can help in banking, we give you the Unified Deposit Formula that can be used for raising deposits. Before using machine learning, we, like most bankers, thought about deposit pricing along a single dimension – price and sensitivity. However, it turns out that price and sensitivity are only part of the equation. Turn artificial intelligence loose on a data set, and you learn an array of little things come into play on the path to achieving your desired level of new deposit balances. This article provides an overview of the equation and highlights our lessons learned.

Raising Deposits Using The Unified Deposit Formula

We covered the basic concepts of raising deposits HERE. Now, we expand on those basic concepts and present the Unified Deposit Formula.

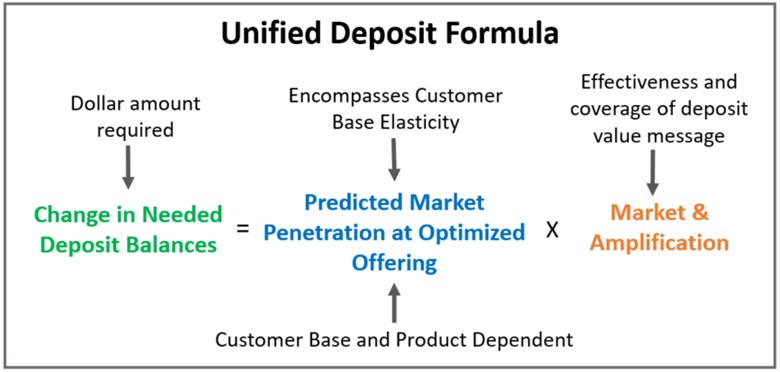

One of the formula’s strengths or “unifying” features is that it ties price, customers, marketing, asset-liability objectives, deposits, loans, and balance sheet profitability together in an excellent package. The simplified formula is below.

The formula highlights the essential concepts of raising deposits effectively.

The significant advantage of this equation outside of its unification properties is that it forces bankers to look at their deposit-gathering effort through a wide-angle lens instead of a microscope centered on one product, such as certificates of deposit, and one input, such as price. This is the primary shortcoming of current deposit models in that they treat price as the only input. While national banks are getting more sophisticated, many regional banks still think of just price, giving community banks a considerable advantage.

As we will soon show, price is often the least important input.

Change in Needed Deposit Balances

The formula starts by asking – given your existing core deposit base, what is desired new amount? The more deposits you need to raise over the stated time horizon, the more inputs are required. The formula is recognition that you can control your deposit growth by controlling your asset growth. Grow loans at an 11% rate, and you will likely need more deposits and expend more effort to raise those deposits.

Predicted Market Penetration at Optimized Offering

The middle portion of the formula is where the magic happens. The Predicted Penetration at Optimized Offering answers the question of what amount of deposits you can expect from any market. This is a dollar amount available to win or gather, given a certain input level. The level of the amount depends on the size of the market you are targeting (target customer base, geography, etc.) and your products. This calculation works for one product, such as a money market account or a complete lineup of products.

Within this function, you calculate the Customer Base Elasticity Demand. Knowing your elasticities for any product and customer segment allows bankers to optimize value. This part of the formula is less complex for a community bank than a regional or national bank and is where community banks can excel.

Customer Base Elasticity of Demand

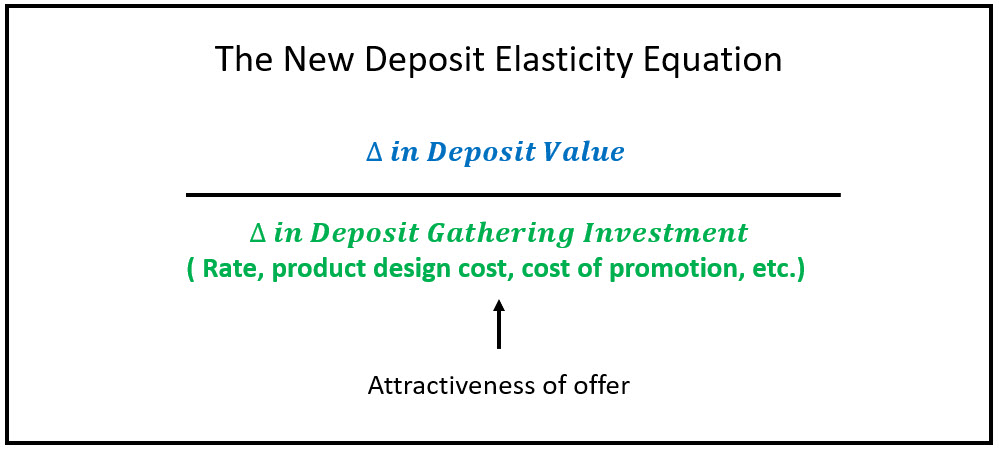

Within the Predicted Market Penetration at Optimized Offering function is an elasticity factor many bankers are familiar with, a notable exception. This is the slope of your deposit demand curve.

In banking schools, most bankers were taught to focus on price as your controlling factor to sensitivity. Increase the price, and the number of deposits you will attract increases.

However, as the data and machine learning have taught us, price is only your most sensitive input in one part of the demand curve. That is, marketing on price tends to attract price-sensitive customers.

There are whole sections of the deposit demand curve where price registers the least sensitive response. Of all your inputs, an investment in product design often results in the best deposit response.

Raising Deposits on Product Value

How a product is structured, the associated fees, the flexibility of the terms, and many other factors all often provide bankers with more sensitivity than rate. Thus, this elasticity function looks like the equation below.

This part of the equation captures both product effectiveness and customer segmentation. Choose the right products targeted at the right customer segment, and you produce an elasticity well in excess of “1,” meaning you will be more effective at raising deposits or have reduced marketing costs (the next part of the equation).

The perceived value proposition of your offer pumps the heart of this customer base elasticity function. Sometimes this is rate, but often it is another factor. It could be giving away a toaster or a term to allow more money to be added to a CD over time. Machine learning was instrumental in helping us understand where, when, and how to apply various inputs to elicit the best demand response for raising deposits.

Adding a lock box for homeowners associations (HOAs) or trade associations, for example, dramatically increases the probability of winning those deposit-rich customers. The percentage change of the deposit volume demanded from a relatively small investment can go way up. Adding real-time payment processing, waiving ATM fees, adding IT support services to products, or hundreds of other ideas can create this response depending on your product and customer segment.

The takeaway is that just like an investment portfolio on the asset side of the balance sheet, investment alternatives should be considered on the liability portion of the balance sheet. When raising deposits, you want to spend the least amount on raising a given level of desired deposits over some time horizon. Why spend 3% on raising $10mm of deposits when you can spend half of that on adding online business account opening and gathering $20mm in deposits?

As bankers work through the equation, they learn that rate does not scale. Pay Fed Funds + 1% now to raise $10mm in deposits, and chances are you will need to pay that same rate level or more to raise your second $10mm. Alternatively, if you invest $1mm in a product to increase deposits, such as a payments hub or online account opening, then each incremental deposit dollar raised comes at a cheaper and cheaper level. Your second $10mm raised will cost less than the first as your fixed investment remains unchanged.

The goal here is to get creative and try various offers to see what product characteristics resonate with different customer sets. By identifying the customer set first, whether college students, retirees, or breweries, banks can better develop product attributes and bundles that resonate. This will also make understanding the Market and Amplification part of the equation easier.

Up Next

Next, we will quantify the value of marketing and highlight the Market & Amplification part of the Unified Deposit Formula. Once you have the product, customer segment, or geography, you want to target – The next question is how much you spend on sales and marketing to achieve your deposit goals.

We will also provide a formula to help banks size their addressable market, gauge the effectiveness of their campaigns, and manage this effort over time.

The Unified Deposit Formula ties various bank functions together and allows a single methodology to be used throughout the bank. It works for a single product or bundled product. While we are presenting this formula for retail and commercial deposits, it also works for loans and fee products.

Instead of just price, the key takeaway from this formula is always thinking of what attributes, other than price, you can add to a deposit product for a specific customer segment that will get you the most “lift” or new deposit balances.

Consider how your bank can increase your marketing penetration by using attributes other than price to attack profitable customer niches with modified deposit products that will garner a better demand response.